Anatomic Pathology Market Size

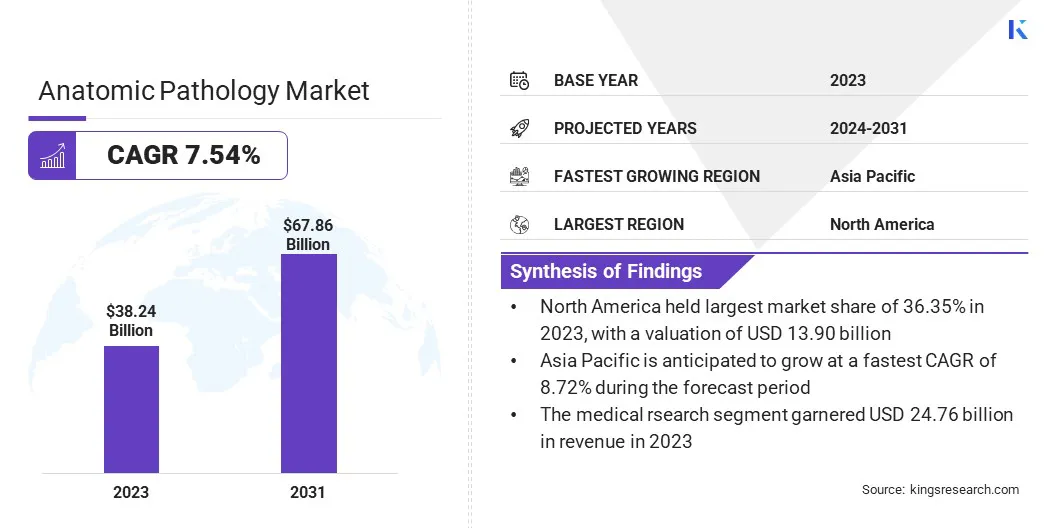

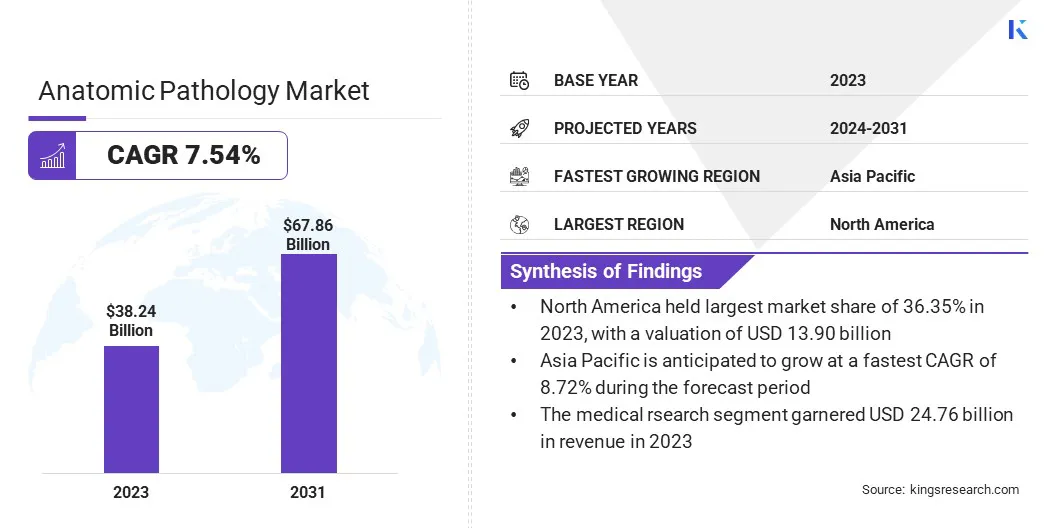

The global anatomic pathology market size was valued at USD 38.24 billion in 2023, and is projected to grow from USD 40.79 billion in 2024 to USD 67.86 billion by 2031, exhibiting a CAGR of 7.54% during the forecast period. The increasing incidence of cancer and chronic diseases globally is primarily fueling the market.

- The latest report from the World Cancer Research Fund reveals that 19.98 million cancer cases were diagnosed in 2022. Approximately 40% of these cases could potentially be prevented by addressing risk factors associated with accurate diagnosis, diet, nutrition, and physical activity.

