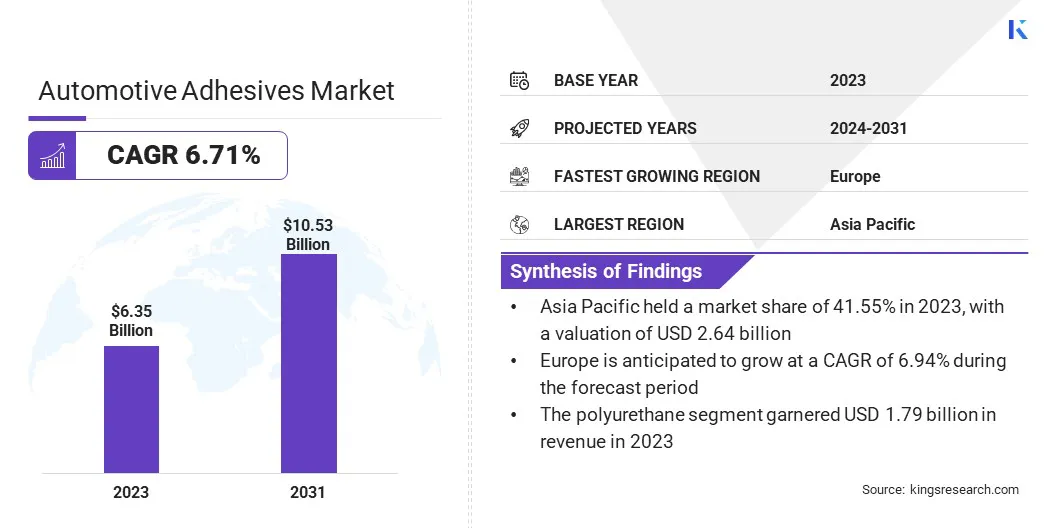

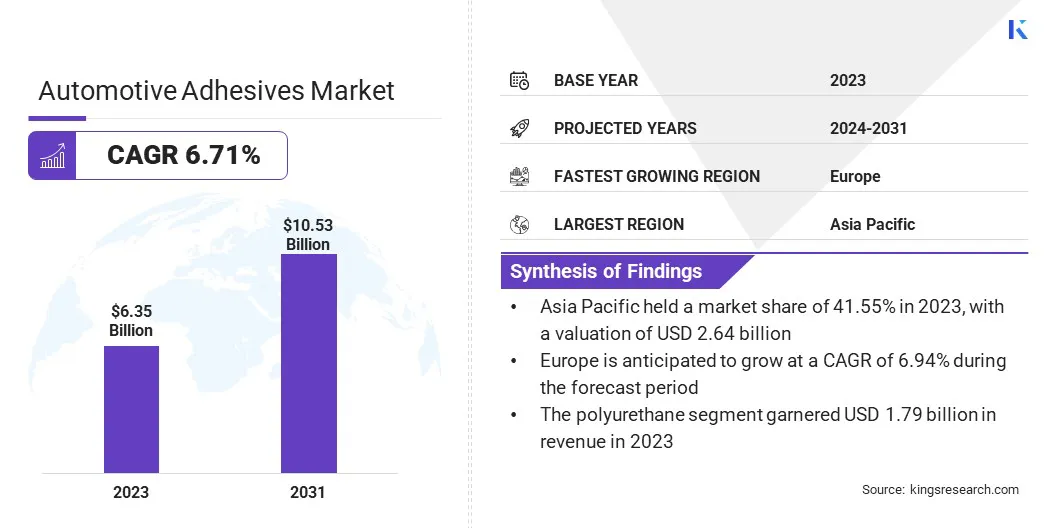

Automotive Adhesives Market Snapshot

The global Automotive Adhesives Market size was valued at USD 6.35 billion in 2023 and is projected to grow from USD 6.69 billion in 2024 to USD 10.53 billion by 2031, exhibiting a CAGR of 6.71% during the forecast period. The market is evolving rapidly, driven by technological advancements and increasing demand for vehicle customization.

Key Market Highlights:

- Market Value (2023): USD 6.35 Billion.

- Forecasted Value (2031): USD 10.53 Billion.

- CAGR (2024 - 2031): 6.71%.

- Largest & Fastest Growing Region (2024 - 2031): Asia-Pacific share stood around 41.55% in 2023 in the global market, with a valuation of USD 2.64 billion.

- The passenger vehicle segment is expected to garner the highest revenue of USD 7.69 billion by 2031.

- The solvent based segment captured the largest share of 34.06% in 2023.

- The polyurethane segment garnered the highest revenue of USD 1.79 billion in 2023.

In the scope of work, the report includes solutions offered by companies such as 3M, Arkema, AVERY DENNISON CORPORATION., DELO Industrie Klebstoffe GmbH & Co. KGaA, Dow, DuPont, H.B. Fuller Company, Henkel Ltd., Huitian, Huntsman International LLC, and others.

