Market Definition

The market focuses on the development and production of technologies designed to prevent accidents or minimize their. Unlike passive systems such as airbags and seatbelts, active safety systems operate before a collision to avoid it.

The report outlines the primary drivers of market growth, along with an in-depth analysis of emerging trends and evolving regulatory frameworks shaping the industry's trajectory.

Automotive Active Safety System Market Overview

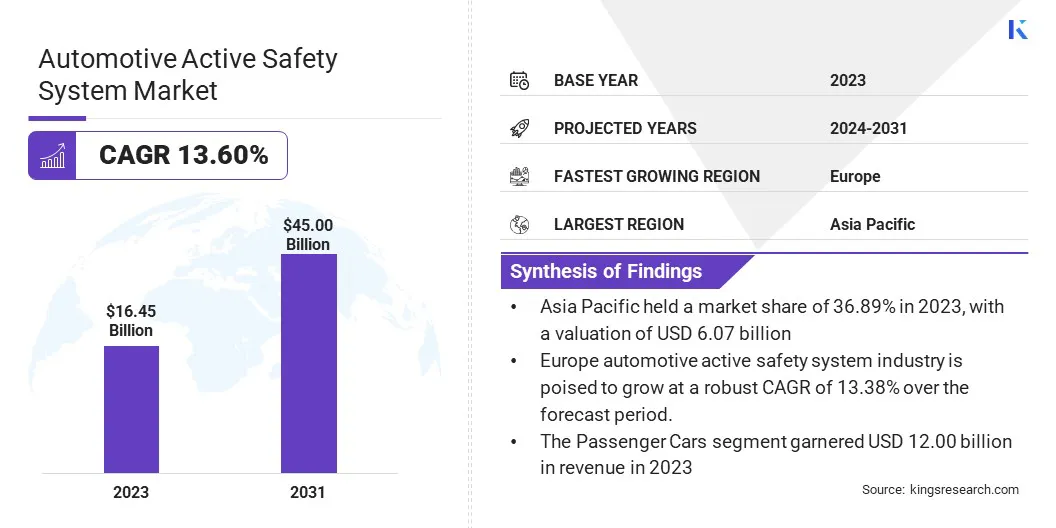

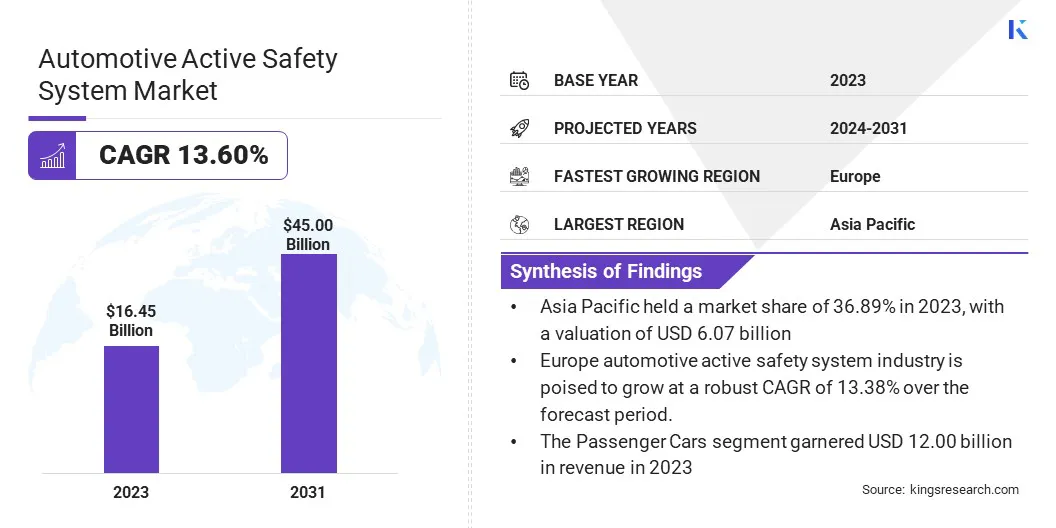

Global automotive active safety system market size was USD 16.45 billion in 2023, which is estimated to be valued at USD 18.43 billion in 2024 and reach USD 45.00 billion by 2031, growing at a CAGR of 13.60% from 2024 to 2031.

The increasing focus on road safety and accident prevention is propelling this growth. Technologies such as driver monitoring systems (DMS) enhance vehicle safety by analyzing driver behavior and reducing the risk of road fatalities.

Major companies operating in the automotive active safety system industry are Robert Bosch GmbH, Continental AG, ZF Friedrichshafen, VALEO, Magna International Inc, DENSO, Teledyne FLIR LLC, AB Volvo, Smart Eye Aktiebolag, Promwad, OMNIVISION, Sensata Technologies, Inc., Infineon Technologies AG, Mobileye, Nissan Motor Co., Ltd, and others.

