Market Definition

The air conditioning market encompasses the manufacturing and sale of systems that regulate indoor temperature, humidity, and air quality across residential, commercial, and industrial settings.

These systems utilizes refrigeration cycles, evaporative cooling, or thermoelectric technology, incorporating refrigerants, compressors, condensers, and expansion valves for efficient heat transfer. The adoption of eco-friendly refrigerants, including hydrofluoroolefins (HFOs) and natural alternatives like CO₂, is rising due to environmental concerns.

Air conditioning solutions are essential in homes, office buildings, data centers, healthcare facilities, and industrial plants, ensuring thermal comfort, equipment protection, and optimal operational conditions.

Air Conditioning Market Overview

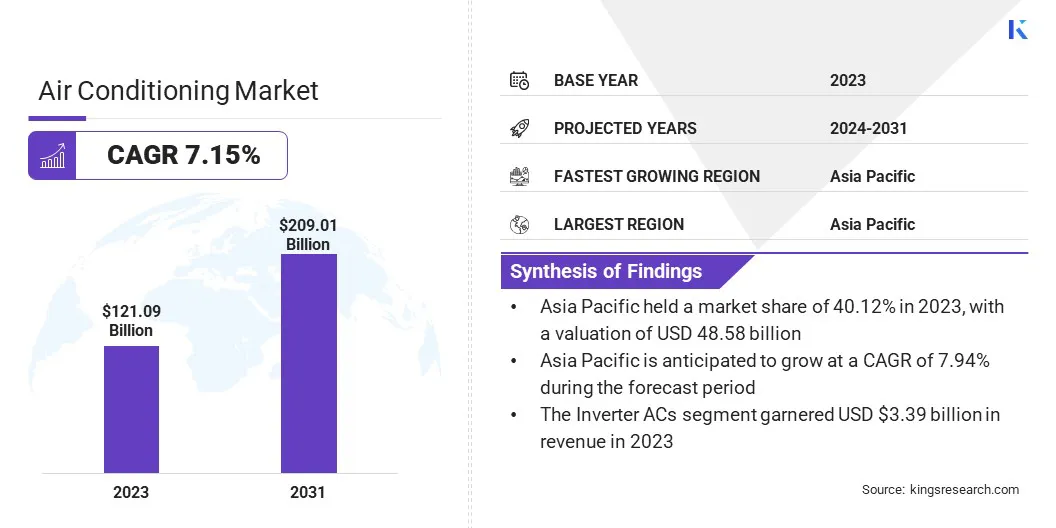

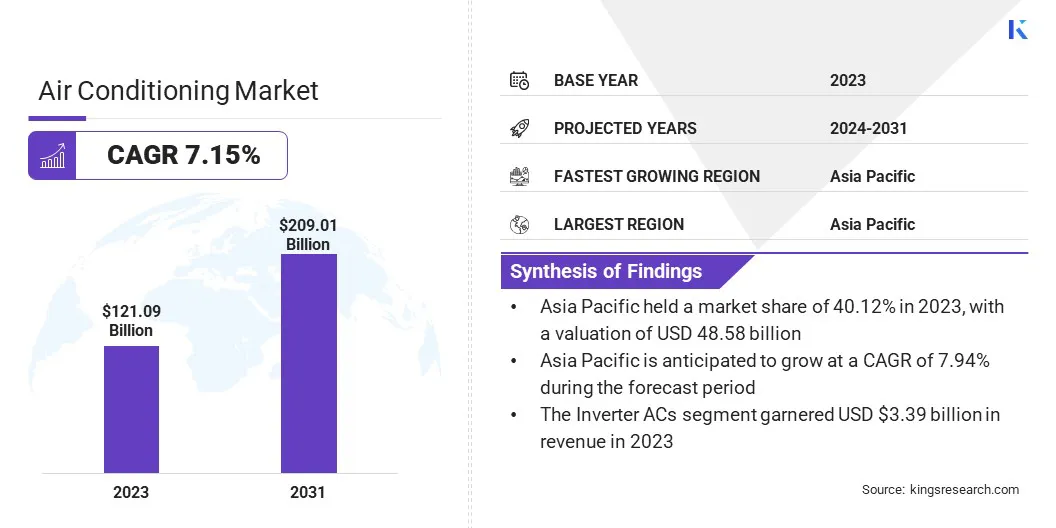

The global air conditioning market size was valued at USD 121.09 billion in 2023 and is projected to grow from USD 128.89 billion in 2024 to USD 209.01 billion by 2031, exhibiting a CAGR of 7.15% during the forecast period.

