Market Definition

The air suspension market involves the production and sale of air suspension systems, which use air springs instead of traditional metal coils to support vehicle weight. These systems enhance ride comfort, handling, and load management in passenger cars, commercial vehicles, and luxury vehicles. Market growth is driven by demand for improved vehicle performance, safety, and comfort across various applications.

Air Suspension Market Overview

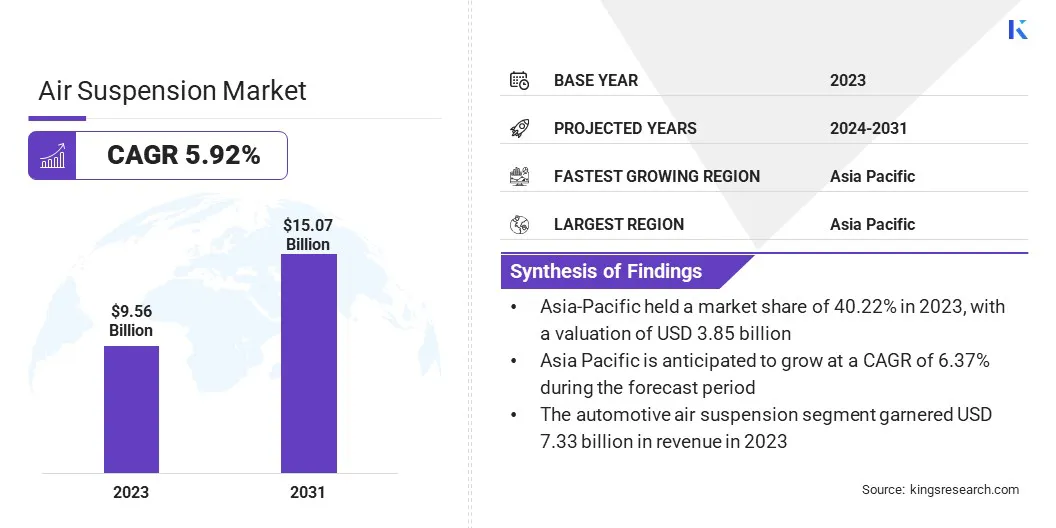

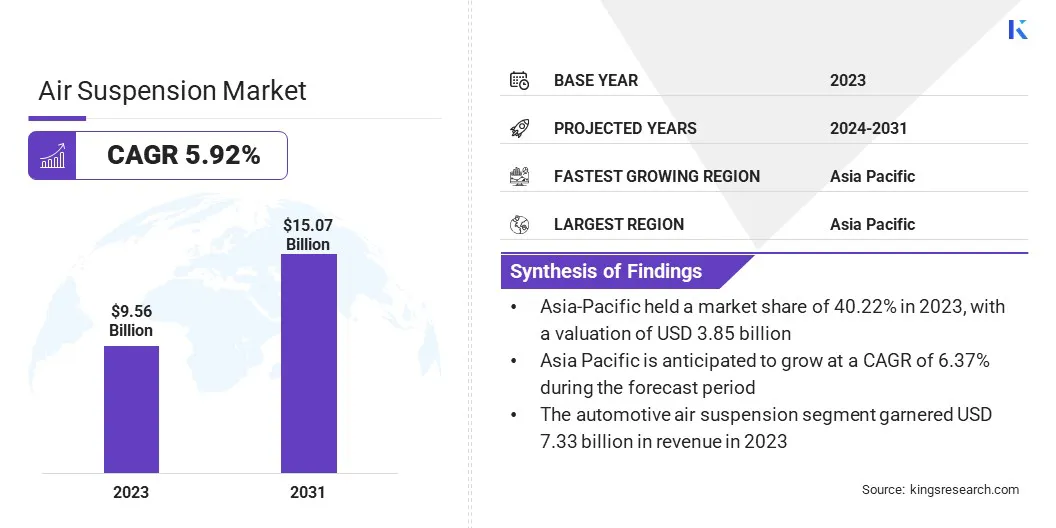

Global air suspension market size was valued at USD 9.56 billion in 2023, which is estimated to be valued at USD 10.07 billion in 2024 and reach USD 15.07 billion by 2031, growing at a CAGR of 5.92% from 2024 to 2031.

The growing demand for enhanced ride comfort, particularly in luxury and high-performance vehicles, is boosting market expansion. Consumers increasingly prefer smoother, adjustable rides, which air suspension systems provide, leading to higher adoption in these segments.

Major companies operating in the global air suspension industry are ZF Friedrichshafen AG, Cummins In, thyssenkrupp AG , SAF-HOLLAND SE, Continental Automotive Technologies GmbH , Pneuride Ltd, STEMCO Products Inc., Vibracoustic SE, Hendrickson USA, L.L.C, Firestone Industrial Products Company, LLC, AccuAir Suspension, Air Lift Performance, Wheels India Limited, Boss Air Suspension, Ridetech, and others.