The market is witnessing significant growth, fueled by increasing demand for enhanced vehicle safety and stringent regulatory requirements. Key systems include adaptive cruise control, autonomous emergency braking, blind spot detection, lane departure warning system, forward collision warning, tire pressure monitoring system, electronic stability control, night vision system and driver monitoring systems.

These systems improve accident prevention, driver awareness, and vehicle stability. Additionally, advancements in artificial intelligence, machine learning, and sensor technologies, along with rising consumer preference for safer vehicles, are boosting market expansion.

- In November 2024, Škoda Auto India globally introduced the Kylaq, its first sub-4m SUV. Designed for Indian roads, the Kylaq features a bold design, spacious interiors, and a comprehensive suite of active and passive safety systems, including six airbags, to enhance occupant protection.

Key Highlights:

- The automotive active safety system market size was recorded at USD 16.45 billion in 2023.

- The market is projected to grow at a CAGR of 13.60% from 2024 to 2031.

- Asia Pacific held a market share of 36.89% in 2023, with a valuation of USD 6.07 billion.

- The adaptive cruise control (ACC) segment garnered USD 3.49 billion in revenue in 2023.

- The passenger cars segment is expected to reach USD 30.30 billion by 2031.

- The sensor fusion segment is anticipated to witness the fastest CAGR of 17.07% over the forecast period

- Europe is anticipated to grow at a CAGR of 13.38% through the projection period.

Market Driver

Increased Focus on Road Safety and Accident Prevention

The automotive industry is placing greater emphasis on road safety and accident prevention, propelling the expansion of the market. As per the World Health Organization, road traffic accidents result in around 1.19 million deaths annually with an additional 20 to 50 million people sustaining non-fatal injuries, many of which lead to long-term or permanent disabilities.

Technologies such as driver monitoring systems (DMS) are increasingly vital in enhancing road safety by analyzing driver behavior and detecting signs of distraction, fatigue, or impairment. These systems help prevent accidents through timely alerts or corrective actions. With stricter road safety regulations tighten and rising consumer demand for safer vehicles, the adoption of such technologies is expected to grow significantly.

- In November 2023, Smart Eye’s AI-powered driver monitoring ystem (DMS) software was integrated into the Volvo EX90, Volvo’s all-electric flagship SUV. The technology enhances safety by monitoring behavior and providing real-time alerts, thereby helping reduce road fatalities and improve traffic safety.

Market Challenge

Cybersecurity Risks

Cybersecurity risks pose a significant challenge to the expansion of the automotive active safety system market, as increasing vehicle connectivity exposes critical safety systems to potential cyberattacks and data breaches. These threats can compromise system functionality, endanger driver safety, and raise serious privacy concerns.

To address this challenge, manufacturers are adopting robust cybersecurity frameworks, including end-to-end encryption and secure updates. Additionally, collaboration with cybersecurity firms and adherence to global automotive cybersecurity standards are essential to ensure system integrity and build consumer trust.

Market Trend

Focus on Realistic Simulation and Testing

The market is witnessing a significant shift toward realistic simulation and testing, supported by the growing use of lifelike dummy targets that replicate human motion and behavior.

These models, representing children, pedestrians, and powered two-wheelers, enable more precise real-world safety evaluations. This trend reflects the industry's commitment to enhancing vehicle safety performance, advancing driver assistance systems, and complying with evolving safety regulations.

- In August 2024, Humanetics and MESSRING announced a collaboration to deliver integrated active safety testing solutions by combining advanced dummy targets with Humanetics platforms. The partnership streamlines testing, enhances product compatibility, and showcases innovation in automotive safety at global industry events.

Automotive Active Safety System Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product Type

|

Adaptive Cruise Control (ACC), Autonomous Emergency Braking (AEB), Blind Spot Detection (BSD), Lane Departure Warning System (LDWS), Forward Collision Warning (FCW), Tire Pressure Monitoring System (TPMS), Electronic Stability Control (ESC), Night Vision System (NVS), Driver Monitoring Systems (DMS)

|

|

By Vehicle Type

|

Passenger Cars, Light Commercial Vehicles (LCVs), Heavy Commercial Vehicles (HCVs), Electric Vehicles (EVs)

|

|

By Technology

|

Radar-based Systems, Lidar-based Systems, Camera-based Systems, Ultrasonic-based Systems, Infrared Sensors, Sensor Fusion

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Product Type [Adaptive Cruise Control (ACC), Autonomous Emergency Braking (AEB), Blind Spot Detection (BSD), Lane Departure Warning System (LDWS), Forward Collision Warning (FCW), Tire Pressure Monitoring System (TPMS), Electronic Stability Control (ESC), Night Vision System (NVS), and Driver Monitoring Systems (DMS)]: The adaptive cruise control (ACC) segment earned USD 3.49 billion in 2023, due to increasing consumer demand for enhanced driver assistance features and safety regulations.

