Aircraft Pumps Market Size

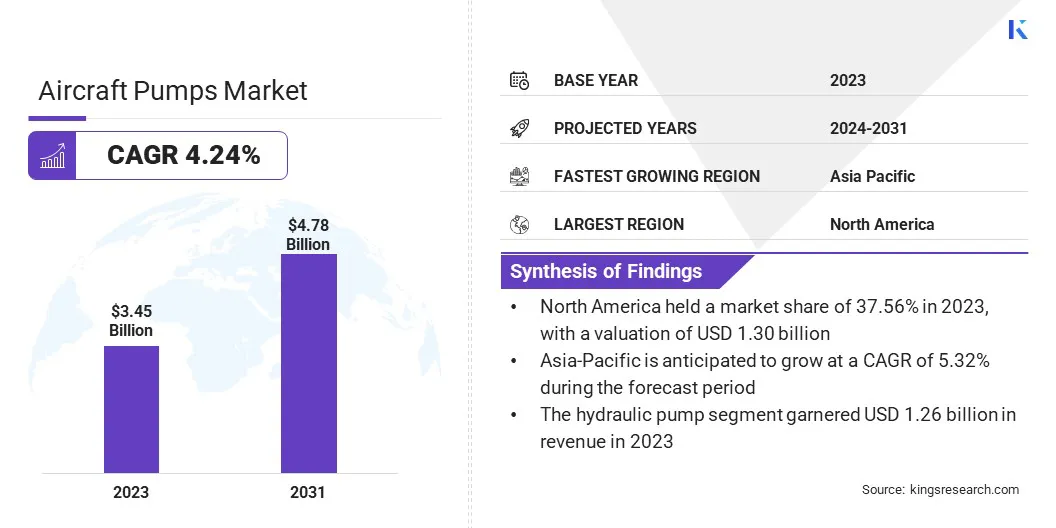

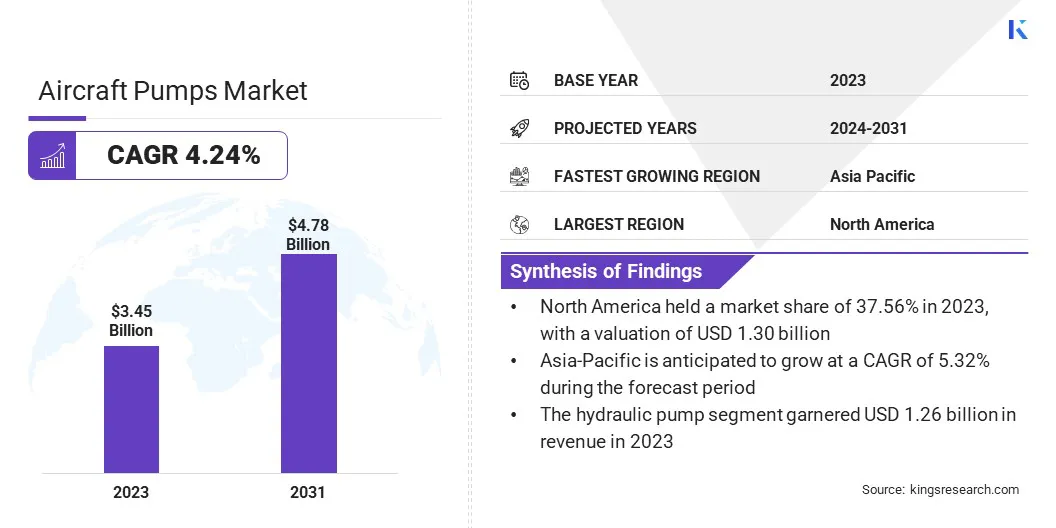

The global Aircraft Pumps Market size was valued at USD 3.45 billion in 2023 and is projected to grow from USD 3.58 billion in 2024 to USD 4.78 billion by 2031, exhibiting a CAGR of 4.24% during the forecast period. The growth of the market is driven by increasing air travel demand, advancements in aerospace technology, and the pressing need for fuel-efficient and reliable aircraft systems.

In the scope of work, the report includes solutions offered by companies such as Collins Aerospace, Crane Aerospace & Electronics, Diehl Stiftung & Co. KG, Eaton, Honeywell International Inc., Safran, Triumph Group, AMETEK. Inc., ITT INC, PARKER HANNIFIN CORP, and others.

The expansion of the aircraft pumps market is driven by increasing air travel demand and advancements in aerospace technology. Growing global tourism and rising disposable incomes boost passenger numbers, leading to higher aircraft production.

Additionally, the expansion of the military aviation sector, fostered by geopolitical tensions and defense modernization programs, contributes significantly to this growth. Technological advancements, such as the development of more efficient and reliable pumps, enhance aircraft performance and fuel efficiency, prompting airlines to upgrade their fleets.

Environmental regulations manadating reduced emissions are propelling the adoption of innovative pump solutions. Furthermore, the increasing focus on aircraft maintenance and the rising number of aging fleets necessitate the replacement and retrofitting of pumps, thereby fueling market growth.