The market is experiencing steady growth, fueled by advancements in automotive technology and increasing demand for superior ride comfort. The market is characterized by a diverse range of applications, including passenger vehicles, commercial vehicles, and luxury cars.

Air suspension systems are becoming integral to modern vehicle designs due to their ability to provide better stability, load management, and enhanced performance. Manufacturers are focusing on innovations to improve efficiency, durability, and customization, fueling market expansion.

- In June 2024, Nidec Corporation announced that Nidec Motor (Dalian) developed a new air suspension motor for automobiles. This compact, durable, and highly responsive motor efficiently powers the air compressor, optimizing vehicle height adjustments for improved comfort and driving dynamics across varying conditions.

Key Highlights:

- The global air suspension market size was recorded at USD 9.56 billion in 2023.

- The market is projected to grow at a CAGR of 5.92% from 2024 to 2031.

- Asia-Pacific held a share of 40.22% in 2023, valued at USD 3.85 billion.

- The automotive air suspension segment is anticipated to register a share of 72.87% in 2031.

- The air springs segment garnered USD 3.74 billion in revenue in 2023.

- The electronic air suspension (EAS) segment is expected to reach USD 6.08 billion by 2031.

- The aerospace segment is anticipated to witness the fastest CAGR of 9.30% over the forecast period

- Europe is anticipated to grow at a CAGR of 5.76% through the projection period.

Market Driver

"Expansion of Electric Vehicle Market"

The expansion of the electric vehicle (EV) market is contributing significantly to the growth of the air suspension market. As EVs gain popularity, air suspension systems provide critical benefits such as enhanced stability, smoother rides, and improved energy efficiency.

- According to the U.S. Energy Information Administration article published in August 2024, electric and hybrid vehicle sales in the United States saw a slight increase in the second quarter of 2024. This growth was primarily driven by a surge in hybrid electric vehicle (HEV) sales, which experienced a significant rise of 30.7% year-over-year.

This is particularly beneficial for electric buses and trucks, where load management and ride comfort are essential. The integration of air suspension in EVs supports better performance and passenger comfort, boosting the adoption of these systems in the growing electric vehicle sector.

- In April 2024, Firestone Airide announced a USD 26 million investment to open new distribution centers at its Williamsburg, Kentucky, and Dyersburg, Tennessee, facilities. This expansion addresses the growing demand for advanced air suspension technology in electric vehicles while supporting the Bridgestone E8 Commitment to operational efficiency and carbon footprint reduction.

Market Challenge

"Complexity in Maintenance"

A major challenge hampering the growth of the air suspension market is the high initial cost and complexity of maintenance, which can deter widespread adoption. These systems require specialized repairs and replacements, making them more expensive to maintain compared to traditional suspension systems.

To address this challenge, manufacturers are focusing on reducing production costs through advancements in materials and component design, improving system durability, and offering comprehensive warranty and maintenance packages. Additionally, increasing consumer education and awareness about the long-term benefits can drive adoption despite the higher upfront costs.

Market Trend

"Technological Innovations in Air Suspension Systems"

A key trend influencing the air suspension market is the ongoing technological innovation aimed at improving durability and efficiency. Advancements in air spring design, compressors, and electronic controls are enhancing the overall performance of air suspension systems.

These innovations result in better energy efficiency, longer service life, and improved system responsiveness, leading to more reliable and cost-effective solutions for both passenger and commercial vehicles. The continuous development of these technologies supports the increasing demand for high-performance, sustainable air suspension systems.

- In September 2024, Hendrickson Truck Commercial Vehicle Systems partnered with International Trucks to introduce a new variant of the PRIMAAX EX severe-duty vocational rear air suspension system. This new variant offers enhanced ride height, load capacity, and air disc brake compatibility for heavy-duty applications.

Air Suspension Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Automotive Air Suspension (Passenger Vehicles, Commercial Vehicles), Non-Automotive Air Suspension (Railway Systems, Industrial Machinery, Other Applications)

|

|

By Component

|

Air Springs (Rubber Air Springs, Fabric Reinforced Air Springs, Contoured Air Springs, Rolling Lobe Air Springs), Compressor (Electric Compressors, Belt-Driven Compressors, Air-Demand Compressors), Control Valves (Height Control Valves, Pressure Relief Valves, Air Distribution Valves), Air Reservoirs (Steel Air Reservoirs, Aluminum Air Reservoirs), Other components

|

|

By Technology

|

Electronic Air Suspension (EAS) (Fully Electronic Control Systems, Semi-Electronic Control Systems), Manual Air Suspension, Semi-Active Air Suspension, Active Air Suspension (Adaptive Air Springs, Sensor-Based Control Systems)

|

|

By End-User Industry

|

Automotive, Railways, Aerospace, Other sectors

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, U.K., Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Automotive Air Suspension and Non-Automotive Air Suspension): The non-automotive air suspension is expected to grow at a CAGR of 6.73% over the forecast period, mainly due to increasing demand for air suspension systems in railways, aerospace, and industrial applications.

