Market Definition

The alternative data industry refers to the collection and analysis of non-traditional data sources, such as social media activity, satellite imagery, credit card transactions, or web traffic. Investors, businesses, and researchers use this data to gain unique insights, enhance decision-making, and uncover patterns not found in traditional financial datasets.

Alternative Data Market Overview

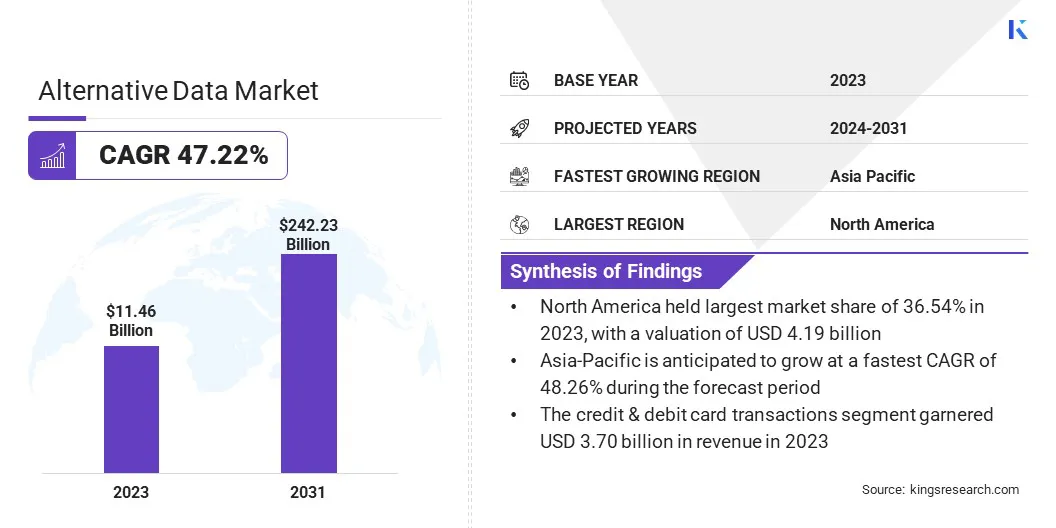

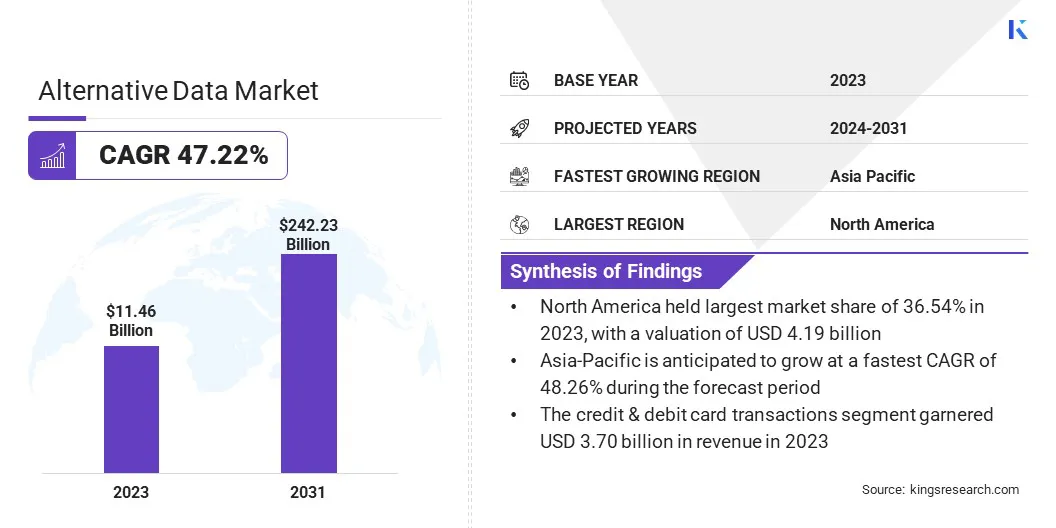

The global alternative data market size was valued at USD 11.46 billion in 2023, which is estimated to be valued at USD 16.16 billion in 2024 and reach USD 242.23 billion by 2031, growing at a CAGR of 47.22% from 2024 to 2031.

The growing reliance on data-driven investment strategies, especially by hedge funds and asset managers, fuels the market. These players leverage unique insights from non-traditional datasets to identify trends, improve decision-making, and gain a competitive market edge.

Major companies operating in the global alternative data market are 1010data, Inc., Advan Research Corporation, Dataminr, Earnest Analytics, Jefferies Financial Group Inc. (M Science), BlackRock, Inc (Preqin), RavenPack, Thinknum Alternative Data, Eagle Alpha, Lighthouse List Company, LLC, Quiver Quantitative, Inc, Alphasense Inc, RiskSeal, Inc, Plaid Inc., and MicroBilt Corporation.

