Market Definition

The market encompasses technologies and solutions that enable automated, two-way communication between utility companies and end-users for efficient energy data monitoring and analysis. It includes smart meters, communication networks, and data management platforms that enable real-time monitoring.

The report offers a thorough assessment of the main factors driving market expansion, along with detailed regional analysis and the competitive landscape influencing industry dynamics.

Advanced Metering Infrastructure Market Overview

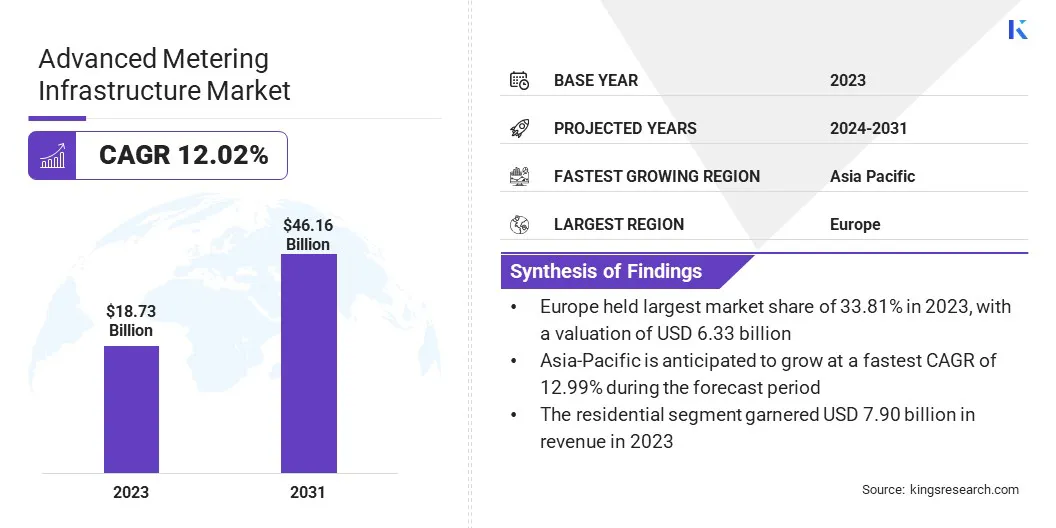

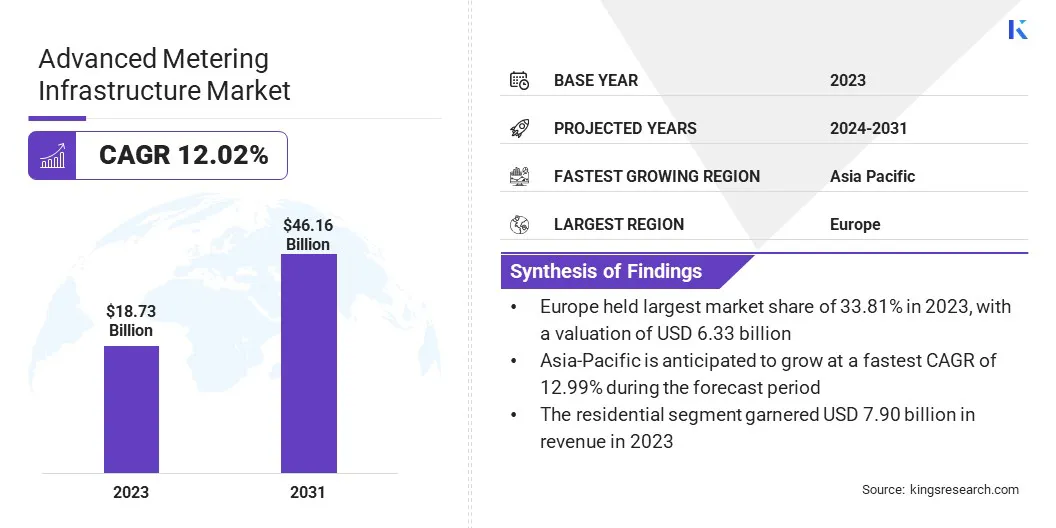

The global advanced metering infrastructure market size was valued at USD 18.73 billion in 2023 and is projected to grow from USD 20.85 billion in 2024 to USD 46.16 billion by 2031, exhibiting a CAGR of 12.02% during the forecast period.

This growth is attributed to the increasing emphasis on energy efficiency, the widespread adoption of smart grid technologies, and the implementation of supportive regulatory policies aimed at modernizing utility networks.

Major companies operating in the advanced metering infrastructure industry are Honeywell International Inc, Siemens, Itron Inc, Trilliant Holdings Inc, Mueller Systems, LLC., IBM, Dynosonic, Cisco Systems, Inc., Schneider Electric, Hubbell, Eaton, General Electric Company, Renesas Electronics Corporation., Genus Power Infrastructures Limited, and Landis+Gyr.

The integration of renewable energy sources, rapid urbanization, and the rising need for real-time energy consumption data are expected to further aid market expansion. Utility providers are increasingly focused on enhancing grid reliability, improving operational efficiency, and strengthening consumer engagement, prompting increased investment and technological innovation in the market.