Market growth is mainly fueled by rapid urbanization and infrastructure development. Rising global temperatures are further contributing to this growth, with frequent heatwaves and extreme weather conditions increasing reliance on cooling systems.

Additionally, advancements in energy-efficient technologies are boosting demand, with manufacturers integrating inverter technology and smart climate control systems to enhance performance while reducing power consumption.

Major companies operating in the global air conditioning industry are Daikin Industries, Ltd., Carrier, Mitsubishi Electric Corporation, Trane, LG Electronics, Panasonic Corporation, FUJITSU GENERAL, Johnson Controls-Hitachi Air Conditioning, SAMSUNG, Lennox International Inc., Midea Group Co., Ltd., Haier Inc., Blue Star Limited, Bosch Thermotechnology Corp., GREE ELECTRIC APPLIANCES, INC. OF ZHUHAI, and others.

Escalating global temperatures have significantly contributed to the growth of the market. Heatwaves and extreme climate conditions have intensified the need for cooling solutions across residential, commercial, and industrial applications.

- A Phys.org report (August 2024) noted that 15 countries experienced record-high temperatures. In July, the global average temperature, exacerbated by widespread heatwaves, was likely the highest in 120,000 years. Heat stress currently causes approximately 500,000 deaths annually, a figure the World Health Organization projects could increase fivefold by 2050. In 2023, extreme heat affected 3.8 billion people for at least one day, with over 47,000 heat-related deaths reported in Europe. Daily temperatures exceeding 86°F have been linked to a 16% rise in weekly air conditioner sales. Currently, 2 billion air conditioners are in use globally, and the International Energy Agency (IEA) forecasts this number will reach 5.6 billion by 2050, equating to 10 units sold per second.

Higher temperatures increase consumer reliance on air conditioning systems for thermal comfort and workplace productivity. The rising frequency of heat-related health issues has further emphasized the importance of air conditioning in healthcare and public spaces.

Governments and organizations are implementing cooling strategies to mitigate climate impacts, accelerating the adoption of energy-efficient air conditioning systems and boosting demand across urban and rural regions.

Key Highlights:

- The global air conditioning market size was recorded at USD 121.09 billion in 2023.

- The market is projected to grow at a CAGR of 7.15% from 2024 to 2031.

- Asia Pacific held a share of 40.12% in 2023, valued at USD 48.58 billion.

- The split air conditioners segment garnered USD 47.63 billion in revenue in 2023.

- The inverter ACs segment is expected to reach USD 90.92 billion by 2031.

- The direct sales segment secured the largest revenue share of 44.09% in 2023.

- The commercial/industrial is poised to grow at a CAGR of 8.79% through the forecast period.

- North America is anticipated to grow at a CAGR of 8.79% over the forecast period.

Market Driver

"Expansion of Residential Real Estate"

Rapid urbanization and increasing disposable income in developing economies are fueling the expansion of the residential real estate sector, leading to increased demand for air conditioning installations.

- According to the International Energy Agency's 2023, residential units constitute nearly 70% of the total air conditioning systems. Since 2000, the number of operational residential units has tripled, surpassing 1.5 billion.

Government-backed affordable housing projects and rising consumer preference for smart home technologies have propelled market expansion. Builders are integrating centralized HVAC systems, smart thermostats, and energy-efficient air conditioning units to enhance property value and comply with evolving energy codes. The surge in premium apartment complexes and luxury housing developments has further boosted demand for ducted, VRF, and hybrid cooling solutions.

