Market Definition

The market focuses on the development and application of Artificial Intelligence (AI)-driven technologies for detecting, analyzing, and diagnosing various forms of cancer. AI models are trained on vast datasets of medical imaging, pathology slides, genomic data, and clinical records to enhance diagnostic accuracy and efficiency.

These systems assist in tumor detection, classification, and prognosis assessment by leveraging deep learning, Machine Learning (ML) algorithms, and computer vision. AI-driven diagnostic tools are widely used in radiology, histopathology, and liquid biopsy analysis, aiding in early cancer detection, reducing diagnostic errors, and supporting personalized treatment strategies for improved patient outcomes.

AI in Cancer Diagnostics Market Overview

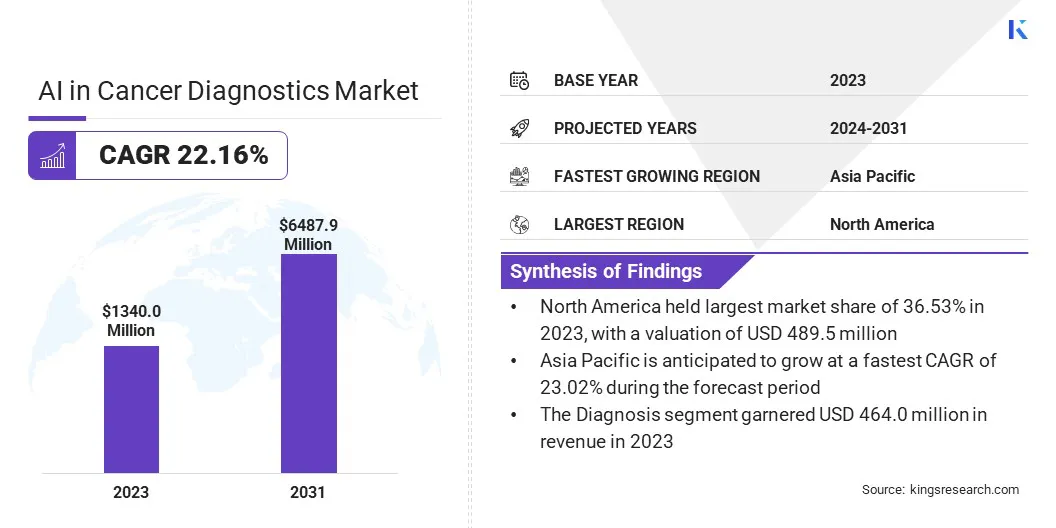

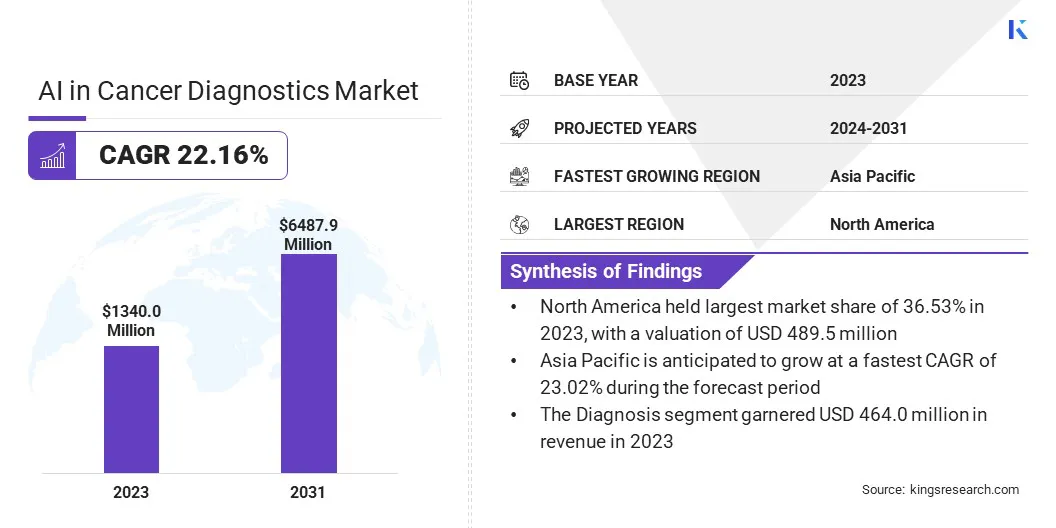

The global AI in cancer diagnostics market size was valued at USD 1,340.0 million in 2023 and is projected to grow from USD 1,598.1 million in 2024 to USD 6,487.9 million by 2031, exhibiting a CAGR of 22.16% during the forecast period.

