Market Definition

Aerosol propellants are pressurized gases or liquefied substances used to expel the active ingredients from a container in the form of a fine mist, spray, or foam. These propellants provide the necessary force to deliver the product uniformly and efficiently.

They are commonly found in applications such as personal care items, household products, and industrial aerosols. Typical types of aerosol propellants include hydrocarbons, compressed gases, and environmentally friendly alternatives designed to reduce their impact on the ozone layer.

Aerosol Propellants Market Overview

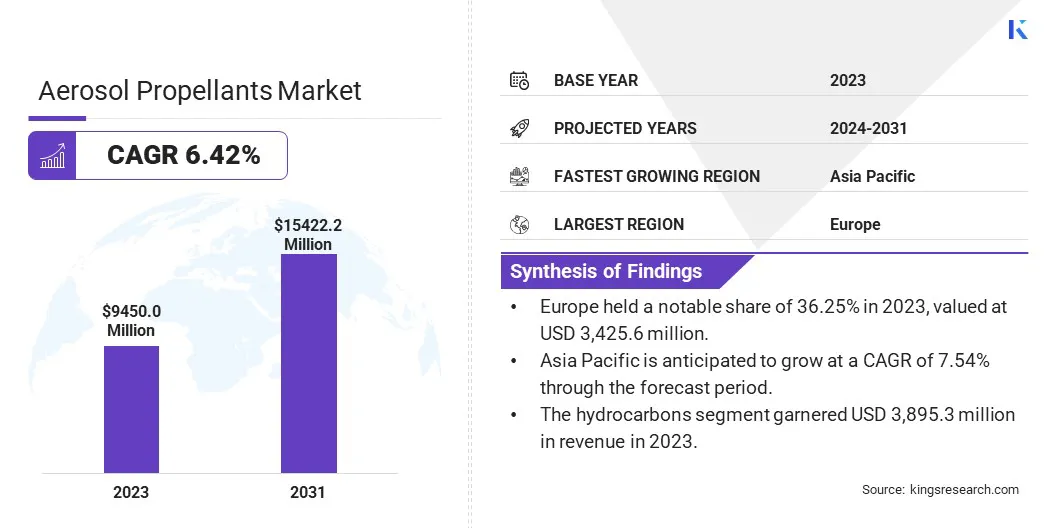

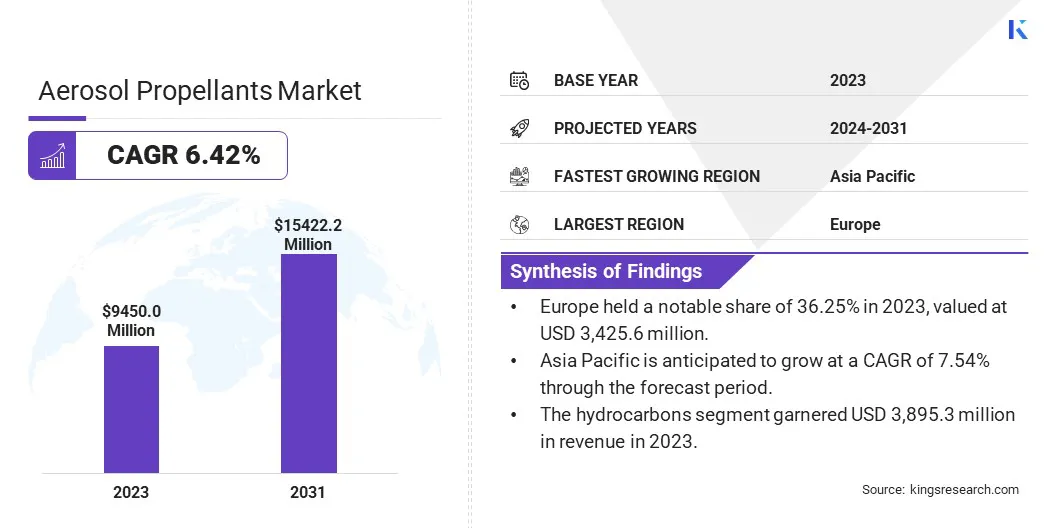

Global aerosol propellants market size was valued at USD 9,450.0 million in 2023, which is estimated to be valued at USD 9,977.4 million in 2024 and reach USD 15,422.2 million by 2031, growing at a CAGR of 6.42% from 2024 to 2031.

