Market Definition

The market encompasses tools and platforms designed to enhance mobile app visibility and performance in app stores. Key features include keyword optimization, A/B testing, performance analytics, competitor analysis, and review management. These solutions serve app developers, marketers, and publishers, supporting both iOS and Android ecosystems.

The market’s scope extends across industries, facilitating improved app discoverability, user acquisition, and retention strategies. The report examines critical driving factors, industry trends, regional developments, and regulatory frameworks impacting market growth through the projection period.

App Store Optimization Software Market Overview

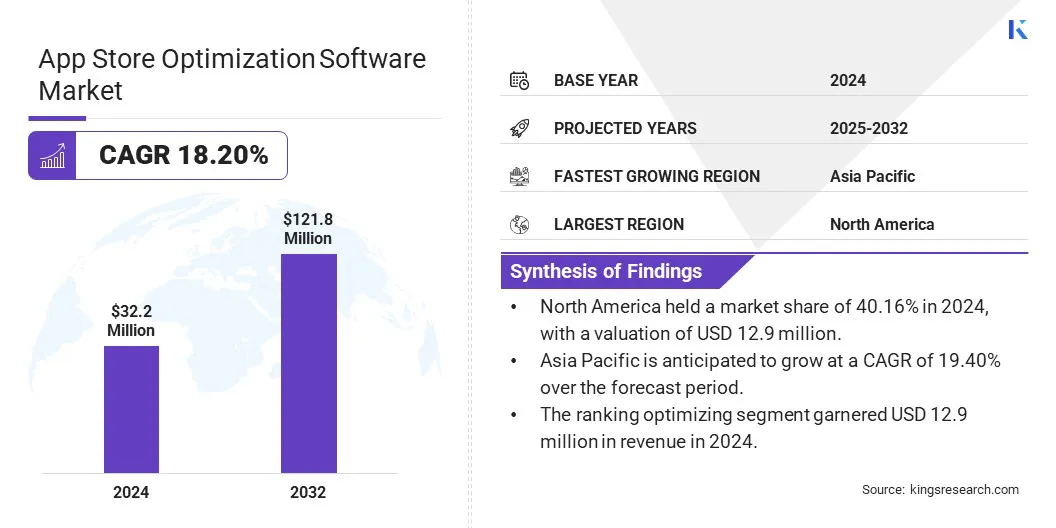

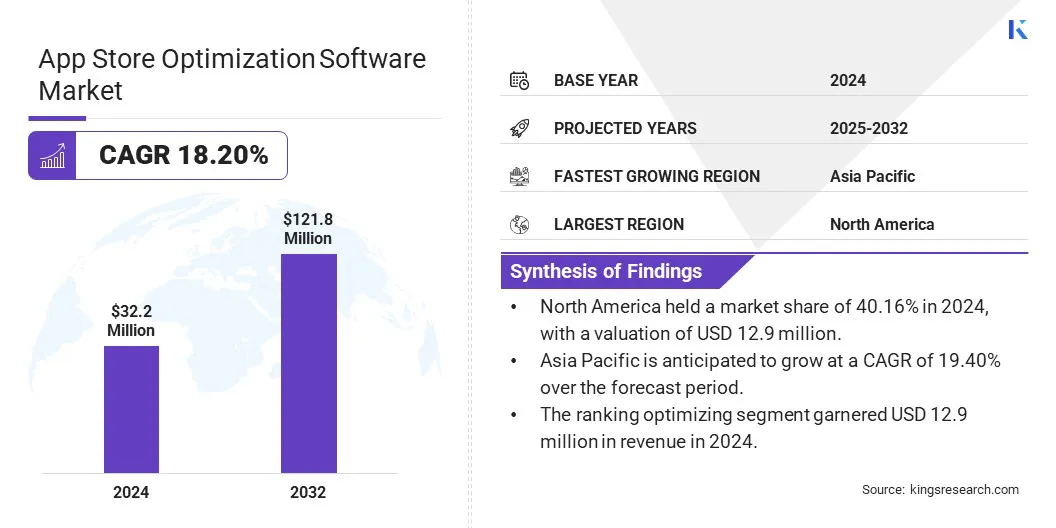

The global app store optimization software market size was valued at USD 32.2 million in 2024 and is projected to grow from USD 37.8 million in 2025 to USD 121.8 million by 2032, exhibiting a CAGR of 18.20% during the forecast period.

