Market Definition

Automotive composites are lightweight materials predominantly utilized in trucks, cars, and other vehicles, primarily for under-the-hood components and interior applications. These composites are highly favored for their ability to reduce vehicle weight, making them ideal for a wide range of automotive interior and exterior uses.

Automotive Composites Market Overview

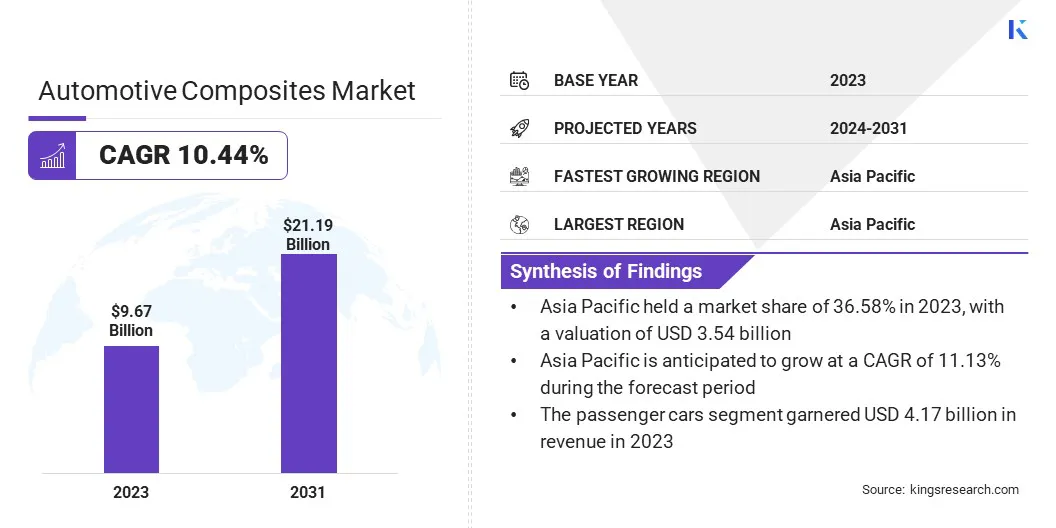

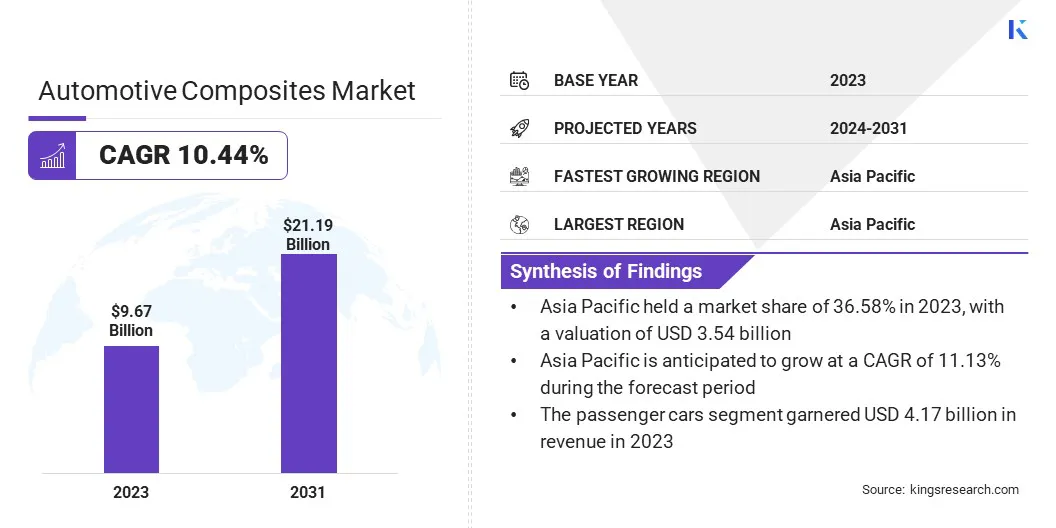

Global automotive composites market size was USD 9.67 billion in 2023, which is estimated to be valued at USD 10.57 billion in 2024 and is projected to reach USD 21.19 billion by 2031, growing at a CAGR of 10.44% from 2024 to 2031.

