Market Definition

Ammonium Nitrate (NH₄NO₃) is a chemical compound consisting of ammonium and nitrate ions. It is widely used as a fertilizer in agriculture due to its high nitrogen content, which is essential for plant growth.

Additionally, it is employed as a key component in explosives for mining and construction due to its oxidizing properties. While stable under normal conditions, ammonium nitrate can pose fire and explosion risks if exposed to high heat, contamination, or improper handling.

Ammonium Nitrate Market Overview

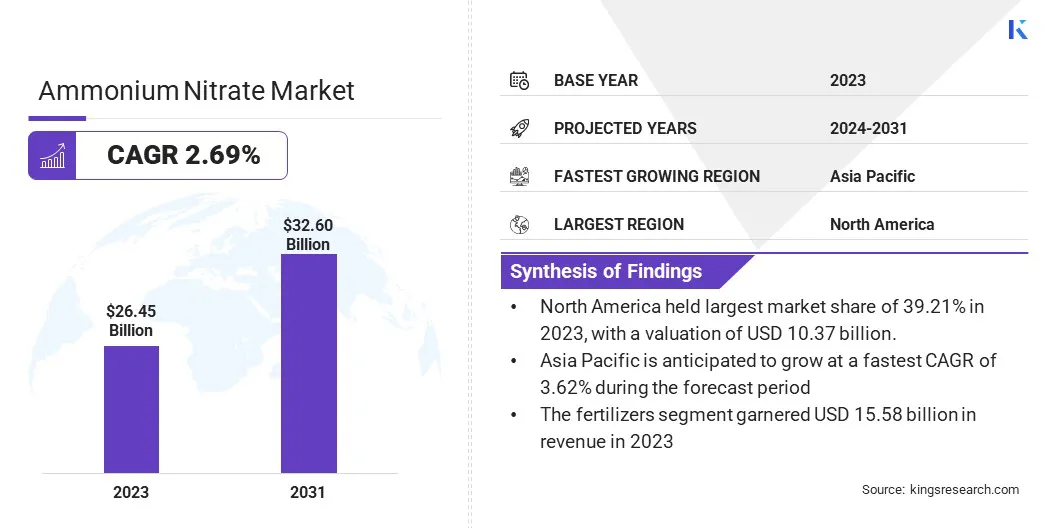

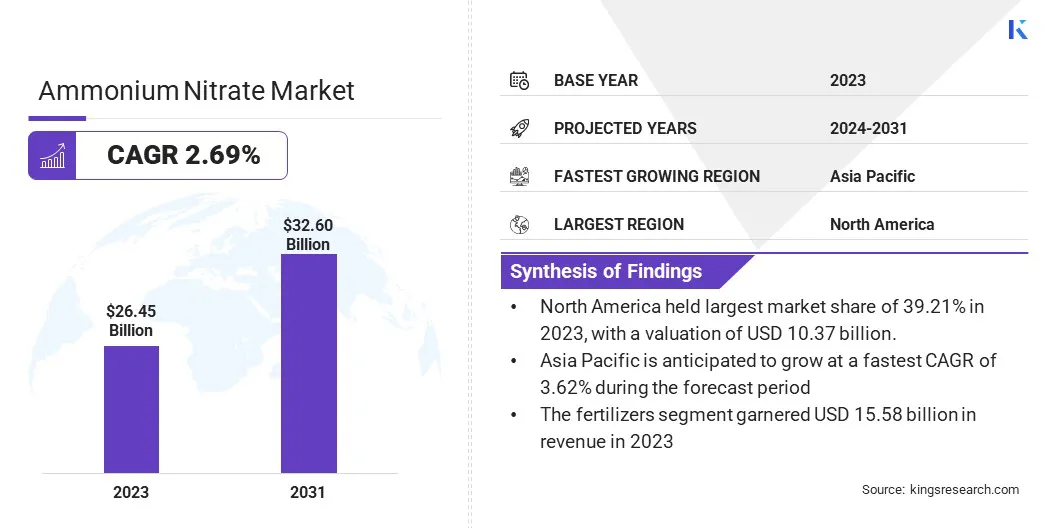

Global ammonium nitrate market size was USD 26.45 billion in 2023, which is estimated to be valued at USD 27.07 billion in 2024 and is projected to reach USD 32.60 billion by 2031, growing at a CAGR of 2.69% from 2024 to 2031.