- According to the International Air Transport Association (IATA), in February 2024, international passenger markets globally experienced robust growth compared to February 2023, with all regions showing significant year-on-year increases. This surge marked the first instance where demand surpassed pre-pandemic levels, although it was influenced by the leap-year effect in February 2024. Key highlights included Asia-Pacific airlines achieving a substantial 53.2% rise in demand, accompanied by increased capacity and higher load factors. Moreover, European carriers saw a notable 15.9% increase in demand with capacity closely aligned. Furthermore, Middle Eastern, North American, Latin American, and African airlines reported strong demand growth, reflecting varied impacts on load factors compared to the previous year.

The market is experiencing steady growth, fueled by the continuous demand for commercial, military, and general aviation aircraft. The market encompasses various types of pumps, including fuel pumps, hydraulic pumps, and lubrication pumps, which are essential for the efficient operation of aircraft systems.

There is a significant investment in research and development to introduce advanced, high-performance pump solutions that meet stringent safety and efficiency standards. The market is characterized by intense competition, with major companies striving to expand their market share through strategic partnerships, mergers, and acquisitions.

- Boeing Commercial Airplanes Current Market Outlook forecasts a 69.23% increase in air traffic by 2042.

The aircraft pumps market refers to the industry segment involved in the manufacturing, distribution, and maintenance of pumps used in various aircraft systems. These pumps are integral components in fuel, hydraulic, lubrication, and coolant systems, ensuring optimal performance and safety. The market includes products designed for commercial jets, military aircraft, helicopters, and general aviation planes.

Aircraft pumps must meet rigorous standards for reliability, efficiency, and durability, given the critical nature of their functions. The market players include both well-established aerospace companies and specialized manufacturers focusing on niche applications. Continuous iInnovations in materials, design, and technology are shaping the market to address the evolving needs of the aviation industry and regulatory requirements.

Analyst’s Review

Manufacturers in the aircraft pumps market are striving to innovate and introduce new products, with a major focus on efficiency and reliability. Companies are investing heavily in research and development to create advanced pump technologies that meet evolving regulatory and operational requirements. The introduction of electric and hybrid pump systems is a notable trend, aimed at reducing emissions and improving fuel efficiency.

- In 2023, Honeywell International Inc. allocated about 4% of its budget, amounting to USD 1,456 million, to research and development. This investment underscores the company's commitment to innovation and the development of advanced technologies.

Manufacturers are advised to continue to prioritize innovation while ensuring cost-effective production to remain competitive. Emphasizing predictive maintenance solutions offer a competitive edge, improving the longevity and performance of aircraft pumps in a rapidly evolving aviation landscape.

Aircraft Pumps Market Growth Factors

The aircraft pumps market is experiencing an increasing demand for fuel-efficient aircraft. Airlines are continuously seeking ways to reduce operational costs and comply with stringent environmental regulations. Aircraft pumps play a crucial role in optimizing fuel consumption and improving overall aircraft efficiency. Innovations in pump technology, such as advanced fuel injection systems and lightweight materials, are enhancing performance and contributing to lower fuel usage.

As airlines invest in newer, more efficient fleets to maintain a competitive edge, the demand for advanced aircraft pumps is rising. This trend is fostering market growth, prompting manufacturers to focus on developing cutting-edge solutions that meet the evolving needs of the aviation industry.

The aircraft pumps market faces challenges due to the high cost associated with advanced pump technologies. These costs are often prohibitive for smaller airlines and operators, which may hinder the adoption of new systems. To overcome this challenge, manufacturers are focusing on cost-effective production methods and economies of scale.

By investing in automated manufacturing processes and exploring innovative materials that reduce costs without compromising quality, companies are effectively lowering prices. Additionally, offering flexible financing options and maintenance packages helps make these technologies more accessible. Collaborations between manufacturers and airlines to develop customized solutions tailored to specific needs further help mitigate cost concerns, thereby ensuring broader market penetration and sustained growth.

Aircraft Pumps Market Trends

The increasing integration of electric pumps in aircraft systems is a prominent trend shaping the market landscape. As the aviation industry transition to more electric aircraft and hybrid-electric aircraft, electric pumps are becoming essential for their efficiency and reliability. These pumps reduce the dependency on traditional hydraulic systems, leading to lighter and more fuel-efficient aircraft. They further offer better control and precision, thereby enhancing overall aircraft performance.

The growing shift toward electric pumps is bolstered by the rising need for more sustainable and environmentally friendly aviation solutions. Manufacturers are investing heavily in developing advanced electric pump technologies, which are gaining significant traction among aircraft designers and operators aiming to meet potential regulatory and operational demands.

The growing adoption of predictive maintenance technologies is a key factor supporting the growth of the market. Airlines and maintenance organizations are increasingly using data analytics and IoT-enabled sensors to monitor the performance of aircraft pumps in real-time. This approach aids in predicting potential failures and scheduling maintenance proactively, thereby reducing downtime and decreasing operational costs.