Market Challenge

"High Energy Consumption and Environmental Impact"

The air conditioning market faces a significant challenge due to high energy consumption and rising environmental concerns. Traditional systems increase electricity demand, straining power grids and leading to higher carbon emissions. Additionally, refrigerants with high global warming potential (GWP) raises sustainability concerns.

- According to the International Energy Agency (IEA) 2024 report, air conditioning contributes 7% of global greenhouse gas emissions. Without action, these emissions could double by 2030 and triple by 2050. To meet global net-zero targets, emissions must be reduced to 40% of current levels by 2030. While advancements in energy efficiency have led to emission reductions, the IEA emphasizes the need to triple the current pace of decline to achieve sustainability goals.

To address these issues, several manufacturers are investing in energy-efficient technologies, including inverter-based compressors and AI-driven climate control, while also developing eco-friendly refrigerants like R-32 and R-290. Additionally, they are exploring solar-powered and hybrid cooling systems to reduce dependence on conventional energy sources and minimize environmental impact.

Market Trend

"Technological Advancements"

The integration of advanced technologies has transformed the air conditioning market, improving energy efficiency and user convenience. Innovations such as inverter-based compressors, variable refrigerant flow (VRF) systems, and AI-powered controls have optimized cooling performance while reducing energy consumption.

- In January 2025, LG Electronics (LG) introduced the DUALCOOL AI Air, an advanced residential air conditioner featuring AI Core-Tech. Equipped with an AI DUAL Inverter, it intelligently adjusts temperature, airflow, and speed for consistent cooling. Additionally, it incorporates a Human Detecting Sensor, Sleep Timer+, and a range of energy-saving functions to enhance user convenience and efficiency.

Furthermore, smart air conditioning units equipped with IoT capabilities enable remote monitoring, predictive maintenance, and automated climate control, enhancing consumer appeal.

Advanced filtration mechanisms, including HEPA and activated carbon filters, improce air quality, attracting health-conscious buyers. The introduction of compact, portable, and ductless air conditioning solutions has further expanded market accessibility to diverse consumer needs.

- In September 2024, Morphy Richards introduced the world’s first certified ductless portable air conditioner. Prior to its official release, tthe unit was deployed in the Paris Olympic Village to enhance athlete comfort and recovery. To meet demand, the company accelerated production, ensuring effective cooling solutions.

Air Conditioning Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product Type

|

Unitary Air Conditioners, Split Air Conditioners, Window Air Conditioners, Portable Air Conditioners, Chillers, VRF (Variable Refrigerant Flow) Systems, Packaged Air Conditioners

|

|

By Technology

|

Inverter ACs, Non-Inverter ACs, Smart ACs, Hybrid ACs

|

|

By Distribution Channel

|

Direct Sales, Retail Store, Online/E-Commerce, HVAC Contractors & Distributors

|

|

By End User

|

Residential, Commercial/Industrial

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Product Type (Unitary Air Conditioners, Split Air Conditioners, Window Air Conditioners, Portable Air Conditioners, Chillers, VRF (Variable Refrigerant Flow) Systems, and Packaged Air Conditioners): The split air conditioners segment earned USD 47.63 billion in 2023 due to its higher energy efficiency, flexible installation, and increasing adoption in residential and commercial spaces, aligning with the growing demand for cost-effective and space-saving cooling solutions.

- By Technology (Inverter ACs, Non-Inverter ACs, Smart ACs, and Hybrid ACs): The inverter ACs segment held a share of 44.09% in 2023, propelled by its superior energy efficiency, optimized cooling performance, and lower operational costs. This growth is further supported by stringent energy regulations and the rising demand for sustainable cooling solutions across residential and commercial sectors.

- By Distribution Channel (Direct Sales, Retail Store, Online/E-Commerce, and HVAC Contractors & Distributors): The direct sales segment is projected to reach USD 90.92 billion by 2031, propelled by manufacturers' ability to directly engage with commercial and residential buyers, providing customized solutions, bulk pricing advantages, and comprehensive after-sales support, which are critical for large-scale installations and high-value projects.

