Market Definition

The market encompasses software solutions that package applications and their dependencies on lightweight, portable units, ensuring consistency across diverse environments. These containers operate using OS-level virtualization, allowing multiple applications to run efficiently on shared system resources.

The market includes container orchestration platforms, security tools, and runtime environments, enabling seamless deployment, scaling, and management. Designed to enhance agility, reliability, and automation in DevOps workflows, application containers are widely used in cloud-native development, microservices architecture, and hybrid cloud infrastructure.

The report highlights key factors influencing the market, along with an in-depth analysis of emerging trends and the evolving regulatory frameworks shaping growth.

Application Container Market Overview

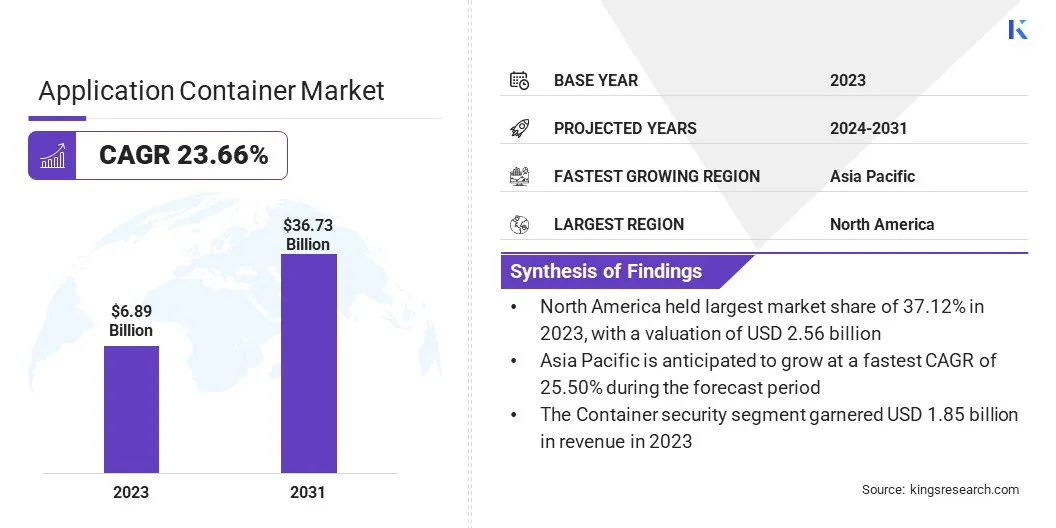

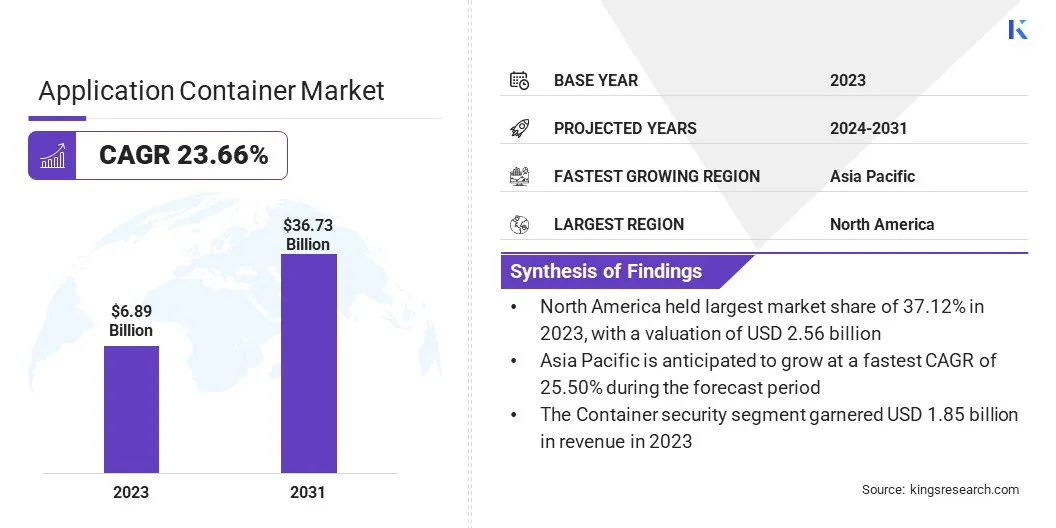

The global application container market size was valued at USD 6.89 billion in 2023 and is projected to grow from USD 8.31 billion in 2024 to USD 36.73 billion by 2031, exhibiting a CAGR of 23.66% during the forecast period.

The growing adoption of cloud-native architectures is driving demand for application containers, enabling businesses to enhance scalability, streamline deployment, and optimize resource utilization. Additionally, the increasing focus on DevOps practices is accelerating container adoption, as organizations seek efficient solutions for continuous integration and deployment. This is supporting the development of flexible and high-performance cloud applications.

Major companies operating in the application container industry are Docker, Inc., Red Hat, Inc., Mirantis Inc., Microsoft, Google, Amazon Web Services, IBM, Alibaba, SUSE, Perforce Software, Inc., Sysdig, Inc., Canonical Ltd., Huawei Technologies Co., Ltd., Tencent, and Broadcom Inc.

The rapid deployment of 5G networks and IoT expansion is fueling market expansion. Containers support low-latency applications and real-time data processing, making them an essential component of next-generation connectivity.

Their ability to deploy lightweight and scalable applications across distributed networks is increasing adoption across sectors such as smart cities, autonomous vehicles, and industrial automation. Enterprises are using containers to ensure seamless connectivity and optimized performance in dynamic environments.

Key Highlights:

- The application container market size was valued at USD 6.89 billion in 2023.

- The market is projected to grow at a CAGR of 23.66% from 2024 to 2031.