The growth of the market is driven by increasing demand for personal care products, such as deodorants and hairsprays, and their expanding use in household and industrial applications, including air fresheners and spray paints.

Advancements in eco-friendly propellants with low environmental impact, rising disposable incomes in emerging economies, and the growing adoption of aerosol-based solutions in the healthcare sector for drug delivery systems further contribute to market expansion globally.

Major companies operating in the aerosol propellants market are The Chemours Company, Nouryon, DuPont, ENOC Company, DiversifiedCPC, Arkema, Shell Group, Honeywell International Inc., AkzoNobel N.V., Repsol, AEROPRES CORPORATION, Linde PLC, MITSUBISHI GAS CHEMICAL COMPANY, INC., AVEFLOR, a.s., GTS SPA, and others.

The rising prevalence of respiratory conditions such as asthma and chronic obstructive pulmonary disease (COPD), coupled with advancements in drug delivery systems, is spurring the demand for aerosol-based pharmaceutical solutions.

- The World Health Organization's 2024 data reveals that chronic obstructive pulmonary disease (COPD) ranked as the fourth leading cause of death globally in 2021, responsible for 3.5 million fatalities , or roughly 5% of all deaths worldwide. Additionally, COPD ranked as the eighth leading contributor to poor health globally.

Increased healthcare spending and the growing elderly population further contribute the growth of the market. The importance of aerosol propellants in ensuring precise and efficient medication delivery underscores their growing significance in the healthcare industry.

Key Highlights:

- The global aerosol propellants market size was recorded at USD 9,450.0 million in 2023.

- The market is projected to grow at a CAGR of 6.42% from 2024 to 2031.

- Europe held a notable share of 36.25% in 2023, valued at USD 3,425.6 million.

- The hydrocarbons segment garnered USD 3,895.3 million in revenue in 2023.

- The personal care segment is expected to reach USD 6,037.7 million by 2031.

- Asia Pacific is anticipated to grow at a CAGR of 7.54% through the forecast period.

Market Driver

"Rising Demand for Personal Care Products"

The increasing focus on personal grooming and hygiene is boosting the growth of the aerosol propellants market. Products such as deodorants, hairsprays, and shaving foams are experiencing increased demand, particularly in urban areas, where consumers prioritize convenience and quality.

- In May 2023, Sure, a leading deodorant brand in the UK, introduced two new scents to its 72-hour aerosol range: Sure Nonstop Freesia & Waterlily for women and Sure Men Nonstop Sensitive for men. Trials across the UK showed high shopper satisfaction, with 72% of participants who switched to the product providing positive feedback.

The growing youth population and rising disposable incomes are influencing purchasing behavior, leading to the widespread adoption of aerosol-based personal care products. In addition, global beauty and personal care brands are expanding their product portfolios with innovative aerosol solutions, aligning with changing consumer preferences.

Market Challenge

"Environmental Impact of Traditional Propellants"

A significant challenge hindering the growth of the aerosol propellants market is the environmental impact of traditional propellants, particularly hydrofluorocarbons (HFCs) and butane, which contribute to global warming and ozone depletion. As regulations become stricter globally, companies face increasing pressure to reduce their carbon footprint and adopt more sustainable alternatives.

To address this challenge, several companies are shifting toward eco-friendly propellants such as hydrofluoroolefins (HFOs) and compressed air. These alternatives offer similar performance while significantly reducing greenhouse gas emissions.

Additionally, companies are investing in innovative technologies and collaborating with research institutions to develop new, environmentally responsible propellant solutions, ensuring compliance with evolving regulations.

