Digital Pathology Market Size

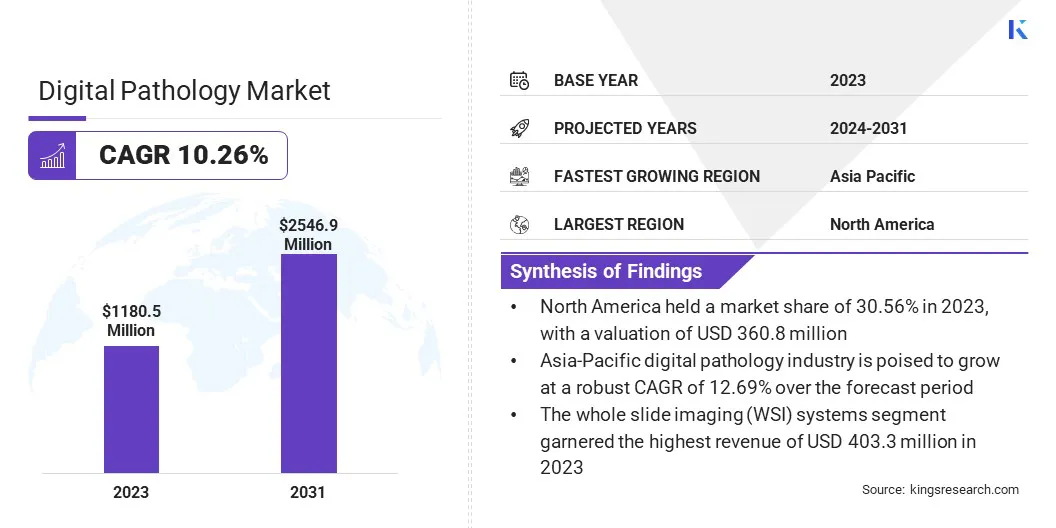

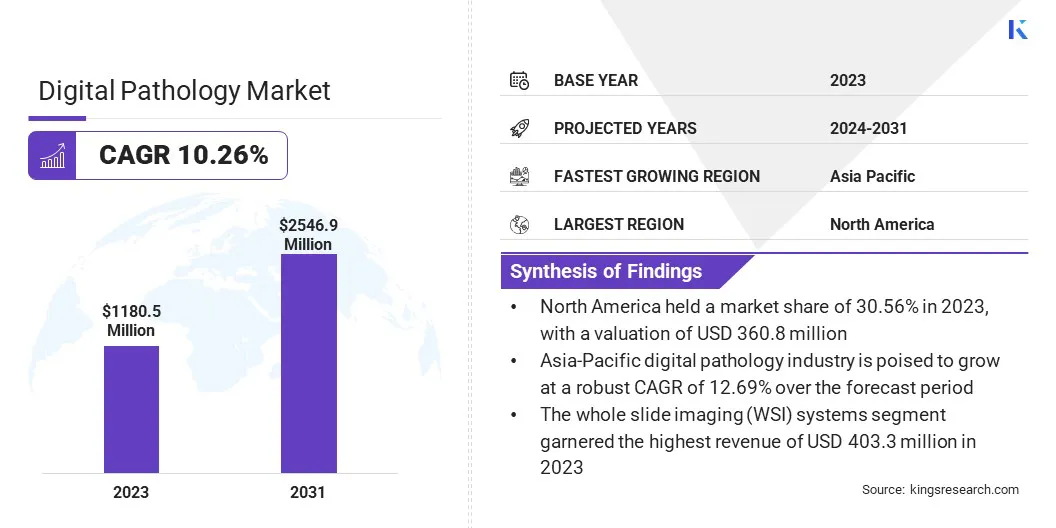

According to Kings Research, the global digital pathology market size was valued at USD 1,180.5 million in 2023 and is projected to reach USD 2,546.9 million by 2031, growing at a CAGR of 10.26% from 2024 to 2031. Advancements in imaging technology, such as whole-slide imaging (WSI), are fueling the growth of the digital pathology market. These innovations offer high-resolution, detailed images that are crucial for accurate pathology analysis.

Key Market Highlights:

- Digital Pathology Market to Reach USD 2.55 Billion by 2031.

- Disease Diagnosis Holds the Largest Market Share: Accounting for over 60% revenue, digital pathology is transforming cancer diagnosis through AI-powered image analysis.

- WSI systems lead the market following FDA approval for primary diagnosis, accelerating clinical adoption worldwide.

- North America dominates due to advanced healthcare infrastructure, while Asia-Pacific records the highest growth rate with rapid digital health adoption.

Improved imaging quality enhances diagnostic capabilities, encourages healthcare providers to transition to digital systems, and promotes collaboration among pathologists, thereby boosting market development. The need for efficient workflow is a significant factor shaping the digital pathology market dynamics.

