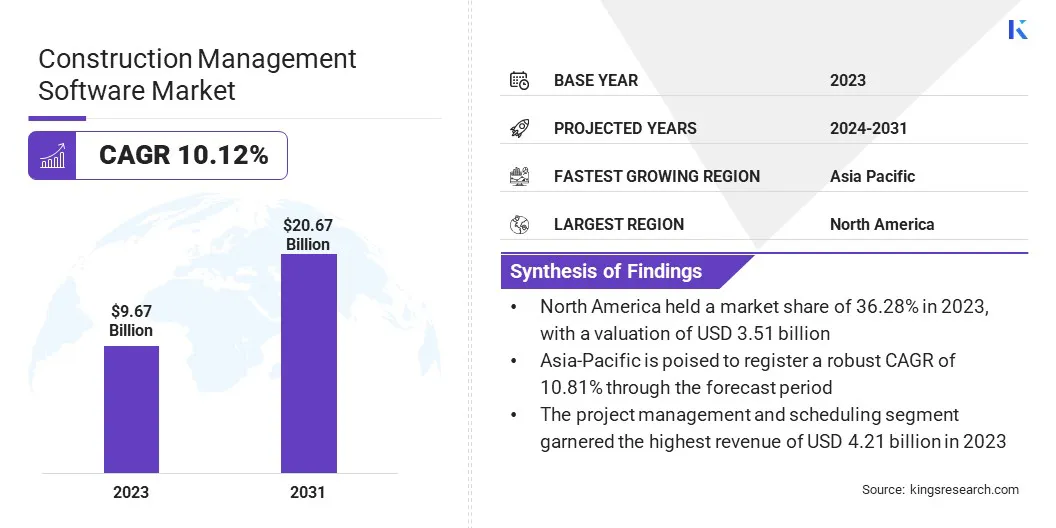

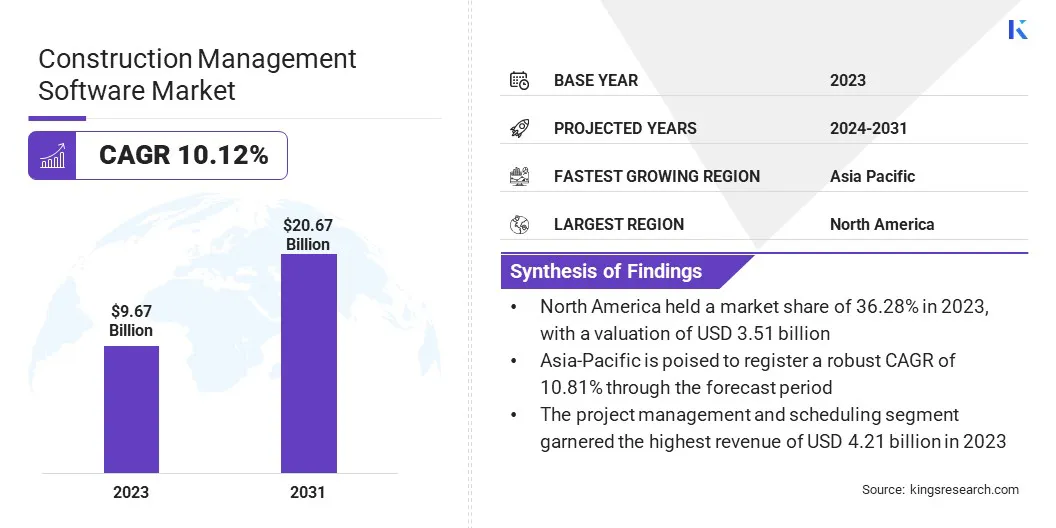

Construction Management Software Market Overview

The global Construction Management Software Market size was valued at USD 9.67 billion in 2023 and is projected to grow from USD 10.52 billion in 2024 to USD 20.67 billion by 2031, exhibiting a CAGR of 10.12% during the forecast period.

Increasing adoption of cloud-based solutions and integration of artificial intelligence and machine learning are boosting the demand of construction management software.

Key Market Highlights:

- Market Value (2023): USD 9.67 Billion.

- Forecasted Value (2031): USD 20.67 Billion.

- CAGR (2024 - 2031): 10.12%.

- Fastest Growing Region (2024-2031): Asia-Pacific is expected to grow at the highest CAGR of 10.81%.

- Largest Region: North America market accounted for 36.28% share of the global market and was valued at USD 3.51 billion in 2023.