- North America held a market share of 37.12% in 2023, with a valuation of USD 2.56 billion.

- The container data management segment garnered USD 2.20 billion in revenue in 2023.

- The cloud-based segment is expected to reach USD 23.10 billion by 2031.

- The large enterprises segment secured the largest revenue share of 56.40% in 2023.

- The retail & e-commerce is estimated to grow at a robust CAGR of 28.25% through the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 25.50% between 2024 and 2031.

Market Driver

Expansion of Cloud-Native Applications

Enterprises are increasingly shifting to cloud-native applications to enhance agility and operational efficiency, propelling the expansion of the market. Their ability to manage applications across hybrid and multi-cloud environments is further supporting this growth.

Containers enable seamless application portability, reducing dependency on underlying infrastructure. The demand for flexible and automated solutions is accelerating container adoption, ensuring faster deployment cycles and improved resource utilization. This shift is reshaping software development strategies across diverse industries.

- In December 2024, Salesforce unveiled significant enhancements to Heroku, its platform-as-a-service (PaaS) solution, to optimize the development, deployment, and scaling of cloud-native applications. These updates are designed to enhance developer productivity, improve platform efficiency, and support seamless integration with open-source standards. By simplifying infrastructure management and reducing operational complexities, these enhancements enable development teams to accelerate innovation and scale modern applications more effectively.

Market Challenge

Complexity in Managing Multi-Cloud and Hybrid Environments

Managing containerized applications across multi-cloud and hybrid environments presents a significant challenge to the progress of the application container market. Issues such as interoperability, security risks, and operational complexities hinder adoption. Organizations face difficulties with workload portability, ensuring consistent performance, and maintaining compliance across different infrastructures.

To overcome these challenges, companies are developing advanced container orchestration solutions, utilizing automation for seamless workload deployment, and enhancing security frameworks. Investments in unified management platforms, such as Kubernetes-based control planes, help streamline operations.

Additionally, organizations are adopting DevSecOps practices to strengthen security while ensuring compliance across diverse cloud ecosystems.