Predictive maintenance enhances the reliability and lifespan of aircraft pumps, ensuring safety and efficiency. The integration of these advanced technologies is transforming maintenance strategies, shifting from reactive to proactive measures. The demand for smart, connected pumps equipped with diagnostic capabilities is rising, thereby stimulating growth and fostering innovation in the market.

Segmentation Analysis

The global market is segmented based on type, pressure, aircraft type, end-user. and geography.

By Type

Based on type, the market is categorized into fuel pump, hydraulic pump, water & waste system pumps, lubrication pumps, and others. The hydraulic pump segment led the aircraft pumps market in 2023, reaching a valuation of USD 1.26 billion. This expansion is supported by its critical role in aircraft systems. Hydraulic pumps are essential for operating flight control surfaces, landing gear, brakes, and other crucial components.

The demand for more efficient and reliable hydraulic systems is increasing as aircraft manufacturers focus on enhancing performance and safety. The growing production of commercial and military aircraft, coupled with the need for modernizing existing fleets, is boosting the expansion of the segment. Additionally, advancements in hydraulic pump technology, such as lightweight materials and improved efficiency, contribute to their widespread adoption.

By Pressure

Based on pressure, the market is classified into 10 psi to 500 psi, 500 psi to 3000 psi, 3000 psi to 5000 psi, and 5000 psi to 6500 psi. The 10 psi to 500 psi segment is poised to witness significant growth at a CAGR of 6.50% through the forecast period (2024-2031). This notable growth is propelled by its broad applicability across various aircraft systems. This pressure range is crucial for auxiliary functions such as cooling, fuel transfer, and lubrication, which are essential for efficient aircraft operations.

The increasing demand for regional and business jets, which often utilize pumps within this pressure range, is further supporting segmental growth. Additionally, advancements in pump technology are enhancing performance and reliability, making these systems more attractive to aircraft manufacturers.

By End-User

Based on aircraft type, the market is segmented into fixed wing, rotary wing, and unmanned aerial vehicles. The fixed wing segment secured the largest aircraft pumps market share of 53.44% in 2023. Fixed wing aircraft are extensively used for passenger and cargo transport, as well as defense applications, necessitating the implementation of robust and reliable pump systems.

The continuous expansion of air travel, attributed to rising global tourism and economic development, boosts the production of fixed wing aircraft. Technological advancements in aircraft design and the integration of more efficient pump systems further contribute to the growth of the segment. Moreover, ongoing fleet expansions and upgrades by airlines and defense sectors further propel the expansion of the fixed wing segment.

Aircraft Pumps Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The North America aircraft pumps market accounted for a significant share of around 37.56% in 2023, with a valuation of USD 1.30 billion. This dominance is reinforced by the region's advanced infrastructure and significant investments in automation technologies. Major ports in the United States and Canada are continually upgrading to enhance efficiency and reduce operational costs.

Moroever, the presence of leading technology providers and strong government support for modernizing port facilities contribute to regional market growth. Furthermore, the region's robust trade activities and strategic location as a global trade hub necessitate efficient container terminal operations, thereby strengthening North America's leading position in the automated container terminal market.

Asia-Pacific is poised to experience considerable growth at a CAGR of 5.32% over the forecast period. This rapid growth is fueled by the region's expanding trade activities and significant investments in port infrastructure. Countries such as China, India, and Japan are focusing on modernizing their port facilities to handle increasing cargo volumes efficiently.

The rising adoption of automation technologies to enhance operational efficiency and reduce turnaround times is bolstering regional market expansion. Additionally, government initiatives to develop smart ports and the growing presence of major shipping companies in the region are aiding Asia-Pacific automated container terminal market development.

Competitive Landscape

The aircraft pumps market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Expansion & investments are the major strategic initiatives adopted by companies in this sector. Industry players are investing extensively in R&D activities, building new manufacturing facilities, and supply chain optimization.

List of Key Companies in Aircraft Pumps Market

- Collins Aerospace

- Crane Aerospace & Electronics

- Diehl Stiftung & Co. KG

- Eaton

- Honeywell International Inc.

- Safran

- Triumph Group

- Inc.

- ITT INC

- PARKER HANNIFIN CORP

Key Industry Development

- May 2023 (Partnership): Parker Aerospace, a division of Parker Hannifin Corporation, finalized a five-year contract with the U.S. Army to overhaul and upgrade UH-60 Blackhawk hydraulic pumps and flight control actuators. The agreement, which encompasses indefinite delivery indefinite quantity (IDIQ) terms and firm-fixed-price (FFP), also includes provision for supply chain management, engineering, and field service support at Corpus Christi Army Depot (CCAD) in Texas. This collaboration aimed to enhance repair processes, thereby ensuring aircraft availability, reliability, and maintainability while meeting performance metrics.

The global aircraft pumps market is segmented as:

By Type

- Fuel Pump

- Hydraulic Pump

- Water & Waste System Pumps

- Lubrication Pumps

- Others

By Pressure

- 10 psi to 500 psi

- 500 psi to 3000 psi

- 3000 psi to 5000 psi

- 5000 psi to 6500 psi

By Aircraft Type

- Fixed Wing

- Rotary Wing

- Unmanned Aerial Vehicles

By End-User

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America