The market has emerged as a transformative force in the global analytics ecosystem, offering unparalleled opportunities for actionable insights. Its evolution reflects a shift towards more innovative and proactive decision-making processes across industries.

Characterized by dynamic and diverse data sources, the market is driven by the increasing importance of precision, speed, and adaptability in decision-making. This space thrives on its ability to provide granular, unique perspectives that complement traditional data, empowering organizations to uncover untapped potential and refine strategies.

- In July 2024, during the 18th Statistics Day Conference, the Governor of the Reserve Bank of India (RBI) emphasized the RBI’s efforts to harness alternative data and AI/ML analytics through its Centralised Information Management System (CIMS) for real-time policy formulation and economic research.

Key Highlights:

- The alternative data industry size was recorded at USD 11.46 billion in 2023.

- The market is projected to grow at a CAGR of 47.22% from 2024 to 2031.

- North America held a market share of 36.54% in 2023, with a valuation of USD 4.19 billion.

- The credit & debit card transactions segment garnered USD 3.70 billion in revenue in 2023.

- The BFSI segment is expected to reach USD 80.20 billion by 2031.

- The market in Asia Pacific is anticipated to grow at a CAGR of 48.26% during the forecast period.

Market Driver

"Competitive Edge for Businesses"

The need for a competitive edge drives businesses to adopt alternative data for enhanced decision-making. By leveraging unique insights from non-traditional sources, companies can improve market forecasting, analyze customer behavior more accurately, and optimize operations.

Alternative data empowers organizations to uncover hidden patterns, predict trends, and gain real-time insights, allowing them to stay ahead of competitors in rapidly evolving markets. This strategic advantage has made alternative data an essential tool for businesses across industries, fueling the market.

- In June 2024, BlackRock announced the USD 3.2 billion acquisition of Preqin, combining its private markets data expertise with Aladdin’s technology to enhance market forecasting, operational efficiency, and decision-making, strengthening competitive advantages in the rapidly growing private markets segment.

Market Challenge

"Concerns Pertaining to Unskilled Professionals"

A significant challenge in the alternative data market is the shortage of skilled professionals proficient in artificial intelligence (AI), machine learning (ML), and data analytics, which hampers the effective use of alternative data. This skill gap limits the ability of companies to extract actionable insights from complex datasets.

Organizations can invest in training programs, partner with educational institutions, and promote upskilling initiatives to develop a pipeline of qualified talent. Additionally, leveraging automated tools and AI-powered platforms can help bridge the skills gap by simplifying data analysis processes and helping the alternative data industry.

- In November 2024, Google.org announced a $15 million funding initiative to upskill U.S. government employees in responsible AI, addressing the growing need for AI expertise. The Partnership for Public Service and InnovateUS will train public sector workers, helping bridge the skills gap in AI.

Market Trend

"Integration with Traditional Data"

A key trend in the alternative data market is the growing integration of alternative data with traditional data sources. This combination allows for more comprehensive decision-making, enabling businesses to achieve deeper insights and make more accurate predictions.

By merging unconventional datasets with established financial or market data, organizations can enhance forecasting accuracy, uncover hidden patterns, and refine strategies, offering a more holistic view that drives better-informed decisions and provides a competitive edge in increasingly complex markets.

- In May 2024, Bloomberg announced the integration of its proprietary Second Measure transaction data analytics with traditional financial data through Bloomberg Data License. This integration allows quants and research analysts to combine alternative data with traditional datasets, enabling more comprehensive market insights and better-informed projections.

Alternative Data Market Report Snapshot

| Segmentation |

Details |

| By Data Type |

Credit & Debit Card Transactions, Email Receipts, Mobile Application Usage, Satellite & Weather Data, Social & Sentiment Data, Others |

| By End-use Industry |

Automotive, BFSI, Energy, Industrial, IT & Telecommunications, Others |

| By Region |

North America: U.S., Canada, Mexico |

| Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

| Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific |

| Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

| South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Data Type (Credit & Debit Card Transactions, Email Receipts, Mobile Application Usage, Satellite & Weather Data, And Social & Sentiment Data, Others): The credit & debit card transactions segment earned USD 3.70 billion in 2023, due to increased demand for consumer spending insights.

- By End-use Industry (Automotive, BFSI, Energy, and Industrial, IT & Telecommunications, Others): The BFSI segment held 29.27% share of the market in 2023, due to its reliance on alternative data for risk assessment.

