Market Definition

The market involves the use of microorganisms, such as bacteria, fungi, and algae, to enhance soil health, improve crop yield, and protect plants from pests and diseases. These microbes are formulated into biological products like biofertilizers, biopesticides, and biostimulants.

They play a key role in promoting sustainable farming practices by reducing the need for chemical inputs. Common applications include soil enrichment, pest control, and plant growth promotion, offering an eco-friendly alternative to traditional agricultural chemicals. This report highlights key market drivers, major trends, regulatory frameworks, and the competitive landscape shaping the industry’s growth.

Agriculture Microbial Market Overview

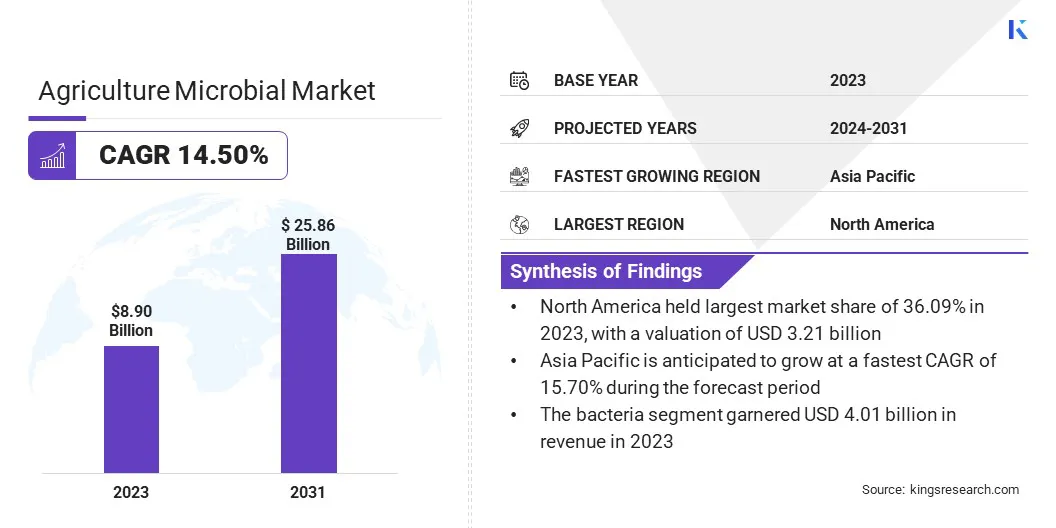

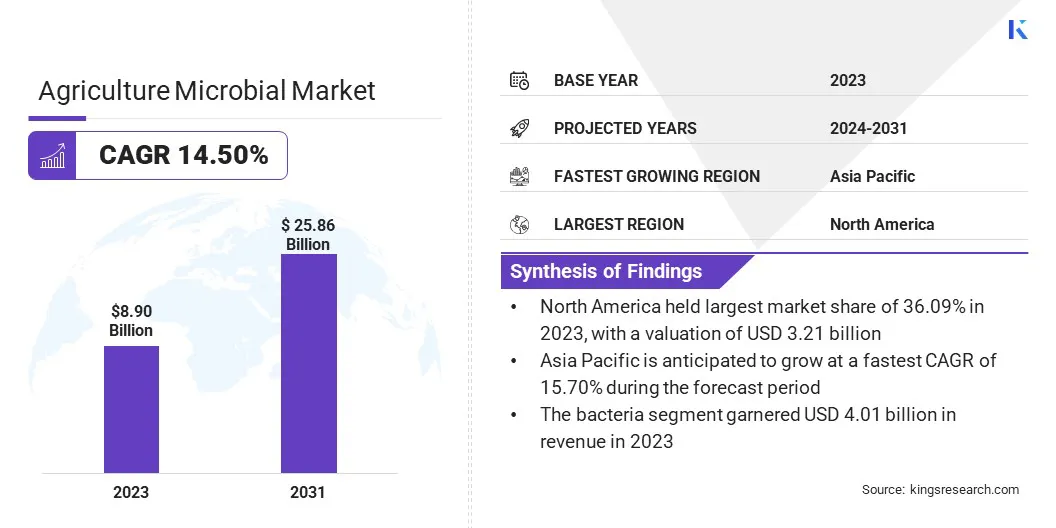

The global agriculture microbial market size was valued at USD 8.90 billion in 2023 and is projected to grow from USD 10.02 billion in 2024 to USD 25.86 billion by 2031, exhibiting a CAGR of 14.50% during the forecast period.

The market is growing due to the increasing crop yields through microbial solutions, which help enhance nutrient uptake and plant resilience. Additionally, advances in microbial research and product innovation are leading to more effective and targeted formulations, supporting wider adoption of biologicals in modern farming systems, in turn boosting market expansion.