- In December 2023, the City of Deer Park launched its Advanced Metering Infrastructure (AMI) project to replace 12,262 water meters. The initiative enables real-time water usage data, leak detection, and consumption alerts, enhancing water efficiency and customer service.

Key Highlights

- The advanced metering infrastructure industry size was valued at USD 18.73 billion in 2023.

- The market is projected to grow at a CAGR of 12.02% from 2024 to 2031.

- Europe held a share of 33.81% in 2023, valued at USD 6.33 billion.

- The solution segment garnered USD 7.07 billion in revenue in 2023.

- The residential segment is expected to reach USD 19.26 billion by 2031.

- Asia Pacific is anticipated to grow at a CAGR of 12.99% over the forecast period.

Market Driver

Rising Demand for Energy Efficiency and Grid Optimization

The market is expanding rapidly, fueled by the increasing need for energy efficiency and grid optimization. Utility providers are leveraging advanced metering infrastructure to minimize energy losses, improve load balancing, and enhance overall grid performance.

Through real-time data acquisition and advanced analytics, this infrastructure enables precise monitoring of consumption patterns, early identification of system inefficiencies, and more accurate demand forecasting. It supports the transition to smart grids by supporting automated responses to changes in energy usage and supply.

- In March 2025, Reading Municipal Light Department (RMLD) partnered with Tantalus Systems to implement its RMLD AMI replacement program and advance distribution grid modernization. This collaboration aims to improve grid reliability, efficiency, and sustainability through the integration of cutting-edge smart grid technologies.

Market Challenge

High Initial Investment Costs

High initial investment costs present a significant barrier to the growth of the advanced metering infrastructure market. The deployment of smart meters, communication networks, data management systems, and integration with existing grid infrastructure requires considerable capital expenditure.

This financial burden is particularly challenging for utilities in regions with limited resources or smaller, economically disadvantaged areas. Furthermore, the return on investment for advanced metering infrastructure, driven by benefits such as enhanced grid efficiency, reduced energy losses, and improved customer engagement, is typically realized over the long term.

Utilities may struggle to justify the upfront costs, leading to delays or reluctance in adoption. Securing external funding or government support is necessary, further complicating the decision-making process.

To mitigate this challenge, utilities can leverage government subsidies, public-private partnerships, and financing options such as loans or leases. A phased deployment approach can help manage costs, while a cost-benefit analysis can justify the expenditure and secure funding. Furthermore, integrating advanced metering systems with other smart technologies can enhance grid efficiency and value.

Market Trend

Technological Advancements in Communication and Data Analytics

Technological advancements in communication, such as IoT, 5G, and LPWAN, is emerging as a notable trend in the market, enabling faster and more reliable data transmission between smart meters and utility systems. These improvements enhance real-time monitoring, helping utilities identify inefficiencies and address issues proactively.

Furthermore, advanced data analytics platforms process large volumes of consumption data, providing insights for optimizing grid operations, improving demand forecasting, and enabling predictive maintenance. These advancements support the integration of renewable energy sources and the transition to smart grids, enhancing grid efficiency and reliability.

- In June 2023, EASYMETERING and Ericsson showcased the latest advancements in smart metering technology using Private LTE networks at the UTC Telecom & Technology Conference in Fort Lauderdale, Florida. This collaboration aims to enhance the efficiency, reliability, and intelligence of utility metering systems by integrating cutting-edge cellular technologies with robust communication infrastructures.

Advanced Metering Infrastructure Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Hardware, Solution (Meter Data Management, Meter Data Analytics, Others), Services (Professional, Managed)

|

|

By End User

|

Residential, Commercial, Industrial

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Component (Hardware, Solution (Meter Data Management, Meter Data Analytics, Others), and Services (Professional, Managed)): The solution segment earned USD 7.07 billion in 2023 due to increased demand for meter data management and analytics solutions that improve grid efficiency.

- By End User (Residential, Commercial, Industrial): The residential segment held a share of 42.17% in 2023, attributed to the rising adoption of smart meters for enhanced energy monitoring and cost management in homes.

