Market Definition

The market involves the production and supply of plastic materials used in the design and manufacturing of aircraft, spacecraft, and related systems such as interiors, insulation, avionics enclosures, ducts, and structural components.

They offer advantages such as reduced weight, durability, and resistance to extreme temperatures and pressure variations. The market is driven by technological advancements, increasing demand for fuel-efficient aircraft, and growing space exploration activities.

The report outlines the primary drivers of market growth, along with an in-depth analysis of emerging trends and evolving regulatory frameworks shaping the industry's trajectory.

Aerospace Plastics Market Overview

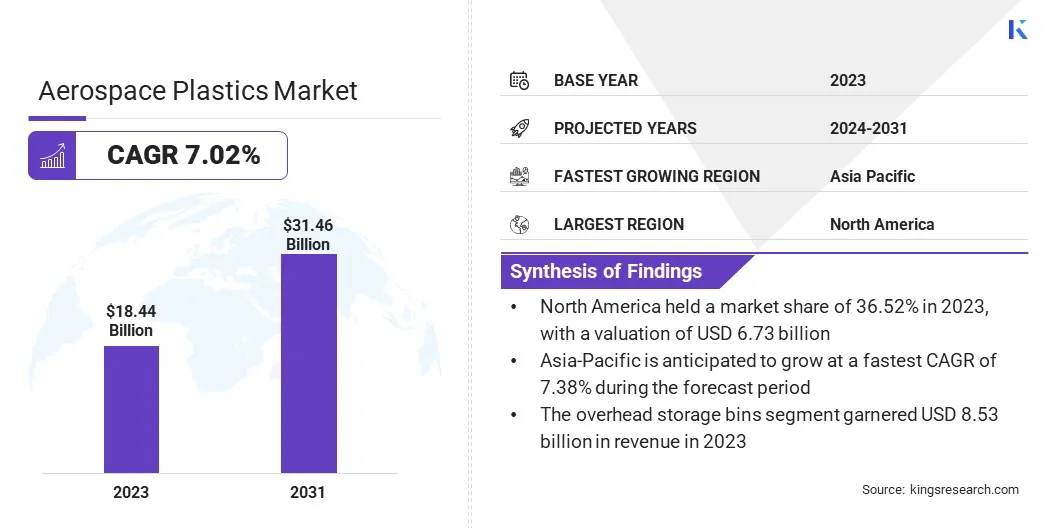

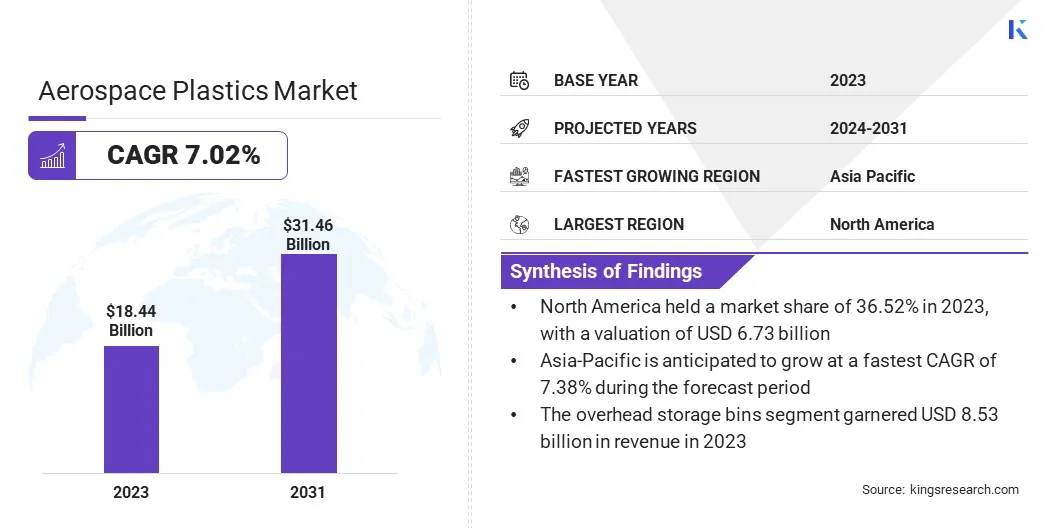

The global aerospace plastics market size was valued at USD 18.44 billion in 2023 and is projected to grow from USD 19.57 billion in 2024 to USD 31.46 billion by 2031, exhibiting a CAGR of 7.02% during the forecast period.