- The project management and scheduling segment garnered the highest revenue of USD 4.21 billion in 2023.

- The residential segment is expected to record a staggering CAGR of 10.24%.

- The on-premises segment captured the largest market share of 58.68% in 2023.

In the scope of work, the report includes services offered by companies such as Oracle, Bentley Systems, Incorporated, Sage Group plc, Procore Technologies, Inc., Microsoft, Trimble Inc., Autodesk, Inc., Intuit Inc., Nemetschek Group, Jonas Construction Software Inc., and others.

The focus on user-friendly interfaces and automation represents a significant opportunity in the construction management software market. As construction projects become more complex, the demand for software that simplify project management processes is increasing.

User-friendly interfaces are gaining pace because they enable even non-technical users to navigate the software easily, reducing the learning curve and increasing overall adoption rates. This aspect is particularly important for small- and medium-sized construction firms that may not have a dedicated IT workforce.

By designing intuitive interfaces, software providers can appeal to a broader audience, ensuring that the tools are accessible to everyone from project managers to on-site workers. Moreover, the companies are acquiring small players to expand their product portfolio.

- For instance, in May 2023, Sage acquired Corecon, a cloud-native preconstruction and project management solution, to strengthens its position as a leading provider of cloud technology in the construction industry, extending its customer relationships beyond financials, and enabling efficient project management from bid to closeout.

Additionally, automation within construction management software can greatly enhance efficiency by streamlining repetitive tasks such as scheduling, budgeting, and resource allocation.

Automated workflows reduce human errors, ensure consistency, and free up valuable time for project teams to focus on core strategic activities. This combination of user-friendliness and automation improves productivity, establishing construction management software as an indispensable tool in the industry, and pave the way for its wider adoption and long-term market growth.

Construction management software is a digital tool designed to assist construction professionals in planning, coordination, and management of different aspects of construction projects. These software solutions typically encompass a wide range of features, including project scheduling, resource allocation, budgeting, document management, and communication tools.

By centralizing all these functionalities, construction management software enables project managers to have a comprehensive overview of their projects, facilitating better decision-making and more efficient use of resources.

Deployment options for these software solutions vary, with cloud-based platforms gaining significant traction due to their accessibility, scalability, and ability to support real-time collaboration among dispersed teams. On-premise solutions, though less common, are still favored by larger firms with specific security or customization needs.

The application of construction management software extends across sectors, including residential, commercial, infrastructure, and industrial construction. These tools are used for managing day-to-day operations for ensuring compliance with regulatory requirements, mitigating risks, and enhancing overall project outcomes.

Therefore, by integrating these software solutions into their operations, construction firms can significantly improve project efficiency, reduce costs, and enhance communication among all stakeholders involved in the construction process.

Analyst’s Review

The construction management software market is characterized by dynamic growth driven by the increasing complexity of construction projects and the industry's ongoing digital transformation. Companies in this space are strategically focusing on expanding their product offerings to include advanced features, such as AI-driven analytics, real-time collaboration tools, and integration with emerging technologies like BIM and IoT.

Current growth trends indicate that companies that are targeting large-scale construction companies are also making concerted efforts to cater to small- and medium-sized enterprises by developing more affordable and scalable solutions. To stay competitive, key players are emphasizing the importance of strategic partnerships and collaborations, particularly with technology providers, to enhance their software capabilities.

- For instance, in July 2024, The Nemetschek Group announced the acquisition of GoCanvas Holdings, Inc., a leading provider of field worker collaboration software that digitizes paper-based processes, simplifies inspections, improves safety, and maximizes compliance.

Additionally, they are investing in extensive research and development to innovate and create solutions that address the evolving needs of the construction industry. These companies maintain a strong focus on customer-centric design, ensuring seamless integration with existing systems and offering robust support services to facilitate smooth adoption and long-term client satisfaction.

As the market continues to grow, the ability to balance technological innovation with ease of use will be crucial for gaining competitive advantage and driving market growth.

What are the major factors affecting this market?

Digital transformation in the construction industry is a powerful factor driving the construction management software market. This transformation involves the integration of digital technologies into all areas of construction, fundamentally changing how projects are planned, executed, and managed.

As the construction sector increasingly embraces digital tools, construction management software becomes essential for enhancing efficiency, improving communication, and ensuring better project outcomes. Digital transformation enables construction firms to shift from traditional, often manual processes to automated, data-driven operations.

