Enquire Now

Agriculture Analytics Market Size, Share, Growth & Industry Analysis, By Offering (Solutions, Services), By Deployment Mode (On-premises, Cloud), By Farm Size (Large Farms, Small and Medium-sized Farms), By Application (Precision Farming, Livestock Farming, Aquaculture Farming, Vertical Farming, Others) & Regional Analysis, 2025-2032

Pages: 210 | Base Year: 2024 | Release: September 2025 | Author: Versha V.

Key strategic points

Agriculture analytics involves the use of advanced technologies, data management tools, and statistical methods to analyze agricultural data for better decision-making. It combines sensors, satellite imagery, machine learning, and predictive modeling to optimize farming practices and resource use.

The market covers diverse areas such as crop monitoring, soil analysis, weather forecasting, and livestock management. These solutions support higher productivity, reduced operational costs, and improved sustainability across farming operations of various sizes and types.

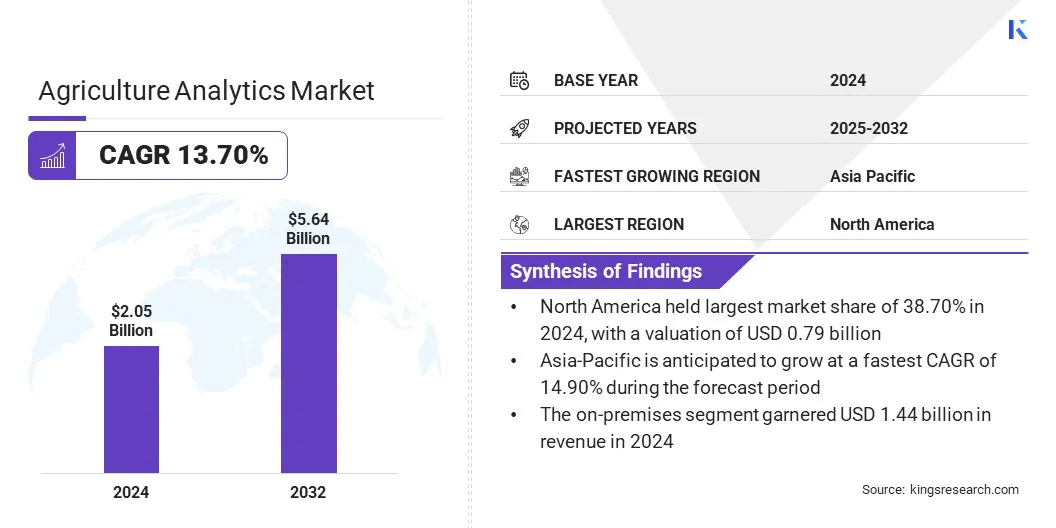

The global agriculture analytics market size was valued at USD 2.05 billion in 2024 and is projected to grow from USD 2.30 billion in 2025 to USD 5.64 billion by 2032, exhibiting a CAGR of 13.70% over the forecast period.

This growth is attributed to the increasing adoption of precision farming solutions aimed at improving crop yields and optimizing resource utilization. The rising use of IoT-enabled sensors, satellite imagery, and predictive analytics tools is fueling market expansion across diverse agricultural applications.

Major companies operating in the agriculture analytics market are SAS Institute Inc., Bayer AG, Trimble Inc., Deere & Company, SAP SE, IBM, Corteva, ABACO S.p.A., Farmers Edge Inc., Iteris, Inc., Stesalit Inc., AGRIVI, Farmer's Business Network, Inc., DeLaval, and Taranis.

Growing focus on sustainable farming practices, minimizing environmental impact, and enhancing operational efficiency is accelerating the demand for advanced analytics platforms. Additionally, advancements in artificial intelligence and machine learning, along with supportive government initiatives for smart agriculture, are contributing to the market growth.

Increasing Adoption of Precision Farming Practices

The growth of the market is fueled by the increasing adoption of precision farming practices aimed at enhancing crop productivity and optimizing resource utilization.

Farmers are increasingly relying on IoT-enabled sensors, satellite imagery, drones, and predictive analytics to monitor soil health, track crop growth, and manage irrigation schedules with greater accuracy. This enables targeted application of fertilizers and pesticides, reducing input costs while minimizing environmental impact.

The shift toward precision farming is further supported by advancements in artificial intelligence, machine learning, and big data platforms, which provide actionable insights for real-time decision-making. Rising government support for smart agriculture initiatives and the growing need to ensure food security amid population growth are accelerating the integration of precision farming technologies worldwide.

Limited Digital and Analytical Skills in the Farming Community

Limited digital and analytical skills in the farming community remain a critical challenge for the growth of the agriculture analytics market, particularly in regions where small and medium-sized farms dominate the agricultural landscape.

Many farmers lack familiarity with advanced technologies such as IoT-enabled sensors, farm management software, and predictive analytics platforms, making it difficult to fully leverage the benefits of data-driven agriculture.

This skills gap results in underutilization of available tools, inefficient decision-making, and slower adoption of modern farming practices. Moreover, the absence of structured training programs, inadequate technical support, and limited access to localized educational resources further hinders market growth.