The market is driven by the rising prevalence of cancer and the increasing need for early detection to improve patient outcomes. Advancements in AI-powered imaging and digital pathology solutions enhance diagnostic accuracy, reducing errors and enabling faster clinical decisions.

Additionally, growing regulatory support and approvals for AI-driven diagnostic tools are accelerating their integration into oncology practices, further boosting their adoption.

Major companies operating in the AI in cancer diagnostics industry are Siemens Healthineers AG, GE HealthCare, Quest Diagnostics Incorporated, Paige AI, Inc., Ibex Medical Analytics Inc., F. Hoffmann-La Roche Ltd, Mindpeak GmbH, Lunit Inc., Tempus AI, Inc., CancerCenter.ai, Azra AI, Freenome Holdings, Inc., Onc.AI, Kheiron Medical Technologies Limited, and Median Technologies.

The increasing global prevalence of cancer has intensified the focus on early and accurate diagnosis. The market benefits from advanced algorithms that analyze vast medical datasets, enhancing the detection of malignancies at initial stages. AI-driven imaging and pathology tools assist healthcare professionals in identifying cancerous patterns with greater precision.

The demand for early detection solutions has led to higher adoption rates across hospitals and diagnostic centers. AI applications reduce diagnostic delays and improve patient outcomes, supporting the expansion of the market in developed and emerging healthcare systems.

- According to the latest cancer data released by the World Health Organization (WHO) in February 2024, approximately one in five people will develop cancer during their lifetime, with about one in nine men and one in twelve women succumbing to the disease. Projections indicate that cancer cases will exceed 35 million by 2050, marking a 77% rise from the estimated 20 million cases recorded in 2022.

Key Highlights:

- The AI in cancer diagnostics industry size was valued at USD 1,340.0 million in 2023.

- The market is projected to grow at a CAGR of 22.16% from 2024 to 2031.

- North America held a market share of 36.53% in 2023, with a valuation of USD 489.5 million.

- The breast cancer segment garnered USD 472.1 million in revenue in 2023.

- The diagnosis segment is expected to reach USD 2,362.2 million by 2031.

- The diagnostic centers segment is poised for a robust CAGR of 24.72% through the forecast period.

- The market in Asia Pacific is anticipated to grow at a CAGR of 23.02% during the forecast period.

How are changing trends in Medical Imaging and Pathology driving the market demand?

The adoption of AI in diagnostics has expanded with its applications in radiology and pathology, contributing to the growth of the AI in cancer diagnostics market. AI-powered imaging solutions enhance the detection of tumors in MRI, CT scans, and mammography, reducing the risk of misdiagnosis.

In pathology, AI streamlines the analysis of biopsy samples by identifying microscopic cancerous changes with precision. AI-driven automation optimizes workflow efficiency, minimizing manual errors and accelerating diagnostic turnaround times.

The ability to provide quantitative imaging insights strengthens clinical decision-making, encouraging healthcare providers to implement AI-driven diagnostic tools for improved cancer detection and monitoring.

- In March 2025, GE HealthCare introduced the Invenia Automated Breast Ultrasound (ABUS) Premium, its latest 3D ultrasound system equipped with advanced AI and innovative features to enhance efficiency, ensure consistent supplemental screening, and simplify exam interpretation for patients with dense breast tissue. The company reports that approximately 71% of cancers develop in dense breasts. Studies conducted across the U.S. and Europe indicate that 40% of women, including 70% of Asian women, have dense breast tissue, increasing their likelihood of a breast cancer diagnosis by four to six times.

What are the major obstacles for this market?

Stringent regulatory requirements pose a significant challenge to the growth of the AI in cancer diagnostics market. Obtaining approvals from agencies like the FDA, EMA, and NMPA requires extensive clinical validation, data transparency, and compliance with evolving guidelines, leading to prolonged approval timelines and increased costs.

Companies are actively collaborating with regulatory bodies, investing in real-world evidence studies, and enhancing algorithm explainability to meet compliance standards. Additionally, firms are adopting adaptive AI models that allow for continuous updates while maintaining regulatory approval, ensuring long-term market viability and wider clinical adoption.

How is AI integration affecting the market?

Investments in AI-driven healthcare technologies have accelerated the growth of the market. Governments, private enterprises, and research institutions allocate substantial funding to AI-based oncology solutions, promoting innovation.