Rising demand for lightweight and fuel-efficient vehicles to enhance fuel efficiency and reduce carbon emissions is driving the growth of the market. Composites such as carbon fiber-reinforced polymers (CFRPs), glass fiber-reinforced polymers (GFRPs), and natural fiber composites are gaining significant traction due to their high strength-to-weight ratio, durability, and design flexibility.

Technological advancements in production techniques, such as resin transfer molding and additive manufacturing, are reducing manufacturing costs and expanding industry adoption. Leading players are focusing on developing technology to enhance heat resistance.

- For instance, in February 2024, the Mitsubishi Chemical Group announced the development of a high heat-resistant ceramic matrix composite (CMC) incorporating pitch-based carbon fibers. This advanced material is designed to withstand temperatures up to 1,500°C.

Major companies operating in the automotive composites industry are Formaplex Technologies Ltd, GMS COMPOSITES, Hexcel Corporation, IDI Composites International, Mitsubishi Chemical Group Corporation, Owens Corning, SGL Carbon, Solvay, TEIJIN LIMITED, Toray Advanced Composites, Huntsman International LLC., Exel Composites, RTP Company, STRUCTeam, Avient Corporation, and others.

Due to severe air pollution, environmental agencies across numerous countries are enforcing stringent regulations to reduce carbon dioxide (CO2) emissions from vehicles.

This is prompting original equipment manufacturers (OEMs) to adopt innovative technologies, such as automotive composites, to decrease vehicle weight while preserving strength and structural integrity.

This trend is further supported by the rise of digitalization, the growing adoption of electric vehicles (EVs), and increased emphasis on redesigning vehicles to enhance safety and performance. Furthermore, key players are developing cost-effective manufacturing methods for automotive composites, fueling market growth.

Key Highlights:

- The automotive composites industry size was valued at USD 9.67 billion in 2023.

- The market is projected to grow at a CAGR of 10.44% from 2024 to 2031.

- Asia Pacific held a share of 36.58% in 2023, valued at USD 3.54 billion.

- The passenger cars segment garnered USD 4.17 billion in revenue in 2023.

- The glass fiber composites segment is expected to reach USD 9.52 billion by 2031.

- The chassis and structural components segment is anticipated to grow at the fastest CAGR of 10.86% over the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 11.13% throuh the projection period.

Market Driver

"Increasing Demand for Electric Vehicles"

The increasing demand for electric vehicles is fueling the the growth of the automotive composites market. As the automotive industry prioritizes sustainability and carbon emission reduction, manufacturers are emphasizing the use of lightweight materials to optimize electric vehicle (EV) performance and battery efficiency.

Composites, renowned for their exceptional strength-to-weight ratio, corrosion resistance, and design versatility, are key in EV production. These materials enhance driving range, energy efficiency, and overall vehicle performance, aligning with consumer expectations and regulatory requirements.

Additionally, increased investments in EV technology and innovations in composite manufacturing processes are propelling market growth.

- According to the International Energy Agency (IEA), a total of 14.0 million electric vehicles were sold globally in 2023, reflecting a significant increase in adoption and accelerating the transition to sustainable and eco-friendly transportation solutions worldwide.

Market Challenge

"High Costs Associated with Advanced Composites and Manufacturing Processes"

The high costs associated with advanced composites and manufacturing processes pose a major challenge to the growth of the automotive composites market. These materials, including carbon fiber-reinforced plastics and glass fiber composites, offer benefits such as reduced weight, enhanced durability, and improved fuel efficiency.

However, their production involves complex, resource-intensive techniques, such as autoclave curing and resin transfer molding, which increase costs. This cost barrier often limits their adoption in mass-market vehicles, restricting broader adoption.

To mitigate this challenge, key players are focusing on process innovation, economies of scale, and advancements in automation, cost-effective materials, and alternative production methods such as out-of-autoclave (OoA) manufacturing.

Additionally, collaborations between automotive manufacturers and composite suppliers to optimize designs and integrate sustainable materials can reduce costs.

Market Trend

"Utilization of AI to Optimize the Selection and Composition of Composite Materials"

AI assists engineers and researchers in determining the optimal combination of materials, such as carbon fiber and resin, to achieve an ideal balance of strength, weight, and cost.

This streamlines the innovation process, enabling the development of highly customized, high-performance composites specifically designed for automotive applications. Companies are introducing AI tools and services to minimize the labor-intensive processes between component design and production.

- For instance, in February 2024, Plyable launched an AI-powered tool specifically engineered for molding various composite materials utilized in the automotive industry.

