Application Development Market Size

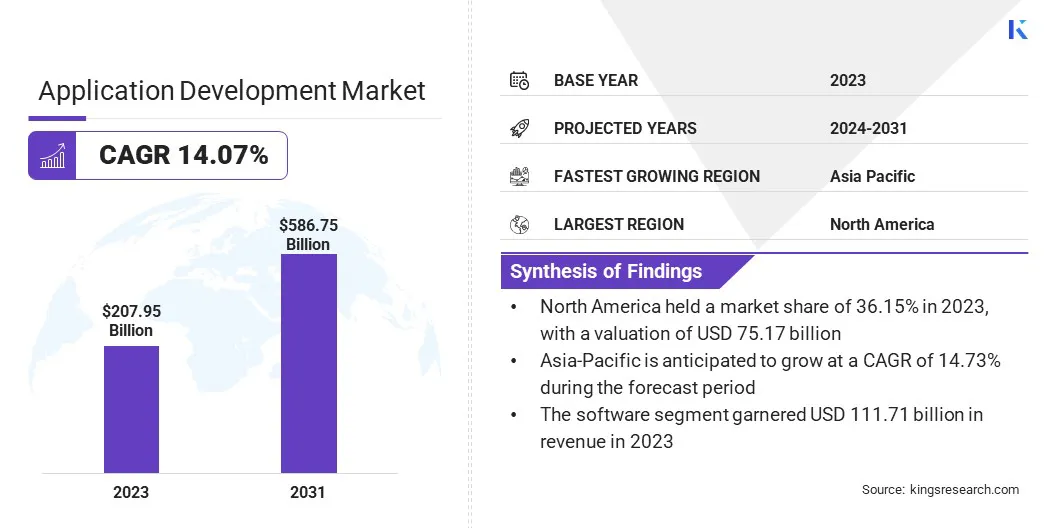

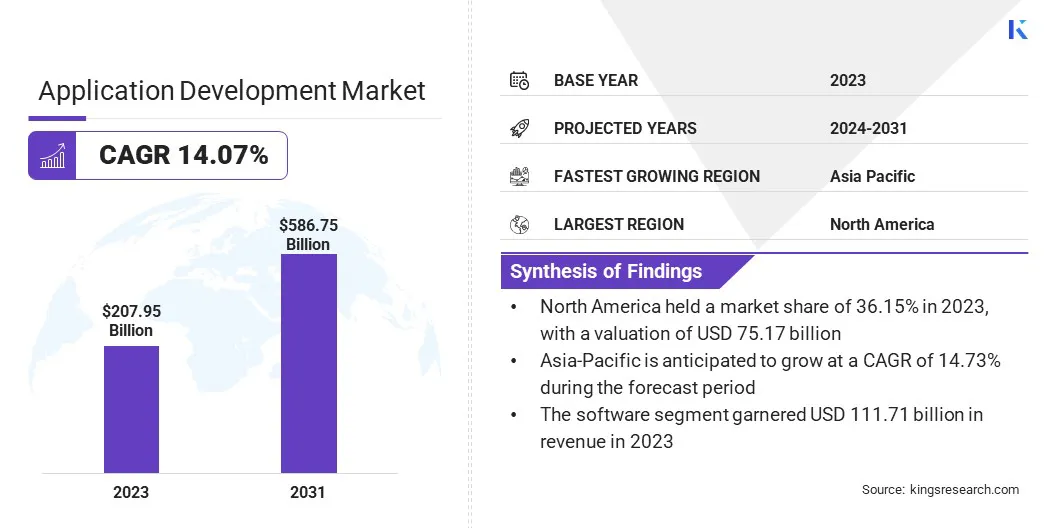

The global Application Development Market size was valued at USD 207.95 billion in 2023 and is projected to grow from USD 233.41 billion in 2024 to USD 586.75 billion by 2031, exhibiting a CAGR of 14.07% during the forecast period. The global proliferation of smartphones and tablets is a significant factor driving the growth of the market.

With billions of users relying on mobile devices for daily activities, companies are investing heavily in developing mobile apps to engage customers and streamline services. In the scope of work, the report includes solutions offered by companies such as Brainhub, Cheesecake Labs, Inc., 10Clouds, EL Passion Next sp. z o.o., Naked Ventures LLC, Utility NYC LLC, Appinventiv, TECH ALCHEMY, OpenXcell, Protonshub Technologies, and others.

Moreover, the adoption of cloud infrastructure and SaaS models is boosting market expansion by allowing businesses to build and scale applications rapidly and cost-effectively. Microservices and serverless architectures are revolutionizing application development by simplifying infrastructure, thereby augmenting market growth.

