Market Definition

The market encompasses the production and use of placenta-derived membranes for regenerative medicine, particularly in ophthalmology, wound care, and surgery. These membranes are used in medical treatments for their anti-inflammatory, anti-scarring, and regenerative properties, with applications in ophthalmology, wound care, and orthopedic surgeries.

Amniotic Membrane Market Overview

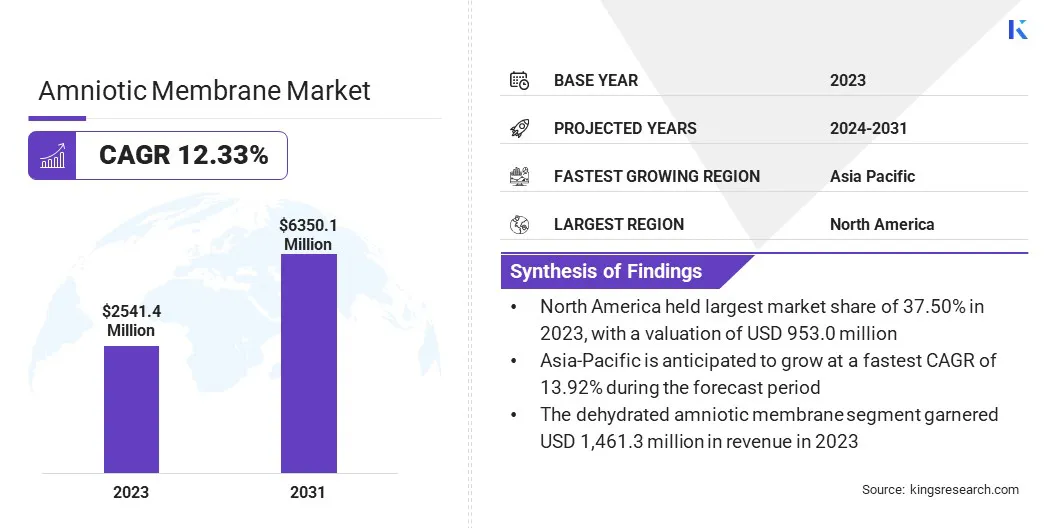

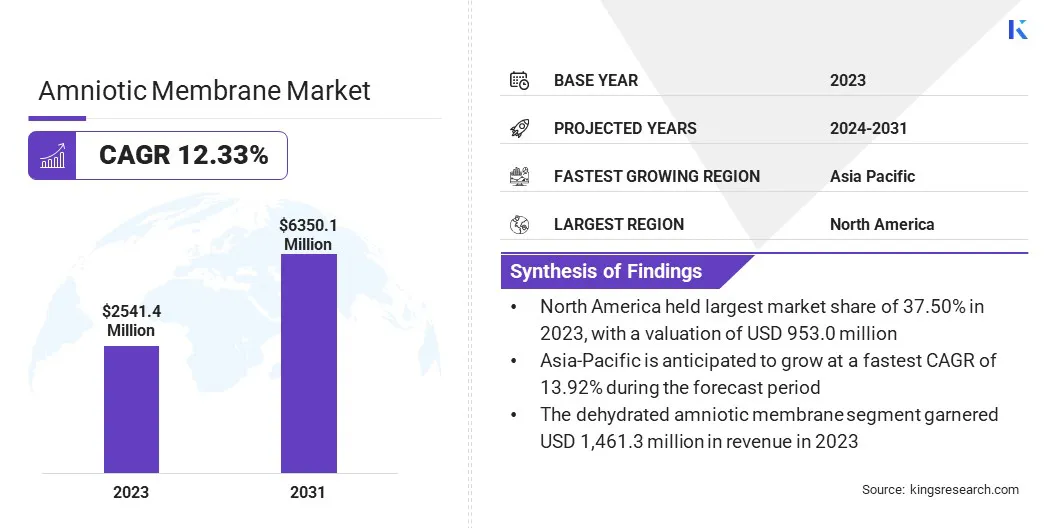

The global amniotic membrane market size was valued at USD 2,541.4 million in 2023 and is projected to grow from USD 2,814.6 million in 2024 to USD 6,350.1 million by 2031, exhibiting a CAGR of 12.33% during the forecast period.

The market is driven by the increasing demand for regenerative medicine, advancements in tissue preservation, and rising applications in ophthalmology, wound care, and orthopedic surgeries.

Key Market Highlights

- The amniotic membrane industry size was valued at USD 2,541.4 million in 2023.

