Market Definition

Artificial intelligence in chemicals market involves using advanced algorithms, data analytics, and machine learning models to optimize research, production, and operations. These technologies enable predictive modeling, process automation, and accelerated material discovery, improving efficiency and innovation.

Applications span chemical manufacturing, product design, material innovation, and environmental monitoring, supporting quality control, cost reduction, sustainability, and regulatory compliance.

AI in Chemicals Market Overview

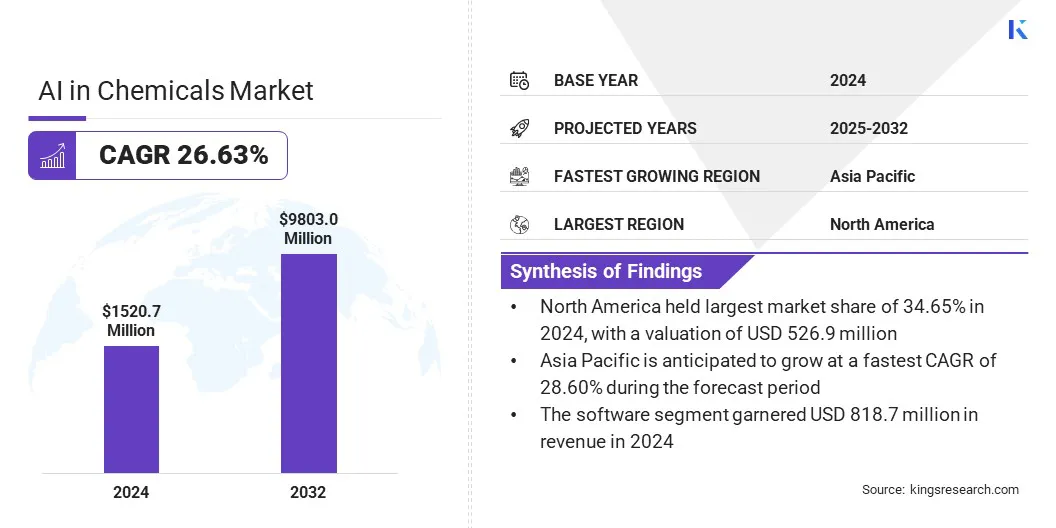

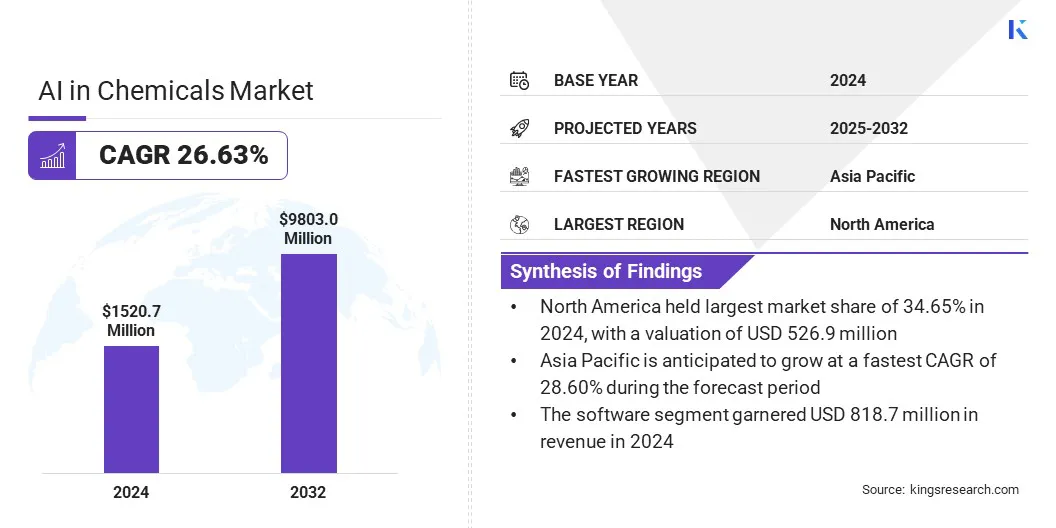

The global AI in chemicals market size was valued at USD 1,520.7 million in 2024 and is projected to grow from USD 1,877.5 million in 2025 to USD 9,803.3 million by 2032, exhibiting a CAGR of 26.63% during the forecast period.

This growth is attributed to the rising demand for advanced digital tools to improve process optimization, accelerate material discovery, and strengthen decision-making across the chemical industry. Expanding adoption of predictive modeling, machine learning, and automated systems is enabling greater accuracy in production planning, quality management, and supply chain operations, further supporting market expansion.

Key Highlights

- The AI in chemicals industry size was valued at USD 1,520.7 million in 2024.

- The market is projected to grow at a CAGR of 26.63% from 2025 to 2032.

- North America held a market share of 34.65% in 2024, valued at USD 526.9 million.