The growth of the market is driven by the rising demand for fertilizers to support agricultural growth, particularly in developing countries. Increasing food production requirements and the shift toward sustainable farming practices are further fueling market expansion.

Additionally, advancements in production technologies, such as greener methods for ammonia synthesis, are reducing environmental impact. The demand for ammonium nitrate in explosives for mining and construction is further bolstering market development.

Major companies operating in the global ammonium nitrate industry are Yara, CF Industries Holdings, Inc., Uralchem, EuroChem Group, Orica Limited, Borealis AG, San Corporation, ENAEX, Incitec Pivot Pty Ltd., Neochim Plc., Austin Powder Company, OSTCHEM, HELM AG, Fertiberia, DFPCL, and others.

The growing demand for cleaner ammonia production methods is leading to the rising adoption of more sustainable practices. Innovations to produce green ammonia with minimal environmental impact are leading promoting eco-friendly practices.

This shift is aligned with stricter environmental regulations and increasing industry efforts to reduce carbon emissions. Cleaner ammonia production methods are expected to improve the sustainability of the ammonium nitrate industry, boosting market growth.

- In August 2024, researchers at Rice University developed a new reactor system that efficiently converts nitrates, a pollutant commonly found in industrial wastewater and agricultural runoff, into ammonia. The innovation holds significant potential for addressing environmental challenges and improving the sustainability of ammonia production.

Key Highlights:

- The global ammonium nitrate market size was recorded at USD 26.45 billion in 2023.

- The market is projected to grow at a CAGR of 2.69% from 2024 to 2031.

- North America held a share of 39.21% in 2023, valued at USD 10.37 billion.

- The powder segment garnered USD 20.69 billion in revenue in 2023.

- The low concentration (<50%) segment is expected to reach USD 14.74 billion by 2031.

- The fertilizers segment secured the largest revenue share of 58.90%in 2023.

- The light commercial vehicles segment is poised to grow at a CAGR of 4.00% over the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 3.62% between 2024 and 2031.

Market Driver

"Integration of Sustainable Practices in the Agricultural Sector"

The ammonium nitrate market is growing due to its role in promoting sustainable farming practices. Efforts to increase agricultural efficiency while reducing environmental impact have led to the widespread adoption of ammonium nitrate, as it provides targeted nutrient delivery with minimal wastage.

This trend is particularly prevalent in developed markets, where regulatory frameworks emphasize eco-friendly agricultural inputs.

- In July 2024, Yara entered into a strategic partnership with ATOME PLC, a prominent developer of sustainable fertilizer projects.Under the agreement, ATOME will supply its entire Calcium Ammonium Nitrate production from the renewable Villeta facility in Paraguay, while Yara will market and distribute the fertilizer under its YaraBela product line.

This collaboration represents a significant milestone for both companies, highlighting their shared commitment to promoting sustainable agriculture and minimizing the environmental impact of fertilizer production.

Market Challenge

"Rising Environmental and Safety Concerns"

Growing environmental and safety concerns associated with the production, storage, and transportation of ammonium nitrate pose a significant challenge to the growth of the market. The risk of hazardous accidents, such as explosions, and the environmental impact of manufacturing processes are critical issues.

A notable example is the 2020 Beirut explosion, reportedly caused by ammonium nitrate, which resulted in over 135 fatalities and numerous severe injuries.

To address this challenge, companies are investing in safer production technologies, enhanced storage systems, and stricter compliance with environmental regulations.