- The market is projected to grow at a CAGR of 12.33% from 2024 to 2031.

- North America held a market share of 37.50% in 2023, with a valuation of USD 953.0 million.

- The dehydrated amniotic membrane segment garnered USD 1,461.3 million in revenue in 2023.

- The cryopreserved segment is expected to reach USD 3,430.3 million by 2031.

- The thin segment is anticipated to register the fastest CAGR of 12.68% during the forecast period.

- The hospitals & clinics segment is expected to reach USD 3,181.7 million by 2031.

- The wound care segment held a market share of 37.50% in 2023, with a valuation of USD 953.0 million.

- The market in Asia Pacific is anticipated to grow at a CAGR of 13.92% during the forecast period.

Major companies operating in the amniotic membrane market are APPLIED BIOLOGICS, Amnio Technology, LLC, Celularity Inc., Integra LifeSciences Corporation., BioTissue, Organogenesis Inc., Corza Medical, Skye Biologics Holdings, LLC, Human Regenerative Technologies, LLC, MIMEDX Group, Inc., Smith+Nephew, Alliqua.com, Stryker, applied biologics., and NuVision Biotherapies Ltd.

Factors such as an aging population, a surge in chronic wounds, and expanding research in stem cell therapy further contribute to market expansion. Additionally, technological innovations and growing healthcare investments are expected to accelerate adoption, positioning the market for substantial growth.

- In February 2025, BioLab Holdings, Inc. a Phoenix-based medical manufacturer specializing in wound healing products, announced that it has received Institutional Review Board (IRB) approval for a clinical trial evaluating the efficacy of Membrane Wrap, a human amniotic membrane, in treating venous leg ulcers.

Rising Demand for Minimally Invasive Treatments

The rising demand for minimally invasive treatments is driving the adoption of amniotic membrane-based therapies across various medical fields. These treatments offer faster healing, reduced scarring, and lower risk of complications compared to traditional surgical procedures.

In ophthalmology, wound care, and orthopedics, amniotic membranes are increasingly used as biologic dressings and grafts to promote natural tissue regeneration without invasive surgery. Additionally, the growing preference for non-surgical regenerative therapies in dermatology and pain management supports the market expansion.

- In October 2024, BioLab Holdings, Inc. announced the launch of its Tri-Membrane Wrap, a triple-layered amniotic skin substitute designed to protect deep wounds in challenging areas. This product features a dehydrated Amnion-Chorion-Amnion tissue structure, enhancing thickness and tensile strength, allowing for suturing when necessary.

High Processing and Preservation Costs

High processing and preservation costs pose a significant challenge in the amniotic membrane market. Advanced techniques like cryopreservation, dehydration, and sterilization require specialized equipment and strict quality controls, increasing production expenses.

Maintaining biological integrity and extending shelf life further add to these expenses. These factors make amniotic membrane products expensive, limiting accessibility, especially in cost-sensitive markets.

Manufacturers can invest in cost-effective preservation techniques, optimize scaling-up production, and enhance automation in processing to reduce labor expenses. Advancements in dehydration and lyophilization methods can improve shelf life while lowering storage costs.

Additionally, increased research funding, strategic partnerships, and government support can help make amniotic membrane products more affordable and accessible, especially in emerging markets.

Advancements in Tissue Preservation and Biotechnology

Advancements in tissue preservation and biotechnology have significantly improved the efficacy, safety, and shelf life of amniotic membrane products. Innovations in cryopreservation, dehydration techniques, and sterilization methods help maintain the membrane’s biological properties, ensuring optimal therapeutic benefits. Additionally, biotechnology advancements have enhanced processing techniques, reducing contamination risks and improving product consistency.

- In October 2024, Merakris Therapeutics, Inc. announced the launch of Dermacyte AC Matrix, a lyophilized amnion-chorion membrane allograft designed to protect deep tissue defects. The product was showcased at the Fall Symposium for Advanced Wound Care (SAWC) in Las Vegas in October, 2024.

Amniotic Membrane Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product Type

|

Cryopreserved Amniotic Membrane, Dehydrated Amniotic Membrane

|

|

By Processing Method

|

Freeze-dried (Lyophilized), Cryopreserved

|

|

By Thickness

|

Thin, Intermediate, Thick

|

|

By End User

|

Hospitals & Clinics, Ambulatory Surgical Centers (ASCs), Research Institutes & Laboratories, Specialty Clinics

|

|

By Application

|

Ophthalmology, Wound Care, Orthopedics, Surgical Applications, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Product Type (Cryopreserved Amniotic Membrane, Dehydrated Amniotic Membrane): The dehydrated amniotic membrane segment earned USD 1,461.3 million in 2023, due to its longer shelf life, ease of storage, and widespread use in wound care and surgical applications.

