Market Definition

The market encompasses the use of unmanned aerial vehicles (UAVs) equipped with advanced sensors, imaging systems, and AI for various agricultural tasks. These drones are utilized for crop monitoring, precision spraying, soil analysis, and field mapping.

By providing real-time data and high-resolution imagery, they enable farmers to optimize resource use, monitor crop health, and improve overall productivity. The report highlights key market drivers, major trends, regulatory frameworks, and the competitive landscape shaping the industry’s growth.

Agriculture Drones Market Overview

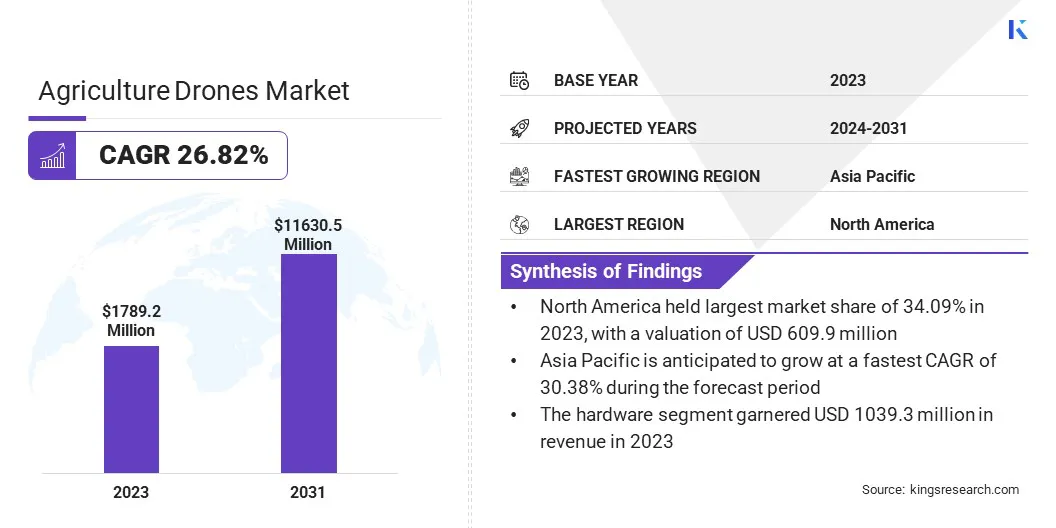

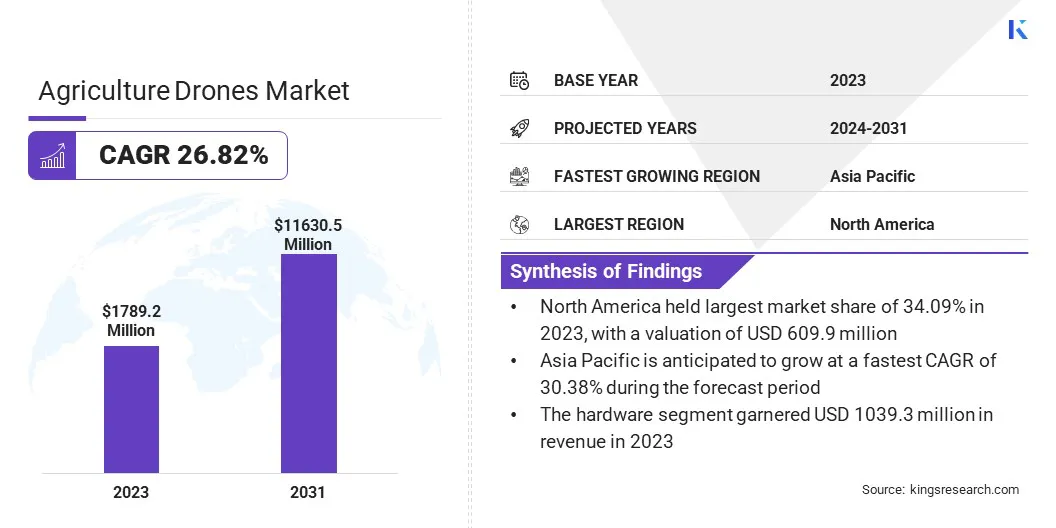

The global agriculture drones market size was valued at USD 1,789.2 million in 2023 and is projected to grow from USD 2,204.2 million in 2024 to USD 11,630.5 million by 2031, exhibiting a CAGR of 26.82% during the forecast period.

