Market Definition

Aircraft fuel cells generate electrical power through electrochemical reactions, offering a clean and efficient alternative to conventional combustion engines. By converting hydrogen or hydrocarbon fuels into electricity, they support propulsion and on-board power requirements. These systems are deployed across military, commercial, general aviation, unmanned aerial vehicles, and advanced air mobility platforms.

Aircraft fuel cells enable applications in propulsion systems, auxiliary power units, and electrical or environmental control systems, improving operational efficiency and reducing emissions in aviation operations.

Aircraft Fuel Cells Market Overview

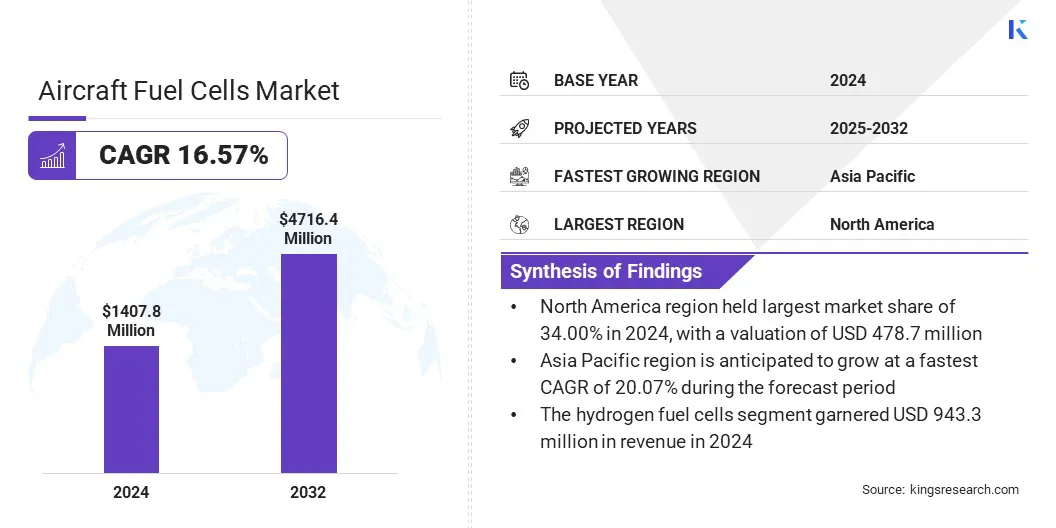

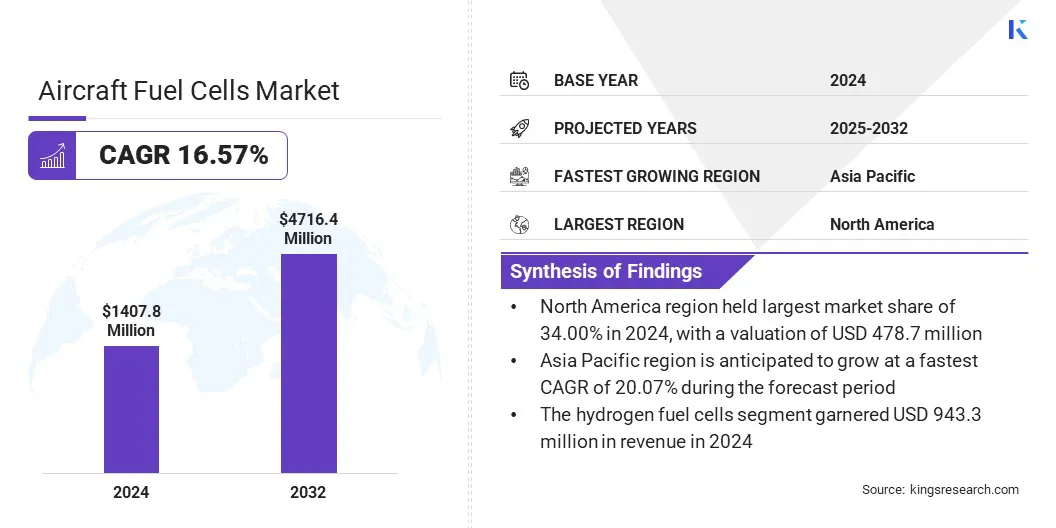

The global aircraft fuel cells market size was valued at USD 1,407.8 million in 2024 and is projected to grow from USD 1,612.2 million in 2025 to USD 4,716.4 million by 2032, exhibiting a CAGR of 16.57% during the forecast period. This growth is attributed to the growing demand for hydrogen fuel cell technology, which offers cleaner and more efficient propulsion systems for aviation.

Additionally, there is a clear shift toward fuel cell–enabled electric aviation, with companies integrating fuel cell systems into hybrid and fully electric aircraft. This combination of advanced hydrogen technology and electric propulsion is enabling the adoption of aircraft fuel cells across regional flights, urban air mobility, and unmanned aerial vehicles.