- By Processing Method (Freeze-dried (Lyophilized), Cryopreserved): The freeze-dried (lyophilized) segment held 53.50% share of the market in 2023, due to its extended shelf life, ease of handling, and maintained biological efficacy without the need for specialized storage.

- By Thickness (Thin, Intermediate, Thick): The intermediate segment is projected to reach USD 2,524.0 million by 2031, owing to its versatile applications in wound healing, ophthalmology, and surgical procedures, offering a balance between durability and flexibility.

- By End User (Hospitals & Clinics, Ambulatory Surgical Centers (ASCs), Research Institutes & Laboratories, Specialty Clinics): The research institutes & laboratories segment is anticipated to grow at a CAGR of 14.52% during the forecast period, due to increasing investment in regenerative medicine, rising stem cell research, and ongoing advancements in biotechnology & tissue engineering.

- By Application (Ophthalmology, Wound Care, Orthopedics, Surgical Applications, Others): The wound care segment held a market share of 37.50% in 2023, with a valuation of USD 953.0 million, due to the rising prevalence of chronic wounds, burns, and ulcers, along with the growing adoption of amniotic membranes for faster healing and reduced scarring.

Amniotic Membrane Market Regional Analysis

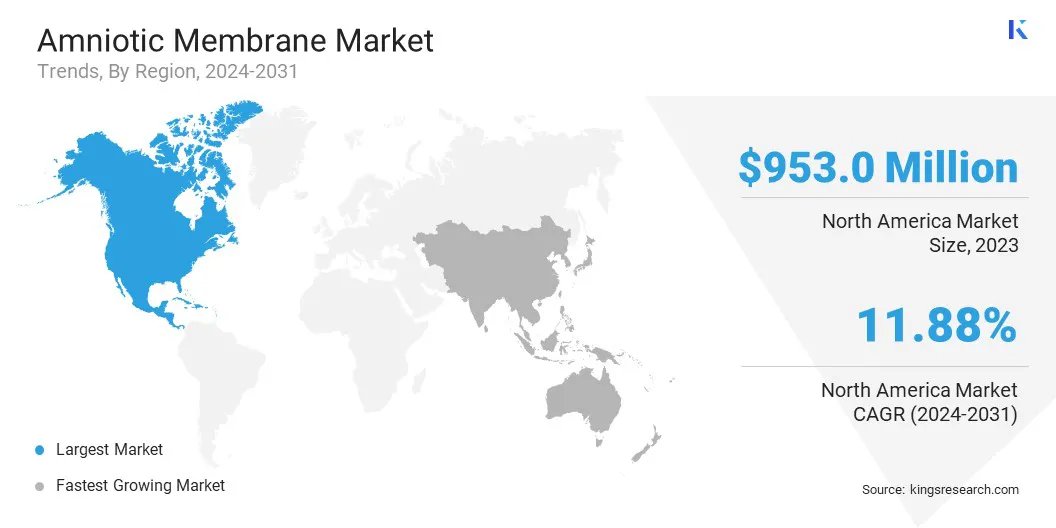

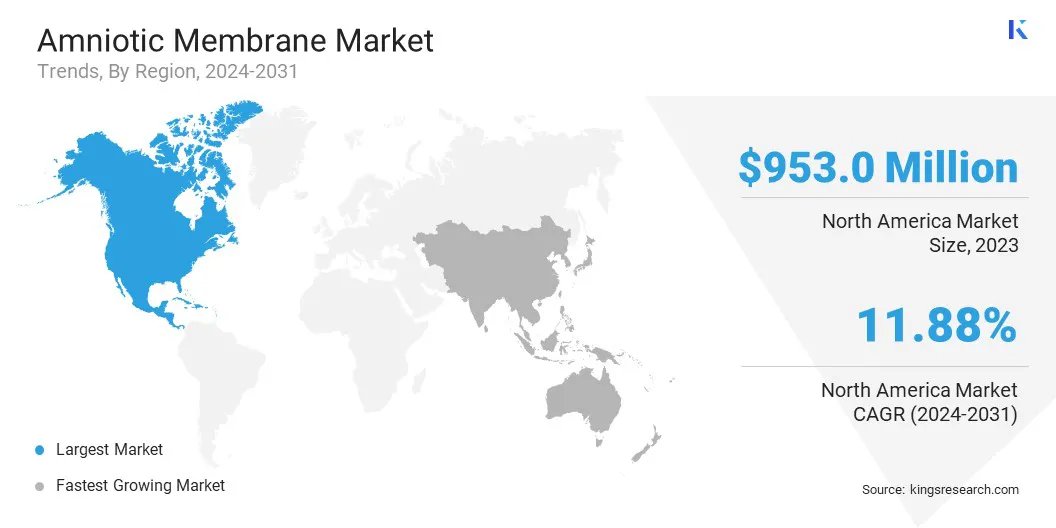

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America amniotic membrane market is accounted for a market share of around 37.50% in 2023, with a valuation of USD 953.0 million. This dominance is attributed to advanced healthcare infrastructure, high adoption of regenerative medicine, and increasing research in stem cell therapies.

The presence of leading market players, favorable reimbursement policies, and rising cases of chronic wounds and ophthalmic disorders further drive the market in the region. Additionally, ongoing technological advancements and increased government funding for biomedical research continue to support North America's strong position in the market.

- In January 2025, BioStem Technologies, Inc. initiated the BR-AM-DFU (BioREtain Amniotic Membrane – Diabetic Foot Ulcers) clinical trial to evaluate the effectiveness of Vendaje, derived from their BioREtain technology, in treating non-healing diabetic foot ulcers. This multicenter, randomized, controlled study will enroll 60 patients across approximately twelve sites in the U.S, comparing Vendaje combined with standard care against standard care alone over a 12-week treatment period.

The amniotic membrane industry in Asia-Pacific is poised for significant growth at a robust CAGR of 13.92% over the forecast period. The market is fueled by rising healthcare investments, increasing awareness of regenerative medicine, and a growing patient pool suffering from chronic wounds and ophthalmic disorders.