Market Trend

Integration of DevOps and CI/CD Pipelines

Businesses are prioritizing DevOps methods to accelerate software development and deployment. The market is expanding due to the seamless integration of containers within CI/CD pipelines, ensuring continuous delivery and operational efficiency.

Containers facilitate automation in development, testing, and production environments, reducing downtime and deployment risks. The demand for streamlined workflows and real-time updates is increasing as enterprises aim to faster innovation cycles and improve software quality.

- The State of CI/CD Report 2024, released by the Continuous Delivery (CD) Foundation, states that in the first quarter of 2024, 83% of developers participated in DevOps-related tasks, including performance monitoring, security testing, and CI/CD processes.

Application Container Market Report Snapshot

|

Segmentation

|

Details

|

|

By Service Type

|

Container Monitoring, Container Security, Container Networking, Container Data Management

|

|

By Deployment Type

|

On-Premises, Cloud-Based

|

|

By Organization Size

|

Small & Medium Enterprises (SMEs), Large Enterprises

|

|

By Industry Vertical

|

IT & Telecom, BFSI, Healthcare, Retail & E-commerce, Government, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Service Type (Container Monitoring, Container Security, Container Networking, and Container Data Management): The container data management segment earned USD 2.20 billion in 2023 due to the growing need for efficient data storage, backup, and security solutions that ensure seamless data availability, scalability, and compliance across containerized environments.

- By Deployment Type (On-Premises and Cloud-Based): The cloud-based segment held a share of 64.80% in 2023, fueled by its ability to provide scalable infrastructure, seamless workload management, and cost-efficient deployment, enabling enterprises to optimize resources and accelerate cloud-native application development.

- By Organization Size (Small & Medium Enterprises (SMEs) and Large Enterprises): The large enterprises segment is projected to reach USD 19.84 billion by 2031, propelled by extensive cloud adoption, substantial investments in container orchestration platforms, and the need for scalable, secure, and high-performance infrastructure.

- By Industry Vertical (IT & Telecom, BFSI, Healthcare, Retail & E-commerce, Government, and Others): The retail & e-commerce segment is set to grow at a staggering CAGR of 28.25% through the forecast period, largely attributed to the growing need for scalable, high-performance applications that support real-time inventory management, personalized customer experiences, and seamless omnichannel operations.

Application Container Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America application container market share stood at around 37.12% in 2023, valued at USD 2.56 billion. North American enterprises are increasingly utilizing Kubernetes and other container orchestration platforms for managing large-scale applications.

The region is home to leading technology firms such as Google, Microsoft, Mirantis and Amazon, which are fostering advancements in container-based architectures. As Kubernetes becomes the standard for container management, businesses across industries are investing in robust orchestration solutions to enhance workload automation, scalability, and resilience, boosting regional market growth.

- In February 2025, Mirantis expanded a Distributed Container Management Environment (DCME), enabling IT teams to deploy a control plane anywhere for streamlined Kubernetes cluster management. Powered by the open-source k0rdent project, it leverages Kubernetes' Cluster API to provide a unified platform for managing clusters across different distributions, enhancing operational flexibility and efficiency.

Moreover, the U.S. federal government is actively investing in cloud modernization initiatives through programs such as FedRAMP and the Cloud Smart Strategy. Government agencies are shifting legacy IT infrastructure to cloud-based platforms, incorporating containers to improve security, scalability, and operational efficiency.

The Asia Pacific application container industry is estimated to grow at a robust CAGR of 25.50% over the forecast period. Asia-Pacific is witnessing large-scale investments in cloud infrastructure, particularly in China, India, Japan, and Southeast Asia. Hyperscalers such as Alibaba Cloud, Tencent Cloud, AWS, and Google Cloud are expanding data center operations.

The region’s strong shift toward sovereign cloud frameworks and government-backed digital transformation initiatives is accelerating the adoption of containerized cloud-native applications. Organizations across the banking, retail, and manufacturing sectors are using container platforms to enhance multi-cloud and hybrid cloud strategies.