The market is driven by rising demand for precision farming and the need to optimize resource usage. Advanced drone technologies enable accurate crop monitoring and targeted application of inputs, helping farmers improve yield efficiency. These capabilities are boosting increased adoption across modern agricultural practices.

Major companies operating in the agriculture drones industry are DJI, 3DR, Inc., AgEagle Aerial Systems Inc, AeroVironment, Inc., Trimble Inc., Parrot Drone SAS, PrecisionHawk, Sentera, DroneDeploy, Microdrones GmbH, AgEagle Aerial Systems Inc., Delair, Quantum-Systems GmbH, Applied Aeronautics, and XAG Co., Ltd.

The growing emphasis on precision farming is significantly driving the growth of the market. Farmers are increasingly adopting drone technology to gather accurate data on soil conditions, crop health, and moisture levels. This data enables targeted interventions, helping reduce input costs while improving yield quality.

Drones equipped with advanced sensors and imaging systems are playing a central role in optimizing resources, enhancing decision-making, and improving overall farm productivity, thereby contributing to the broader adoption of agricultural drone solutions.

- In June 2024, Europe-based ABZ Innovation introduced a LiDAR-based situational awareness system for advanced obstacle detection and high precision in terrain following. This solution generates a high-resolution 3D map of the field in real time, enabling drones to identify obstacles with high accuracy and dynamically adjust their altitude to suit the unique requirements of each treatment.

Key Highlights

- The agriculture drones market size was valued at USD 1,789.2 million in 2023.

- The market is projected to grow at a CAGR of 26.82% from 2024 to 2031.

- North America held a market share of 34.09% in 2023, with a valuation of USD 609.9 million.

- The hardware segment garnered USD 1,039.3 million in revenue in 2023.

- The rotary-wing segment is expected to reach USD 6,809.7 million by 2031.

- The crop monitoring segment secured the largest revenue share of 40.11% in 2023.

- Asia Pacific is anticipated to grow at a CAGR of 30.38% during the forecast period.

Market Driver

Growing Popularity of Sustainable Farming Practices

The increasing focus by governments, environmental agencies, and the agricultural sector on sustainability in agriculture is boosting the growth of the market. Drones help minimize environmental impact by enabling precise application of fertilizers and pesticides, reducing chemical runoff and soil degradation.

By promoting efficient resource utilization, drones align with the goals of eco-friendly farming. This growing demand for sustainable solutions is prompting large-scale and smallholder farmers to adopt drones as part of their environmental management strategies.

In July 2024, DJI revealed that by the end of June 2024, agricultural drones had treated over 500 million hectares of farmland globally. Their exceptional efficiency has resulted in significant resource savings, including a cumulative reduction of 210 million metric tons of water and 47,000 metric tons of pesticides.

Additionally, the use of agricultural drones has cut carbon emissions by 25.72 million metric tons, an impact comparable to the carbon absorption of 1.2 billion trees, highlighting the sustainable and environmentally friendly role of drone technology in modern farming.

Market Challenge

Limited Technical Expertise Among Farmers

A major challenge impacting the agriculture drones market is the limited technical knowledge among farmers, particularly in rural regions. Operating and maintaining drones, analyzing data, and integrating insights into farming practices demand specialized training, which many farmers currently lack.

To address this, companies are investing in farmer education programs, offering user-friendly drone interfaces, and partnering with agricultural institutions to deliver hands-on training.