Increased capital flows have led to the development of AI algorithms, enhancing diagnostic accuracy and clinical applicability. The focus on AI-driven research collaborations supports the commercialization of novel cancer diagnostic tools.

Financial backing from healthcare investors has facilitated the deployment of AI-powered diagnostic platforms, strengthening market penetration and adoption across diagnostic laboratories, hospitals, and cancer research centers.

- In September 2024, Roche enhanced its digital pathology open environment by incorporating over 20 advanced AI algorithms from eight new partners. These collaborations are designed to assist pathologists and researchers in cancer diagnostics and research through the use of advanced AI technology.

AI in Cancer Diagnostics Market Report Snapshot

|

Segmentation

|

Details

|

|

By Cancer Type

|

Breast Cancer, Lung Cancer, Prostate Cancer, Colorectal Cancer, Others

|

|

By Application

|

Screening, Diagnosis, Prognosis, Risk Assessment, Drug Discovery and Development

|

|

By End Users

|

Hospitals, Diagnostic Centers, Research Institutes, Pharmaceutical Companies

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Cancer Type (Breast Cancer, Lung Cancer, Prostate Cancer, Colorectal Cancer, and Others): The breast cancer segment earned USD 472.1 million in 2023, due to its high global prevalence, increased adoption of AI-driven imaging & pathology solutions for early detection, and strong regulatory support for AI-based screening technologies.

- By Application (Screening, Diagnosis, Prognosis, Risk Assessment, Drug Discovery and Development): The diagnosis segment held 34.62% share of the market in 2023, due to its ability to enhance early detection accuracy, streamline pathology workflows, and reduce diagnostic errors, leading to improved clinical outcomes and increased adoption by healthcare providers.

- By End Users (Hospitals, Diagnostic Centers, Research Institutes, Pharmaceutical Companies): The diagnostic centers segment is projected for a CAGR of 24.72% million over the forecast period, owing to the high adoption of AI-powered imaging and pathology solutions, enabling faster and more accurate cancer detection while addressing increasing patient volumes and operational efficiency demands.

What is the market scenario in North America and Asia-Pacific region?

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America accounted for 36.53% share of the AI in cancer diagnostics market in 2023, with a valuation of USD 489.5 million. North America has emerged as a key hub for AI-driven cancer diagnostics, due to the presence of leading healthcare technology firms and AI research institutions.

Companies such as IBM Watson Health, GE HealthCare, Tempus, and PathAI are at the forefront of developing AI-powered cancer diagnostic solutions. The strong regional ecosystem fosters continuous innovation, with AI models being refined through collaborations between AI developers, healthcare providers, and academic institutions.

The rapid commercialization of AI-driven diagnostic platforms accelerates market growth, ensuring that advanced cancer detection solutions reach hospitals and diagnostic centers across the region.

Government agencies in North America, particularly the U.S. Food and Drug Administration (FDA) and Health Canada, have actively supported the adoption of AI in cancer diagnostics. The FDA has granted approvals for several AI-driven diagnostic tools, ensuring their compliance with healthcare regulatory standards.

- In February 2025, the FDA granted 510(k) clearance to Ibex Prostate Detect, an AI-driven digital pathology solution designed to detect small and rare prostate cancers in tissue biopsies. The system utilizes AI to analyze whole slide images of prostate core needle biopsies stained with hematoxylin and eosin. Furthermore, the AI technology identified 13% of prostate cancer cases that were initially overlooked by pathologists during the first diagnosis.

The market in Asia Pacific is poised for significant growth at a robust CAGR of 23.02% over the forecast period. Asia Pacific has registered a sharp rise in cancer cases, with countries such as China, India, and Japan reporting some of the highest cancer burdens globally.

The increasing prevalence of cancers, including lung, breast, and gastrointestinal cancers, has intensified the demand for advanced diagnostic solutions. Approximately 49% of all newly diagnosed cancer cases occurred in Asia, home to 59% of the global population. China alone accounted for 24% of these cases, with 4.8 million diagnoses, according to a report by the American Cancer Society.

AI-powered diagnostic tools help address the growing need for early detection by enhancing imaging accuracy and automating pathology analysis. Governments and healthcare institutions are prioritizing AI-driven screening programs to improve cancer detection rates, driving the market in the region.