Regulatory Frameworks

- The European Union (EU) enforces strict data protection and cybersecurity laws that significantly impact application container deployments. The General Data Protection Regulation (GDPR) mandates robust data security measures, requiring organizations to implement stringent control over personal data processing. The NIS2 Directive strengthens cybersecurity regulations for service providers, including those that use containerized applications. Organizations operating in the EU must comply with these laws to ensure secure container environments while mitigating risks related to data privacy breaches.

- China enforces strict data security laws that impact the deployment of application containers. The Cybersecurity Law requires companies to localize critical data and conduct security assessments for cross-border transfers. The Data Security Law categorizes data based on sensitivity, imposing stringent compliance requirements on businesses managing containerized workloads. Companies operating in China must implement strong data governance practices to align with these regulations, ensuring secure containerized application deployments.

- Japan regulates data privacy and security through the Act on the Protection of Personal Information (APPI), which mandates strict data handling and transfer requirements. Organizations using application containers must implement measures to protect personal data in compliance with APPI. The Personal Information Protection Commission (PPC) oversees enforcement, ensuring that businesses follow secure container deployment practices.

Competitive Landscape

Companies operating in the application container market are focusing on continuous innovations and product enhancements to strengthen their industry position. By integrating advanced capabilities into their existing platforms, companies are improving scalability, security, and performance, addressing the evolving needs of enterprises adopting cloud-native applications.

These updates enhance compatibility with emerging technologies and bolster market expansion by offering more efficient solutions for managing containerized workloads. Innovations enable organizations to efficiently deploy, operate, and scale applications.

- In March 2024, Red Hat expanded its cloud-native application development and deployment portfolio by introducing new capabilities to Red Hat OpenShift with support for Amazon Web Services (AWS) Outposts and Wavelength Zones, enhancing hybrid and edge computing capabilities. The update also introduced version 1.0 of OpenShift Virtualization,enabling containerized virtualization to streamline workload management across cloud and on-premise environments.

List of Key Companies in Application Container Market:

- Docker, Inc.

- Red Hat, Inc.

- Mirantis Inc.

- Microsoft

- Google

- Amazon Web Services

- IBM

- Alibaba

- SUSE

- Perforce Software, Inc.

- Sysdig, Inc.

- Canonical Ltd.

- Huawei Technologies Co., Ltd.

- Tencent

- Broadcom Inc.

Recent Developments (Product Launch)

- In February 2025, Mirantis introduced k0rdent, the first open-source Distributed Container Management Environment (DCME), offering a unified control point for cloud-native applications. Designed to operate seamlessly across on-premises, public cloud, and edge environments, k0rdent enables efficient container management on any infrastructure, enhancing flexibility and scalability for modern deployments.

- In December 2024, Broadcom Inc. introduced Bitnami Premium, a commercial enterprise of Bitnami by VMware Tanzu. Additionally, the company appointed Arrow Electronics, a leading technology solutions provider, as the global distributor for Bitnami Premium. Bitnami enables developers to seamlessly access the latest open-source innovations in their preferred formats, including virtual machines, containers, and Helm charts.

- In November 2024, Red Hat, Inc. introduced new enhancements for Red Hat OpenShift, a leading hybrid cloud application platform built on Kubernetes, along with a technology preview of Red Hat OpenShift Lightspeed. With the release of Red Hat OpenShift 4.17, these updates aim to foster innovation across hybrid cloud environments. The latest features also provide a seamless experience for managing both virtual machines and containers, optimizing workload efficiency and deployment flexibility.

- In November 2024, Mirantis introduced Mirantis Harbor Registry Support and Mirantis KubeVirt Support, enabling seamless management of container image registries and virtual machine workloads across any Kubernetes environment. These solutions offer broad compatibility across infrastructures and Kubernetes distributions, enhancing enterprise flexibility and operational efficiency.