Market Definition

The market involves the production and distribution of alpha-lipoic acid, a naturally occurring compound used for its antioxidant properties across various industries. It is widely utilized in pharmaceuticals, dietary supplements, cosmetics, and animal feed for its role in energy metabolism, oxidative stress reduction, and potential therapeutic benefits.

The market includes both synthetic and natural sources and covers a broad range of applications driven by growing health awareness, chronic disease management, and demand for anti-aging and wellness products. This report covers the key factors influencing market growth, regulatory landscape, and emerging trends across global regions.

Alpha-lipoic Acid Market Overview

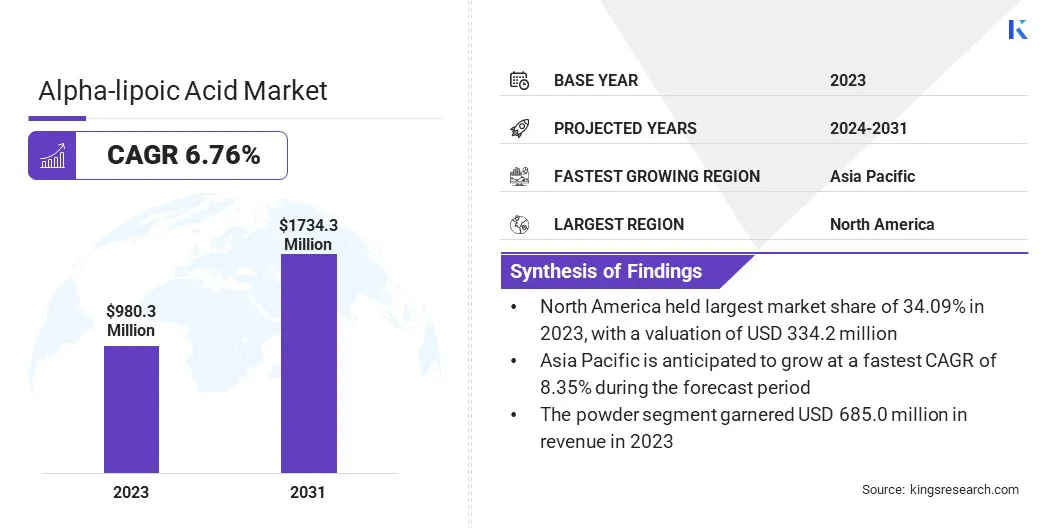

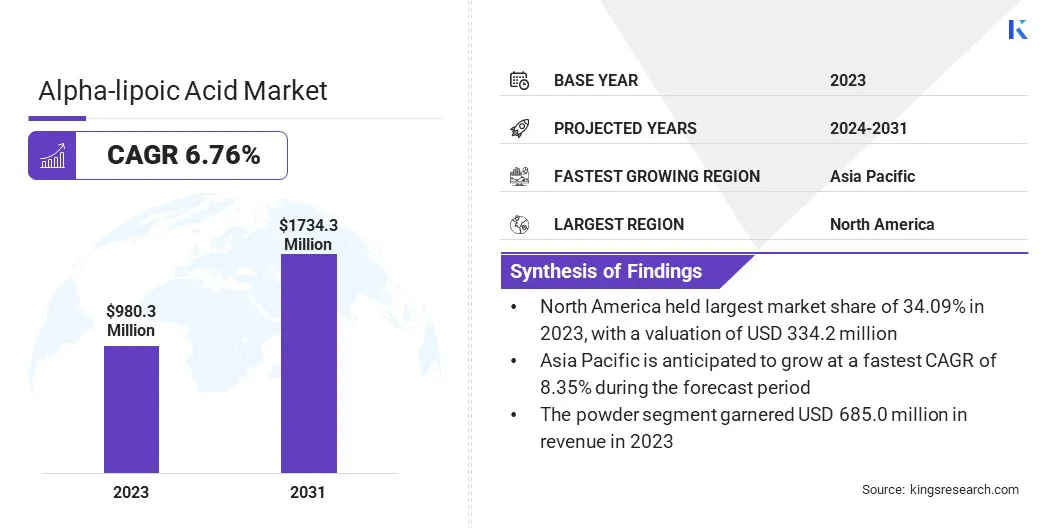

The global alpha-lipoic acid market size was valued at USD 980.3 million in 2023 and is projected to grow from USD 1,044.7 million in 2024 to USD 1,734.3 million by 2031, exhibiting a CAGR of 7.51% during the forecast period.