Many are adopting advanced safety protocols and exploring eco-friendly alternatives to reduce their carbon footprint and improve sustainability. Industry collaboration on research into safer handling and production methods is further driving these advancements.

Market Trend

"Technological Advancements in Manufacturing and Handling"

Advancements in the manufacturing and safe handling of ammonium nitrate have enhanced its appeal. Innovations in production processes have improved efficiency and reduced costs, while modern storage solutions have mitigated safety risks.

These developments have promoted its widespread adoption across industries, contributing to the growth of the ammonium nitrate market.

- In August 2024, researchers at UNSW Sydney developed an innovative method to produce ammonium ions from nitrate-rich wastewater using a custom-designed solar panel resembling an artificial leaf. This process, known as photoelectrocatalysis (PEC), employs a nano-structured thin layer of copper and cobalt hydroxide on the solar panel to facilitate the chemical reaction that generates ammonium nitrate from wastewater.

Ammonium Nitrate Market Report Snapshot

| Segmentation |

Details |

| By Form |

Powder, Liquid |

| By Concentration |

High Concentration (>90%), Medium Concentration (50–90%), Low Concentration (<50%) |

| By Application |

Fertilizers, Explosives, Chemical Manufacturing, Other Industrial Applications |

| By End Use Industry |

Agriculture, Mining, Defense, Others |

| By Region |

North America: U.S., Canada, Mexico |

| Europe: France, U.K., Spain, Germany, Italy, Russia, Rest of Europe |

| Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific |

| Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

| South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Form (Powder and Liquid): The powder segment earned USD 20.69 billion in 2023 due to its suitability for explosive formulations and its widespread use in mining, quarrying, and construction applications.

- By Concentration (High Concentration (>90%), Medium Concentration (50–90%), and Low Concentration (<50%)): The Low Concentration (<50%) segment held a share of 49.65% in 2023, largely attributed to its extensive use in fertilizers, offering balanced nitrogen content and enhanced safety for handling and storage.

- By Application (Fertilizers, Explosives, Chemical Manufacturing, and Other Industrial Applications): The fertilizers segment is projected to reach USD 19.22 billion by 2031, fueled by its critical role in enhancing crop yield and agricultural productivity.

- By End Use Industry (Agriculture, Mining, Defense, and Others): The mining segment is poised to grow at a CAGR of 4.00% over the forecast period, as a result of its surging use as a primary component in explosives for open-pit and underground mining operations.

Ammonium Nitrate Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

The North America ammonium nitrate market accounted for a substantial share of around 39.21% in 2023, valued at USD 10.37 billion. This dominance is reinforced by the growing agricultural sector in the region.

The need for high-efficiency fertilizers to enhance crop yields and support food production leads to a significant rise in ammonium nitrate consumption. Farmers are adopting advanced techniques to boost productivity, further fueling demand for fertilizers. Furthermore, the transition to greener ammonia production methods is prompting companies to invest in carbon-neutral technologies.

In 2023, the U.S. Department of Energy, through its Advanced Research Projects Agency-Energy (ARPA-E), allocated funding to various research initiatives aimed at developing innovative technologies to significantly reduce emissions in ammonia production. These projects are part of broader efforts to establish sustainable ammonia synthesis methodswith minimla environmental impact.

The Asia Pacific ammonium nitrate industry is likely to grow at a robust CAGR of 3.62% over the forecast period. The expanding mining, construction, and manufacturing sectors in the region create a robust demand for ammonium nitrate demand.

In particular, the use of ammonium nitrate in explosives for mining operations is supporting this growth, fueled by expansion in resource extraction and infrastructure development.

- In April 2023, Chambal Fertilisers announced plans to construct a greenfield technical ammonium nitrate (TAN) plant in Rajasthan, India, with an annual capacity of 240,000 tonnes. The new plant is scheduled to begin operations by October 2025, supporting the company’s expansion to meet the growing demand for ammonium nitrate in the region.