Digital pathology solutions streamline complex workflow processes by digitizing slide preparation, analysis, and reporting. This automation reduces turnaround times, minimizes errors, and enhances productivity in pathology laboratories.

Moreover, digital platforms enable seamless remote collaboration among pathologists, allowing experts to consult on cases regardless of geographic location. This improves diagnostic accuracy while facilitating knowledge-sharing and training opportunities. As healthcare providers increasingly prioritize operational efficiency and quality of care, the demand for digital pathology solutions that optimize workflow is growing steadily.

Digital pathology refers to the digitization of traditional glass slides containing tissue samples for pathological analysis. It involves scanning these slides to create high-resolution digital images that pathologists can view and analyze using specialized software.

Applications of digital pathology include primary diagnosis, second opinions, remote consultation, research, and education. End users of digital pathology solutions encompass various stakeholders in the healthcare sector, such as pathology laboratories, hospitals, academic institutions, research organizations, and pharmaceutical companies.

Pathologists and laboratory technicians are primary users, utilizing digital pathology for accurate diagnosis, collaboration, and sharing of insights. Additionally, healthcare administrators utilize digital pathology systems to improve workflow efficiency, enhance patient care, and support data-driven decision-making processes.

Analyst view on Digital Pathology Market

The digital pathology market, valued at USD 1.18 billion in 2023, is rapidly transitioning into routine clinical use, driven by AI-enabled whole slide imaging and regulatory approvals. Increasing cancer diagnostics and workload pressures are accelerating adoption across hospitals and laboratories, supporting a 10.26% CAGR through 2031.

Digital platforms improve diagnostic accuracy, turnaround time, and remote collaboration, making them essential to scalable pathology operations. Continued investments in compliant, secure data infrastructures are reinforcing long-term adoption and trust.

They ensure compliance with data privacy laws, such as GDPR and HIPAA, by implementing robust security measures for patient data protection. Moreover, industry associations and advocacy groups are working closely with regulatory bodies to establish standards and guidelines for digital pathology practices, which is fostering trust and confidence among stakeholders.

Digital Pathology Market Growth Factors

The rising prevalence of cancer is a key driver supporting digital pathology market growth, as the increasing burden of chronic diseases is intensifying the need for accurate and timely pathology diagnoses to guide effective treatment decisions.

Digital pathology solutions enhance diagnostic precision, streamline laboratory workflows, and improve collaboration among healthcare professionals, all of which are critical for managing complex chronic conditions.

- AI-enhanced scanners and software from companies like Leica Biosystems are boosting image analysis precision while supporting real-time collaboration.(Source: financialcontent.com).

In addition, the capability of digital systems to efficiently process and analyze large volumes of pathology data strengthens research efforts aimed at advancing disease understanding and treatment.

As healthcare institutions worldwide seek more precise diagnostic solutions to address the growing incidence of chronic illnesses, the adoption of digital pathology continues to accelerate, further reinforcing market expansion.

Remote patient monitoring presents a significant opportunity for the growth of the digital pathology market. By integrating digital pathology with telemedicine platforms, healthcare providers are remotely monitoring patients' pathology results, enabling timely interventions and treatment adjustments. This integration enhances access to healthcare services, particularly in remote or underserved areas where access to specialist pathologists is limited.

Patients are receiving expert pathology consultations without the need for extensive travel, thereby reducing costs and improving healthcare outcomes. Moreover, real-time data transmission and analysis through digital pathology systems allow for continuous monitoring of chronic conditions, early detection of disease progression, and personalized treatment plans.

As telemedicine continues to expand and evolve, utilizing digital pathology in remote patient monitoring holds immense potential to improve patient care, streamline healthcare delivery, and address healthcare disparities across diverse populations.

Data privacy and security concerns present a major challenge to digital pathology market expansion. Managing and securing large volumes of digital pathology data, including high-resolution images and patient medical records, requires robust cybersecurity measures to prevent unauthorized access, data breaches, and potential misuse.

- Healthcare organizations must comply with stringent regulations such as HIPAA (Health Insurance Portability and Accountability Act) and GDPR (General Data Protection Regulation) to ensure patient data privacy, which adds complexity to data management processes.

Implementing encryption techniques, access controls, audit trails, and regular security audits are essential strategies to mitigate potential risks. Collaborative efforts involving IT professionals, cybersecurity experts, healthcare providers, and regulatory bodies are necessary to address evolving cybersecurity threats and maintain trust in digital pathology systems amidst growing data privacy and security challenges.

Digital Pathology Market Trends

AI-driven diagnostics are transforming digital pathology, with AI algorithms enabling automated image analysis, pattern recognition, and predictive analytics. These advancements improve diagnostic accuracy and efficiency, allowing for faster and more precise pathology interpretations.

