Market Definition

The market involves the development, integration, and application of Artificial Intelligence (AI) technologies to enhance defense operations, intelligence gathering, and combat strategies. This market encompasses AI-driven solutions for autonomous systems, surveillance, cybersecurity, logistics, and decision-making processes.

Key components include Machine Learning (ML), computer vision, Natural Language Processing (NLP), and data analytics, which are employed to improve threat detection, mission planning, and operational efficiency across land, air, naval, and space domains.

Artificial Intelligence in Military Market Overview

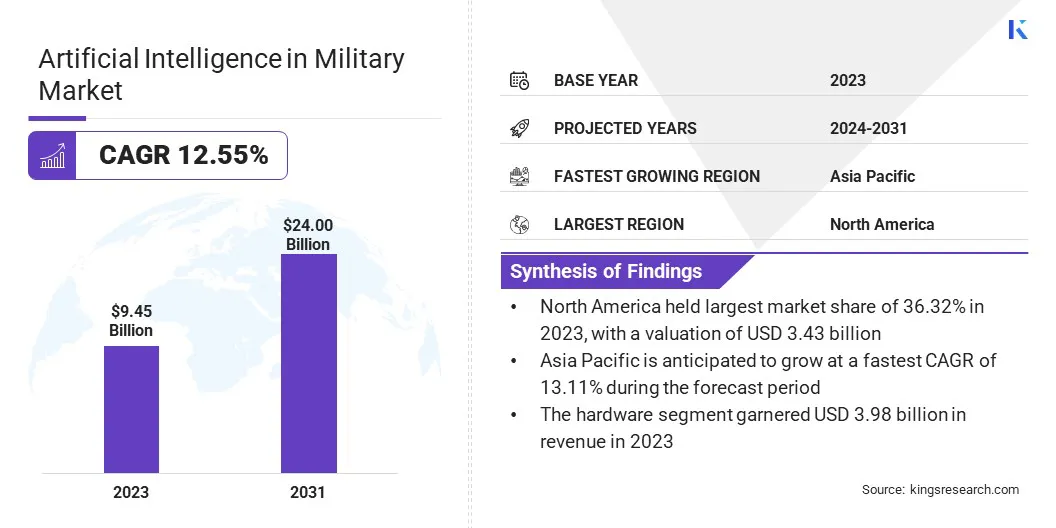

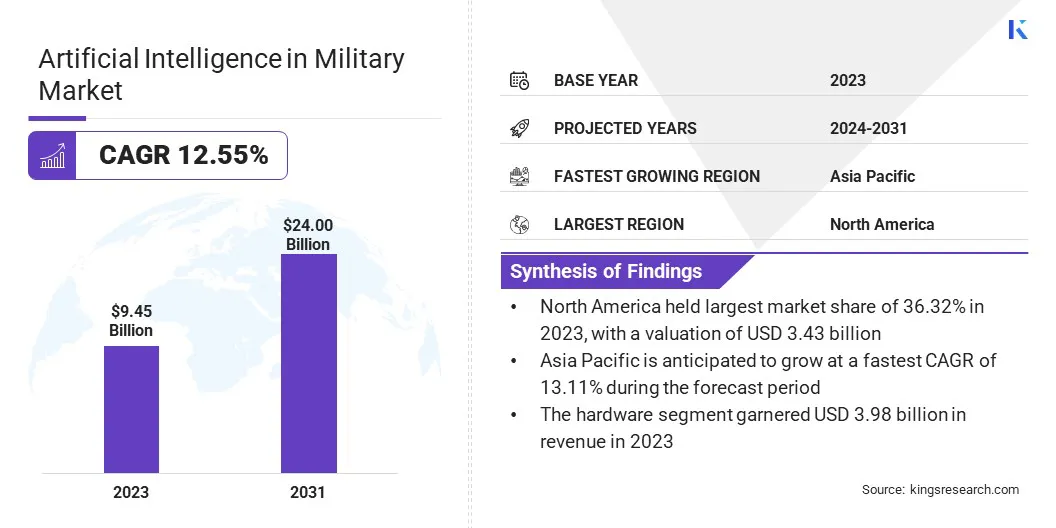

The global artificial intelligence in military market size was valued at USD 9.45 billion in 2023 and is projected to grow from USD 10.49 billion in 2024 to USD 24.00 billion by 2031, exhibiting a CAGR of 12.55% during the forecast period.

This market is registering significant growth driven by increasing investments in defense modernization and the adoption of advanced AI-driven technologies for strategic operations. The rising demand for autonomous systems, such as unmanned aerial vehicles (UAVs), ground vehicles, and naval vessels, is fueling the market.

Enhanced data analytics capabilities and AI-powered decision support systems are improving mission planning, intelligence analysis, and threat identification, contributing to greater operational efficiency.