- The software segment garnered USD 818.7 million in revenue in 2024.

- The production optimization segment is expected to reach USD 2,694.4 million by 2032.

- The specialty chemicals segment is anticipated to witness the fastest CAGR of 27.51% during the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 28.60% through the projection period.

Major companies operating in the AI in chemicals market are IBM, Sumitomo Chemical Co., Ltd., Iktos, Google LLC, C3.ai, Inc., Amazon Web Services, Inc., NobleAI, SAP SE, Nexocode, NVIDIA Corporation, GE Vernova, BASF, Chemical.AI, Schneider Electric, and Honeywell International Inc.

The growing emphasis from chemical manufacturers and regulators on sustainability, compliance, and cost efficiency is further driving integration of AI into core workflows. Additionally, ongoing R&D investments, strategic collaborations, innovations, and rapid digitalization initiatives are accelerating market expansion.

- In July 2025, Elsevier introduced Reaxys AI Search, enabling researchers to query over 121 million chemistry documents, patents, and journal articles using natural language. The tool interprets user intent, handles spelling variations and synonyms, and delivers the most relevant results.

Market Driver

Advanced Material Discovery and Innovation

The growth of AI in chemicals industry is fueled by its ability to accelerate material discovery and product innovation. Advanced algorithms analyze extensive datasets to predict molecular behavior, enabling the rapid design of new compounds and formulations with improved performance. This capability is particularly valuable for specialty chemicals, polymers, and sustainable alternatives, where speed and precision in R&D provide a competitive edge.

The reduction in time-to-market and development costs is supporting the adoption of AI in chemical research and production. Rising demand for high-performance materials, stricter environmental regulations, and the need for cost-efficient R&D are promoting wider adoption of AI-driven discovery platforms. This shift is strengthening the ability of chemical producers to deliver advanced, compliant products.

- In July 2025, Kemira formed a strategic partnership with CuspAI to advance AI-driven materials innovation in the chemical sector. The collaboration leverages CuspAI’s AI capabilities and Kemira’s expertise to accelerate the development of new materials, initially focusing on removing per- and polyfluoroalkyl substances (PFAS) from water. The partnership aims to shorten material discovery timelines from years to approximately six months.

Market Challenge

Data Management and Integration Issues

Data management and integration challenges create significant barriers to the adoption of AI in the chemical industry. Many companies rely on legacy infrastructure and fragmented databases, which restrict access to reliable and standardized datasets.

Variations in data formats, incomplete records, and the absence of uniform protocols diminish the reliability of predictive modeling and constrain the practical application of AI. Integrating AI platforms with enterprise systems such as process control, supply chain, and quality management requires substantial investment and technical expertise.

These issues are particularly pronounced in large-scale production environments, where operations generate complex datasets from multiple sources, including sensors, laboratories, and enterprise resource planning systems. Difficulties in harmonizing this information delay AI deployment and diminish its potential impact.

To overcome these constraints, companies are investing in advanced data governance frameworks, cloud-based integration platforms, and standardized data management practices. These efforts aim to enhance data reliability, improve interoperability, and ensure consistent application of AI systems.

Market Trend

Adoption of Generative AI for Accelerated Molecular Design & Innovation

The AI in chemicals market is experiencing a notable shift toward generative AI–driven molecular design and innovation, supported by the need for faster and more accurate chemical development.

Generative AI models enable the prediction of compound properties, identification of new molecules, and optimization of synthesis pathways, reducing reliance on traditional experimental methods. This approach is particularly relevant in specialty chemicals, polymers, and sustainable materials, where efficiency and precision in development are critical.

Chemical companies are increasingly adopting generative AI into their innovation processes, leveraging predictive modeling and simulation tools to streamline workflows and improve development outcomes. AI-driven design platforms help reduce development time, lower resource consumption, and enhance consistency of results. The growing application of generative AI is establishing it as a key tool for advancing chemical innovation and supporting operational efficiency.

- In July 2024, Exscientia launched an AI-powered platform for drug discovery in collaboration with Amazon Web Services (AWS). The platform combines generative AI models with lab automation to accelerate the design, synthesis, and testing of drug candidates, aiming to improve efficiency and reduce early-stage development costs.

AI in Chemicals Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Hardware, Software, and Services

|

|

By Application

|

Production Optimization, New Material Innovation, Operational Process Management, Pricing Optimization, Raw Material Demand Forecasting, and Others

|

|

By End Use

|

Base Chemicals & Petrochemicals, Agrochemicals, and Specialty Chemicals

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Hardware, Software, and Services): The software segment earned USD 818.7 million in 2024, primarily due to the widespread adoption of AI applications in chemical operations.

- By Application (Production Optimization, New Material Innovation, Operational Process Management, Pricing Optimization, Raw Material Demand Forecasting, and Others): The production optimization segment held a share of 29.62% in 2024, fueled by increasing adoption of AI for improving efficiency and reducing operational costs.

