Market Definition

An all-flash array (AFA) is an enterprise data storage system that exclusively uses flash-based solid-state drives (SSDs) to deliver high-speed performance, low latency, and improved reliability.

It replaces traditional hard disk-based storage to support modern IT demands. AFAs are commonly used in databases, virtualization, analytics, and cloud infrastructure to improve application performance, operational efficiency, and cost-effectiveness.

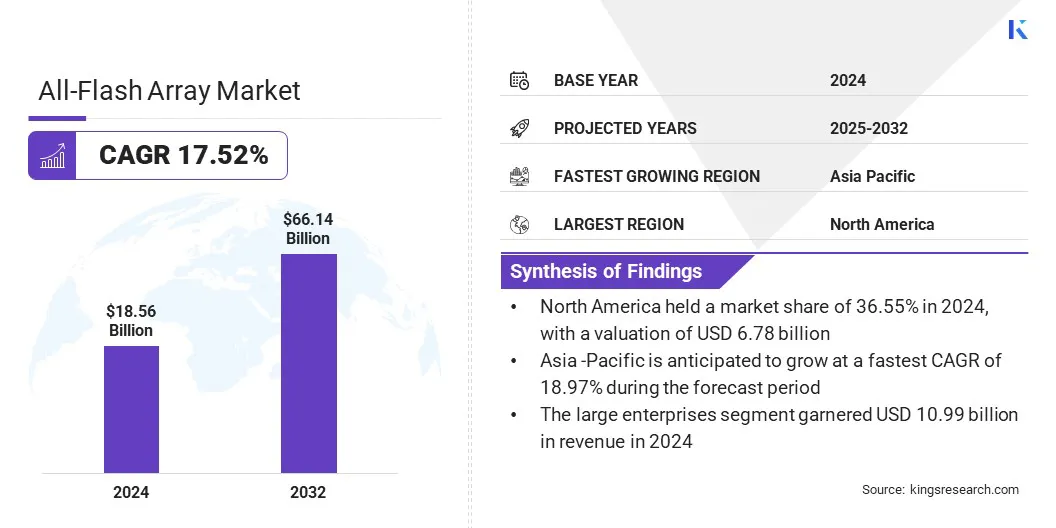

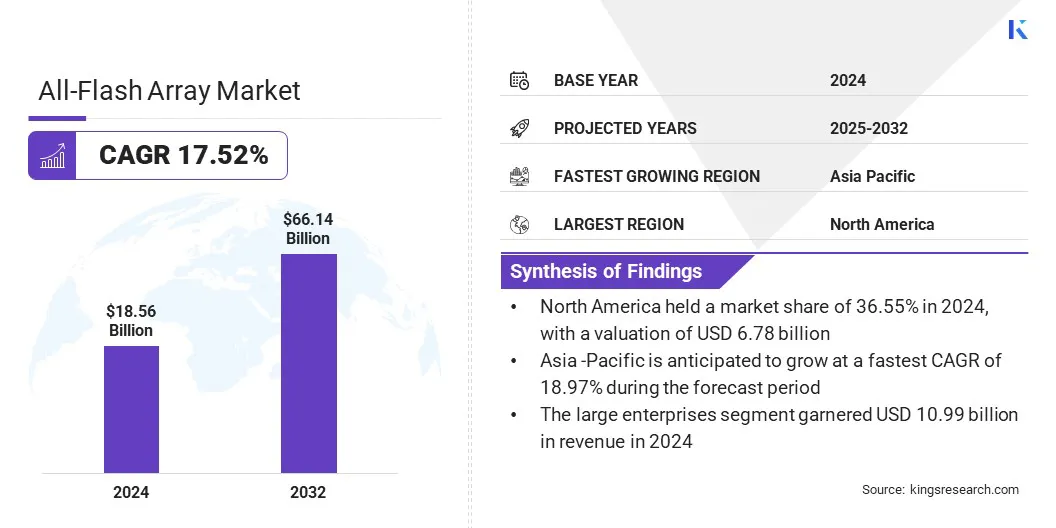

The global all-flash array market size was valued at USD 18.56 billion in 2024 and is projected to grow from USD 21.37 billion in 2025 to USD 66.14 billion by 2032, exhibiting a CAGR of 17.52% during the forecast period. The rising demand for high-performance storage is leading to increased adoption of all-flash arrays across enterprises that run data-intensive workloads such as AI, analytics, and virtualization.

This expansion is further propelled by the integration of AI and machine learning in storage management that improves performance, enables predictive maintenance, and supports efficient data handling in all-flash array systems.

Key Market Highlights:

- The all-flash array industry size was recorded at USD 18.56 billion in 2024.

- The market is projected to grow at a CAGR of 17.52% from 2025 to 2032.

- North America held a share of 36.55% in 2024, valued at USD 6.78 billion.

- The hardware segment garnered USD 10.54 billion in revenue in 2024.

- The traditional AFA segment is expected to reach USD 34.28 billion by 2032.

- The large enterprises segment held a share of 59.22% in 2024 .