Cancer cases are rising significantly, which is boosting the demand for advanced diagnostic techniques to identify malignancies and guide treatment strategies.

In the scope of work, the report includes products and services offered by companies such as F. Hoffmann-La Roche Ltd., Danaher Corporation, PHC Holdings Corporation, Agilent Technologies, Inc., Cardinal Health, Quest Diagnostics Incorporated, Laboratory Corporation of America Holdings, NeoGenomics Laboratories, Inc., BioGenex, and Sakura Finetek USA, Inc..

Governments, private organizations, and healthcare providers are increasingly investing in advanced diagnostic infrastructure to improve patient outcomes. These investments are enabling the adoption of innovative technologies, enhancing diagnostic accuracy and accessibility. Emerging economies are also witnessing significant growth in healthcare budgets, creating opportunities for pathology service providers.

The prioritization of healthcare innovations and infrastructure development is anticipated to sustain this upward trajectory, ensuring steady market expansion in the coming years.

Additionally, the rapid adoption of personalized medicine is boosting the demand for anatomic pathology, driving the anatomic pathology market. Tailored therapeutic approaches rely on precise diagnostic evaluations, particularly for complex diseases like cancer and rare genetic disorders. The role of anatomic pathology in identifying biomarkers and supporting targeted treatment strategies has positioned it as a critical component in personalized healthcare.

Anatomic pathology is a branch of medicine that focuses on the study and diagnosis of diseases through the examination of tissues, organs, and bodily specimens. This discipline involves analyzing samples obtained during surgeries, biopsies, or autopsies to identify abnormalities, such as tumors, infections, or degenerative conditions.

Techniques commonly employed in anatomic pathology include gross examination, microscopic evaluation, histochemical staining, and molecular testing. Pathologists use these methods to understand disease mechanisms, guide clinical treatment, and provide prognostic information. Anatomic pathology plays a critical role in medical research, cancer diagnostics, and forensic investigations, contributing significantly to advancing patient care and medical knowledge.

Analyst’s Review

Companies in the anatomic pathology market are adopting advanced diagnostic technologies as a key strategy to drive growth and meet the increasing demand for accurate and efficient disease diagnosis. Leading firms are investing in digital pathology systems equipped with high-resolution imaging, remote analysis capabilities, and integrated data-sharing platforms.

- In October 2024, NYU Langone Health introduced a groundbreaking digital pathology program, revolutionizing disease diagnosis by transitioning from traditional microscopes to high-definition digital imaging. This advancement enables real-time sharing of tissue sample images across the hospital network, providing unparalleled clarity for analysis. The initiative significantly reduces diagnosis times and enhances collaboration among medical professionals

These innovations are streamlining diagnostic workflows, reducing turnaround times, and improving operational efficiency. Additionally, companies are leveraging artificial intelligence (AI) and machine learning (ML) algorithms to enhance diagnostic precision by identifying intricate patterns in tissue samples and minimizing human errors.

Significant emphasis is also placed on the development of molecular diagnostics to cater to the growing demand for precision medicine and oncology-specific solutions.

- In September 2024, Paige introduced Alba, an AI-powered clinical-grade co-pilot designed to enhance diagnostics and treatment in pathology and oncology. Leveraging Paige’s advanced Foundation Models, Alba provides real-time, AI-driven patient insights, representing a significant advancement toward achieving Artificial General Intelligence (AGI).

Furthermore, strategic collaborations between companies, healthcare providers, and research institutions are further accelerating the adoption of these technologies. Firms are channeling investments into R&D to integrate automation and scalable solutions that address the need for high-throughput pathology services. These initiatives are reshaping the industry, driving adoption rates, and creating sustainable growth opportunities within the market.

Anatomic Pathology Market Growth Factors

The proliferation of diagnostic laboratories and healthcare facilities is accelerating the growth of the anatomic pathology market. New diagnostic centers equipped with innovative technologies are improving accessibility to advanced pathological services in both urban and rural areas.

These expansions are addressing the growing demand for timely and accurate disease diagnosis, particularly in underserved regions. The rise of private diagnostic providers and partnerships between healthcare institutions and pathology firms is further driving the market.