Alternative Data Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America accounted for around 36.54% share of the market in 2023, with a valuation of USD 4.19 billion. North America leads the alternative data market, driven by its innovation in technology, data analytics, and AI. The region benefits from a robust financial ecosystem and a growing number of startups focusing on data-driven solutions.

With significant investment from both private and public sectors, businesses in North America are increasingly integrating alternative data to enhance decision-making, improve forecasting, and gain a competitive edge. This favorable environment supports the adoption of advanced data solutions, propelling the market.

The market in Asia Pacific is poised for significant growth at a robust CAGR of 48.26% over the forecast period. Asia Pacific is emerging as a fast-growing market for alternative data, fueled by rapid digital transformation, growing tech adoption, and an expanding base of data-driven businesses.

Countries in these regions are investing heavily in AI, ML, and big data analytics, creating significant demand for alternative data. With a surge in internet penetration, mobile usage, and e-commerce activity, businesses are increasingly leveraging diverse data sources to enhance decision-making and drive innovation, positioning Asia Pacific as a key player in the alternative data industry.

- In April 2024, Nikkei Group a Japan-based company, introduced its news sentiment factor using the RoBERTa language model, leveraging MLto analyze news sentiment. This factor, developed with 70,000 labeled data points, enhances investment decisions by providing valuable insights into market sentiment through the SMACOM tool.

Region’s Regulatory Framework Also Plays a Significant Role in Shaping the Market

- The General Data Protection Regulation (GDPR) sets out detailed requirements for companies and organisations on collecting, storing and managing personal data. It applies both to European organisations that process personal data of individuals in the EU, and to organisations outside the EU that target people living in the EU.

- UK Market Abuse Regulation (MAR) aims to increase market integrity and investor protection, enhancing the attractiveness of securities markets for capital raising. It contains prohibitions of insider dealing, unlawful disclosure of inside information and market manipulation, and provisions to prevent and detect these.

- In Japan, the Protection of Personal Information Act protects the rights and interests of individuals while ensuring the smooth and proper management of the processes or services of administrative entities as well as ensuring due consideration of the value of personal information.

Competitive Landscape:

The alternative data market is characterized by a number of participants, including both established corporations and rising organizations. Several firms in the market have launched new products aimed at enhancing data analytics capabilities.

These launches include advanced sentiment analysis tools, real-time consumer behavior tracking systems, and integration platforms that combine traditional financial data with alternative datasets for improved decision-making.

- In September 2024, BlueFlame AI launched Nexus, an AI-powered solution designed to transform the way firms analyze and report unstructured data. Nexus centralizes and structures data from various documents, enhancing search capabilities and enabling faster, more informed decision-making for investment management teams.

List of Key Companies in Alternative Data Market:

- 1010data, Inc.

- Advan Research Corporation

- Dataminr

- Earnest Analytics

- Jefferies Financial Group Inc. (M Science)

- Preqin

- RavenPack

- Thinknum Alternative Data

- Eagle Alpha

- Lighthouse List Company, LLC

- Quiver Quantitative, Inc

- Alphasense Inc

- RiskSeal, Inc

- Plaid Inc.

- MicroBilt Corporation

Recent Developments:

- In August 2024, Bipsync announced a data integration partnership with Preqin, providing seamless access to the latest alternative data on investors, private equity, hedge funds, and more. This partnership enhances Bipsync’s platform, enabling clients to overlay Preqin’s data with proprietary research, optimizing investment workflows and ensuring decision accuracy.

- In May 2024, Datos partnered with Exabel to integrate clickstream data into Exabel’s alternative data research platform. This collaboration enables investment teams to access Datos’ datasets for insights on consumer behavior, trends, and company performance, enhancing decision-making through advanced analytics, visualizations, and KPI monitoring tools.

- In October 2024, HES FinTech partnered with Credolab to integrate AI-powered credit risk solutions leveraging alternative data, including behavioral biometrics and device metadata. This collaboration enhances the ability of lenders to assess creditworthiness, expanding access to underserved populations and promoting financial inclusion.

- In Nov 2024, Advan Research Corporation expanded its alternative data analytics portfolio by acquiring Real Estate Intelligence (REI). The integration strengthens Advan’s capabilities in retail real estate analytics, delivering actionable insights through advanced mobile location data and transaction-based metrics.

- In July 2023, Earnest Analytics launched Vela Velorum, an enhanced transaction data panel. Integrating credit and debit card data, this development enhances insights into consumer behavior, benefiting decision-makers in the alternative data industry with granular analytics.

- In October 2024, Coalition Greenwich, in collaboration with Bloomberg L.P., revealed that economists are increasingly leveraging alternative data, such as social media sentiment and transaction data, alongside generative AI tools. These innovations are transforming macroeconomic analysis, enabling precise predictions for investment decisions.