Addressing this challenge requires the development of user-friendly platforms, targeted farmer training initiatives, and collaborative efforts between technology providers, government agencies, and agricultural extension services. Such measures can enhance farmers’ digital literacy, improve operational efficiency, and accelerate the adoption of precision agriculture solutions.

Surging Deployment of Cloud Analytics Platforms

The increasing deployment of cloud analytics platforms is transforming agricultural operations by offering flexible and scalable solutions for managing and analyzing farm data. These platforms provide real-time access to critical insights on crop health, soil conditions, weather patterns, and market dynamics, enabling data-driven decisions without the need for extensive on-premises systems.

Contrary to traditional software models, cloud-based solutions allow farmers and agribusinesses to scale resources as needed, reduce upfront technology costs, and access advanced analytics capabilities from any location. This enhances collaboration among farmers, agronomists, researchers, and supply chain partners, thereby streamlining operations and improving productivity.

Furthermore, advancements in cloud security, integration with IoT devices and remote sensing technologies, and the expansion of rural connectivity are enhancing reliability, data accuracy, and user adoption.

|

Segmentation |

Details |

|

By Offering |

Solutions, and Services |

|

By Deployment Mode |

On-premises, and Cloud |

|

By Farm Size |

Large Farms, and Small and Medium-sized Farms |

|

By Application |

Precision Farming, Livestock Farming, Aquaculture Farming, Vertical Farming, and Others |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific |

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

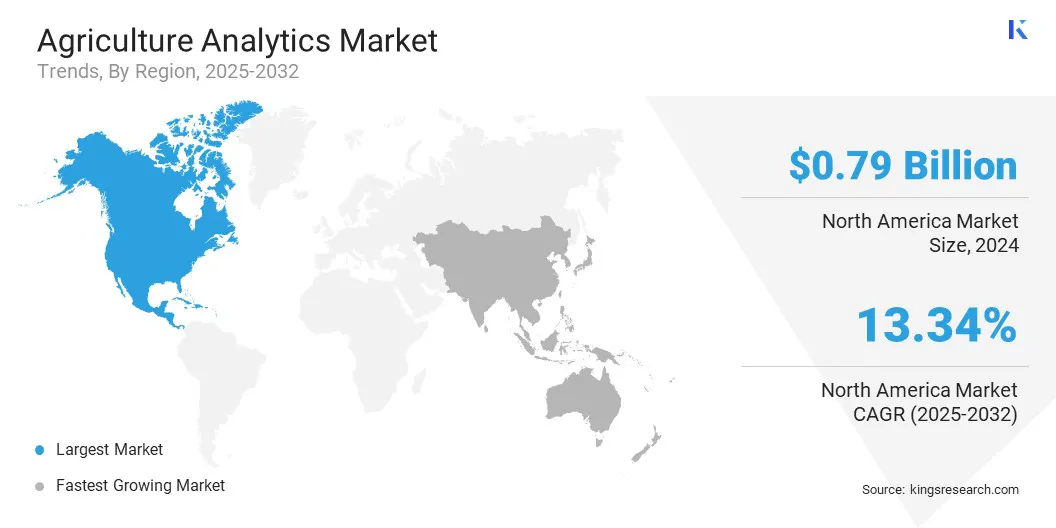

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America agriculture analytics market share stood at 38.70% in 2024, with a valuation of USD 0.79 billion. This dominance is attributed to the region’s advanced agricultural infrastructure, strong digital connectivity, and presence of leading analytics providers.

The early adoption of precision farming tools, remote sensing technologies, and farm management platforms is enabling farmers to make data-driven decisions that enhance productivity and sustainability.

Additionally, substantial investments in agri-tech innovations, supported by favorable government policies and research funding, are accelerating the deployment of analytics solutions across various farming applications. The increasing focus on resource efficiency, environmental stewardship, and supply chain optimization is further driving market growth across North America.

Asia-Pacific is poised for a CAGR of 14.90% over the forecast period. This growth is attributed to rapid digitalization in agriculture, expanding rural internet access, and increasing demand for improved crop productivity to support a growing population.

The region’s rising investments in agri-tech startups, government initiatives focused on smart farming, and the modernization of agricultural practices are driving the adoption of advanced analytics solutions.

Supportive policies promoting sustainable agriculture and technology integration, along with the growing use of mobile advisory services and cloud-based platforms, are accelerating market growth across this region.

Additionally, partnerships between technology providers, research institutions, and farmers are boosting innovation and improving accessibility, driving sustained growth in the market in the Asia-Pacific.

Companies operating in the agriculture analytics market are actively working to expand their market presence by driving technological innovation and expanding their product portfolios.

Leading players are actively investing in research and development to improve data accuracy, platform interoperability, real-time analytics, and cybersecurity, aiming to deliver scalable and cost-effective agriculture analytics solutions.

Market players are developing advanced technologies, including AI-powered predictive models, IoT-integrated monitoring systems, and cloud-based platforms, to meet the diverse needs of modern farming operations and stay competitive.

Additionally, they are collaborating with government bodies, agricultural research institutions, and technology providers to secure long-term projects, enhance deployment capabilities, and strengthen their foothold across both established and emerging agricultural sectors.

Frequently Asked Questions