- In September 2024, Redcliffe Labs, an omnichannel diagnostics service provider, secured USD 42 million in Series C funding. This investment will support the company’s ambitious expansion plans, with a strategic focus on strengthening its presence in Tier-II and Tier-III cities across India. The funds will be utilized to establish additional laboratories and diagnostic centers, enhancing accessibility and service reach.

The rise in healthcare spending across the globe is bolstering the growth of the anatomic pathology market. Governments, private organizations, and healthcare providers are increasingly investing in advanced diagnostic infrastructure to improve patient outcomes.

These investments are enabling the adoption of state-of-the-art technologies, enhancing diagnostic accuracy and accessibility. Emerging economies are also witnessing significant growth in healthcare budgets,creating opportunities for pathology service providers.

However, the volatility of cost associated with advanced diagnostic technologies, particularly digital pathology systems and AI-powered tools is restraining the market expansion. The initial investment required for these technologies can be prohibitive, especially in emerging markets where healthcare budgets are limited.

To address this challenge, companies are adopting strategies such as offering cost-effective subscription models, partnering with government initiatives to subsidize costs, and developing more affordable, scalable solutions for smaller clinics and hospitals. Additionally, manufacturers are focusing on improving the cost-efficiency of their products through technological innovation and automation, ensuring wider accessibility and adoption.

Anatomic Pathology Industry Trends

The rising emphasis on oncology research is a key factor driving the anatomic pathology market. Research initiatives that rely on advanced pathological analysis for developing novel therapies heavily are supported by initiatives led by government institutions.

- In September 2024, the U.S., Australia, India, and Japan initiated a pioneering effort to eliminate cancer in the Indo-Pacific, beginning with cervical cancer and laying the foundation to tackle other types of cancer in the future. This initiative was announced as part of a broader set of commitments made during the Quad Leaders Summit.

Pharmaceutical companies and research organizations are collaborating with pathology service providers to ensure precise evaluation of tissue samples, which is critical for drug discovery and clinical trials.

The growing burden of infectious diseases is significantly contributing to the growth of the anatomic pathology industry. Pathological evaluation plays a critical role in diagnosing infections caused by bacteria, viruses, fungi, and parasites by analyzing tissue and organ samples.

The emergence of new infectious diseases and the re-emergence of resistant strains have heightened the need for accurate diagnostic methods. Governments and healthcare organizations are increasing investments in diagnostic research and laboratory infrastructure to combat outbreaks effectively.

Segmentation Analysis

The global market has been segmented based on products and services, application, end-user, and geography.

By Products and Services

Based on products and services, the market has been segmented into services, consumables, and instruments. The services segment led the anatomic pathology market in 2023, reaching the valuation of USD 16.65 billion. As healthcare systems worldwide focus on providing accurate and timely diagnoses, pathology services have become essential in oncology, precision medicine, and other medical fields.

Healthcare providers increasingly rely on outsourced pathology services to ensure high-quality analysis, reduce operational costs, and maintain diagnostic accuracy. Additionally, the integration of advanced technologies, such as digital pathology and AI-driven analysis, has enhanced the value of these services. The growing complexity of disease diagnoses, particularly cancer, further solidifies the importance of expert pathology services, driving their dominance in the market.

By Application

Based on application, the market has been classified into disease diagnostics and medical research. The medical research segment secured the largest revenue share of 64.76% in 2023. Research institutions heavily rely on anatomic pathology for in-depth tissue analysis, particularly in oncology and genetic studies, to drive precision medicine.

The need for accurate, detailed data to support clinical trials, biomarker discovery, and disease understanding fuels the demand for advanced pathology technologies. Furthermore, governments and private sectors are investing in medical research, enabling better access to cutting-edge diagnostic tools.

By End-User

Based on end-user, the market has been divided into hospital laboratories, clinical laboratories, and other end users. The clinical laboratories segment is poised for significant growth at a robust CAGR of 8.44% through the forecast period. These laboratories are equipped with advanced technology and skilled personnel, enabling efficient processing and analysis of tissue samples.