- By Vehicle Type [Passenger Cars, Light Commercial Vehicles (LCVs), Heavy Commercial Vehicles (HCVs), and Electric Vehicles (EVs)]: The passenger cars segment held a share of 64.77% in 2023, fueled by the widespread adoption of active safety systems in personal vehicles and rising consumer awareness of road safety.

- By Technology (Radar-based Systems, Lidar-based Systems, Camera-based Systems, Ultrasonic-based Systems, Infrared Sensors, and Sensor Fusion): The camera-based systems market is projected to reach USD 13.43 billion by 2031, propelled by advancements in sensor technologies and the growing demand for enhanced driver assistance features.

Automotive Active Safety System Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific automotive active safety system market share stood at around 36.89% in 2023, valued at USD 6.07 billion. This dominance is reinforced by growing automotive industry, increasing disposable incomes, and expanding adoption of safety technologies. This growth is further fueled by rising consumer demand for advanced safety features, particularly in countries such as China, India, and Japan.

Additionally, government initiatives to improve road safety and reduce traffic accidents are boosting the uptake of these systems. The region’s continuous technological advancements and the rise of electric and autonomous vehicles create significant opportunities for regional market expansion.

- In March 2025, Honda Cars India reached a milestone with 50,000 advanced driver-assistance system (ADAS)-enabled vehicles on Indian roads, reflecting the increasing adoption of advanced safety technologies such as Honda SENSING. The strong market response to ADAS-equipped models such as the Honda City, Elevate, and Amaze highlights rising consumer demand for safer driving and reinforces Honda’s commitment to automotive safety and innovation in India.

Europe automotive active safety system industry is poised to grow at a robust CAGR of 13.38% over the forecast period. This expansion is bolstered by the increasing demand for advanced driver-assistance technologies and a strong emphasis on improving road safety.

Leading countries such as Germany, France, and the UK are at the forefront of integrating cutting-edge safety systems into vehicles. The region's robust automotive industry and commitment to innovation further accelerate the adoption of these technologies, positioning Europe as a major market for automotive active safety systems.

Regulatory Frameworks

- In the U.S., the National Highway Traffic Safety Administration’s (NHTSA) New Car Assessment Program (NCAP) evaluates vehicle safety through crashworthiness and crash avoidance tests, providing 5-Star Safety Ratings to guide consumer purchasing decisions.

- In the EU, the Vehicle General Safety Regulation mandates advanced driver-assistance systems (ADAS) to enhance road safety and establishes a legal framework for approving automated and fully driverless vehicles.

- In India, the Ministry of Road Transport & Highways launched the Bharat NCAP on October 1, 2023, to enhance vehicle safety, allowing consumers to make informed decisions by comparing crash test performance.

Competitive Landscape

In the automotive active safety system market, companies are prioritizing the development of cutting-edge sensor technologies, including radar, and camera-based systems, to enhance vehicle safety.

These technologies are being integrated into systems such as advanced driver assistance systems (ADAS), enabling real-time detection of potential hazards and improving crash avoidance. Manufacturers are also prioritizing system reliability, vehicle autonomy, and consumer safety, aiming to reduce accidents and improve road safety worldwide.

- In November 2024, NOVOSENSE Microelectronics and Continental Automotive signed a memorandum to develop automotive-grade sensors, advancing vehicle safety systems. This collaboration focuses on sensor integrated circuits (ICs) with functional safety, ensuring system reliability from airbag triggers to battery monitors, thereby enhancing global integration and competitiveness in automotive safety applications.

List of Key Companies in Automotive Active Safety System Market:

- Robert Bosch GmbH

- Continental AG

- ZF Friedrichshafen

- VALEO

- Magna International Inc

- DENSO

- Teledyne FLIR LLC

- AB Volvo

- Smart Eye Aktiebolag

- Promwad

- OMNIVISION

- Sensata Technologies, Inc.

- Infineon Technologies AG

- Mobileye

- Nissan Motor Co., Ltd

Recent Developments (Partnerships/Product Launch)

- In April 2024, Volvo Buses unveiled its third-generation active safety systems, designed to protect vulnerable road users such as pedestrians and cyclists. These systems, which surpass EU regulations, are standard on electric and Euro 6 Volvo buses. Key features include collision warning with emergency braking, side collision avoidance support, adaptive cruise control, and lane-keeping support. Volvo aims to enhance safety globally, reduce accidents, and support its Zero Accidents Vision, ensuring safer road conditions for drivers, passengers, and pedestrians alike.

- In June 2023, Magna completed its acquisition of Veoneer Active Safety, strengthening its leadership in the active safety sector. This expansion broadens Magna's capabilities in sensors, software, and systems engineering, strenghtheing its global presence with nine dedicated facilities and 30 engineering and sales locations focused on active safety solutions in key automotive markets.