Regulatory Frameworks

- In the U.S., the FDA oversees the regulation of AI-based medical devices, including those used in cancer diagnostics. The FDA employs a risk-based classification system, categorizing devices into Class I, II, or III based on their potential risk to patients. AI-driven diagnostic tools typically fall into Class II or III, necessitating rigorous premarket approval or clearance processes. The FDA has also issued guidance documents to address the unique challenges posed by AI and ML technologies, emphasizing the need for transparency, performance evaluation, and real-world monitoring.

- The European Union (EU) has established a comprehensive regulatory framework for AI applications in healthcare through the European Medical Device Regulation (MDR) and the proposed AI Act. The MDR, effective since May 2021, classifies software used for diagnostic purposes, including AI-based tools, as medical devices, subjecting them to stringent conformity assessments. The proposed AI Act introduces a risk-based approach, categorizing AI systems into unacceptable, high, and low/minimal risk levels, with high-risk systems, such as AI in cancer diagnostics, facing strict requirements for data governance, transparency, and human oversight.

- China has proactively developed regulatory guidelines for AI in healthcare. The National Medical Products Administration (NMPA) issued the "Technical Guideline on AI-aided Software" in June 2019, focusing on data quality, algorithm validation, and clinical risk assessment. Subsequent guidelines, such as the "Guidelines for the Classification and Definition of Artificial Intelligence-Based Software as a Medical Device" (July 2021) and the "Guidelines for Registration and Review of Artificial Intelligence-Based Medical Devices" (March 2022), provide detailed frameworks for the classification, registration, and evaluation of AI medical devices, ensuring their safety and efficacy.

Competitive Landscape:

The AI in cancer diagnostics industry is characterized by several market players that are actively pursuing strategies like partnerships and the commercialization of advanced diagnostic tests to strengthen their presence and drive the market.

Collaborations between AI-driven diagnostic firms and healthcare technology companies are enabling the widespread adoption of innovative cancer detection solutions. Companies are enhancing the accessibility and reliability of cancer diagnostics by integrating AI-powered tests into clinical practice and securing regulatory approvals.

Additionally, the inclusion of AI-based diagnostic tools in national guidelines and reimbursement programs is accelerating their adoption in mainstream oncology, further expanding the market’s reach and impact.

- In February 2025, Tempus announced a partnership with Artera, the pioneers of MMAI-based cancer prognostic and predictive tests, to commercialize Artera’s advanced prostate cancer risk stratification test. The ArteraAI Prostate Test, an AI-driven algorithm that evaluates digital biopsy images and clinical data to predict patient outcomes and treatment effectiveness, is the first AI-based test to be included in a national guideline.

Key Companies in AI in Cancer Diagnostics Market:

- Siemens Healthineers AG

- GE HealthCare

- Quest Diagnostics Incorporated

- Paige AI, Inc.

- Ibex Medical Analytics Inc.

- Hoffmann-La Roche Ltd

- Mindpeak GmbH

- Lunit Inc.

- Tempus AI, Inc.

- Azra AI

- Freenome Holdings, Inc.

- Kheiron Medical Technologies Limited

- Median Technologies

Recent Developments (Partnerships/Product Launch)

- In March 2025, Mindpeak partnered with AstraZeneca to assess and implement its AI-powered solution for early breast cancer detection across multiple centers globally. The collaboration aims to explore the impact of AI on improving diagnostic accuracy, streamlining pathology workflows, and assisting pathologists in detecting invasive breast cancer and Ductal Carcinoma in Situ (DCIS) more efficiently and at earlier stages.

- In January 2025, Tempus introduced xT CDx, its FDA-approved, NGS-based in vitro diagnostic device. xT CDx is a 648-gene next-generation sequencing test designed for solid tumor profiling, including microsatellite instability status and companion diagnostic claims for colorectal cancer patients. Utilizing a normal-matched approach, where both tumor and normal patient samples undergo parallel DNA sequencing, the test enhances the accuracy of identifying cancer-driving somatic variants.

- In December 2024, Siemens Healthineers launched the Acuson Sequoia 3.5, a major software and hardware upgrade to the Acuson Sequoia ultrasound system, integrating AI-powered features to enhance workflow, efficiency, and clinical performance. The update includes AI Abdomen with improved ergonomics, along with new solutions for breast and musculoskeletal (MSK) imaging. With AI-driven detection, labeling, and measurements, the system streamlines diagnostics for conditions like kidney stones, digestive issues, and cancerous tumors, allowing clinicians to focus more on patient care.

- In January 2024, Paige introduced an AI-powered application capable of detecting cancer across more than 17 tissue types, including skin, lung, and the gastrointestinal tract, as well as various rare tumors and metastatic deposits.