The increasing demand for early disease detection, particularly in oncology, is driving clinical laboratories to adopt cutting-edge anatomic pathology tools, such as digital pathology and AI-based systems, to improve diagnostic accuracy and reduce turnaround times.

Anatomic Pathology Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America accounted for 36.35% share og the global anatomic pathology market in 2023, with a valuation of USD 13.90 billion. The region's robust healthcare infrastructure, including well-equipped hospitals, laboratories, and research facilities, supports the implementation of advanced diagnostic tools. This infrastructure provides a fertile ground for the adoption of innovative anatomic pathology solutions, including digital pathology and AI-driven diagnostics.

Moreover, companies in North America are at the forefront of developing and integrating cutting-edge technologies such as digital pathology, AI, and molecular diagnostics. The rapid adoption of these technologies, particularly in the U.S., has enhanced diagnostic accuracy, reduced turnaround times, and driven market growth.

- In July 2024, AGFA HealthCare, a global leader in healthcare imaging management solutions, announced the launch of Enterprise Imaging for Pathology, powered by Corista DP3, in North America. This advanced solution is designed to tackle the challenges faced by pathology departments transitioning from analog to digital systems, focusing on reducing complexity, enhancing clinical collaboration, and improving efficiency within pathology workflows.

The market in Asia Pacific is poised for significant growth at a robust CAGR of 8.72% over the forecast period. Asia Pacific is registering a sharp increase in cancer cases, particularly in countries like China and India, where the aging population and lifestyle changes contribute significantly to the growing burden. The growing need for tissue-based diagnostics in oncology is accelerating the anatomic pathology industry growth in the region.

Furthermore, Asia Pacific has become a hub for medical tourism, with patients from around the world seeking high-quality, cost-effective healthcare services. Countries like India, Thailand, and Singapore are attracting international patients for cancer treatments and diagnostic services.

This growing influx of patients is pushing healthcare providers to adopt the latest anatomic pathology technologies to meet global standards and ensure accurate diagnoses, thereby contributing to the market growth in the region.

Competitive Landscape

The global anatomic pathology market report will provide valuable insights with an emphasis on the fragmented nature of the market. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Strategic initiatives, including investments in R&D activities, establishment of new manufacturing facilities, and supply chain optimization, could create opportunities for market growth.

List of Key Companies in Anatomic Pathology Market

- Hoffmann-La Roche Ltd.

- Danaher Corporation

- PHC Holdings Corporation

- Agilent Technologies, Inc.

- Cardinal Health

- Quest Diagnostics Incorporated

- Laboratory Corporation of America Holdings

- NeoGenomics Laboratories, Inc.

- BioGenex

- Sakura Finetek USA, Inc.

Key Industry Developments

- September 2024 (Partnership): Roche has partnered with Lunit to integrate Lunit SCOPE PD-L1 22C3 TPS into Roche's Navify Digital Pathology platform. This collaboration represents the first deployment of Lunit's AI technology within Roche, providing pathologists and scientists with advanced tools to enhance cancer research.

- July 2024 (Expansion): Danaher Corporation has unveiled two new laboratories certified by the Clinical Laboratory Improvement Amendments (CLIA) and the College of American Pathologists (CAP). These labs are strategically designed to expedite the development and commercialization of Companion Diagnostics (CDx) and Complementary Diagnostics (CoDx), which are essential for advancing personalized medicine.

The global anatomic pathology market has been segmented as:

By Products and Services

- Services

- Histopathology

- Cytopathology

- Consumables

- Antibodies

- Primary Antibodies

- Secondary Antibodies

- Kits & Reagents

- Stains and Solvents

- Fixatives

- Other Kits and Reagents

- Probes

- Other Consumables

- Instruments

- Slide Staining Systems

- Tissue Processing Systems

- Cell Processors

- Microtomes

- Embedding Systems

- Coverslippers

- Other Instruments

By Application

- Disease Diagnostics

- Cancer

- Breast Cancer

- Gastrointestinal Cancer

- Lung Cancer

- Prostate Cancer

- Other Cancers

- Other Diseases

- Medical Research

By End-User

- Hospital Laboratories

- Clinical Laboratories

- Other End Users

By Region

- North America

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America