- For instance, in September 2023, Procore Technologies announced Procore Copilot, a new artificial intelligence-powered conversational and predictive experience that provides customers the ability to automate time-intensive, manual processes across the Procore Platform. Procore Copilot helps customers make the next best decision by leveraging advanced artificial intelligence technology, powered by the Procore Platform.

Moreover, the use of Building Information Modeling (BIM), drones, and IoT devices is also revolutionizing project management by providing real-time data and insights, which are critical for informed decision-making. Construction management software plays a pivotal role in this digital shift by centralizing project data, facilitating collaboration among stakeholders, and offering advanced analytics that can predict potential project risks and optimize resource allocation.

However, the high initial costs of purchasing and implementing construction management software present a significant challenge for many construction firms, particularly small- and medium-sized enterprises (SMEs). These costs include expenses related to customization, integration with existing systems, training staff, and maintenance.

For SMEs, these upfront investments could be prohibitive, which can make it difficult to justify the switch from traditional project management methods to digital solutions. Additionally, the implementation process itself can be time-consuming and complex, requiring firms to temporarily divert resources and potentially disrupt ongoing projects. This financial barrier often deters smaller firms from adopting construction management software, despite the long-term benefits it offers in terms of efficiency, cost savings, and risk management.

To mitigate this challenge, companies can explore flexible pricing models, such as subscription-based or pay-as-you-go options, which can reduce the financial burden by spreading costs over time. Additionally, investing in scalable solutions that allow firms to start with basic features and expand as needed can make the adoption of construction management software more accessible.

What are the major trends in this market?

The rising demand for mobile applications in the construction industry is a significant trend shaping the development of construction management software market. Mobile applications offer construction professionals the ability to access project data, manage tasks, and communicate with team members from anywhere, at any time.

This flexibility is particularly valuable in industries where on-site presence is crucial and real-time decision-making can make or break a project.

The increasing ownership of smartphones and tablets among construction workers has fueled this trend, as these devices become essential tools for managing day-to-day operations. Mobile applications enhance collaboration by enabling instant communication, update sharing, and access to project documents directly from the construction site.

Moreover, these applications often come with GPS tracking, time and expense management, and on-site photo documentation, which further streamline project management processes.

As the demand for mobility continues to grow, construction management software providers focus on developing robust mobile solutions that offer the same level of functionality and security as their desktop counterparts.

This is another major trend that is expected to drive further innovation in the market, with mobile applications becoming increasingly sophisticated and integral to the construction management ecosystem.

Segmentation Analysis

The global market has been segmented based on deployment, building type, application, end-user, and geography.

What is the market share of on-premises segment?

Based on deployment, the market has been categorized into cloud-based and on-premises. The on-premises segment captured the largest construction management software market share of 58.68% in 2023, primarily due to its appeal to large construction firms and enterprises that prioritize control, security, and customization.

On-premises construction management software is hosted on the company's own servers, providing organizations full control over their data and the ability to tailor the software to meet specific operational needs. This level of control is particularly important for large firms that manage complex projects requiring highly customized workflows and processes.

Moreover, industries with stringent regulatory requirements, such as government or defense-related construction, often prefer on-premises solutions to ensure compliance with data protection laws.

How fast will the residential segment grow in this market?

Based on building type, the construction management software market has been classified into commercial and residential. The residential segment is expected to record a staggering CAGR of 10.24% over the forecast period, driven by a combination of factors that are transforming the global housing market.

Increasing urbanization, population growth, and rising demand for affordable housing are primary drivers fueling the need for residential construction projects worldwide. Additionally, government initiatives and incentives aimed at promoting homeownership and developing sustainable housing solutions are boosting investments in the residential sector.

As more people look to become homeowners, particularly in emerging markets, the volume of residential construction projects is expected to surge.

This growth creates a significant demand for construction management software that can streamline project planning, budgeting, and execution, particularly as residential projects often involve multiple stakeholders and tight timelines.

Furthermore, the trend toward smart homes and sustainable building practices is encouraging the adoption of advanced construction management solutions that can integrate these modern requirements into residential projects.

How big is the project management and scheduling segment in the market?

Based on application, the market has been divided into project management and scheduling, safety and reporting, field service management, and others. The project management and scheduling segment garnered the highest revenue of USD 4.21 billion in 2023, propelled by the critical role these functions play in the successful execution of construction projects.

Project management and scheduling are integral features of a construction management software, providing the tools necessary to plan, coordinate, and oversee various aspects of construction projects from start to finish.

The complexity of modern construction projects, which often involve multiple contractors, tight deadlines, and significant financial investments, has made the use of effective project management and scheduling indispensable.