In manufacturing, artificial intelligence (AI) enhances process automation, boosting production efficiency and minimizing errors. AI-powered systems monitor and manage composite manufacturing processes, ensuring accuracy and consistency in operations such as molding, layering, and curing.

This increases output, reduces material waste, and promotes sustainable production practices. Additionally, AI-enabled predictive maintenance enhances machinery performance by minimizing downtime, thereby optimizing factory efficiency.

AI enables manufacturers to assess the performance of materials prior to physical testing, thus expediting product development cycles. This approach reduces costs while improving safety and durability in automotive applications.

Automotive Composites Market Report Snapshot

| Segmentation |

Details |

| By Vehicle Type |

Passenger Cars, Commercial Vehicles, High-Performance Vehicles |

| By Fiber Type |

Carbon Fiber Composites, Glass Fiber Composites, Natural Fiber Composites |

| By Application |

Body Panels, Chassis and Structural Components, Interior Components, Others |

| By Region |

North America: U.S., Canada, Mexico |

| Europe: France, U.K., Spain, Germany, Italy, Russia, Rest of Europe |

| Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific |

| Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

| South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Vehicle Type (Passenger Cars, Commercial Vehicles, and High-Performance Vehicles): The passenger cars segment earned USD 4.17 billion in 2023 due to the surging demand for lightweight materials to reduce CO2 emissions, enhance performance, and increase fuel efficiency. Automotive composites and glass-fiber-reinforced polymers are increasingly used in manufacturing body panels, structural parts, and interior components.

- By Fiber Type (Carbon Fiber Composites, Glass Fiber Composites, and Natural Fiber Composites): The glass fiber composites segment held a share of 46.53% 2023, fueled by their extensive use in the production of automotive components such as body panels, interiors, and structural elements. Offering a cost-effective alternative, glass fiber composites meet the strength and flexibility requirements of mass-market and mid-range vehicles, allowing manufacturers to improve fuel efficiency while keeping production costs low.

- By Application (Body Panels, Chassis and Structural Components, Interior Components, and Others): The body panels segment is projected to reach USD 9.16 billion by 2031, propelled by the growing demand for lightweight, durable materials that enhance fuel efficiency and safety. The growth in applications for exterior body panels, inlcuding hoods, doors, and fenders, is fueled by their performance and aesthetic benefits.

Automotive Composites Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific automotive composites market accounted for a substantial share of around 36.58% in 2023, valued at USD 3.54 billion. Rapid industrialization and the increased use of composites materials in the automotive sector is fostering this growth. Countries such as China, Japan, and India are at the forefront of advancements in the composites sector.

China stands as the largest contributor, with significant investments in aerospace and automotive industries, where lightweight composite materials are essential for vehicle and aircraft components.It also leads in wind turbine installation capacity, generating demand for advanced composites in turbine blade manufacturing.

Japan is a major consumer of carbon fiber composites, particularly for the automotive and aerospace sectors. Key players are launching products for electric vehicles, thus aiding regional market expansion.

- For instance, in December 2024, HKS Co., Ltd. and Nippon Seiki Co., Ltd. (Defi) announced a strategic partnership to launch new products for the automotive aftermarket sector. This collaboration combines HKS's expertise in both the automotive aftermarket and OEM sectors with Defi's strenghths in the manufacturing and design of vehicle instrumentation. The partnership focuses on developing advanced meter systems and precision instruments tailored for electric vehicles (EVs).

Companies have incorporated composites into electric vehicle (EV) production to reduce weight and enhance performance. India is emerging as a key market, supported by the rising adoption of composites in the automotive industry and a growing emphasis on sustainable manufacturing practices.

The increasing demand for electric vehicles in the Asia Pacific region is further accelerating the use of automotive composites, as these materials are critical for improving EV efficiency and extending battery life.

North America automotive composites industry is poised to grow at a robust CAGR of 10.54% over the forecast period. Surging demand for lightweight materials in the automotive sector is fostering this growth.

Composites, particularly carbon fiber and glass fiber materials, offer an optimal balance of strength, durability, and reduced weight, which are essential for enhancing vehicle performance and fuel efficiency, key priorities for consumers.

Moreover, the growing shift toward electric vehicles (EVs), which require lighter, more efficient components for improved battery management and range, further highlights the need for automotive composites.