- By End User (Residential and Commercial/Industrial): The commercial/industrial segment is likely to grow at a CAGR of 8.79% through the forecast period, largely attributed to the rising adoption of large-scale HVAC systems across commercial buildings, manufacturing facilities, and data centers due to the increasing demand for advanced climate control solutions to enhance operational efficiency and indoor air quality.

Air Conditioning Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

The Asia Pacific air conditioning market share stood at around 40.12% in 2023, valued at USD 48.58 billion. Asia Pacific is experiencing record-breaking high temperatures, leading to a surge in demand for air conditioning.

Countries such as India, China, and Australia have recorded extreme heatwaves, prompting increased investments in cooling solutions across households, businesses, and public institutions.

In 2024, the Indian Meteorological Department reported the highest average summer temperature in decades, with urban heat island exacerbating cooling requirements in densely populated cities. Governments and businesses are increasingly prioritizing air conditioning as a necessity rather than a luxury, propelling regional market expansion.

Additionally, governments across Asia Pacific are implementing cooling policies and energy efficiency regulations to promote sustainable air conditioning adoption.

India’s Cooling Action Plan (ICAP) aims to reduce cooling demand by 25–30% by 2037–38 while promoting the use of energy-efficient systems. China’s latest Five-Year Plan mandates high-performance HVAC systems in commercial and residential buildings.

Southeast Asian countries, including Thailand and Malaysia, have introduced stricter Minimum Energy Performance Standards (MEPS), prompting manufacturers to develop inverter-based and eco-friendly refrigerant models. These regulatory measures are fostering innovation and increasing the adoption of energy-efficient air conditioning systems.

North America air conditioning industry is likely to grow at CAGR of 7.11% over the forecast period. The region is witnessing rapid expansion in data center construction, fueling demand for high-performance air conditioning systems.

Hyperscale cloud providers, including Microsoft Azure, Google Cloud, and AWS, are investing in large-scale data centers across Virginia, Texas, and Ontario. The rise of AI-driven applications and high-density computing is prompting data center operators to deploy liquid cooling and energy-efficient HVAC systems.

- The 2024 International Energy Agency report highlights a sharp rise in investment in new data centers over the past two years, with the U.S. leading this growth. Annual spending data center construction has doubled, propelled by major industry players, Google, Microsoft, and Amazon. In 2023, their combined capital expenditures exceeded the total investment of the U.S. oil and gas sector, accounting for approximately 0.5% of the nation's GDP. This surge underscores the rising dominance of AI-driven infrastructure and the growing demand for high-performance data processing.

Furthermore, rising environmental concerns and regulatory mandates are driving the adoption of sustainable air conditioning solutions in North America. The transition toward low-global-warming-potential (GWP) refrigerants, such as R-32 and R-454B, is gaining momentum due to phasedown regulations under the American Innovation and Manufacturing (AIM) Act.

District cooling systems are being implemented in urban developments to reduce energy consumption and carbon emissions. The growing interest in geothermal cooling and solar-powered air conditioning solutions is further expanding the market, with companies developing hybrid HVAC systems that integrate renewable energy sources to enhance efficiency.

Regulatory Frameworks

- The U.S. air conditioning industry operates under stringent regulations to enhance energy efficiency and environmental sustainability. ASHRAE Standard 90.1 sets minimum efficiency requirements for HVAC systems, influencing national building codes. The Environmental Protection Agency (EPA) enforces the Significant New Alternatives Policy (SNAP) program to phase out ozone-depleting refrigerants, while the Department of Energy (DOE) mandates efficiency standards to reduce oenergy consumption.

- The European Union implements rigorous energy efficiency policies through the Ecodesign Directive, which sets minimum performance standards for air conditioners to minimize environmental impact. Additionally, the F-Gas Regulation restricts the use of high-global-warming-potential refrigerants, promoting the adoption of low-impact alternatives. These initiatives align with the EU’s broader climate action goals to reduce carbon emissions across industries.