Market Trend

"Innovations in Eco-Friendly Propellants"

The adoption of sustainable practices is fueling advancements in eco-friendly aerosol propellants. Companies are investing heavily in research and development to create propellants with low global warming potential (GWP) and zero ozone depletion potential (ODP), addressing growing environmental concerns.

- In 2023, Unilever reduced its Scope 1 and 2 greenhouse gas (GHG) emissions by 74% from its 2015 baseline, surpassing its 2025 target of a 70% reduction two years ahead of schedule. The company primarily utilizes natural hydrocarbon propellant gases with low global warming potential (GWP) in its products, including hairsprays, body sprays, and deodorants.

These innovations align with stringent government regulations aimed at reducing the environmental harm caused by conventional propellants. The shift toward green alternatives, including hydrofluoroolefins (HFOs) and compressed gases like nitrogen, is attracting environmentally conscious consumers and businesses. The focus on sustainability is bolstering market expansion and opening new avenues for growth in both developed and emerging economies.

Aerosol Propellants Market Report Snapshot

| Segmentation |

Details |

| By Product Type |

Hydrocarbons, Dimethyl Ether (DME), Nitrous Oxide and Carbon Dioxide, Others |

| By Application |

Personal Care, Pharmaceuticals, Household, Automotive and Industrial, and Others |

| By Region |

North America: U.S., Canada, Mexico |

| Europe: France, U.K., Spain, Germany, Italy, Russia, Rest of Europe |

| Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific |

| Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

| South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Product Type (Hydrocarbons, Dimethyl Ether (DME), Nitrous Oxide and Carbon Dioxide, Others): The hydrocarbons segment earned USD 3,895.3 million in 2023 due to its cost-effectiveness, wide availability, and low environmental impact compared to chlorofluorocarbons.

- By Application (Personal Care, Pharmaceuticals, Household, Automotive and Industrial, and Others): The personal care segment is projected to reach USD 6,037.7 million by 2031, primarily fueled by the increasing demand for convenient, effective, and innovative aerosol-based products, such as deodorants, hairsprays, and body sprays, supported by evolving consumer preferences for personal grooming and hygiene.

Aerosol Propellants Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Europe aerosol propellants market accounted for a share of around 36.25% in 2023, valued at USD 3,425.6 million. Europe’s stringent environmental regulations, including the European Union’s F-Gas Regulation, are boosting the adoption of eco-friendly alternatives to traditional propellants such as HFCs and CFCs.

This regulatory framework is prompting companies to innovate and adopt sustainable solutions such as hydrofluoroolefins (HFOs), which offer lower global warming potential, thus contributing to regional market growth.

- In August 2023, Salvalco Eco-Valve, developed by the Spray Research Group (SRG) at Salford, was launched in collaboration with the Mentholatum Company (Healthcare and Pharma). This innovative product led to the release of new Deep Heat and Deep Freeze products in the UK, which utilize eco-friendly nitrogen propellants. The Salvalco Eco-Valve is designed to allow aerosols to be sprayed effectively using harmless gases like nitrogen or compressed air.

European consumers are increasingly prioritizing sustainability in their purchasing decisions. This has led to a rise in demand for aerosol products that use low-GWP propellants and are packaged in environmentally friendly materials. Brands that align with these consumer preferences are experiencing a boost in market share, further propelling domestic market growth.

Asia Pacific aerosol propellents market is set to grow at a robust CAGR of 7.54% over the forecast period. Rapid urbanization and a growing middle-class population in the region are leading to increased demand for consumer goods, particularly personal care and household products. This surge in consumption is highlighting the need for aerosol propellants, which are widely used in products such as deodorants, hair sprays, and air fresheners.

Regulatory Framework Also Plays a Significant Role in Shaping the Market

- In the U.S., the EPA regulates the use of ozone-depleting substances and greenhouse gases, including certain propellants used in aerosols. The agency has implemented measures to phase out substances such as chlorofluorocarbons (CFCs) and hydrofluorocarbons (HFCs) due to their environmental impact. Manufacturers are encouraged to adopt alternative propellants with lower environmental footprints.