- The healthcare segment is expected to grow at a CAGR of 18.61% over the forecast period

- Asia Pacific is anticipated to grow at a CAGR of 18.97% through the projection period.

Major companies operating in the all-flash array market are NetApp, Pure Storage, Inc, Dell Inc., IBM Corporation, Hewlett Packard Enterprise Development LP, Sandisk Corporation, Hitachi, Ltd, iXsystems, Inc. dba TrueNAS, VAST, Micron Technology, Inc, Seagate Technology LLC, Fujitsu, Super Micro Computer, Inc, StarWind Software Inc., and DD.

All-Flash Array Market Report Scope

|

Segmentation

|

Details

|

|

By Component

|

Hardware, Software

|

|

By Storage Architecture

|

Traditional AFA, Scale-Out AFA

|

|

By Enterprise Size

|

Large Enterprises, Small and Medium-sized Enterprises

|

|

By End-Use Industry

|

IT & Telecom, BFSI, Healthcare, Government & Public Sector, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

All-Flash Array Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America accounted for a share of 36.55% in 2024, valued at USD 6.78 billion. This dominance is attributed to stringent regulatory compliance and data protection requirements. Enterprises in the region are investing in advanced storage infrastructure that supports secure and rapid data recovery to meet evolving cybersecurity regulations.

The integration of backup software, IT services, and flash storage systems that ensures continuous operations and data resilience in threat-prone environments is fueling regional market expansion.

Moreover, organizations in the region are implementing zero-trust security frameworks and automated recovery processes to enhance data integrity and maintain compliance with stringent cybersecurity standards.

Key regional players are adopting all-flash systems that support forensic validation and workload restoration in regulated environments. These developments are addressing the growing demand for secure, compliant, and efficient storage infrastructure, thereby contributing to regional market expansion.

- In June 2025, Commvault, Kyndryl, and Pure Storage partnered to deliver cyber-resilient data recovery and compliance solutions. The joint offering integrates all-flash storage, backup software, and managed IT services to help enterprises meet regulations such as DORA and NIS2. It supports rapid recovery, zero-trust architecture, and automated testing to address rising cyber threats and data protection needs.

The Asia-Pacific all-flash array market is set to grow at a robust CAGR of 18.97% over the forecast period. This growth is attributed to the rising demand for low-latency, high-throughput storage infrastructure that supports AI, edge computing, and virtualized workloads.

Enterprises in the region are accelerating digital transformation and increasing investment in data infrastructure to support workload-intensive operations, fueling domestic market progress.

Additionally, regional players are introducing next-generation all-flash array systems that offer enhanced performance, availability of critical data, and scalability for enterprise workloads. The regional market further benefits from increased enterprise adoption of NVMe-oF-based architectures that meet evolving business needs.

- In August 2024, QSAN Technology Inc., a Taiwan-based enterprise storage provider, launched the XF5200 all-flash array to address rising demand for performance-intensive workloads in the Asia-Pacific region. Featuring sub-100 µs latency, NVMe-oF support, and 99.9999% availability, the solution supports AI, virtualization, and edge computing use cases, underscoring Asia-Pacific’s growing capacity to both develop and deploy next-generation all-flash storage technologies.

All-Flash Array Market Overview

Advancements in high-performance all-flash array technology are enabling faster data processing, lower latency, and greater input-output efficiency. These improvements are supporting the needs of modern applications such as real-time analytics, AI, and virtualization.

Enterprises are increasingly seeking faster access to large datasets through high-throughput and low-latency storage systems, which is accelerating the adoption of all-flash arrays across IT environments.

- In September 2024, Huawei unveiled the seventh-generation OceanStor Dorado all-flash array portfolio to support AI and business applications. The high-end Dorado 18000 delivers over 100 million IOPS and 0.03 ms latency, with enhanced fault tolerance, ransomware protection, and continuous data recovery. The portfolio targets a wide range of business needs, including basic storage requirements and high-performance enterprise workloads.

Market Driver

Rising Demand for High-Performance Storage

The expansion of the market is spurred by the rising demand for high-performance storage to support data-intensive applications such as AI, machine learning, real-time analytics, and virtualization.

Enterprises are increasingly adopting storage solutions that deliver low latency, high IOPS, and fast data access to meet the performance needs of modern workloads.

This demand is prompting organizations to replace traditional HDD-based systems with all-flash arrays that can handle large-scale processing while ensuring speed, reliability, and operational efficiency across dynamic IT environments.

- In May 2025, Pure Storage and Nutanix launched a hyperconverged infrastructure solution that integrates Pure’s all-flash FlashArray with Nutanix’s AHV platform. The solution supports large-scale enterprise workloads and includes VM-level snapshots, data reduction, and NVMe/TCP support to meet the demand for scalable, high-performance storage in virtualized environments.

Market Challenge

High Initial Capital Investment

A key challenge limiting the progress of the all-flash array market is the high initial capital investment required for deployment, which can be a barrier for small and mid-sized enterprises.