- By End Use (Base Chemicals & Petrochemicals, Agrochemicals, and Specialty Chemicals): The specialty chemicals segment is projected to reach USD 3,646.2 million by 2032, owing to growing demand for advanced materials and high-performance chemical solutions.

AI in Chemicals Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America AI in chemicals market share stood at 34.65% in 2024, valued at USD 526.9 million. This dominance is reinforced by increasing investments by chemical manufacturers and technology providers, growing demand for process automation, and the presence of major chemical companies.

In March 2025, the U.S. Department of Energy announced a USD 78 million funding initiative to decarbonize chemicals manufacturing, aimed at supporting modernization and advancing sustainable practices in the sector. Furthermore, the regional market benefits from extensive AI adoption across specialty chemicals, polymers, and petrochemicals, where efficiency, accuracy, and innovation are critical.

Supportive regulatory frameworks, skilled talent availability, and a focus on digital transformation further enable AI implementation. Additionally, growth in R&D, technological collaborations, and integration of predictive analytics positions North America as a key region for AI adoption in the chemical industry.

- In August 2025, CAS (Chemical Abstracts Service), a division of the American Chemical Society, enhanced CAS SciFinder by integrating advanced AI capabilities, including Search Sense for natural language queries and AI-generated summaries. A real-time interactive retrosynthesis tool was also added, reducing synthetic planning time from minutes to seconds. These features aim to improve efficiency and support innovation in R&D.

The Asia-Pacific AI in chemicals industry is set to grow at a staggering CAGR of 28.60% over the forecast period. This growth is fueled by increasing chemical production, rapid industrialization, and rising adoption of AI technologies across manufacturing and research sectors. Expanding specialty chemicals, polymers, and petrochemical industries are utilizing AI to enhance process efficiency, optimize resource utilization, and accelerate product innovation.

Additionally, government-led digital transformation initiatives across the region, including India’s Digital India, Make in India, and Startup India programs, along with collaborations between local manufacturers and global technology providers, are supporting AI adoption and infrastructure development.

Furthermore, the emphasis on predictive analytics, automation, and data-driven decision-making, supported by workforce development and technological advancements, is boosting long-term adoption. The expansion of smart manufacturing facilities and growing focus on operational efficiency further propel regional market expansion.

Regulatory Frameworks

- In the European Union, Regulation (EU) 2024/1689 (Artificial Intelligence Act) regulates the development, deployment, and use of AI systems. It establishes standards for transparency, accountability, and risk management to ensure safe and reliable AI applications across industrial and commercial sectors.

- In the U.S., the Framework for Artificial Intelligence Diffusion governs the export and use of advanced AI technologies. It establishes controls on high-performance AI models and integrated circuits to protect national security and foreign policy, with implications for industries adopting AI in research, process optimization, and manufacturing.

Competitive Landscape

Companies operating in the AI in chemicals industry are maintaining competitiveness through investments in AI technologies, software development, and strategic collaborations and acquisitions. They are implementing AI platforms for generative modeling, predictive analytics, and process optimization to support operations across specialty chemicals, polymers, and petrochemicals.

Firms are expanding their offerings with cloud-based platforms, automation tools, and data integration solutions to address operational requirements and regulatory standards. Focus is placed on establishing regional centers and collaborating with technology providers and research institutions to support adoption. Additionally, companies are providing technical support, training programs, and AI-driven monitoring tools to improve efficiency and sustain competitive positioning.

- In June 2025, Syensqo and Microsoft signed a Memorandum of Understanding to collaborate on AI and sustainable materials development. The partnership leverages Microsoft’s AI capabilities and Syensqo’s expertise to accelerate innovation in bio-based polymers, circular composites, and clean energy materials.

Key Companies in AI in Chemicals Market:

- IBM

- Sumitomo Chemical Co., Ltd.

- Iktos

- Google LLC

- C3.ai, Inc.

- Amazon Web Services, Inc.

- NobleAI

- SAP SE

- Nexocode

- NVIDIA Corporation

- GE Vernova

- BASF

- Chemical.AI

- Schneider Electric

- Honeywell International Inc.

Recent Developments (Partnerships/Product Launches)

- In March 2024, Elsevier and Iktos announced a multi-year partnership to integrate Iktos's AI-driven synthetic planning tools with Elsevier's Reaxys database. The collaboration aims to accelerate early-stage drug discovery by enhancing retrosynthesis, synthetic accessibility, and reaction analysis for pharmaceutical and chemical research.

- In December 2023, MilliporeSigma launched AIDDISON, an AI platform integrating drug discovery and synthesis. Using generative AI and machine learning, it screens over 60 billion chemical compounds to identify viable candidates and recommends optimal synthesis routes, improving efficiency in drug development.