Automotive Adhesives Market Overview

Innovations in adhesive formulations are enhancing the integration of new materials and improving overall vehicle aesthetics and functionality. As automakers seek to differentiate their products and enhance performance, the demand for versatile and high-quality adhesives is growing.

The global automotive industry is experiencing a notable increase in vehicle production, spurred by rising consumer demand and robust economic growth, particularly in emerging markets. As production increases, the need for efficient and reliable bonding solutions fuels the demand for automotive adhesives.

- According to the National Automobile Dealers Association (NADA), in 2023, battery electric vehicle (BEV) sales exceeded 1.1 million units for the first time, accounting for 7.2% of all new light vehicles sold. Of these sales, franchised dealerships represented 40.1% of the total BEV sales.

Additionally, the adoption of specialized adhesives in EVs, which require superior thermal management and insulation, is propelling market expansion. The trend toward eco-friendly adhesives with low VOC emissions and recyclable properties is gaining momentum due to stringent environmental regulations and is boosting the automotive adhesives market growth.

Automotive adhesives are specialized bonding agents used in the assembly and repair of vehicles. They are specifically designed to provide strong adhesion between various materials, such as metals, plastics, glass, and composites, which are commonly found in automotive manufacturing.

These adhesives are essential for enhancing vehicle durability, safety, and performance by enabling efficient bonding of parts, reducing weight, and improving overall structural integrity.

Automotive adhesives are available in various forms, including epoxy, polyurethane, and silicone, each offering unique properties for applications such as sealing, gasketing, and structural bonding. Their advanced formulations adhere to stringent industry standards and enhance vehicle innovation and efficiency.

Analyst’s Review

Merger and acquisition (M&A) activities and strategic product launches are expected to aid the growth of the market. Through M&As, companies are expanding their portfolios, gaining access to new technologies, and strengthening their market presence.

Additionally, frequent product launches present cutting-edge adhesives with enhanced bonding strength, thermal management, and eco-friendly formulations. These innovations cater to evolving industry demands, ensuring that manufacturers remain competitive and responsive to market needs, thereby fostering sustained growth in the automotive adhesives market.

- For instance, in August 2023, Dow introduced VORANOL CP1100 polyol, engineered for high-performance automotive adhesives. This polyol is designed to provide exceptional adhesion, flexibility, and durability, making it ideal for bonding lightweight materials, sealing components, and attaching trim, thereby enhancing overall performance and reliability in automotive manufacturing.

Automotive Adhesives Market Growth Factors

The growing emphasis on lightweight vehicle manufacturing is stimulating the growth of the automotive adhesives market. As automakers strive to comply with fuel efficiency and emissions regulations, the demand for advanced adhesive solutions to replace heavier mechanical fasteners is rising.

These adhesives contribute to weight reduction while also enhancing vehicle performance and safety. This shift is leading to increased adoption of specialized adhesives across various automotive applications, thereby fueling market expansion.

The growing shift toward lighter, more fuel-efficient vehicles is prompting manufacturers to invest in innovative adhesive technologies, thus propelling market expansion. The growth of the market is expected to hindered by the fluctuating cost and availability of raw materials, due to supply chain disruptions and volatile petroleum prices.

Additionally, stringent environmental regulations are compelling manufacturers to adopt eco-friendlier adhesive solutions, which may be costly and require technological advancements.

To mitigate these challenges, key players are increasingly investing in research and development to create sustainable adhesive formulations that comply with environmental standards. They are further diversifying their supply chains to reduce dependency on limited sources and optimize production costs.

Strategic partnerships and collaborations with material suppliers are allowing manufacturers to ensure a steady supply of raw materials. These factors are projected to fuel the growth of the market in the forecast period.

Automotive Adhesives Market Trends

The increasing adoption of electric vehicles (EVs) is creating a strong demand for advanced adhesive solutions specifically tailored to their unique requirements.

- As reported by the International Energy Agency (IEA), electric car sales reached nearly 14 million in 2023, with China, Europe, and the United States accounting for 95% of the total.

Unlike traditional vehicles, EVs rely heavily on adhesives with specialized properties, such as superior thermal management and insulation, to ensure the safety and efficiency of battery systems. These adhesives are crucial for protecting batteries from heat, vibration, and electrical interference, thereby ensuring overall vehicle performance and safety.

As the EV market expands, manufacturers are developing and deploying specialized adhesive products tailored to meet the market's needs thus fostering innovation and stimulating industry growth.

The shift toward sustainable and eco-friendly adhesives is fueling the expansion of the automotive adhesives industry. With environmental regulations becoming stricter and consumer demand for greener products rising, manufacturers face increasing pressure to adopt adhesives that align with sustainability goals.