North America's position as a hub for major automotive manufacturers and suppliers supports continued growth as these manufacturers increasingly adopt advanced composite materials to enhance vehicle design and performance, with ongoing investments to expand production capacity.

- For instance, in May 2024, Teijin Automotive Technologies invested $100 million in a new manufacturing facility in Indiana to enhance its production capacity.

Regulatory Framework Also Plays a Significant Role in Shaping the Market

- The U.S. federal regulations for the automotive industry focus on safety, fuel standards, and emission, while state laws govern driving and licensing. The NHTSA oversees vehicle safety and traffic control standards, the EPA regulates emissions, and the NHTSA sets Corporate Average Fuel Economy (CAFE) standards.

- The federal government influences automotive manufacturing and imports through international trade agreements and tariffs. The United States-Mexico-Canada Agreement (USMCA), which replaced the North American Free Trade Agreement (NAFTA) in 2021, establishes rules of origin for manufacturing. These rules restrict the locations where the majority of a vehicle can be assembled.

- In Europe, government regulations promote the adoption of automotive composites by incentivizing manufacturers to reduce vehicle weight and CO2 emissions, leading to increased use of lightweight composite materials such as carbon fiber and glass fiber in car parts, with a particular focus on recycling and end-of-life vehicle management aimed at supporting circularity in the automotive industry.

- In India, the Ministry of Heavy Industries (MHI) has issued standard operating procedures (SOPs) under the Production Linked Incentive (PLI) program. This initiative supports automotive manufacturers and component suppliers by offering financial incentives for the production of electric or hydrogen vehicles and high-value, advanced components, aimed at boosting domestic manufacturing in the sector.

Competitive Landscape

The global automotive wrap films market is characterized by a number of participants, including both established corporations and rising organizations. Companies in the market are investing in research and development to expand their production capacity.

To gain a competitive edge in this evolving industry, companies are focusing on new product launches, collaborations, corporate expansions, and mergers and acquisitions.

Market players are focusing on advancing composite manufacturing technologies to increase the accessibility and affordability of composite materials for use in automotive applications.

To reduce production costs and enhance scalability, key players are prioritizing innovations such as three-dimensional (3D) printing, resin transfer molding (RTM), and automated fiber placement (AFP). Companies are also focusing on recycling to manufacture lightweight and durable components, which helps reduce costs and greenhouse gas emissions.

- For instance, in February 2024, National Renewable Energy Laboratory (NREL) launched a thermoforming technique that improves the recyclability of carbon fiber composites, promoting sustainability without compromising their strength and durability.

List of Key Companies in Automotive Composites Market:

- Formaplex Technologies Ltd

- GMS COMPOSITES

- Hexcel Corporation

- IDI Composites International

- Mitsubishi Chemical Group Corporation

- Owens Corning

- SGL Carbon

- Solvay

- TEIJIN LIMITED

- Toray Advanced Composites

- Huntsman International LLC.

- Exel Composites

- RTP Company

- STRUCTeam

- Avient Corporation

Recent Developments (M&A/Partnership/Agreements/New Product Launch)

- In June 2024, Borealis launched a new glass fiber product, GD3600SY, designed for a wide range of applications within the automotive sector.

- In April 2024, Toray Industries, Inc. partnered with Hyundai Motor Group to advance material innovation for the next generation of vehicles. This collaboration is a part of Hyundai's future mobility strategy, focusing on significant advancements in material technology.

- In January 2024, Sonychem launched an innovative project aimed at producing bio-based plastic composites for the automobile industry.

- In October 2023, Mitsubishi Chemical Group (MCG) acquired CPC, a leading Italian manufacturer of automotive carbon fiber composite components. As carbon fiber-reinforced plastic (CFRP) is essential for reducing vehicle weight and meeting stringent fuel efficiency and CO2 emission standards, demand for CFRP is growing in the global automotive market. The automotive industry is rapidly integrating CFRP into vehicle components, positioning MCG to lead the market by delivering superior solutions across the entire value chain, from component design to production.

- In September 2023, Teijin Limited agreed to sell its full stake in GH Craft Co., Ltd., a subsidiary specilaizing in composite materials for automotive, railway, and industrial applications, to TIP Composite Co., Ltd. TIP Composite, a supplier of composite materials across various sectors, has collaborated with GH Craft on select projects. This acquisition will enable TIP Composite to leverage GH Craft’s expertise and technology to foster business growth.