Major companies operating in the agriculture microbial industry are BASF, Syngenta Crop Protection AG, Novozymes A/S, Bayer AG, FMC Corporation, Valent BioSciences LLC, Certis USA L.L.C., UPL, ADAMA, AgBiome, Inc., Zytex, Biome Makers Inc., BioWorks, Inc, Corteva, and Koppert.

The shift toward sustainable farming is a major factor driving the growth of the market. Farmers and agribusinesses are increasingly focusing on eco-friendly solutions such as microbial fertilizers, biopesticides, and soil enhancers that enhance crop productivity without degrading soil health.

Agricultural microbials offer a reliable alternative to chemical-based products, helping reduce the environmental impact of farming operations. This trend is gaining momentum across both developed and developing countries, making microbials an essential tool for sustainable crop production.

Key Highlights

- The agriculture microbial industry size was valued at USD 8.90 billion in 2023.

- The market is projected to grow at a CAGR of 14.50% from 2024 to 2031.

- North America held a market share of 36.09% in 2023, with a valuation of USD 3.21 billion.

- The bacteria segment garnered USD 4.01 billion in revenue in 2023.

- The soil amendment segment is expected to reach USD 10.87 billion by 2031.

- The fruits & vegetables segment secured the largest revenue share of 39.12% in 2023.

- The dry is poised for a robust CAGR of 17.81% through the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 15.70% during the forecast period.

Market Driver

Increasing Crop Yields Through Microbial Solutions

The ability of microbial products to boost crop yields is increasing their demand, contributing significantly to the growth of the market. Microbials improve nutrient uptake, stimulate plant growth, and offer protection against pests and diseases.

These benefits lead to higher productivity and better profitability for farmers. As food demand continues to rise globally, the need for yield-enhancing technologies is strengthening the demand for microbial solutions, thereby driving the growth of the market.

- In April 2024, the ICAR-Indian Institute of Spices Research (ICAR-IISR), Kozhikode, introduced three newly developed microbial formulations incorporating granular lime and gypsum. Created using IISR’s proprietary, patent-pending technology, these formulations are designed to enhance agricultural productivity by simultaneously correcting soil pH and delivering beneficial microorganisms in a single application.

Market Challenge

Regulatory Hurdles and Slow Approval Processes

A significant challenge facing the growth of the agriculture microbial market is the complex and time-consuming regulatory approval processes for microbial products. These products require extensive testing and data to demonstrate their safety and effectiveness, which can delay market entry.

To address this, companies are investing in improved research and development to meet regulatory requirements more efficiently. Market players are also working closely with regulatory bodies to streamline the approval process. Additionally, partnerships with local agricultural agencies help ensure faster adoption and compliance with regional regulations, enabling quicker access to the market.

Market Trend

Advances in Microbial Research and Product Innovation

Continuous advancements in microbial research are improving the effectiveness and stability of microbial products, fueling the growth of the market.

Innovations in formulation technologies, strain development, and delivery mechanisms are enhancing product performance under varied field conditions. Companies are increasingly investing in R&D to create crop-specific and region-specific microbial solutions, which is helping expand the application of microbial products in mainstream agriculture.

- In December 2024, BioConsortia, Inc. entered into an agreement with New Zealand-based H&T. Under this agreement, H&T will introduce BioConsortia’s innovative FixiN 33 microbial seed treatment in New Zealand. Targeting key crops such as corn, brassicas, and cereals, the FixiN 33 seed coating aims to enhance nitrogen-use efficiency, support sustainable fertilizer practices, and reduce nitrogen runoff.

Agriculture Microbial Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Bacteria, Fungi, Virus, Others

|

|

By Function

|

Soil Amendment, Crop Protection, Seed Treatment

|

|

By Crop Type

|

Cereals & Grains, Fruits & Vegetables, Oilseeds & Pulses, Others

|

|

By Formulation

|

Liquid, Dry

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Type (Bacteria, Fungi, Virus, Others): The bacteria segment earned USD 4.01 billion in 2023 due to its broad-spectrum functionality, including nitrogen fixation, phosphate solubilization, and plant growth promotion.

- By Function (Soil Amendment, Crop Protection, Seed Treatment): The soil amendment segment held 50.12% of the market in 2023, due to its crucial role in improving soil structure, enhancing microbial activity, and increasing nutrient availability.

- By Crop Type (Cereals & Grains, Fruits & Vegetables, Oilseeds & Pulses, and Others): The fruits & vegetables segment is projected to reach USD 10.38 billion by 2031, owing to the high demand for residue-free produce and the increased adoption of biologicals to maintain crop quality and extend shelf life.

- By Formulation (Liquid and Dry): The dry segment is poised for significant growth at a CAGR of 17.81% through the forecast period, attributed to its longer shelf life, ease of storage and transportation, and compatibility with existing farming equipment.