All-flash systems typically involve higher upfront costs compared to traditional HDD or hybrid storage solutions due to the premium price of flash technology and advanced hardware components. This cost sensitivity can prompt organizations to delay adoption or opt for lower-performance alternatives.

To overcome this challenge, market players are introducing flexible pricing models such as storage-as-a-service (STaaS), pay-as-you-grow options, and subscription-based licensing. These models reduce upfront costs and allow businesses to scale storage based on actual usage.

Additionally, vendors are launching entry-level all-flash systems with optimized performance-to-cost ratios and bundling software features to enhance value. They are also offering financing plans to make adoption more accessible for small and mid-sized enterprises seeking high-performance storage.

Market Trend

Integration of AI and Machine Learning in Storage Management

A key trend influencing the market is the integration of AI and machine learning into storage management systems to enhance operational intelligence and resilience. Storage vendors are embedding AI-driven tools to automate data placement, monitor system health, and detect anomalies such as ransomware threats in real time.

This trend is enabling the development of smarter, self-optimizing storage platforms that reduce manual intervention and downtime. These innovations are helping enterprises improve performance, predict failures, and ensure data protection across dynamic IT environments.

- In April 2024, IBM launched the FlashSystem 5300, a compact all-flash storage platform offering improved throughput, AI-powered ransomware detection, and up to 1.81PB effective capacity in a 1U footprint. Positioned for small and mid-sized enterprises, it expands IBM’s entry-level AFA offerings with enhanced performance, data protection, and hybrid cloud support.

Market Segmentation

- By Component (Hardware and Software): The hardware segment earned USD 10.54 billion in 2024, mainly due to the increasing deployment of high-performance flash storage systems across enterprise data centers.

- By Storage Architecture (Traditional AFA and Scale-Out AFA): The traditional AFA segment held a share of 58.76% in 2024, fueled by its widespread adoption in legacy IT environments requiring stable, centralized storage.

- By Enterprise Size (Large Enterprises and Small and Medium-sized Enterprises): The large enterprises segment is projected to reach USD 44.84 billion by 2032, owing to rising demand for scalable and secure storage infrastructure to support complex workloads.

- By End-user Industry (IT & Telecom, BFSI, Healthcare, Government & Public Sector, and Others): The healthcare segment is anticipated to grow at a CAGR of 18.61% over the forecast period, propelled by the need for fast, reliable access to large volumes of patient and imaging data.

Regulatory Frameworks

- In the U.S., the Federal Trade Commission (FTC) oversees data privacy and cybersecurity standards that affect the deployment of all-flash arrays across enterprise environments. It ensures that companies handling sensitive consumer and enterprise data implement secure storage practices, prevent unauthorized access, and comply with data protection laws such as the FTC Act and associated federal regulations.

- In China, the Ministry of Industry and Information Technology (MIIT) regulates data infrastructure and storage security landscape, including technologies such as all-flash arrays. It ensures compliance with the Cybersecurity Law and oversees the development, localization, and certification of IT hardware in critical sectors.

- In India, the Ministry of Electronics and Information Technology (MeitY) governs digital infrastructure, including data storage systems such as all-flash arrays. MeitY oversees policies related to cybersecurity, cloud services, and data localization under frameworks like the Information Technology Act. It ensures that enterprises deploying flash-based storage adhere to standards for secure data handling, particularly for sectors such as finance, telecom, and government.

Competitive Landscape

Market players in the all-flash array market are enhancing their competitiveness by expanding their portfolios with advanced, high-performance storage solutions. They are focusing on integrating all-flash and hybrid storage architectures that support low-latency operations and intelligent data caching.

Players are adopting strategic acquisitions to incorporate proven technologies and innovative features that strengthen their presence in the enterprise segment. Additionally, they are optimizing system architectures to enable faster data access, enhance workload performance, and meet the evolving needs of high-demand enterprise environments.

- In January 2025, Lenovo acquired Infinidat, a provider of data center storage systems, including all-flash and hybrid arrays. Infinidat’s portfolio includes the InfiniBox SSA line, which features sub-millisecond latency and AI-powered data caching. The acquisition is expected to expand Lenovo’s presence in the high-end enterprise storage segment.

Key Companies in All-Flash Array Market:

- NetApp

- Pure Storage, Inc

- Dell Inc.

- IBM Corporation

- Hewlett Packard Enterprise Development LP

- Sandisk Corporation

- Hitachi, Ltd

- iXsystems, Inc. dba TrueNAS

- VAST

- Micron Technology, Inc

- Seagate Technology LLC

- Fujitsu

- Super Micro Computer, Inc

- StarWind Software Inc.

- DDN

Recent Developments (New Product Launch)

- In June 2025, Pure Storage expanded its all-flash array portfolio by launching next-generation products, including FlashArray//XL R5 and FlashArray//ST, designed to support high-performance and latency-sensitive workloads. The expansion aims to address modern application needs across hybrid and on-premises environments with efficient, unified, and intelligent storage infrastructure.