Additionally, market players are developing service-based models where trained operators manage drone operations, making the technology more accessible without requiring farmers to have advanced technical skills. These efforts are expanding adoption across diverse regions.

Market Trend

Integration of AI and Data Analytics in Drone Platforms

The integration of artificial intelligence and data analytics in agricultural drones is accelerating their adoption and expanding the growth of the market. AI-powered drones can analyze images in real-time, identify crop diseases, and detect variations in plant health.

Advanced data processing capabilities enable drones to generate actionable insights that help optimize farming strategies. This technology-driven approach to agriculture is improving operational efficiency and supporting more sustainable farming practices, encouraging long-term investment in drone systems.

- In April 2025, ARB IOT Group Limited introduced its Smart AI Drone, an advanced plantation mapping system powered by artificial intelligence and integrated with drone technology. Featuring high-resolution imaging, real-time data analytics, and intelligent automation, the Smart AI Drone supports precision mapping, crop health monitoring, pest detection, and automated spraying. This solution empowers farmers to make informed, data-driven decisions that enhance resource efficiency and boost overall productivity.

Agriculture Drones Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Hardware, Software & Analytics, Services

|

|

By Drone Type

|

Fixed-Wing, Rotary-Wing, Hybrid

|

|

By Application

|

Crop Monitoring, Spraying & Seeding, Soil & Field Mapping, Livestock Monitoring, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Component (Hardware, Software & Analytics, and Services): The hardware segment earned USD 1,039.3 million in 2023 due to the high demand for drone airframes, sensors, GPS modules, and spraying systems that form the core infrastructure required for precision farming operations.

- By Drone Type (Fixed-Wing, Rotary-Wing, Hybrid): The rotary-wing segment held 51.98% of the market in 2023, due to its ability to hover, maneuver in tight spaces, and perform precise spraying and monitoring tasks over complex field terrains.

- By Application (Crop Monitoring, Spraying & Seeding, Soil & Field Mapping, and Livestock Monitoring, Others): The crop monitoring segment is projected to reach USD 3,220.9 million by 2031, owing to its ability to provide real-time, precise data on crop health, enabling farmers to make informed decisions that optimize yield and resource usage.

Agriculture Drones Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America agriculture drones market share stood at around 34.09% in 2023 in the global market, with a valuation of USD 609.9 million. The presence of prominent companies in the region is significantly contributing to the market's growth.

These companies bring in expertise, innovation, and substantial investments, which are enhancing product development, expanding service offerings, and boosting competition. Advanced features such as high-resolution imaging, LiDAR sensors, and AI-based data analytics are being integrated into drones.

These innovations allow farmers to access precise field data, enhancing crop monitoring, soil analysis, and pest control. The region’s strong focus on R&D accelerates the development of more efficient, reliable, and user-friendly drone solutions, further contributes to the growth of the agriculture drones market.

- In September 2024, the University of Kentucky’s Martin-Gatton College of Agriculture, Food and Environment received a USD 910,000 grant from the U.S. Department of Agriculture (USDA) to advance drone technology for cattle management. The five-year project, titled "Precision Livestock Management: Cattle Monitoring and Herding Using Cooperative Drones," focuses on utilizing drones to assist in herding, monitoring, and gathering physiological data from beef cattle. The initiative aims to reduce labor requirements and improve operational efficiency for livestock producers.

Asia Pacific is poised for significant growth at a robust CAGR of 30.38% over the forecast period. Governments across the Asia-Pacific region are actively supporting the integration of drone technology into agriculture through subsidies, funding programs, and regulatory reforms.

These initiatives aim to help farmers enhance productivity and address challenges such as labor shortages, crop management, and resource optimization. The region's focus on boosting agricultural innovation through policy support is significantly driving the growth of the agricultural drones market.