- By Component (Air Springs, Compressor, Control Valves, Air Reservoirs, and Other Components): The air springs segment earned USD 3.74 billion in 2023, supported by their essential role in providing ride comfort and stability.

- By Technology [Electronic Air Suspension (EAS), Manual Air Suspension, Semi-Active Air Suspension, and Active Air Suspension]: The EAS segment held a notable share of 44.09% in 2023, fueled by its ability to offer dynamic, adjustable ride height and performance.

- By End-User Industry (Automotive, Railways, Aerospace, and Other sectors): The automotive segment is projected to reach USD 10.21 billion by 2031, propelled by the growing demand for enhanced comfort and vehicle performance.

Air Suspension Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific air suspension market captured a susbtantial share of around 40.22% in 2023, valued at USD 3.85 billion. This dominance is reinforced by rapid industrialization, growing automotive production, and increasing demand for commercial vehicles.

Countries such as China, India, and Japan are leading the adoption of advanced air suspension systems in both passenger and commercial vehicles. The regional market benefits from strong automotive manufacturing hubs, significant infrastructure development, and the growing popularity of electric vehicles (EVs).

Europe air suspension industry is likely to grow at a robust CAGR of 5.76% over the forecast period. This rapid growth is fueled by innovations in automotive technologies and a shift toward electric and hybrid vehicles.

Strong demand for high-performance air suspension systems, particularly in luxury, commercial, and electric vehicles, is supporting this growth. With stringent regulations for vehicle safety and emissions, Europe’s emphasis on sustainable transportation solutions has spurred advancements in air suspension technologies. Additionally, major automotive manufacturers are investing in next-generation air suspension systems, further boosting regional market expansion.

- In November 2024, MidOcean Partners acquired Arnott Industries, a leader in suspension technologies, including air suspension systems. With a strong presence in both North America and Europe, Arnott’s innovative aftermarket products aligns with the growing demand for air suspension solutions in the European market.

Regulatory Frameworks

- Technical harmonization in the EU follows the Whole Vehicle Type-Approval System (WVTA), allowing manufacturer to certify a vehicle type in one EU country and market it across the EU without additional testing. Certification is granted by a type-approval authority, with tests conducted by designated technical services.

- ISO 26262 applies to safety-related systems incorporating one or more electrical and/or electronic (E/E) components in series production passenger cars with a maximum gross vehicle mass of 3 500 kg.

Competitive Landscape

The global air suspension market is characterized by a large number of participants, including both established corporations and emerging players. Market particiapants have been focusing on launching advanced systems that offer improved performance, durability, and energy efficiency.

These innovations often include enhanced air spring designs, more responsive electronic controls, and better integration with electric and autonomous vehicles. Such launches aim to meet growing consumer demand for superior ride comfort, stability, and environmental sustainability in both commercial and passenger vehicles.

- In March 2024, Hendrickson introduced ROADMAAX Z, its lightest 46,000 lb. capacity rear air suspension system. Featuring innovative Zero Maintenance Damping (ZMD) technology, it enhances ride quality, reduces maintenance costs, and ensures optimal performance for both on- and off-highway applications.

List of Key Companies in Air Suspension Market:

- ZF Friedrichshafen AG

- Cummins In

- thyssenkrupp AG

- SAF-HOLLAND SE

- Continental Automotive Technologies GmbH

- Pneuride Ltd

- STEMCO Products Inc.

- Vibracoustic SE

- Hendrickson USA, L.L.C

- Firestone Industrial Products Company, LLC

- AccuAir Suspension

- Air Lift Performance

- Wheels India Limited

- Boss Air Suspension

- Ridetech

Recent Developments (Collaboration/Launch)

- In April 2024, Vibracoustic collaborated with XPENG to engineer and supply a two-chamber air spring system for the XPENG G9 all-electric SUV. This innovative solution provides two stiffness levels, optimizing comfort, driving dynamics, and battery protection, addressing the unique challenges of electric vehicle suspension systems.

- In May 2024, ZF showcased its advanced AxTrax 2 LF electric axle for low-floor city buses at Busworld Türkiye. This next-generation axle offers improved performance, energy savings, and compatibility with ZF's air suspension and braking systems, supporting the transition to decarbonized public transport.