Major companies operating in the artificial intelligence in military industry are Anduril Industries, Inc., RAFAEL Advanced Defense Systems Ltd., L3Harris Technologies, Inc., Palantir Technologies Inc., Adarga Limited, Thales, IBM Corporation, RTX Corporation, Northrop Grumman, Lockheed Martin Corporation, BAE Systems plc, Charles River Analytics, Inc., Avathon, Inc., General Dynamics Information Technology, and NVIDIA Corporation.

Additionally, the integration of AI in surveillance, reconnaissance, and cybersecurity solutions is enhancing situational awareness and strengthening defense capabilities. Growing collaborations between defense agencies and technology providers, along with advancements in ML algorithms and AI hardware, are further accelerating the adoption of AI solutions in military applications globally.

- In December 2024, the United Nations First Committee approved a draft resolution addressing the implications of AI in the military domain. The resolution encourages the states to address AI-related opportunities and challenges from humanitarian, legal, security, technological, and ethical perspectives.

Key Highlights

- The artificial intelligence in military industry size was valued at USD 9.45 billion in 2023.

- The market is projected to grow at a CAGR of 12.55% from 2024 to 2031.

- North America held a market share of 36.32% in 2023, with a valuation of USD 3.43 billion.

- The hardware segment garnered USD 3.98 billion in revenue in 2023.

- The machine learning (ML) segment is expected to reach USD 9.83 billion by 2031.

- The surveillance & situational awareness segment is expected to reach USD 6.94 billion by 2031.

- The market in Asia Pacific is anticipated to grow at a CAGR of 13.11% during the forecast period.

Market Driver

Rising Investments in AI-driven Autonomous Systems

The artificial intelligence in military market is expanding, due to rising investments in AI-driven autonomous systems, which are designed to enhance battlefield decision-making, situational awareness, and operational efficiency. These systems utilize advanced ML algorithms, computer vision, and sensor fusion to process large volumes of data in real time.

They provide actionable insights, identify potential threats, and support critical decisions during high-pressure combat scenarios. Autonomous systems integrated with AI also reduce human intervention in repetitive or high-risk tasks, improving mission accuracy and response times.

- In January 2025, GSI Technology, Inc. announced its selection by the U.S. Army for a potential contract award of up to USD 250,000 under the DoD Small Business Innovation Research (SBIR) program. The project will focus on developing advanced edge AI computing solutions using GSI's Gemini-II compute-in-memory technology to enhance military operational efficiency and situational awareness. The initiative includes integrating AI models tailored for edge computing and identifying suitable AI algorithms for low-latency, high-throughput military applications.

Additionally, the growing demand for AI-enabled defense platforms is significantly contributing to the market growth. Defense organizations are increasingly adopting AI solutions to counter evolving security threats, such as Unmanned Aerial Systems (UAS), cyberattacks, and sophisticated surveillance techniques.

AI-driven platforms enhance reconnaissance, surveillance, and intelligence-gathering capabilities, enabling faster threat detection and improved response strategies. These technologies are integrated into advanced defense systems for applications such as missile guidance, drone swarms, and electronic warfare, ensuring enhanced security and operational readiness in modern military environments.

Market Challenge

Data Security and Privacy Concerns

A major challenge in the artificial intelligence in military market is ensuring data security and safeguarding sensitive information from cyber threats. AI systems in defense rely heavily on vast volumes of data gathered from intelligence networks, reconnaissance tools, and battlefield sensors.

This data is crucial for real-time decision-making, predictive analytics, and automated responses. However, the extensive flow of classified information across interconnected AI platforms makes these systems highly vulnerable to cyber-attacks, data breaches, and adversarial manipulation.

Hackers may exploit these vulnerabilities to corrupt mission-critical data, manipulate AI-driven decisions, or disable autonomous military systems, posing significant risks to national security and operational stability. Thus, defense organizations are increasingly adopting advanced cybersecurity frameworks and robust encryption protocols to secure AI infrastructure.

Techniques such as secure multi-party computation allow data analysis across different parties without sharing sensitive information. Similarly, privacy-preserving encryption enables calculations on encrypted data while keeping the original information hidden.

Market Trend

Advancements in AI-driven Decision Making and Manned-unmanned Coordination

The market is registering notable advancements driven by evolving operational requirements and technological innovation. A key trend is the growing adoption of AI-powered cognitive systems designed to enhance decision-making, automate data analysis, and accelerate response times in dynamic battlefield environments.

These systems leverage advanced algorithms to process vast volumes of data from sensors, reconnaissance tools, and communication networks, enabling defense forces to identify threats, assess risks, and execute informed decisions with greater speed and precision.

The increased integration of AI-driven systems to enhance coordination between manned and unmanned platforms is revolutionizing modern military operations.