Application development refers to the process of designing, creating, testing, and deploying software applications tailored to meet specific business or user needs. It involves a series of structured activities, including requirements gathering, coding, interface design, testing for functionality and security, and ongoing maintenance.

Application development spans various platforms, such as mobile, web, and desktop, ranging from consumer apps to complex enterprise software solutions. The process can follow traditional methodologies such as Waterfall or modern approaches, including Agile and DevOps, depending on project requirements.

Analyst’s Review

Governments globally are contributing significantly to the expansion of the application development market by investing heavily in digital infrastructure and smart city initiatives. Public sector projects, particularly in areas such as e-governance, healthcare, education, and transportation, are creating strong demand for innovative applications that enhance service delivery and operational efficiency.

- In August 2023, at the G20 Summit in India, the World Health Organization (WHO) launched the Global Initiative on Digital Health, aimed at boosting the adoption of digital technologies to promote Universal Health Coverage (UHC) and achieve the Sustainable Development Goals (SDGs). This initiative introduced an updated set of 23 indicators, aligned with the strategic objectives of the WHO’s Digital Health Strategy. This standardized framework is anticipated to play a major role in tracking the implementation of digital health solutions within the Global Initiative on Digital Health.

In addition, the shift toward smart cities, driven by IoT, AI, and big data, necessitates custom-built applications to integrate and manage complex, connected systems. Moreover, government-backed funding for tech startups and innovation hubs is supporting market growth, fostering the development of cutting-edge solutions tailored to public needs.

Application Development Market Growth Factors

The deployment of 5G technology is propelling the growth of the market by enabling faster, more reliable data transfer and real-time communication capabilities. Developers are now able to create data-intensive applications for augmented reality (AR), virtual reality (VR), and IoT, capitalizing on 5G’s low latency and high bandwidth.

- According to a report by 5G Americas in March 2024, the adoption of 5G connections experienced remarkable growth in 2023, reaching a total of 1.76 billion globally. This represents a 66% increase, with an addition of 700 million new connections.

This presents new opportunities in gaming, telemedicine, and smart cities, among other industries. The ability to deliver richer, more responsive user experiences is prompting businesses to prioritize next-generation app development, thus bolstering market expansion.

Moreover, the integration of AI and machine learning technologies is fueling the growth of the application development market. AI-driven applications are transforming industries by enabling automation, predictive analytics, and real-time data processing.

From chatbots that enhance customer service to personalized recommendation engines, businesses are increasingly relying on AI-based applications to improve decision-making and customer engagement. In healthcare, finance, and retail, AI is becoming a critical component for app development, creating continuous demand and contributing to market expansion.

However, high costs associated with developing and maintaining applications, particularly for small and medium-sized enterprises (SMEs), pose a significant challenge to the growth of the market. Investments in advanced technologies, regulatory compliance, and ongoing maintenance requirements, including frequent security updates and patches, can strain financial resources and deter businesses from initiating new projects.

To mitigate these challenges and sustain market growth, companies are increasingly adopting cost-effective strategies such as cloud-based development, outsourcing, and using low-code/no-code platforms to streamline the development process. Additionally, agile methodologies, DevOps practices, and third-party maintenance solutions are helping businesses manage costs more efficiently, enabling continued investment in application development initiatives despite financial constraints.

Application Development Market Trends

The increasing adoption of IoT is emerging as a notable trend in the market. The increasing connectivity of devices, from wearables to industrial sensors, is resulting in a significant demand for IoT-compatible applications. IoT applications, which manage, monitor, and analyze data from connected devices, are transforming industries such as manufacturing, healthcare, and agriculture.

The convergence of IoT with AI and big data analytics is leading to the development of smarter, more efficient applications, thereby contributing to the growth of the application development market.

- According to a report by 5G Americas in March 2024, there were 3.1 billion global IoT subscriptions and 6.6 billion smartphone subscriptions in 2023. By 2026, IoT subscriptions are anticipated to increase to 4.5 billion, while smartphone subscriptions are expected to grow to 7.4 billion.

The global shift toward remote work has created strong demand for collaboration and productivity tools. Applications such as Zoom, Slack, and Microsoft Teams have seen widespread adoption, prompting businesses to develop custom solutions to meet their unique operational needs.

As hybrid work models become more common, organizations require advanced applications that ensure seamless collaboration, data security, and workflow automation. The ongoing investment in robust remote work solutions by businesses is supporting the expansion of the market.

Segmentation Analysis

The global market has been segmented based on component, enterprise size, deployment mode, industry vertical, and geography.

By Component

Based on component, the market has been segmented into software and services. The software segment led the application development market in 2023, reaching a valuation of USD 111.71 billion, owing to the rising demand for efficient development tools that accelerate the app creation process.