Agriculture Microbial Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America agriculture microbial market share stood around 36.09% in 2023 in the global market, with a valuation of USD 3.21 billion. North America’s well-established agricultural research institutions and biotech companies are driving innovation within the market.

Ongoing research, coupled with strong public-private collaboration, is leading to the rapid development and field validation of microbial products. The presence of cutting-edge agri-biotech startups further boost innovation and commercialization, positioning North America as a hub for microbial product development. These factors are driving market growth and expanding the adoption of microbial solutions in agriculture.

- In February 2025, Pivot Bio developed nitrogen-producing microbes as a sustainable alternative to synthetic fertilizers across the U.S. These microbial colonies grow alongside the plant and release nitrogen precisely when it is needed, helping reduce nitrogen runoff. With this technology, farmers can replace up to 40 pounds of conventional nitrogen fertilizer per acre, equivalent to roughly 25% of the total nitrogen requirement for crops such as corn.

Asia Pacific is poised for significant growth at a robust CAGR of 15.70% over the forecast period. The widespread use of rice and high-value horticultural crops across Asia Pacific is contributing to the rise in microbial product use.

These crops benefit from microbial seed treatments, biofertilizers, and disease-control solutions that help optimize yields and reduce chemical input costs. Moreover, the need to maintain export quality and meet international safety standards is also pushing growers to integrate microbial inputs into their production cycles, boosting agriculture microbial market expansion.

Several governments in Asia Pacific are investing in programs to restore soil fertility and reduce land degradation. These initiatives include subsidies, training, and promotional support for biological inputs, including microbial formulations.

As part of broader sustainable agriculture goals, these programs are actively encouraging farmers to adopt microbials, which is further driving the market in Asia Pacific.

Regulatory Frameworks

- The U.S. Environmental Protection Agency (EPA) oversees the registration and regulation of microbial pesticides under the Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA). The EPA's Office of Pesticide Programs provides specific guidelines for microbial pesticides, including data requirements for product identity, manufacturing processes, toxicology, and environmental impact. Applicants must submit comprehensive data packages demonstrating the safety and efficacy of their microbial products.

- The European Food Safety Authority (EFSA) and the European Commission regulate microbial pesticides under Regulation (EC) No 1107/2009. Applicants must submit dossiers containing comprehensive data on the microorganism's identity, biological properties, toxicology, and environmental impact. The EFSA conducts risk assessments to ensure the product's safety for human health and the environment. Approved microbial pesticides are listed in the EU Pesticides Database.

- The Ministry of Agriculture and Rural Affairs (MARA) regulates microbial pesticides in China. The "Regulations on the Management of Pesticides" (State Council Decree 677) and subsequent announcements outline the requirements for registration, production, and marketing of pesticides, including microbial agents. Applicants must provide data on the microorganism's identity, efficacy, toxicology, and environmental impact.

Competitive Landscape

Key players in the agriculture microbial market are increasingly focusing on strategic partnerships and expanding their product lines to strengthen their market position. These efforts are aimed at offering more targeted and effective biological solutions across various crops and farming systems.

By collaborating with developers of agricultural biotechnology, such as those working on advanced microbial strains, fermentation processes and regional distributors, companies are broadening their reach and accelerating product availability. Moreover, the introduction of new microbial formulations is helping meet the rising demand for sustainable inputs, contributing to the growth of the market.

- In December 2024, Koppert partnered with Amoéba to launch a new biofungicide called AXPERA. Developed using Amoéba’s proprietary amoeba lysate technology, AXPERA is formulated to deliver effective protection against fungal diseases.

List of Key Companies in Agriculture Microbial Market:

- BASF

- Syngenta Crop Protection AG

- Novozymes A/S

- Bayer AG

- FMC Corporation

- Valent BioSciences LLC

- Certis USA L.L.C.

- UPL

- ADAMA

- AgBiome, Inc.

- Zytex

- Biome Makers Inc.

- BioWorks, Inc

- Corteva

- Koppert

Recent Developments (Agreements/ Product Approval)

- In May 2024, Bioceres Crop Solutions Corp announced that Brazil’s Ministry of Agriculture and Livestock (MAPA – Ministério da Agricultura e Pecuária) granted approval for three new bio-insecticidal and bio-nematocidal products. These solutions are developed using inactivated cells from the company’s proprietary Burkholderia platform.

- In May 2024, FMC Corporation entered into an agreement with Optibrium to accelerate the development of new crop protection technologies, including biopesticides. The collaboration leverages machine learning and artificial intelligence to enhance the discovery process and bring innovative solutions to market more efficiently.

- In April 2024, Bayer signed an exclusive licensing agreement with UK-based AlphaBio Control for a new biological insecticide. The product is intended for arable crops like oilseed rape and cereals. It is set for launch in 2028, subject to further development and registration.