- China has implemented the Minimum Energy Performance Standards (MEPS) for air conditioners to improve efficiency and lower electricity consumption. The China Energy Label categorizes appliances based on performance, prompting consumers to purchase energy-efficient models.

- India’s air conditioning industry is governed by the Energy Conservation Building Code (ECBC), which mandates efficiency standards for HVAC systems in commercial buildings. The Bureau of Energy Efficiency (BEE) enforces a star-rating system to guide consumer purchases, while government incentives and policies support green cooling solutions and phase-out of high-GWP refrigerants, aligning with national sustainability commitments.

Competitive Landscape

The global air conditioning market is characterized by market players implementing strategies such as introducing sustainable products and forming strategic acquisitions. Companies are focusing on developing energy-efficient air conditioning systems that comply with evolving environmental regulations and cater to the growing demand for eco-friendly cooling solutions.

Additionally, acquisitions of specialized firms are strengthening market presence and expanding service offerings, particularly in data center cooling and residential HVAC systems. These initiatives strenghthen competitiveness, support sustainability goals, and address the increasing demand for advanced air conditioning solutions globally.

- In December 2024, Mitsubishi Electric Corporation, through its wholly-owned subsidiary Mitsubishi Electric Europe B.V., acquired Crystal Air Holdings Limited, an Ireland-based air-conditioning installation and maintenance company. This acquisition strengthens Mitsubishi Electric’s ability to meet the rising demand for IT cooling solutions in European data centers. Additionally, it enhances the company’s one-stop service model, integrating equipment sales, installation, operation, and maintenance, supporting its strategy to expand its presence and market share in the growing data center cooling sector across Europe.

List of Key Companies in Air Conditioning Market:

- Daikin Industries, Ltd.

- Carrier

- Mitsubishi Electric Corporation

- Trane

- LG Electronics

- Panasonic Corporation

- FUJITSU GENERAL

- Johnson Controls-Hitachi Air Conditioning

- SAMSUNG

- Lennox International Inc.

- Midea Group Co., Ltd.

- Haier Inc.

- Blue Star Limited

- Bosch Thermotechnology Corp.

- GREE ELECTRIC APPLIANCES, INC. OF ZHUHAI

Recent Developments (M&A/Joint Venture/Agreements/Product Launch)

- In February 2025, LG Electronics presented its latest heating, ventilation, and air conditioning (HVAC) solutions at the AHR Expo 2025 in Orlando, Florida. With the industry transitioning to decarbonization and a growing demand for electrification technologies, LG’s expanded HVAC lineup delivers customized solutions for both commercial and residential applications.

- In January 2025, Panasonic Corporation's Heating & Ventilation A/C Company (HVAC Company) launched the OASYS Residential Central Air Conditioning System in the U.S. market. As the first system of its kind, OASYS integrates a Mini Split AC, Energy Recovery Ventilator (ERV), and DC motor-driven transfer fans, enhancing ventilation efficiency and reducingheating and cooling energy consumption by over 50% compared to conventional systems.

- In September 2024, Daikin Industries Ltd. signed a memorandum of understanding to 33 additional acres near its existing plant in southern India. This expansion aligns with the company’s growing regional presence in the region, following a strong first-quarter performanec, with approximately 700,000 units sold in India—marking a 40% year-on-year increase in local currency.

- In May 2024, Lennox and Samsung announced a joint venture agreement to expand the sales of ductless air conditioners and heat pumps (including mini-split, multi-split, and VRF systems) across the United States and Canada. The newly formed entity, Samsung Lennox HVAC North America, aims to leverage both companies' expertise to enhance product offerings and market reach.

- In April 2024, Mitsubishi Electric Corporation, through its subsidiaries Mitsubishi Electric Hydronics & IT Cooling Systems S.p.A. and Mitsubishi Electric Europe B.V., completed the acquisition of AIRCALO, a France-based air-conditioning company. This acqusition strengthens Mitsubishi Electric’s hydronic HVAC systems business in Europe, enabling it to address rising demand for customized solutions and align with sustainability initiatives.