Market Definition

The automotive camera market involves the development, production, and sales of cameras used in vehicles for safety, driver assistance, and autonomous driving applications. These cameras enhance visibility; enable features like lane departure warning, adaptive cruise control, and parking assistance; and support advanced driver-assistance systems (ADAS).

The market is segmented by type into single-view systems, which provide images from a single camera for basic functions like rear-view monitoring, and multi-view systems, which integrate multiple cameras to offer a comprehensive 360-degree view for enhanced situational awareness.

Automotive Camera Market Overview

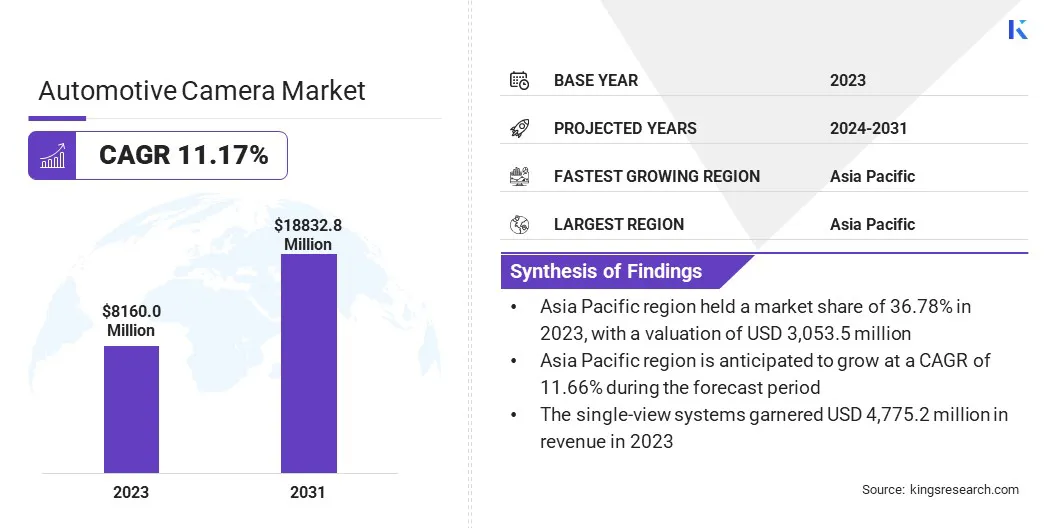

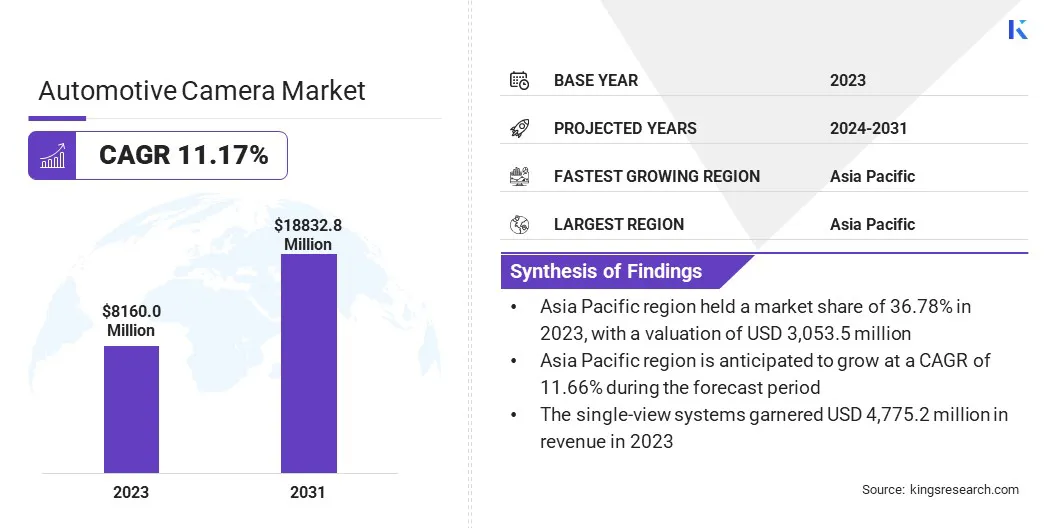

The global automotive camera market size was valued at USD 8,160.0 million in 2023 and is projected to grow from USD 8,975.8 million in 2024 to USD18,832.8 million by 2031, exhibiting a CAGR of 11.17% during the forecast period.