The growing adoption of cloud-based project management solutions, which offer flexibility and accessibility, is further expected to fuel the segment's revenue over the forecast period.

- For instance, in November 2023, Sage launched Sage Construction Management in Canada to expand its construction cloud suite. This addition would enhance Sage's industry-leading portfolio by integrating cloud-based pre-construction and project management capabilities, further strengthening its offering in the construction sector.

This segment's revenue growth is driven by the increasing need for accurate and efficient scheduling tools that can help construction firms optimize resource allocation, reduce project delays, and minimize cost overruns.

Additionally, the integration of advanced features such as real-time progress tracking, predictive analytics, and automated scheduling has enhanced the value proposition of project management software, making it a critical investment for construction companies looking to improve project outcomes.

What is the market scenario in Asia-Pacific and North America regions?

Based on region, the global market has been segmented into North America, Europe, Asia-Pacific, MEA, and Latin America.

North America construction management software market accounted for 36.28% share of the global market and was valued at USD 3.51 billion in 2023, reflecting the region's strong emphasis on technological adoption and its well-established construction industry.

The market dominance in North America can be attributed to the widespread use of advanced construction management tools among large construction firms and the growing trend of digital transformation across the sector. The region's construction companies have been early adopters of software solutions that enhance project efficiency, reduce costs, and improve collaboration among stakeholders.

- For instance, in July 2024, Hitachi Construction Machinery Co., Ltd. selected Oracle Cloud Infrastructure (OCI) to migrate its critical business systems, including accounting, production, and HR. Utilizing Oracle Cloud VMware Solution and Oracle Exadata Database Service on OCI, the company planned to achieve a seamless cloud transition, reducing operating costs by 20% while enhancing performance.

Additionally, the increasing number of large-scale infrastructure projects, particularly in the U.S. and Canada, has driven the demand for sophisticated project management tools that can handle the complexity and scale of these projects.

The presence of major software providers in North America further supports the market's growth as these companies continue to innovate and offer tailored solutions to meet the specific needs of the construction industry.

Moreover, the regulatory environment, which often mandates stringent compliance and documentation, encourages the adoption of construction management software to ensure projects meet all legal and safety requirements.

On the other hand, Asia-Pacific is expected to grow at the highest CAGR of 10.81% over the forecast period, driven by rapid urbanization, economic development, and increasing infrastructure investments across emerging economies. The region is witnessing a construction boom fueled by population growth, rising income levels, and government initiatives to improve infrastructure.

The demand for residential, commercial, and industrial construction is also surging, generating a significant need for efficient project management tools. Construction management software is becoming increasingly essential in the region, enabling firms to manage complex projects more effectively and meet tight deadlines.

Additionally, growing awareness of the benefits of digitalization in construction is encouraging companies in the Asia-Pacific to invest in advanced software solutions that enhance productivity and reduce costs.

Construction industry in this region is also benefiting from the influx of foreign investments and collaborations, which often bring the latest technology and best practices, further driving the adoption of construction management software.

Furthermore, the expansion of cloud-based solutions and mobile applications is making it easier for construction firms in the Asia-Pacific to implement and scale these tools, which is expected to account for the region's robust market growth.

Competitive Landscape

The global construction management software market report provides valuable insights with focus on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Manufacturers are adopting a range of strategic initiatives, including investments in R&D activities, establishment of new manufacturing facilities, and supply chain optimization, to strengthen their market standing.

Top Companies in Construction Management Software Market

Key Industry Developments

- August 2024 (Expansion): The Pennsylvania Department of Transportation (PennDOT) selected Bentley Systems in a multi-award Request for Proposal to provide statewide civil design solutions. This contract would strengthen Bentley's long-standing partnership with PennDOT, which has now adopted Bentley’s OpenRoads 3D design software and ProjectWise for comprehensive engineering project management.

- July 2024 (Merger): FRILO Software GmbH and DC-Software Doster & Christmann GmbH merged with ALLPLAN Group, enhancing ALLPLAN’s portfolio by integrating structural analysis and foundation engineering. This strategic move created a comprehensive end-to-end workflow, strengthening integrated design-to-build solutions.

The global construction management software market has been segmented as below:

By Deployment

By Building Type

By Application

- Project Management and Scheduling

- Safety and Reporting

- Field Service Management

- Others

By End-User

- General Contractors

- Subcontractors

- Owners

- Architects and Engineers

By Region

- North America

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America