The market is driven by increasing consumer awareness of health and wellness, rising demand for dietary supplements, and the expanding application of antioxidant ingredients in pharmaceuticals and cosmetics. Moreover, the rising emphasis on preventive healthcare is driving the increased use of alpha-lipoic acid in nutraceuticals due to its role in supporting metabolic health and reducing oxidative stress.

Major companies operating in the alpha-lipoic acid industry are Avanscure, Jiangsu Tohope Pharmaceutical Co., Ltd., Suzhou Fushilai Pharmaceutical Company Limited, NNB Nutrition, Rochem International Inc., Pharm-Rx Chemical Corp, Amilifescience, TAGOOR LABORATORIES PVT. LTD., Xi'an Green Spring Technology Co.,Ltd, Supreem Pharmaceuticals Mysore Pvt. Ltd., MANUS AKTTEVA BIOPHARMA LLP, GeroNova Research, Inc., Alzchem Group AG, Bio Actives Japan Corporation, and Prinova Group LLC.

Additionally, the aging population and a surge in lifestyle-related health conditions have fueled demand for products that promote cellular health and metabolism.

In the cosmetics sector, alpha-lipoic acid is getting adopted as a key ingredient in anti-aging and skin-rejuvenating formulations, contributing to its broader market appeal. Innovation in formulation technologies and the development of functional foods and beverages further support the market’s upward trajectory.

Key Highlights

- The alpha-lipoic acid industry size was valued at USD 980.3 million in 2023.

- The market is projected to grow at a CAGR of 7.51% from 2024 to 2031.

- North America held a market share of 34.09% in 2023, with a valuation of USD 334.2 million.

- The R-Alpha-Lipoic Acid segment garnered USD 569.5 million in revenue in 2023.

- The powder segment is expected to reach USD 1,191.7 million by 2031.

- The pharmaceuticals segment is expected to reach USD 700.0 million by 2031.

- The market in Asia Pacific is anticipated to grow at a CAGR of 8.35% during the forecast period.

Market Driver

Rising Demand for Therapeutic and Preventive Applications

The alpha-lipoic acid market is experiencing strong growth, fueled by the increasing global prevalence of diabetes and metabolic disorders, which are driving the demand for supportive therapeutic agents. Alpha-lipoic acid contributes to improved glucose metabolism and helps manage oxidative stress, critical in mitigating complications such as diabetic neuropathy.

With rising incidences of these conditions due to sedentary lifestyles, poor dietary habits, and aging populations, there is an expanding need for therapies that enhance conventional treatment outcomes. Additionally, a growing consumer focus on preventive healthcare is further boosting the demand for dietary supplements.

Alpha-lipoic acid is being widely adopted as a core ingredient in the nutraceuticals sector due to its ability to support cellular energy production and maintain antioxidant balance, thereby driving market growth.

Market Challenge

Stability and Formulation Challenges

The instability of alpha-lipoic acid, caused by its sensitivity to heat, light, and pH fluctuations during processing and storage, poses a significant challenge for the market. Alpha-lipoic acid can degrade quickly under unfavorable conditions, which affects its shelf life, bioavailability, and overall product performance.

This issue is especially prevalent in liquid formulations or complex blends such as multi-ingredient nutraceuticals and cosmetics. This instability poses technical difficulties for manufacturers aiming to maintain potency and consistency across batches, limiting its integration into a wider range of consumer products.

To overcome this issue, companies are investing in advanced formulation technologies such as microencapsulation, lipid-based carriers, and controlled-release systems. These innovations help protect the active compound from degradation while improving its delivery and absorption in the body.

Continued R&D in formulation science is essential to enhancing product stability, ensuring long-term efficacy, and supporting the development of novel alpha-lipoic acid applications across therapeutic and consumer health sectors.

Market Trend

Product Innovation and Cosmetic Integration

The growing use of high-purity R-isomer formulations and broader integration into cosmetics are leading trends in the global alpha-lipoic acid market. The biologically active R-isomer form is increasingly getting adopted in pharmaceutical and nutraceuticals formulations aimed at managing metabolic and neurodegenerative conditions.

Industry players are investing in advanced purification technologies to ensure the consistent quality and bioavailability of these formulations. Moreover, alpha-lipoic acid is being utilized in premium skincare and cosmetic formulations due to its ability to improve skin tone enhance elasticity, and combat inflammation.