The development of low-VOC, recyclable, and renewable resource-based adhesives is meeting these demands, and creating new market growth opportunities.

By offering products that help automakers reduce their environmental footprint, adhesive manufacturers are gaining a competitive edge and expanding their market reach. This focus on sustainability is fueling innovation and augmenting the expansion of the market.

Segmentation Analysis

The global market has been segmented based on resin type, technology, vehicle type, application, and geography.

By Resin Type

Based on resin type, the automotive adhesives market has been categorized into polyurethane, epoxy, acrylics, silicone, SMP, polyamide, and others. The polyurethane segment garnered the highest revenue of USD 1.79 billion in 2023, mainly due to their superior bonding strength, flexibility, and resistance to environmental conditions in diverse automotive applications.

These adhesives are crucial for structural bonding, sealing, and gasketing. The growth of the segment is further fueled by advancements in polyurethane formulations that enhance performance and durability. Additionally, the increasing use of lightweight materials and complex vehicle designs boosts the demand for high-performance adhesives.

This trend, combined with ongoing innovations, is significantly contributing to the robust growth of the polyurethane adhesives.

By Technology

Based on technology, the market has been categorized into hot melt, solvent-based, water-based, pressure sensitive, and others. The solvent based segment captured the largest automotive adhesives market share of 34.06% in 2023. This growth is fueled by automotive manufacturers' rising demand for reliable bonding solutions with proven performance.

Solvent-based adhesives remain crucial for applications requiring strong initial adhesion and quick curing times. Advances in low-VOC formulations and improved safety measures are further supporting the growth of the segment.

By Vehicle Type

Based on vehicle type, the market has been categorized into passenger vehicle, light commercial vehicle, heavy commercial vehicle. The passenger vehicle segment is expected to garner the highest revenue of USD 7.69 billion by 2031. This expansion is largely attributed to its diverse applications, including structural bonding, interior assembly, and sealing.

Adhesives used in passenger vehicles must meet stringent performance criteria such as durability, impact resistance, and flexibility to ensure vehicle safety and longevity. Innovations in adhesive technology are focused on improving bonding efficiency, weight reduction, and integration with advanced materials such as composites and lightweight alloys.

The growing trend toward vehicle customization and enhanced interior features is highlighting the need for specialized adhesives, which is likely to bolster segmental growth.

Automotive Adhesives Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

Asia-Pacific automotive adhesives market share stood around 41.55% in 2023 in the global market, with a valuation of USD 2.64 billion. This growth is spurred by rapid industrialization, increasing vehicle production, and rising consumer demand for automobiles. China, India, and Japan are contributing significantly to this notable expansion, with China emerging as a key automotive manufacturing hub.

The region's ongoing infrastructure development, rapid urbanization, and economic expansion are fueling automotive production and increasing the demand for adhesives. Additionally, the shift toward electric vehicles and lightweight materials is fostering innovation in adhesive technologies.

Europe is anticipated to witness substantial growth at a CAGR of 6.94% over the forecast period, mainly due to stringent climate regulations and a notable shift toward sustainability.

- As part of the European Commission's climate goals, the "Fit for 55" legislation aims to reduce greenhouse gas emissions by at least 55% by 2030. This includes a 55% reduction in CO2 emissions from cars and a 50% reduction from vans.

As EVs become increasingly popular, there is an increased demand for specialized adhesives and sealants designed to meet the performance requirements of these vehicles, including enhanced thermal management and electrical insulation. The focus on reducing greenhouse gas emissions and advancing automotive technology is expected to aid the growth of the Europe market.

Competitive Landscape

The global automotive adhesives market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expanding services, investing in research and development (R&D), establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Automotive Adhesives Market

- 3M

- Arkema

- AVERY DENNISON CORPORATION.

- DELO Industrie Klebstoffe GmbH & Co. KGaA

- Dow

- DuPont

- B. Fuller Company

- Henkel Ltd.

- Huitian

- Huntsman International LLC

Key Industry Development

- September 2023 (Product Launch): Sika introduced the SikaForce-7760 structural adhesive, specifically designed for bonding lightweight materials used in electric vehicles and other automotive applications. It offers high strength, durability, and exceptional resistance to chemicals and extreme temperatures, making it ideal for demanding automotive environments.

The global automotive adhesives market is segmented as:

By Resin Type

- Polyurethane

- Epoxy

- Acrylics

- Silicone

- SMP

- Polyamide

- Others (Rubber and Phenolic Adhesives)

By Technology

- Hot melt

- Solvent-Based

- Water-Based

- Pressure Sensitive

- Others (Reactive and Thermosetting)

By Vehicle Type

- Passenger Vehicle

- Light Commercial Vehicle

- Heavy Commercial Vehicle

By Application

- Body-in-White (BIW)

- Powertrain

- Paint Shop

- Assembly

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America