Expanding research initiatives, improving healthcare infrastructure, and a surge in demand for advanced wound care solutions contribute to market expansion. Countries like China, India, and Japan are at the forefront, benefiting from government support, a rising geriatric population, and technological advancements in tissue preservation and biotechnology.

Regulatory Frameworks

- The U.S. Food and Drug Administration (FDA) Regulation of Human Cells, Tissues, and Cellular and Tissue-Based Products (HCT/Ps) governs the processing, storage, and distribution of human-derived tissues, including amniotic membrane products.

- Japan Pharmaceuticals and Medical Devices Agency (PMDA) provides the legal framework for regulating medical devices, in vitro diagnostic reagents, pharmaceuticals, quasi-pharmaceutical products, cosmetic products, and regenerative medicine products in Japan.

- The U.S. FDA Investigational New Drug (IND) Application regulates clinical testing of new drugs, ensuring safety and efficacy before market approval.

Competitive Landscape

The amniotic membrane industry is highly competitive, with key players focusing on product innovation, strategic partnerships, and expansion into emerging markets to strengthen their market presence.

Leading companies invest in Research and Development (R&D), advanced tissue preservation technologies, and product launches to gain a competitive edge. Mergers, acquisitions, and collaborations with biotechnology firms, research institutes, and healthcare providers are common strategies to enhance market share.

Additionally, increasing regulatory approvals and government support for regenerative medicine further drive competition.

- In September 2023, NovaBay Pharmaceuticals, Inc. announced a partnership with BioStem Technologies, Inc. to commercialize an amniotic tissue allograft under the brand name Avenova Allograft. This agreement expands NovaBay’s ophthalmic product portfolio, leveraging BioStem’s expertise in regenerative medicine to enhance eye care treatments.

Key Companies in Amniotic Membrane Market:

- APPLIED BIOLOGICS

- Amnio Technology, LLC

- Celularity Inc.

- Integra LifeSciences Corporation.

- BioTissue

- Organogenesis Inc.

- Corza Medical

- Skye Biologics Holdings, LLC

- Human Regenerative Technologies, LLC

- MIMEDX Group, Inc.

- Smith+Nephew

- Alliqua.com

- Stryker

- applied biologics.

- NuVision Biotherapies Ltd

Recent Developments (New Product Launch)

- In June 2024, Axogen Corporation officially launched Avive+ Soft Tissue Matrix, a resorbable, multi-layer amniotic membrane allograft designed to act as a soft tissue barrier, offering temporary protection and tissue separation during the crucial phase of peripheral nerve healing.

- In April 2024, Xtant Medical Holdings, Inc. announced the full commercial launch of SimpliGraft and SimpliMax, two amniotic membrane allografts designed to serve as barriers and provide protective coverage for chronic and acute wounds.