Additionally, countries such as China, India, and Indonesia are expanding their production capabilities to meet the growing demand for fertilizers and industrial applications. New facilities are increasing local production, reducing import reliance, and lowering production costs, making ammonium nitrate more accessible for the region’s agricultural, industrial, mining, and construction sectors.

- In February 2023, Rashtriya Chemicals and Fertilizers Ltd. (Trombay, India), a prominent public sector fertilizer and chemical manufacturer, adopted Casale's NitroPIPE technology for a new 425 MTPD ammonium nitrate melt facility. The project, executed on an LSTK basis by Larsen & Toubro (Energy Hydrocarbon Division), enhances ammonium nitrate production capabilities.

Regulatory Framework Also Plays a Significant Role in Shaping the Market

- In the U.S., the sale and transfer of ammonium nitrate are regulated under the 6 U.S. Code 488a to prevent its use in acts of terrorism. The Cybersecurity and Infrastructure Security Agency (CISA) oversees these regulations, requiring facilities to register and maintain records of sales and transfers.

- In the European Union, Directive 2003/2003/EC governs the marketing of fertilizers, including ammonium nitrate, establshing standards for the composition, labeling, and packaging to ensure safety and quality.

- In the UK, the Control of Explosives Regulations 1991 regulates the storage, handling, and exportation of explosives, including ammonium nitrate, to ensure safety.

- In Germany, the Explosives Act (Sprengstoffgesetz) regulates the handling of explosives, including ammonium nitrate. It requires licensing, safety measures, and adherence to storage and transportation regulations to prevent misuse and accidents.

- In India, the manufacture, storage, and import of ammonium nitrate are regulated under the Indian Explosives Act, 1884 and the Ammonium Nitrate Rules, 2012. These regulations mandate licensing, safety measures, and adherence to storage guidelines to prevent accidents and misuse.

- In Japan, the Industrial Safety and Health Act mandates safety measures, reporting, and emergency response plans for handling hazardous substances, including ammonium nitrate, to protect workers and the public.

Competitive Landscape

The ammonium nitrate industry is characterized by a large number of participants, including both established corporations and rising organizations. To foster market growth, several companies are adopting partnership strategies aimed at providing sustainable blasting solutions.

These collaborations enable firms to combine their strengths in technology, production, and sustainability practices to create environmentally-friendly products.

- In June 2024, Orica and Fertiberia successfully conducted the first blast using low-carbon Technical Ammonium Nitrate (TAN) at the Canteras de Santullán quarry in Spain. This milestone follows their September 2023 announcement of a partnership to offer low-carbon as a sustainable blasting solutions.

Through these collaborations, companies are developing low-carbon ammonium nitrate formulations that meet increasing regulatory demands and customer preferences for green alternatives.

List of Key Companies in Ammonium Nitrate Market:

- Yara

- CF Industries Holdings, Inc.

- Uralchem

- EuroChem Group

- Orica Limited

- Borealis AG

- San Corporation

- ENAEX

- Incitec Pivot Pty Ltd.

- Neochim Plc.

- Austin Powder Company

- OSTCHEM

- HELM AG

- Fertiberia

- DFPCL

Recent Developments (Agreements)

- In January 2024, Incitec Pivot Limited’s Dyno Nobel signed a non-binding Memorandum of Understanding (MOU) with Saudi Chemical Company Limited to collaborate on the development of an ammonium nitrate plant in Saudi Arabia. Under the terms of this agreement, Dyno Nobel will provide expertise to support the development and operation of the Technical Ammonium Nitrate (TAN) Plant.

- In May 2024, LSB Industries, Inc. announced an agreement to supply up to 150,000 short tons per year of low-carbon ammonium nitrate solution (ANS) to Freeport Minerals Corporation. The supply, sourced from LSB's El Dorado, Arkansas facility, will support Freeport's copper mining operations in the U.S. over a five-year period.