This trend involves deploying AI technologies that enable seamless communication and collaboration between crewed vehicles, such as fighter jets, helicopters, or ground units, and autonomous systems like drones, unmanned ground vehicles, or robotic surveillance tools. AI algorithms process real-time data from multiple sources, including sensors, radar systems, and satellite feeds.

This data integration allows both manned and unmanned platforms to operate in sync, improving situational awareness and reducing the cognitive load on human operators.

- In June 2024, Airbus Defence and Space and Helsing announced a collaboration to develop AI technologies for Manned-Unmanned Teaming (MUM-T) in military aircraft. The partnership will focus on integrating AI into Airbus' future Wingman system, an unmanned fighter-type aircraft designed to operate alongside manned combat jets.

Artificial Intelligence in Military Market Report Snapshot

|

Segmentation

|

Details

|

|

By Offering

|

Hardware (AI-specific processors, Sensors, Robotics and drones, Others), Software (Cybersecurity software, Simulation and training software, Others), Services (Deployment and integration services, Upgrades and maintenance, Software support, Consulting services)

|

|

By Technology

|

Machine Learning (ML), Natural Language Processing (NLP), Context-Aware Computing, Others

|

|

By Application

|

Warfare Platforms, Cybersecurity, Logistics & Transportation, Surveillance & Situational Awareness, Command & Control, Battlefield Healthcare, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Offering (Hardware, Software, Services): The hardware segment earned USD 3.98 billion in 2023, due to the increased deployment of AI-enabled defense equipment and advanced sensor systems.

- By Technology (Machine Learning (ML), Natural Language Processing (NLP), Context-Aware Computing, Others): The Machine Learning (ML) segment held 37.44% share of the market in 2023, due to its extensive use in autonomous systems, predictive maintenance, and data-driven decision-making.

- By Application (Warfare Platforms, Cybersecurity, Logistics & Transportation, Surveillance & Situational Awareness, Command & Control, Others): The surveillance & situational awareness segment is projected to reach USD 6.94 billion by 2031, owing to the increasing adoption of AI-powered monitoring systems and real-time threat detection solutions.

Artificial Intelligence in Military Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America accounted for 36.32% share of the artificial intelligence in military market in 2023, with a valuation of USD 3.43 billion. This dominance is largely driven by substantial defense spending, particularly in the U.S., which allocates significant resources to integrating AI technologies across various military applications.

The region's well-established defense infrastructure, coupled with strong government-backed initiatives such as the U.S. Department of Defense’s AI strategy, has accelerated the adoption of advanced AI solutions. Investments in autonomous systems, AI-driven intelligence platforms, and sophisticated threat detection technologies have further reinforced this region's market position.

Additionally, collaborations between defense organizations and technology innovators are enhancing capabilities in areas such as cybersecurity, predictive maintenance, and command-and-control systems, contributing to continued growth.

- In December 2024, Anduril Industries partnered with OpenAI to develop and deploy advanced AI solutions for national security missions. The collaboration aims to enhance counter-unmanned aircraft systems (CUAS) by integrating OpenAI's AI models with Anduril's defense systems and Lattice software platform. This initiative focuses on improving real-time threat detection, situational awareness, and decision-making to protect U.S. and allied military personnel.

Asia Pacific is expected to register the fastest growth in the market, with a projected CAGR of 13.11% over the forecast period. This growth is fueled by increasing defense modernization programs and rising geopolitical tensions, prompting nations to strengthen their military capabilities.

Countries like China are investing heavily in AI-powered surveillance systems, autonomous combat platforms, and enhanced situational awareness solutions to advance strategic defense operations. Meanwhile, India’s focus on leveraging AI for border security, unmanned systems, and decision-support technologies is further driving the regional market.

The growing adoption of AI in logistics management, intelligence gathering, and battlefield data analysis reflects the region’s commitment to enhancing military efficiency through technological advancements.

Regulatory Frameworks

- In the U.S., the regulatory framework for AI in the military is guided by the Department of Defense (DoD) under the DoD AI Ethical Principles established in 2020. These principles emphasize responsibility, equity, traceability, reliability, and governability in the development and deployment of AI technologies. The National Defense Authorization Act (NDAA) also outlines funding, research, and ethical considerations for AI in defense applications. Additionally, the Joint Artificial Intelligence Center (JAIC) oversees AI integration in military operations, ensuring compliance with ethical and security standards.

- In Europe, AI in military applications is regulated under the European Defence Fund (EDF), which funds research while promoting responsible AI development. The European Union Artificial Intelligence Act establishes rules for high-risk AI systems, including those used in defense, ensuring transparency, accountability, and security.