- In the European Union, aerosol dispensers are regulated under Aerosol Dispensers Directive (ADD) 75/324/EEC, which sets safety standards for the construction and testing of aerosol containers. This directive mandates that aerosol cans undergo deformation and burst tests to ensure consumer safety, with pressure resistance based on the product's expected pressure at 50°C.

- The European Union's F-Gas Regulation (EU) No 517/2014 addresses the use of fluorinated gases (F-gases) in various applications, including aerosol propellants. It aims to reduce emissions of F-gases, which have high global warming potential, by promoting the use of alternative substances and technologies. It includes bans on certain high-GWP F-gases and requirements for leak checks and F-gas recovery.

- In the UK, the UK Conformity Assessed (UKCA) marking, indicates compliance with regulations for aerosol products placed on the market in Great Britain. This marking must be clearly visible and legible when affixed to the product.

- India's Bureau of Indian Standards (BIS) sets safety standards for aerosol dispensers, focusing on the construction and testing of aerosol containers to ensure consumer safety. Manufacturers must comply with these standards to market aerosol products in India.

Competitive Landscape

The aerosol propellants market is characterized by a large number of participants, including both established corporations and rising organizations. Several market participants are adopting strategies focused on the innovation of sustainable products to align with global environmental regulations.

Additionally, major industry players are investing in alternative propellants with minimal impact on ozone depletion and global warming, supporting the long-term sustainability of the aerosol propellant market.

- In July 2023, the clinical sun care brand myDerm incorporated Honeywell’s Solstice Propellant (HFO-1234ze) into its new broad-spectrum sunscreen, Mineral SPF 50 Clinical Sunscreen Continuous Spray. This non-ozone depleting hydrofluoroolefin (HFO) solution reduces greenhouse gas (GHG) emissions by 99% compared to traditional aerosol propellants.

With global phase-down regulations aimed at reducing carbon emissions and phasing out harmful propellants such as hydrofluorocarbons (HFCs) and hydrocarbons, Honeywell's Solstice Propellant delivers significant environmental, regulatory, and performance advantages.

List of Key Companies in Aerosol Propellants Market:

- The Chemours Company

- Nouryon

- DuPont

- ENOC Company

- DiversifiedCPC

- Arkema

- Shell Group

- Honeywell International Inc.

- AkzoNobel N.V.

- Repsol

- AEROPRES CORPORATION

- Linde PLC

- MITSUBISHI GAS CHEMICAL COMPANY, INC.

- AVEFLOR, a.s.

- GTS SPA

Recent Developments:

- In October 2024, Diversified CPC International unveiled its new NGL processing plant in Beaumont, Texas. Equipped with proprietary technology and extensive resources, the facility enhances the company's capacity to produce, test, certify, and distribute high-purity products. This strategic expansion strengthens the company's position in the market by enabling the delivery of sustainable and high-quality propellant solutions to a wide range of industries.

- In October 2024, Honeywell Energy partnered with DevPro Biopharma to develop an innovative respiratory inhaler aimed at improving the management of respiratory conditions while significantly reducing carbon emissions. By utilizing Honeywell’s Solstice Air HFO-1234ze technology, a low-global-warming-potential (GWP) propellant, DevPro Biopharma’s new albuterol inhaler will reduce carbon emissions by 99.9% compared to traditional inhalers, without compromising efficacy.

- In November 2023, The Chemours Company announced a 20 percent increase in the production of Chemours HFC-152a. This versatile, low-GWP, non-VOC aerosol propellant and foam-blowing agent is widely used in personal care, household, industrial, and construction applications. The expansion aims to reduce volatile organic compounds (VOCs) in consumer products while meeting the rising demand for thermal insulation foam products.

- In August 2023, Honeywell and contract development and manufacturing organization (CDMO) Recipharm formed a commercial partnership to advance the development of pressurized metered dose inhalers (pMDIs) utilizing Honeywell's near-zero global warming potential (GWP) propellant.