Key Highlights

- The aircraft fuel cells industry size was recorded at USD 1,407.8 million in 2024.

- The market is projected to grow at a CAGR of 16.57% from 2025 to 2032.

- North America held a share of 34.00% in 2024, valued at USD 478.7 million.

- The hydrogen fuel cells segment garnered USD 943.3 million in revenue in 2024.

- The 100 kW to 500 kW segment is set to reach USD 2,044.5 million by 2032.

- The advanced air mobility (AAM) segment is projected to attain a valuation of USD 1,220.9 million by 2032.

- The propulsion systems segment is expected to reach USD 2,505.0 million by 2032.

- Asia Pacific is anticipated to grow at a CAGR of 20.07% over the forecast period.

Major companies operating in the aircraft fuel cells market are ZeroAvia, Inc., Intelligent Energy Limited, Ballard Power Systems, Advent Technologies, Plug Power Inc., FFC, Inc., United Fuel Cells Corporation, H2FLY GmbH, MTU Aero Engines AG, Honeywell International Inc., and Safran.

Market growth is propelled by major reductions in weight, volume, and cost of aerospace-applicable fuel cell systems, which make integration into aircraft more feasible and efficient. Enhanced reliability of these advanced systems ensures consistent performance in propulsion and auxiliary power applications, increasing operator confidence.

Lighter and more compact fuel cells allow for optimized aircraft design and improved energy efficiency. These technological improvements are promoting broader adoption across commercial aviation, unmanned aerial vehicles, and urban air mobility platforms.

- In March 2025, ZeroAvia announced the successful demonstration of its SuperStack Flex highly-customizable LTPEM fuel cell system, achieving over 1.0 kW/kg specific net power in a 150 kW configuration for a major customer. The system leverages innovative additive manufacturing techniques to reduce parts from over 200 to fewer than 100, achieving approximately 50% reductions in weight and volume while enhancing reliability and lowering costs.

Market Driver

Growing Demand for Hydrogen Fuel Cell Technology

The aircraft fuel cells market is witnessing strong growth, primarily due to the increasing adoption of hydrogen fuel cell technology. Airlines and aircraft manufacturers are focusing on hydrogen fuel cells as a clean and efficient alternative to conventional propulsion systems, which helps reduce greenhouse gas emissions and operational costs.

Hydrogen fuel cells offer high energy density and longer endurance, making them suitable for both regional and sub-regional flights. This rising interest in sustainable aviation solutions is leading to increased investments in research, development, and deployment of hydrogen-based fuel cell systems across the industry.

- In June 2025, Airbus and MTU Aero Engines signed a Memorandum of Understanding to advance hydrogen fuel cell propulsion for aviation. The partnership focuses on developing fully electric, hydrogen-powered aircraft through joint research, alignment of R&T roadmaps, and maturation of critical fuel cell technologies.

Market Challenge

Limited Hydrogen Refueling and Storage Infrastructure

A key challenge hindering the progress of the aircraft fuel cells market is the limited hydrogen refueling and storage infrastructure at airports. This restricts the operational use of fuel cell–powered aircraft and increases logistical complexities for airlines and operators. This limitation slows adoption, despite growing interest in sustainable aviation technologies.

To overcome this challenge, companies are investing in developing hydrogen production, storage, and refueling facilities, while collaborating with airport authorities and energy providers to expand infrastructure and support the large-scale integration of fuel cell systems.

Market Trend

Rising Shift Toward Fuel Cell–Enabled Electric Aviation

The aircraft fuel cells market is experiencing a significant trend toward fuel cell–enabled electric aviation. Leading companies are focusing on integrating hydrogen and hydrocarbon fuel cell systems with electric propulsion technologies to develop hybrid and fully electric aircraft. This transition supports the reduction of carbon emissions and enhances energy efficiency, helping the aviation sector meet environmental regulations.

Fuel cell–based electric propulsion is increasingly applied in regional aircraft, urban air mobility, and unmanned aerial vehicles, fostering technological innovation and creating significant opportunities for scalable and sustainable aviation solutions.

- In May 2025, researchers at MIT announced the development of a sodium-air fuel cell capable of delivering more than three times the energy per unit weight compared to conventional lithium-ion batteries. The technology uses liquid sodium metal as fuel and air as the oxidizer, with a solid ceramic electrolyte facilitating the electrochemical reaction.