Alpha-lipoic Acid Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

R-Alpha-Lipoic Acid, S-Alpha-Lipoic Acid

|

|

By Form

|

Powder, Liquid

|

|

By Application

|

Pharmaceuticals, Dietary Supplements, Cosmetics, Food & Beverage Additives

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (R-Alpha-Lipoic Acid, S-Alpha-Lipoic Acid): The R-Alpha-Lipoic Acid segment earned USD 569.5 million in 2023 due to its higher bioavailability and superior antioxidant properties compared to the S-isomer.

- By Form (Powder, Liquid): The powder segment held 69.88% of the market in 2023, due to its ease of formulation, longer shelf life, and widespread use in dietary and pharmaceutical products.

- By Application (Pharmaceuticals, Dietary Supplements, Cosmetics, and Food & Beverage Additives): The pharmaceutical segment is projected to reach USD 700.0 million by 2031, owing to increasing adoption in treatments for diabetic neuropathy, liver disorders, and metabolic syndromes.

Alpha-lipoic Acid Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America accounted for 34.09% share of the alpha-lipoic acid market in 2023, with a valuation of USD 334.2 million. This dominance is primarily attributed to the region’s advanced healthcare infrastructure, high consumer awareness about antioxidant supplements, and the growing demand for functional foods and nutraceuticals.

The U.S. leads regional growth due to increasing incidences of diabetes and metabolic disorders, which have driven the adoption of alpha-lipoic acid for its insulin-sensitizing and antioxidant properties. Additionally, rising interest in clean-label ingredients in supplements and cosmetics is further driving the demand for alpha-lipoic acid in this region.

The alpha-lipoic acid industry in Asia Pacific is expected to register the fastest growth in the market, with a projected CAGR of 8.35% over the forecast period. This growth is driven by expanding pharmaceutical and supplement manufacturing sectors in China and India, supported by increasing consumer spending on health and wellness products.

Rapid urbanization and the rising popularity of anti-aging and skin health supplements in countries like Japan and South Korea are also driving the adoption of alpha-lipoic acid in Asia Pacific.

Additionally, cost-effective production capabilities and a growing number of local manufacturers are improving regional supply and driving exports. Countries like China and India are playing a major role in expanding access to alpha-lipoic acid across the pharmaceutical, nutraceutical, and cosmetic sectors.

Regulatory Frameworks

- In the United States, alpha-lipoic acid is regulated as a dietary supplement under the Dietary Supplement Health and Education Act (DSHEA), overseen by the Food and Drug Administration (FDA), which monitors labeling and manufacturing practices but does not require pre-market approval.

- In the European Union, alpha-lipoic acid is governed by the Food Supplements Directive and must comply with European Food Safety Authority (EFSA) safety assessments on nutrition and health claims made on foods.

- In China, alpha-lipoic acid is regulated by the National Medical Products Administration (NMPA) and is classified either as a health food or drug depending on its intended use, with strict approval requirements for claims and formulations.

- In Japan, alpha-lipoic acid is regulated under the Food for Specified Health Uses (FOSHU) or Food with Functional Claims (FFC) categories by the Consumer Affairs Agency, depending on the health benefit claims made, with requirements for scientific substantiation.

- In India, alpha-lipoic acid is regulated by the Food Safety and Standards Authority of India (FSSAI) under the Food Safety and Standards (Health Supplements, Nutraceuticals, Food for Special Dietary Use, and Food for Special Medical Purposes, Functional Food and Novel Food) Regulations.

Competitive Landscape

The alpha-lipoic acid market is characterized by the presence of several established players competing on the basis of product quality, purity levels, pricing, and application innovation. Key manufacturers are focusing on the development of high-purity R-isomer formulations to meet the growing demand in pharmaceutical and nutraceutical sectors.

Strategic partnerships, capacity expansions, and investment in advanced production technologies are commonly adopted to strengthen market position. Additionally, players are diversifying their portfolios by introducing cosmetic-grade alpha-lipoic acid for skincare applications.

List of Key Companies in Alpha-lipoic Acid Market:

- Avanscure

- Jiangsu Tohope Pharmaceutical Co., Ltd.

- Suzhou Fushilai Pharmaceutical Company Limited

- NNB Nutrition

- Rochem International Inc.

- Pharm-Rx Chemical Corp

- Amilifescience

- TAGOOR LABORATORIES PVT. LTD.

- Xi'an Green Spring Technology Co.,Ltd

- Supreem Pharmaceuticals Mysore Pvt. Ltd.

- MANUS AKTTEVA BIOPHARMA LLP

- GeroNova Research, Inc.

- Alzchem Group AG

- Bio Actives Japan Corporation

- Prinova Group LLC.

known for its superior absorption and efficacy,