This growth is driven by increasing vehicle safety regulations, rising adoption of ADAS features, and advancements in camera technologies, such as high-resolution imaging and artificial intelligence (AI)-based object detection.

Major companies operating in the global automotive camera Industry are Magna International Inc., Garmin Ltd., OMNIVISION, Panasonic Automotive Systems, Robert Bosch GmbH, ZF Friedrichshafen AG, Continental AG, GENTEX CORPORATION, Sony Semiconductor Solutions Corporation, Valeo SA, STMicroelectronics, Samsung, Aptiv, Autoliv Inc., and DENSO CORPORATION.

The demand for autonomous and connected vehicles further fuels the market, with key players focusing on product innovation and partnerships to enhance vehicle safety and performance.

Key Highlights:

- The global automotive camera market size was valued at USD 8,160.0 million in 2023.

- The market is projected to grow at a CAGR of 11.17% from 2024 to 2031.

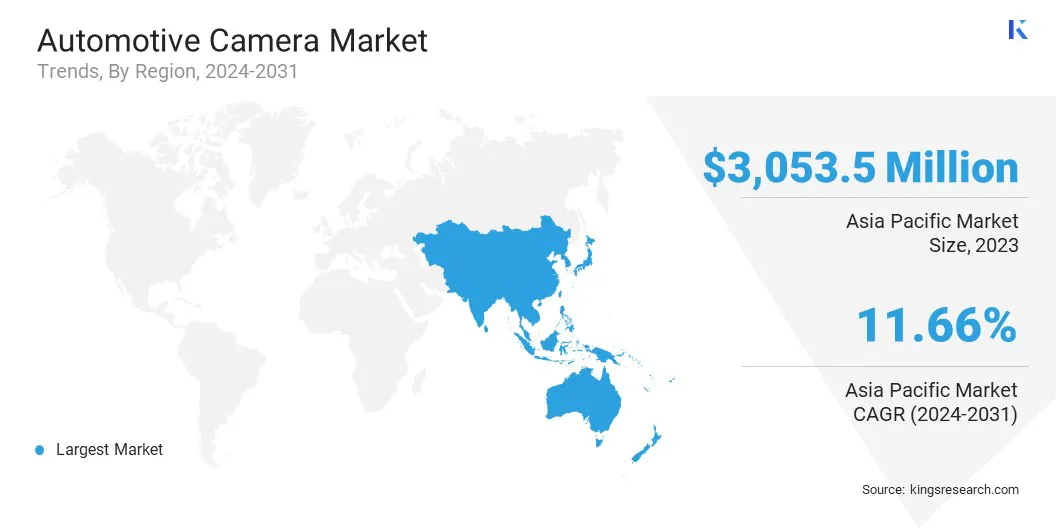

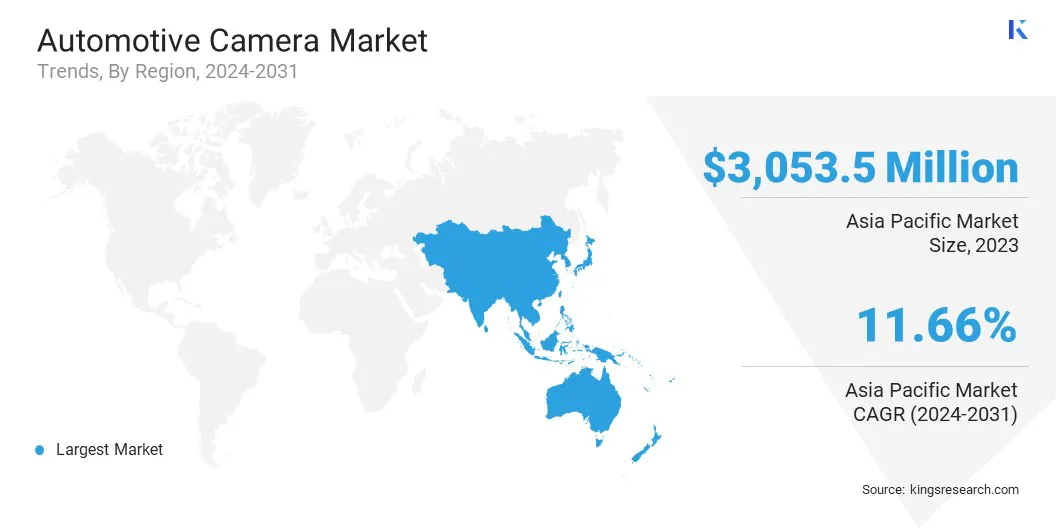

- Asia Pacific held a market share of 37.42% in 2023, with a valuation of USD 3,053.5 million.

- The single-view systems segment garnered USD 4,775.2 million in revenue in 2023.

- The digital cameras segment is expected to reach USD 8,976.1 million by 2031.

- The park assist segment is expected to reach USD 6,312.1 million by 2031.

- The market in Europe is anticipated to grow at a CAGR of 11.66% during the forecast period.

Market Driver

"Rising Adoption of ADAS"

The automotive camera market is registering significant growth, due to the rising adoption of ADAS that enhance vehicle safety, driving efficiency, and overall user experience.

Automakers are prioritizing camera-based ADAS features, as they play a crucial role in reducing accidents, improving driver awareness, and enabling semi-autonomous driving functionalities.

This increasing reliance on sophisticated vision-based technologies is fostering strategic collaborations among automakers, semiconductor manufacturers, and AI solution providers, driving continuous innovation in sensor fusion, real-time data processing, and next-generation ADAS capabilities.

The market will continue to expand as automotive safety and automation evolve, driven by the pursuit of smarter, safer, and more autonomous mobility solutions.

- In August 2024, Pioneer launched its AI-powered smart dashcam portfolio for Indian roads, enhancing ADAS capabilities with real-time collision alerts, driver monitoring, and lane departure warnings. This innovation reflects the growing demand for AI-driven automotive cameras to improve road safety and driving efficiency in diverse traffic conditions.