Technological advancements in 3D printing, such as SLS and FDM, are driving the market by enabling lightweight, high-performance components. The shift towards bio-based and recyclable plastics enhances sustainability, reduces carbon footprints, and meets regulatory standards, providing companies with a competitive advantage.

Major companies operating in the aerospace plastics industry are Victrex plc, Ensinger, SABIC, Solvay, BASF Corporation, Toray Advanced Composites, Saint-Gobain Aerospace, DuPont, Celanese Corporation, The Mitsubishi Chemical Group of companies, PPG Industries Inc, Röchling, Evonik Industries AG, Drake Plastics, and Grafix Plastics.

Technological advancements in 3D-printed aerospace parts such as Selective Laser Sintering (SLS), Fused Deposition Modeling (FDM) are driving the growth of the market. These advancements enable the production of lightweight, high-performance components with complex geometries that traditional manufacturing methods cannot achieve.

- In February 2025, Materialise launched its Aerospace Competence Center in the Aerospace Innovation Hub in Delft, Europe.

Key Highlights

- The aerospace plastics industry size was recorded at USD 18.44 billion in 2023.

- The market is projected to grow at a CAGR of 7.02% from 2024 to 2031.

- North America held a market share of 36.52% in 2023, with a valuation of USD 6.73 billion.

- The PEEK (polyetheretherketone) segment garnered USD 7.07 billion in revenue in 2023.

- The cabin windows & windshields segment is expected to reach USD 7.72 billion by 2031.

- The commercial & freighter aircraft segment is anticipated to witness the fastest CAGR of 7.98% during the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 7.38% during the forecast period.

Market Driver

"Sustainable Materials Fuel Development of Bio-Based and Recyclable Plastics in Aerospace"

The increasing emphasis on sustainability is driving the development of bio-based and recyclable plastics for aerospace applications. These eco-friendly materials offer significant environmental benefits by reducing reliance on traditional, non-renewable resources.

By incorporating bio-based plastics, aerospace companies are lowering carbon footprints and enhancing fuel efficiency. This also helps them to meet stringent regulatory standards.

- For instance, in September 2024, Toray Advanced Composites launched Toray Cetex TC1130 PESU thermoplastic composite. This high-performance composite is designed to meet the increasing demand for lightweight and sustainable materials in aircraft interiors.

Market Challenge

"Ensuring Aerospace Plastics Meet Standards"

Compliance with stringent safety, performance, and regulatory standards is essential for the widespread adoption of aerospace plastics. These materials undergo comprehensive testing to ensure durability and reliability.

Manufacturers face the challenge of aligning product innovation with strict regulatory compliance, as non-adherence can result in operational disruptions, legal liabilities, and financial penalties. Manufacturers are tackling these challenges by prioritizing advanced testing and quality control to meet safety and performance standards.

By collaborating with regulatory bodies and consistently innovating their products, they ensure that new materials comply with required regulations. Furthermore, adopting strong compliance management systems helps mitigate legal risks and penalties.

Market Trend

"Bio-Based and Recyclable Plastics Transform Aerospace Industry"

The adoption of bio-based and recyclable plastics is reshaping the aerospace plastics market, driven by the industry's increasing focus on environmental responsibility. These materials offer a reduced carbon footprint and support the circular economy by enabling recyclability and reducing waste.

Manufacturers are integrating eco-friendly alternatives to meet evolving regulatory standards and market demand for greener solutions.This trend enhances operational efficiency and provides a competitive edge for companies committed to sustainability in the aerospace sector.

- In June 2024, Airbus annouched that the company is developing bio-based carbon fibers to replace traditional materials used in structural components like wings and fuselage. The company aims to achieve equivalent performance and safety while reducing carbon emissions in production.

Aerospace Plastics Market Report Snapshot

|

Segmentation

|

Details

|

|

By Polymer Type

|

PEEK (Polyetheretherketone), PMMA (Polymethyl Methacrylate), ABS (Acrylonitrile Butadiene Styrene), Others

|

|

By Application

|

Cabin Windows & Windshields, Cabin Lighting, Overhead Storage Bins, Others

|

|

By End Use

|

Commercial & Freighter Aircraft, General Aviation, Military Aircraft, Rotary Aircraft

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Polymer Type (PEEK (Polyetheretherketone), PMMA (Polymethyl Methacrylate), ABS (Acrylonitrile Butadiene Styrene), Others): The PEEK (polyetheretherketone) segment earned USD 7.07 billion in 2023 due to its exceptional strength, high-temperature resistance, and durability.

- By Application (Cabin Windows & Windshields, Cabin Lighting, Overhead Storage Bins, and Others): The overhead storage bins segment held 46.51% of the market in 2023, due to their essential role in maximizing cabin space and enhancing passenger comfort in commercial aircraft.