Businesses increasingly rely on software solutions such as integrated development environments (IDEs), low-code/no-code platforms, and cloud-based development frameworks to reduce complexity, speed up coding, and improve scalability. These solutions enable developers to quickly build, test, and deploy applications, meeting the dynamic demands of industries such as healthcare, finance, and retail.

By Enterprise Size

Based on enterprise size, the market has been bifurcated into large enterprise and small & medium-sized enterprise (SMEs). The large enterprise segment secured the largest revenue share of 57.32% in 2023, primarily due to its substantial financial resources, complex operational needs, and large-scale digital transformation initiatives.

These organizations can invest heavily in custom application development to optimize their business processes, improve customer engagement, and maintain a competitive edge. Furthermore, large enterprises require advanced, secure, and scalable solutions that integrate seamlessly across multiple departments and global locations, thereby boosting the demand for sophisticated, enterprise-grade applications.

By Industry Vertical

Based on industry vertical, the market has been divided into healthcare, BFSI, media and entertainment, it and telecom, e-commerce, and others. The healthcare segment is set to experience significant growth at a robust CAGR of 15.46% through the forecast period.

The rising demand for telemedicine, electronic health records (EHR), and mobile health (mHealth) applications has led to the growing need for customized, secure, and regulatory-compliant software solutions. Healthcare organizations are making significant investments in applications that improve diagnostics, remote monitoring, and patient engagement, fueled by the need to streamline processes and improve outcomes.

Additionally, the surge in digital health initiatives, personalized medicine, and AI-driven diagnostics are promptng healthcare providers to adopt cutting-edge applications, thus fostering segmental expansion.

Application Development Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

North America application development market captured a substantial share of around 36.15% in 2023, with a valuation of USD 75.17 billion. This growth is largely attributed to the rising frequency of cyberattacks and the implementation of stricter data protection regulations in North America are .

Businesses across the region are increasingly prioritizing the creation of secure applications to protect sensitive data and maintain compliance with regulations such as HIPAA and CCPA.

- In March 2024, Microsoft announced that hackers associated with Russia's foreign intelligence agency were attempting to infiltrate its systems again. These attackers were utilizing data from corporate emails to regain access to the company, which is integral to U.S. national security infrastructure.

Developers are dedicating efforts to integrate advanced security features, including encryption and secure coding practices, to enhance application resilience. Sectors such as healthcare, finance, and government are particularly focused on producing compliant applications, highlighting the need for cybersecurity-centric app development.

This trend is poised to support the expansion of the North America market, especially as data privacy and security concerns intensify.

Asia Pacific is projected to witness considerable growth at a robust CAGR of 14.73% over the forecast period. The rapid expansion of e-commerce in the region is significantly contributing to the growth of the Asia Pacific application development market.

Businesses are increasingly focused on developing applications that deliver seamless shopping experiences across mobile devices, desktops, and in-store interactions.

The adoption of Progressive Web Apps (PWAs) and omnichannel strategies is allowing companies to effectively integrate online and offline touchpoints, thereby enhancing customer satisfaction and driving sales.

- As reported by the International Trade Administration, the e-commerce market in the Asia-Pacific region was valued at USD 19.3 trillion in 2023 and is projected to exceed USD 28.9 trillion by 2026.

Additionally, the surge in digital payment solutions and secure online transactions is stimulating regional market expansion, as more businesses invest in custom applications to bolster their e-commerce operations and improve customer engagement efforts.

Competitive Landscape

The global application development market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, could create new opportunities for market growth.

List of Key Companies in Application Development Market

- Brainhub

- Cheesecake Labs, Inc.

- 10Clouds

- EL Passion Next sp. z o.o.

- Naked Ventures LLC

- Utility NYC LLC

- Appinventiv

- TECH ALCHEMY

- OpenXcell

- Protonshub Technologies

Key Industry Developments

- August 2024 (Collaboration): Alchemy announced a collaboration with HackIndia, a prominent Indian Web3 hackathon, to deliver cutting-edge Web3 infrastructure to universities across India. This collaboration is focused on empowering the next generation of developers with advanced tools and expert mentorship in the Web3 space.

- May 2024 (Partnership): Cheesecake Labs partnered with the Hyperledger Foundation to introduce the Stellar Connector, aimed at tapping into the potential of the blockchain ecosystem. The Stellar Connector utilizes Hyperledger Cacti’s approach, which separates the application layer from the DLT protocol, thereby facilitating interaction between distributed ledger networks for atomic transactions and state commits.

The global application development market is segmented as:

By Component

By Enterprise Size

- Large Enterprise

- Small and Medium-Sized Enterprise (SMEs)

By Deployment Mode

By Industry Vertical

- Healthcare

- BFSI

- Media and Entertainment

- IT and Telecom

- E-commerce

- Others

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America