The rapid adoption of smartphones is expanding the mobile user base, creating a strong demand for AI-powered ASO software that enhances app visibility, automates optimization, and adapts to evolving algorithms for a competitive edge.

Major companies operating in the app store optimization software industry are AppVector.io, AppTweak., Asodesk, Auxano Global Services., Desuvit, Grewon Technologies, Mobulous Technology, SplitMetrics, Moweb Limited, Concept Infoway., Matrix Bricks, Orangemantra Technology Pvt. Ltd, Tecocraft, Moon Technologies Pvt. Ltd, G2S Technology, and others.

Rising focus on organic traffic growth propels demand for app store optimization software. Businesses prioritize maximizing visibility and user acquisition through unpaid channels to reduce customer acquisition costs and enhance sustainable growth.

Enhanced app discoverability via optimized metadata, keyword strategies, and user engagement metrics directly impacts conversion rates, leading to the widespread adoption of ASO solutions across competitive mobile ecosystems.

Key Highlights:

Key Highlights:

- The app store optimization software industry size was recorded at USD 32.2 million in 2024.

- The market is projected to grow at a CAGR of 18.20% from 2025 to 2032.

- North America held a market share of 40.16% in 2024, with a valuation of USD 12.9 million.

- The ranking optimizing segment garnered USD 12.9 million in revenue in 2024.

- The gaming entertainment segment is expected to reach USD 43.5 million by 2032.

- Asia Pacific is anticipated to grow at a CAGR of 19.40% over the forecast period.

Market Driver

Rapid Increase in Smartphone Usage

The surging adoption of smartphones is propelling the expansion of the app store optimization (ASO) software market, broadening the mobile user base. This is prompting developers to leverage ASO solutions to enhance app visibility, optimize search rankings, and increase download volumes. This is supporting market growth by stimulating investments in advanced optimization technologies critical for maintaining competitiveness in app stores.

- In December 2023, the World Economic Forum reported that India had over 700 million smartphone users, including 425 million in rural areas, highlighting the rapid adoption of smartphones and rural India’s growing role in the global smart technology landscape.

Market Challenge

Navigating Algorithm Complexity and Competitive Dynamics

The expansion of the app store optimization software market is impeded by the increasing complexity of app store algorithms and intensified app competition. Manufacturers face challenges from dynamic ranking factors, including user behavior shifts and frequent platform updates, which complicate accurate performance forecasting.

To address these challenges, vendors are investing in advanced AI-driven analytics and real-time data integration, enhancing keyword optimization and competitive benchmarking capabilities. Additionally, strategic partnerships with app developers and continuous algorithm refinement enable manufacturers to deliver adaptive solutions that help clients maintain visibility and maximize organic downloads in an evolving digital landscape.

Market Trend

Integration of AI and Machine Learning

The integration of AI and machine learning is emerging as a prominent trend in the app store optimization (ASO) software market. This trend reflects a notable shift toward data-driven, automated optimization processes that enhance app discoverability and user engagement.

Market players increasingly prioritize AI-enabled features to refine targeting strategies and adapt swiftly to evolving app store algorithms, signaling a new standard in ASO solutions.

- In December 2023, the IEEE Computer Society highlighted that integrating AI and ML into Software-as-a-Service (SaaS) applications presents a major opportunity for businesses. This integration is transforming the very foundation of software, driving companies to innovate and excel by delivering unparalleled efficiency and opening up new possibilities.

App Store Optimization Software Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product

|

Ranking Optimizing, Keyword Trackers, Data Platforms

|

|

By Application

|

Gaming Entertainment, Social Media, Lifestyle, Utilities, News and Information

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Product (Ranking Optimizing, Keyword Trackers, and Data Platforms): The ranking optimizing segment earned USD 12.9 million in 2024, reflecting its critical role in improving app visibility and discoverability, thus driving higher downloads and user engagement, which are key market success metrics.