- In China, AI in military applications is governed by the State Administration for Science, Technology, and Industry for National Defense (SASTIND). The Artificial Intelligence Development Plan (2017-2030) outlines strategic objectives for AI integration in defense. China’s military AI development also follows directives from the Central Military Commission (CMC), ensuring technological advancements align with national security priorities and ethical frameworks.

- In Japan, AI in military systems is regulated by the Ministry of Defense (MoD), which follows the Defense Technology Guidelines to ensure responsible AI integration. The Japanese Security Strategy emphasizes the use of AI for enhancing surveillance, cybersecurity, and autonomous defense systems while adhering to international humanitarian laws.

- In India, the Ministry of Defence (MoD) established the Defence Artificial Intelligence Council (DAIC) to oversee AI adoption in military operations. The Task Force on Artificial Intelligence for Defence, formed under the Department of Defence Production (DDP), outlines policies for AI integration with a focus on ethical deployment, security standards, and national defense objectives.

Competitive Landscape

The artificial intelligence in military industry is characterized by continuous advancements in AI-driven defense technologies, strategic collaborations, and increased government investments to enhance military capabilities. Defense organizations globally are actively adopting AI to improve battlefield intelligence, automate mission planning, and strengthen threat detection systems.

Several nations are focusing on integrating AI into autonomous platforms, including unmanned aerial vehicles, ground robots, and naval systems to improve operational efficiency and reduce human risk.

Key developments in the market include the expansion of AI-based cybersecurity frameworks to counter evolving digital threats and safeguard critical defense networks. Defense agencies are also leveraging AI for predictive maintenance solutions, enhancing equipment readiness and minimizing downtime.

Moreover, investments in AI-powered surveillance and reconnaissance systems are rising, enabling real-time data analysis for improved situational awareness and decision-making. Countries are increasingly forming alliances with technology providers to develop AI-integrated command and control systems, further enhancing strategic operations.

Additionally, the adoption of AI-enabled simulation and training platforms is gaining traction, offering defense personnel advanced learning environments to improve combat readiness.

The increasing focus on edge computing solutions to support faster data processing in battlefield environments is also driving innovation within the market. These advancements collectively reflect the growing role of AI in strengthening military strategies and enhancing defense capabilities globally.

- In March 2025, Booz Allen Hamilton and Shield AI announced a partnership to deliver AI-enabled, software-defined autonomous solutions for the U.S. government. This collaboration will combine Booz Allen’s mission engineering expertise with Shield AI’s Hivemind Enterprise platform to enhance uncrewed systems, providing the U.S. military with improved decision-making and operational capabilities in complex environments.

List of Key Companies in Artificial Intelligence in Military Market:

- Anduril Industries, Inc.

- RAFAEL Advanced Defense Systems Ltd.

- L3Harris Technologies, Inc.

- Palantir Technologies Inc.

- Adarga Limited

- Thales

- IBM Corporation

- RTX Corporation

- Northrop Grumman

- Lockheed Martin Corporation

- BAE Systems plc

- Charles River Analytics, Inc.

- Avathon, Inc.

- General Dynamics Information Technology

- NVIDIA Corporation

Recent Developments (Partnerships /New Technology Launch)

- In March 2025, Singapore's Defence Science and Technology Agency (DSTA) partnered with Oracle to implement an Oracle Cloud Isolated Region, supporting the Ministry of Defence (MINDEF) and the Singapore Armed Forces (SAF). This collaboration enables MINDEF and SAF to access high-performance, air-gapped cloud infrastructure and AI services for mission-critical defence applications. The Oracle Cloud Isolated Region will enhance SAF’s Command, Control, Communications, and Computers (C4) functions, improving scalability, performance, and decision-making capabilities in secure military environments.

- In February 2025, Helsing and Mistral AI announced a strategic partnership to jointly develop next-generation AI systems for European defense. The collaboration will focus on Vision-Language-Action models to improve battlefield decision-making, enhance human-AI collaboration, and enable defense platforms to understand their environment and communicate with operators.

- In December 2024, the Chief Digital and Artificial Intelligence Office (CDAO) and the Defense Innovation Unit (DIU) announced the launch of the AI Rapid Capabilities Cell (AI RCC) to accelerate the Department of Defense's (DoD) adoption of advanced AI technologies, including Generative AI. The AI RCC will focus on key areas such as command and control, logistics, intelligence, and cybersecurity, with USD 100 million allocated for pilot projects and AI infrastructure investments in FY 2024 and FY 2025.

- In November 2024, JSW Defence Pvt. Ltd. and Shield AI, Inc. announced a strategic partnership to indigenize and manufacture Shield AI’s “V-BAT,” a Group 3 Unmanned Aerial System (UAS). The collaboration aims to enhance India’s defense capabilities by establishing a local supply chain and manufacturing facility for large-scale V-BAT production, supporting the Indian Armed Forces and global distribution.