- By End Use (Commercial & Freighter Aircraft, General Aviation, Military Aircraft, and Rotary Aircraft): The commercial & freighter aircraft segment is projected to reach USD 14.17 billion by 2031, owing to the growing demand for air travel and the expansion of global cargo transportation.

Aerospace Plastics Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America aerospace plastics market share stood around 36.52% in 2023 in the global market, with a valuation of USD 6.73 billion. North America's dominance in the market is attributed to the well-established aerospace industry, led by key players such as Boeing and Lockheed Martin.

Key growth drivers in the region include continuous technological advancements, substantial government investments, and advanced R&D infrastructure. Additionally, increasing demand for commercial and cargo aircraft, further drives the demand for high-performance aerospace plastics.

- In August 2024, Trelleborg Group, through its Trelleborg Sealing Solutions division, signed an agreement to acquire Magee Plastics, a leading manufacturer of high-performance thermoplastic and composite materials for the aerospace industry. Through this acquisition, Trelleborg aims to enhance its capabilities in thermoforming and vacuum forming, expanding its interior fittings offerings and aftermarket services.

Asia-Pacific aerospace plastics industry is poised for significant growth at a robust CAGR of 7.38% over the forecast period. A key driver of market growth in the Asia-Pacific region is the strategic shift toward domestic aerospace manufacturing.

The market in the Asia Pacific region is experiencing growth due to rising investments in domestic aerospace manufacturing capabilities. Governments and defense organizations are increasingly supporting the localization of production to enhance self-reliance and reduce dependence on foreign suppliers.

This trend is fueling demand for high-performance plastic materials used in the production of avionics, wiring, and structural components. The growing emphasis on indigenous defense manufacturing, combined with a skilled workforce and expanding infrastructure, is positioning the region as a key hub for aerospace production.

- In November 2024, Boeing Defence Australia (BDA) received Military Production Organisation Approval from Defence Aviation Safety Authority (DASA), for local manufacturing of aerospace parts for the Australian Defence Force (ADF). This allows BDA to mass-produce avionics, wiring, and structural components in Australia.

Regulatory Frameworks

- In Asia Pacific, Japan Civil Aviation Bureau (JCAB) standards regulate the safety and certification of materials, including plastics, for aircraft manufacturing, ensuring market access and product approval.

- In North America, the federal aviation administration establishes strict safety and certification standards for aerospace materials, including plastics, ensuring performance and durability. The environmental protection agency enforces environmental regulations on material use, disposal, and recycling, promoting the adoption of sustainable, eco-friendly plastics in aerospace manufacturing.

- In Europe, aerospace plastics are regulated by the European Union Aviation Safety Agency (EASA) for safety and certification, while the European Chemicals Agency (ECHA) enforces REACH regulations on material safety and environmental impact, promoting sustainable, eco-friendly plastics in aerospace manufacturing.

Competitive Landscape

The market is characterized by a large number of participants, including both established corporations and rising organizations. Key players in the aerospace plastics industry are adopting strategic initiatives, including mergers and acquisitions, to strengthen their market position and expand their product portfolios.

Additionally, the launch of innovative products is driving growth by addressing evolving customer demands and enhancing operational capabilities. These strategies enable companies to leverage synergies, gain access to new technologies, and expand their geographical reach, thereby positioning themselves to capitalize on emerging opportunities and further accelerate the growth of the market.

- In April 2023, Solvay and GKN Aerospace extended their collaboration to enhance the use of thermoplastic composite materials in aerospace structures. The partnership focuses on developing a joint roadmap for new materials and manufacturing processes, targeting high-rate programs.

List of Key Companies in Aerospace Plastics Market:

- Victrex plc

- Ensinger

- SABIC

- Solvay

- BASF Corporation

- Toray Advanced Composites

- Saint-Gobain Aerospace

- DuPont

- Celanese Corporation

- The Mitsubishi Chemical Group of companies

- PPG Industries Inc

- Röchling

- Evonik Industries AG

- Drake Plastics,

- Grafix Plastics.

Recent Developments

- In October 2024, Ensinger launched the TECAPART online platform to simplify ordering CNC-manufactured plastic parts. This new platform allows customers to easily upload CAD models and technical drawings to receive quick quotations for turned and milled parts made from high-performance plastics like PEEK, POM, and PA.

- In November 2023, Drake Plastics unveiled plans to establish a new headquarters to double its manufacturing output. The company aims to enhance its capacity and strengthen the supply chain within the high-performance polymers industry