Market Challenge

"High Implementation Costs"

A key challenge in the automotive camera market is high implementation costs, especially for multi-camera systems used in ADAS and autonomous driving. These systems require sophisticated hardware, advanced software algorithms, and extensive vehicle integration, increasing the overall cost of production and consumer pricing.

A potential solution is cost optimization through economies of scale and sensor fusion technology, which integrates cameras with radar and LiDAR for more efficient performance. Additionally, advancements in chip technology and mass production can help reduce component costs while maintaining system accuracy.

Market Trend

"Integration of AI And Deep Learning Algorithms"

The market is registering a significant transformation with the integration of AI and deep learning algorithms into ADAS. AI-powered cameras enhance real-time object recognition, driver monitoring, and automated decision-making, improving overall vehicle safety and driving efficiency.

These intelligent systems can analyze vast amounts of visual data, detecting pedestrians, lane markings, traffic signs, and other vehicles with high accuracy, even in complex road conditions.

The increasing adoption of 3D imaging and ML algorithms is further strengthening the role of AI-powered vision systems, positioning them as a crucial component in the evolution of ADAS and self-driving technologies.

- In August 2023, Brigade Electronics launched AI Intelligent Detection Cameras, enhancing ADAS capabilities by identifying vulnerable road users in real time. These AI-powered cameras improve object detection accuracy, reducing collision risks and advancing vehicle safety solutions in the automotive camera market.

Automotive Camera Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Single-view Systems, Multi-view Systems

|

|

By Technology

|

Digital Cameras, Infrared Cameras, Thermal Cameras

|

|

By Application

|

Park Assist, Lane Departure Warning Systems, Collision Avoidance Systems, Blind Spot Detection, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Type (Single-view Systems, Multi-view Systems): The single-view systems segment earned USD 4,775.2 million in 2023, due to its widespread adoption in rear-view and front-view applications, particularly in entry-level and mid-range vehicles.