Aircraft Fuel Cells Market Report Snapshot

|

Segmentation

|

Details

|

|

By Fuel Cell Type

|

Hydrogen Fuel Cells (Proton Exchange Membrane Fuel Cells (PEMFC), Solid Oxide Fuel Cells (SOFC), Others), Hydrocarbon Fuel Cells, Others

|

|

By Power Output

|

Less than 100 kW, 100 kW to 500 kW, Above 500 kW

|

|

By Platform Type

|

Military Aviation, Commercial Aviation, General Aviation, Unmanned Aerial Vehicles (UAVs), Advanced Air Mobility (AAM)

|

|

By Application

|

Propulsion Systems, Auxiliary Power Units (APUs), On-board Electrical & Environmental Control Systems

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Fuel Cell Type (Hydrogen Fuel Cells, Hydrocarbon Fuel Cells, and Others): The hydrogen fuel cells segment earned USD 943.3 million in 2024, due to the increasing demand for clean and efficient energy solutions in aviation.

- By Power Output (Less than 100 kW, 100 kW to 500 kW, and Above 500 kW): The less than 100 kW segment held a share of 46.00% in 2024, attributed to its suitability for small aircraft and UAV applications.

- By Platform Type (Military Aviation, Commercial Aviation, General Aviation, Advanced Air Mobility (AAM), and Unmanned Aerial Vehicles (UAVs)): The advanced air mobility (AAM) segment is projected to reach USD 1,220.9 million by 2032, owing to the rising adoption of urban air mobility solutions.

- By Application (Propulsion Systems, Auxiliary Power Units (APUs), and On-board Electrical & Environmental Control Systems): The propulsion systems segment is projected to reach USD 2,505.0 million by 2032, owing to the growing integration of fuel cells in aircraft propulsion technology.

Aircraft Fuel Cells Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America aircraft fuel cells market share stood at 34.00% in 2024, valued at USD 478.7 Million. This dominance is attributed to substantial investments in research and development, which have accelerated advancements in hydrogen and hybrid fuel cell technologies.

The regional market further benefits from the advanced aviation infrastructure and strong collaboration between manufacturers and technology providers, allowing efficient integration of fuel cell systems into propulsion and auxiliary power units. These factors strengthen North America’s position as the leading market for aircraft fuel cells.

The Asia-Pacific aircraft fuel cells industry is poised to grow at a significant CAGR of 20.07% over the forecast period. This growth is primarily fostered by strategic partnerships between industry players, which enable knowledge sharing, co-development of advanced fuel cell systems, and streamlined commercialization.

These collaborations support the rapid adoption of fuel cell technologies in commercial aviation, unmanned aerial vehicles, and urban air mobility solutions, positioning Asia Pacific as the fastest-growing market for aircraft fuel cells.

- In March 2025, Stralis secured a contract with a major Japanese aircraft industry partner to provide expertise in high-temperature proton exchange membrane (HTPEM) fuel cells and hydrogen-electric propulsion systems. This partnership aligns with Japan’s commitment to sustainable aviation and its broader hydrogen energy strategy, leveraging the country’s leadership in hydrogen innovation across transportation and industrial sectors.

Regulatory Frameworks

- In the U.S., the Federal Aviation Administration (FAA) regulates aircraft components, including electrical and propulsion systems, through certification standards addressing safety, performance, and advanced technologies such as fuel cells.

- In Europe, the European Union Aviation Safety Agency (EASA) sets certification requirements for aircraft power and auxiliary systems, ensuring compliance with safety standards across member states.

- In Japan, the Civil Aviation Bureau (CAB) under MLIT oversees aircraft components and power system certifications, aligning with international safety and performance standards.

Competitive Landscape

Key players operating in the aircraft fuel cells industry are investing in research and development to enhance fuel cell efficiency and durability for aviation applications. Companies are developing and scaling up hydrogen and hydrocarbon fuel cell systems to support sub-regional and regional flights.

Strategic collaborations with aircraft manufacturers and technology providers are being adopted to integrate fuel cells into propulsion and auxiliary power systems. Companies are also expanding production capabilities and optimizing supply chains to meet emerging demands while maintaining competitive pricing and reliable delivery.

- In July 2024, Intelligent Energy (IE) launched its IE-FLIGHT family of hydrogen fuel cell products, designed for sub-regional and regional aircraft. The IE-FLIGHT F300 Fuel Cell System employs a patented high-temperature operation architecture, enabling smaller heat exchangers, reduced weight and drag, and improved power density.

Key Companies in Aircraft Fuel Cells Market:

- ZeroAvia, Inc.

- Intelligent Energy Limited

- Ballard Power Systems

- Advent Technologies

- Plug Power Inc.

- FFC, Inc.

- United Fuel Cells Corporation

- H2FLY GmbH

- MTU Aero Engines AG

- Honeywell International Inc.

- Safran

Recent Developments (Agreements)

- In May 2025, ZeroAvia announced that RVL Aviation will operate the Cessna Grand Caravan aircraft retrofitted with ZeroAvia’s ZA600 hydrogen-electric powertrain, marking the likely world’s first zero-emission commercial cargo flights in the UK. The agreement covers UK domestic operations upon completion of engine certification, airframe integration, and crew training.