- In November 2024, the Department of Agriculture & Farmers Welfare (DoA&FW), India, introduced the Namo Drone Didi Scheme. It aims to empower 14,500 Women Self-Help Groups (SHGs) under the Deendayal Antyodaya Yojana-National Rural Livelihood Mission (DAY-NRLM) initiative by utilizing drone technology for agricultural services. The scheme aims to empower Women SHGs by equipping them with drones for offering rental services in fertilizer and pesticide application to improve crop yields and reduce operational costs.

Regulatory Frameworks

- In the U.S., the Federal Aviation Administration (FAA) regulates agricultural drones under Part 107 of the Federal Aviation Regulations. This includes requirements for remote pilot certification, operational limits, and airspace restrictions. For agricultural operations, drones must comply with the "No Permission, No Takeoff" (NPNT) policy, which mandates that drones be registered and approved through the FAA's Digital Sky Platform before flight.

- In the UK, the Civil Aviation Authority (CAA) oversees drone operations. Recent regulatory changes aim to allow drones to operate beyond visual line of sight (BVLOS) in "atypical" environments, such as remote areas and over open water. This expansion is supported by a USD 20.46 million investment into the CAA to develop a regulatory framework enabling such operations by 2026.

- Japan's Ministry of Land, Infrastructure, Transport and Tourism (MLIT) oversees drone regulations. Since 2015, agricultural drones must be registered with a special organization to spray pesticides, fertilizers, and seeds.

Competitive Landscape

Market players are increasingly focusing on strategies such as enhancing technological capabilities and broadening their product offerings to stay competitive and meet evolving customer needs.

By integrating advanced features into drone systems and introducing specialized solutions for diverse agricultural applications, companies are improving operational efficiency and data accuracy for end users. Market players are supporting wider adoption across varying terrains and farming practices, while also addressing challenges related to precision, scalability, and reliability.

- In September 2024, Trimble introduced the APX RTX portfolio, a premium direct georeferencing solution designed for mapping sensors on uncrewed aerial vehicles (UAVs). Tailored for original equipment manufacturers (OEMs) and drone payload integrators, this technology enables users to operate drones continuously across diverse and challenging environments. The solution enhances mapping efficiency and supports the delivery of highly accurate and dependable geospatial data products with improved speed and reliability.

List of Key Companies in Agriculture Drones Market:

- DJI

- 3DR, Inc.

- AgEagle Aerial Systems Inc

- AeroVironment, Inc.

- Trimble Inc.

- Parrot Drone SAS

- PrecisionHawk

- Sentera

- DroneDeploy

- Microdrones GmbH

- AgEagle Aerial Systems Inc.

- Delair

- Quantum-Systems GmbH

- Applied Aeronautics

- XAG Co., Ltd.

Recent Developments (Partnerships/Collaboration/Product Launch)

- In April 2024, DJI introduced its latest agricultural drones, the Agras T50 and Agras T25 on a global scale, alongside an enhanced version of the SmartFarm app. The Agras T50 is engineered for large-scale farming operations, delivering improved stability, efficiency, and precision. The compact Agras T25 is tailored for smaller plots. Both models are equipped with advanced obstacle avoidance, rapid charging capabilities, and high payload support for spraying and spreading tasks. The updated SmartFarm app enhances drone management and streamlines data visualization for users.

- In February 2024, Trimble Inc. partnered with DroneDeploy to integrate its Applanix POSPac Cloud post-processed kinematic GNSS positioning service, which includes CenterPoint RTX, into DroneDeploy’s reality capture platform. This collaboration enables DroneDeploy users to access centimeter-level positioning accuracy while streamlining drone mapping and data collection processes through an automated workflow.

- In January 2024, Trimble Inc. collaborated with the Indian Institute of Technology Kanpur (IIT Kanpur) to support a new UAV initiative within the Department of Aerospace Engineering. The collaboration focuses on building expertise in UAV georeferencing and incorporating the technology into academic programs, research activities, and practical applications across sectors such as agriculture and telecommunications.

the