- The Mayo Clinic Platform Accelerate program announced its latest cohort of AI health tech startups, fostering innovation in AI diagnostics and digital health tools. These startups will leverage Mayo Clinic’s expertise to develop AI systems that enhance diagnostic accuracy, predictive analytics, and clinical decision support. (Source: mayoclinic.org).

A growing trend in the digital pathology market is the adoption of blockchain technology to tackle data security challenges. Its decentralized and tamper-proof framework ensures safe storage and sharing of pathology data while preserving patient privacy and maintaining data integrity an essential factor for regulatory compliance and building trust in healthcare systems.

Additionally, the use of AR/VR technologies is emerging as a key trend in the Digital Pathology Market, enhancing training and education. These immersive technologies simulate complex pathology scenarios, supporting the training of pathologists and improving educational programs, which ultimately strengthens diagnostic skills and contributes to better patient outcomes.

Segmentation Analysis

The global digital pathology market is segmented based on product type, application, end user, and geography.

By Product Type

By product type, the market is classified into whole slide imaging (WSI) systems, image analysis-integrated systems, information management systems, telepathology systems, and others. The whole slide imaging (WSI) systems segment garnered the highest revenue of USD 403.3 million in 2023 due to significant advancements and regulatory approvals.

- In May 2023, the U.S. Food and Drug Administration (FDA) approved the use of WSI for primary surgical pathology diagnosis. This regulatory milestone signifies the technology's reliability and accuracy, fostering increased confidence among healthcare providers. With FDA approval, pathologists are using WSI systems for routine clinical practice, thus driving higher adoption rates and market revenue. The endorsement by regulatory authorities boosts the standing of WSI systems as a preferred choice for digital pathology solutions.

By Application

By application, the market is segmented into drug discovery & development, disease diagnosis, teleconsultation, training & education, and others. The disease diagnosis segment acquired the largest revenue share of 60.77% in 2023 due to the transformative impact of digital pathology and AI technologies on healthcare.

- A 2021 publication by the National Cancer Institute (NCI), U.S., underscores the potential of digital pathology and AI in improving cancer diagnosis. It emphasizes how digital analysis surpasses human capabilities by extracting vital information from pathology images, enabling precise diagnoses and personalized treatment strategies. This recognition of digital pathology's enhanced capabilities has propelled its adoption in disease diagnosis, particularly in oncology, thereby driving the growth of the segment.

By End User

By end user, the market is divided into hospitals & clinics, pharmaceutical & biotechnology companies, academic & research institutes, diagnostic laboratories, others. The hospitals & clinics segment is poised to attain a CAGR of 12.01% over the projection period.

The increasing adoption of digital pathology solutions in hospitals and clinics is driven by the need for efficient diagnostic tools to improve patient care outcomes. Additionally, advancements in technology are enhancing diagnostic accuracy and workflow efficiency in clinical settings. Moreover, rising healthcare investments and global initiatives to digitize healthcare infrastructure are supporting the growth of the hospitals and clinics segment.

Digital Pathology Market Regional Analysis

Based on region, the global digital pathology market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The North America Digital Pathology Market share stood around 30.56% in 2023 in the global market, with a valuation of USD 360.8 million. This growth can be attributed to the region's advanced healthcare infrastructure, widespread adoption of digital technologies in healthcare, and significant investments in research and development. Moreover, supportive government initiatives and increasing demand for efficient diagnostic solutions are propelling regional market growth.

The Asia-Pacific digital pathology industry is poised to grow at a robust CAGR of 12.69% over the forecast period. Rapid urbanization, increasing healthcare expenditure, rising adoption of digital healthcare solutions, and growing awareness regarding advanced diagnostic technologies are contributing significantly to market growth in the region.

Additionally, developments in healthcare infrastructure and the presence of key market players focusing on expanding their footprint in emerging economies are driving regional market expansion.

Competitive Landscape

The global digital pathology market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, are set to create new opportunities for market growth.

Key Companies in Digital Pathology Market

Key Industry Developments

- March 2024 (Partnership): IBEX and PathPresenter partnered to expedite the implementation of AI-driven digital pathology solutions. The collaboration aimed to integrate IBEX's AI technology with PathPresenter's digital pathology platform, thereby enhancing diagnostic capabilities for healthcare applications. This alliance sought to advance precision medicine and improve patient outcomes through innovative digital pathology solutions.

- April 2023 (Partnership): Lumea Digital and OPTRASCAN partnered to revolutionize pathology services with AI-driven solutions. This collaboration integrated Lumea Digital's digital pathology platform with OPTRASCAN's AI technology, enhancing diagnostic accuracy and workflow efficiency in pathology labs. The synergy aimed to improve patient outcomes through advanced technology in medical diagnostics.