- By Technology (Digital Cameras, Infrared Cameras, Thermal Cameras): The digital cameras segment held 46.23% share of the market in 2023, due to advancements in high-resolution imaging, AI-powered object detection, and cost-effectiveness.

- By Application (Park Assist, Lane Departure Warning Systems, Collision Avoidance Systems, Blind Spot Detection, and Others): The park assist segment is projected to reach USD 6,312.1 million by 2031, owing to the rising demand for automated parking solutions and increasing urban congestion.

Automotive Camera Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific accounted for a automotive camera market share of around 37.42% in 2023, with a valuation of USD 3,053.5 million. This dominance is driven by the rapid expansion of the automotive sector, growing demand for ADAS, and increased vehicle production in major economies such as China, Japan, South Korea, and India.

Additionally, urbanization, increasing disposable income, and evolving consumer preferences for safer, technology-enhanced vehicles are accelerating the adoption of automotive camera systems across both passenger and commercial vehicle segments.

The automotive camera Industry in Europe is poised to grow at a significant CAGR of 10.75% over the forecast period, driven by the rising adoption of ADAS technologies, increasing penetration of electric vehicles (EVs), and the presence of premium automotive manufacturers.

The region is home to leading luxury and high-performance automakers, such as BMW, Mercedes-Benz, Audi, and Volvo, which are integrating multi-camera ADAS features to enhance safety, driver convenience, and automation. The widespread deployment of blind-spot monitoring, automated parking assist, and driver monitoring systems is fueling the market.

Regulatory Frameworks

- In the U.S., the National Highway Traffic Safety Administration (NHTSA), operating under the U.S. Department of Transportation (DOT), regulates the automotive camera market by establishing vehicle safety standards that influence the adoption and implementation of camera-based systems, particularly for rear visibility and ADAS.

- In Europe, the European Commission (EC) regulates the market through the General Safety Regulation (GSR), mandating camera-based ADAS features like automatic emergency braking (AEB), lane-keeping assistance (LKA), and driver monitoring systems (DMS) to enhance vehicle safety.

Competitive Landscape:

The global automotive camera market is highly competitive, with a mix of established industry leaders and emerging players driving innovation. Leading automotive suppliers focus on developing high-performance ADAS solutions, integrating AI-driven object detection, sensor fusion, and high-resolution imaging, to enhance vehicle safety and automation.

Meanwhile, advancements in semiconductor and imaging technologies are enabling more precise ADAS functionalities and autonomous vehicle capabilities. The market is also registering increased competition from new entrants and startups, introducing cost-effective, AI-powered camera solutions that push the boundaries of affordability and performance.

Companies are investing in strategic collaborations, acquisitions, and innovations in edge computing, thermal imaging, and real-time data processing to maintain a competitive edge.

List of Key Companies in Automotive Camera Market:

- Magna International Inc.

- Garmin Ltd.

- OMNIVISION

- Panasonic Automotive Systems

- Robert Bosch GmbH

- ZF Friedrichshafen AG

- Continental AG

- GENTEX CORPORATION

- Sony Semiconductor Solutions Corporation

- Valeo SA

- STMicroelectronics

- Samsung

- Aptiv

- Autoliv Inc.

- DENSO CORPORATION

Recent Developments (New Product Launch)

- In May 2024, Sheba Microsystems launched Sharp 7, the world’s first AI-powered autofocus automotive camera, enhancing ADAS performance with real-time object detection and precise imaging. This innovation improves safety, low-light visibility, and environmental adaptability, advancing the automotive camera market and enabling smarter driver-assistance technologies.

- In October 2024, e-con Systems introduced STURDeCAM34, the world's first 140dB HDR, hot-pluggable GMSL2 camera, designed for ADAS and autonomous vehicles. Its AI-powered image processing enhances visibility in extreme lighting conditions, improving real-time object detection and situational awareness, crucial for next-generation automotive safety and automation.

- In December 2024, LG Electronics introduced an AI-powered automotive camera system that enhances ADAS capabilities by improving real-time object recognition and driver monitoring. This advanced vision technology enables enhanced safety features, optimizing vehicle perception for autonomous driving and smart mobility solutions, reinforcing LG’s presence in the market.