- By Application (Gaming Entertainment, Social Media, Lifestyle, Utilities, and News and Information): The gaming entertainment segment held a share of 35.23% in 2024, fueled by high user acquisition costs. This has increased the demand for effective optimization strategies to maximize visibility and downloads.

App Store Optimization Software Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America app store optimization software market share stood at around 40.16% in 2024, valued at USD 12.9 million. This dominance is reinforced by its advanced digital infrastructure, high smartphone penetration, and strong presence of major app developers. The region's early adoption of mobile technologies and continuous investment in AI-driven analytics significantly fuel regional market growth.

North America app store optimization software market share stood at around 40.16% in 2024, valued at USD 12.9 million. This dominance is reinforced by its advanced digital infrastructure, high smartphone penetration, and strong presence of major app developers. The region's early adoption of mobile technologies and continuous investment in AI-driven analytics significantly fuel regional market growth.

Additionally, the U.S. houses key ASO software providers and benefits from a mature app economy, generating consistent demand for performance-driven app visibility and user acquisition solutions.

The Asia Pacific app store optimization software industry is set to grow at a robust CAGR of 19.40% over the forecast period. This growth is propelled by the rapid expansion of the mobile gaming industry.

The increasing volume of mobile game launches has intensified competition within app marketplaces, prompting developers to adopt ASO solutions to improve discoverability and user acquisition. This surge in mobile gaming activity is significantly contributing to the growing demand for optimization tools, fueling regional market expansion.

Regulatory Frameworks

- In the U.S., the Federal Trade Commission (FTC) enforces Section 5’s Unfair or Deceptive Acts or Practices (UDAP) rules, which prohibit misleading advertising such as fake reviews, deceptive app descriptions, and false performance claims. ASO tools involved in review generation must follow endorsement and testimonial disclosure requirements to ensure compliance.

- In China, the Personal Information Protection Law (PIPL) mandates ASO tools to secure explicit user consent for collecting personal data. It enforces stringent rules on data localization, cross-border data transfers, and data security. Compliance is essential to prevent substantial fines and operational restrictions.

Competitive Landscape

The market is witnessing intensified competition, marked by strategic acquisitions and innovative product launches. Key market participants are expanding capabilities through targeted acquisitions to enhance feature portfolios and geographic reach.

Concurrently, new software solutions are being introduced, emphasizing AI-driven analytics and automation to improve app visibility and user engagement. These developments underscore a shift toward integrated, data-centric platform, driving market consolidation and accelerating technological advancements.

List of Key Companies in App Store Optimization Software Market:

- AppVector.io

- AppTweak.

- Asodesk

- Auxano Global Services.

- Desuvit

- Grewon Technologies

- Mobulous Technology

- SplitMetrics

- Moweb Limited

- Concept Infoway.

- Matrix Bricks

- Orangemantra Technology Pvt. Ltd

- Tecocraft

- Moon Technologies Pvt. Ltd

- G2S Technology

Recent Developments (M&A)

- In November 2023, SplitMetrics acquired SplitMetrics, a strategic move aimed at accelerating global app growth. App Radar’s ASO tool has been integrated into SplitMetrics’ product portfolio and now benefits from enhanced development resources for further improvement.

Key Highlights:

Key Highlights: North America app store optimization software market share stood at around 40.16% in 2024, valued at USD 12.9 million. This dominance is reinforced by its advanced digital infrastructure, high smartphone penetration, and strong presence of major app developers. The region's early adoption of mobile technologies and continuous investment in AI-driven analytics significantly fuel regional market growth.

North America app store optimization software market share stood at around 40.16% in 2024, valued at USD 12.9 million. This dominance is reinforced by its advanced digital infrastructure, high smartphone penetration, and strong presence of major app developers. The region's early adoption of mobile technologies and continuous investment in AI-driven analytics significantly fuel regional market growth.