Advanced Metering Infrastructure Market Regional Analysis

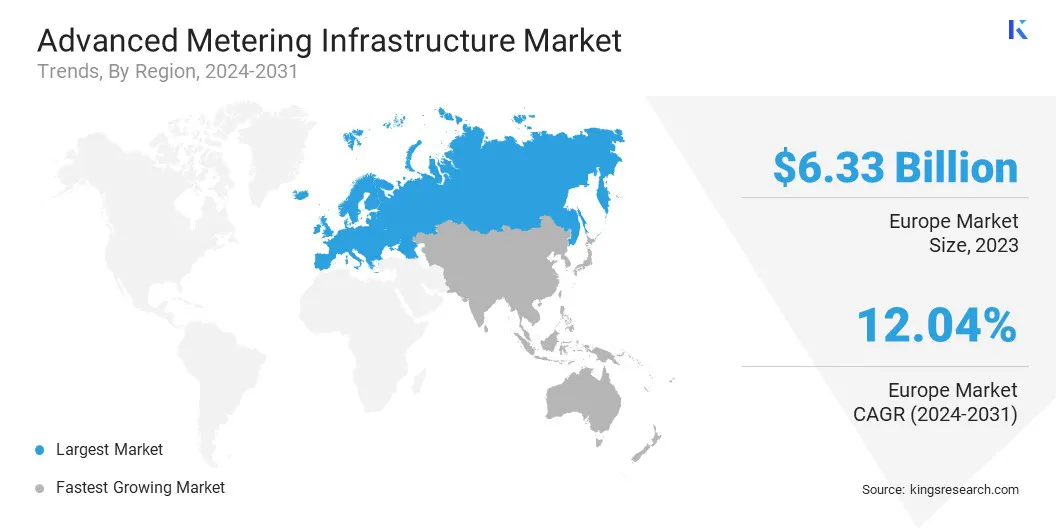

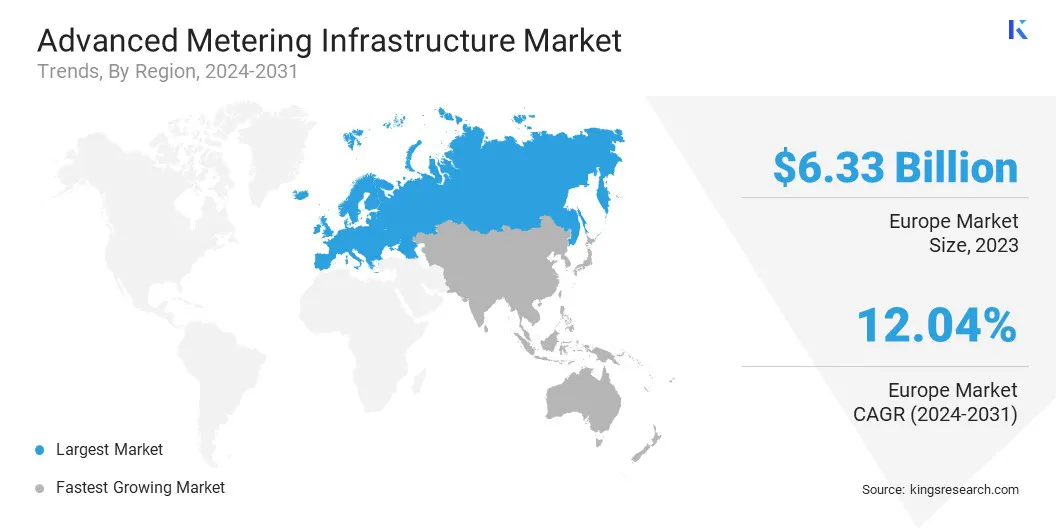

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Europe advanced metering infrastructure market share stood at around 33.81% in 2023, valued at USD 6.33 billion. This dominance is attributed to the strong regulatory support for smart grid initiatives, increasing demand for energy efficiency, and the ongoing modernization of utility infrastructure.

Additionally, Europe’s commitment to sustainability and reducing carbon emissions has boosted the adoption of advanced metering systems, which facilitate better energy consumption management and integration of renewable energy sources. The presence of established utility companies and favorable government policies further contributed to regional market expansion.

- In March 2025, Netmore Group AB launched Metering-as-a-Service (MaaS) to accelerate the adoption of smart metering for water and gas utilities. This service offers a cost-efficient alternative to traditional, capital-intensive advanced metering infrastructure (AMI) deployments by eliminating upfront costs, allowing utilities to modernize more effectively.

The Asia-Pacific advanced metering infrastructure industry is estimated to grow at a robust CAGR of 12.99% over the forecast period. This rapid expansion is primarily spurred by rapid urbanization, industrialization, and increasing energy demand. As countries focus on modernizing their utility grids and improving energy efficiency, the adoption of advanced metering infrastructure is rising.

Moreover, government initiatives and policies promoting smart grid technology and renewable energy integration are fueling regional market expansion. The growing need for real-time energy monitoring and efficient consumption management, coupled with the region's large population base, presents substantial opportunities for market expansion.

Regulatory Frameworks

- In New Zealand, the Electricity Authority regulates advanced metering infrastructure under the Electricity Industry Participation Code 2010. The guidelines recommend advanced metering systems that support accurate readings, reduce fraud, and enhance grid reliability.

- In the United States, the Department of Energy’s Cybersecurity for Energy Delivery Systems (CEDS) provides guidelines on the security considerations for advanced metering infrastructure (AMI). These guidelines focus on identifying potential threats to AMI systems, including vulnerabilities in data transmission and storage.

- In the District of Columbia, Chapter 15B of Title 34 of the District of Columbia Code regulates advanced metering infrastructure. It authorizes the implementation of smart grid technologies, allowing utilities to deploy advanced metering systems for real-time data collection and improved grid management.

Competitive Landscape

Leading participants in the advanced metering infrastructure market include large technology providers, utility solution firms, and specialized startups focused on advancing smart grid technologies. They are emphasizing product performance, integration capabilities, and cost-effectiveness.

To foster growth and enhance technological offerings, companies adopt strategic partnerships, mergers, and acquisitions. Furthermore, increased investment in research and development is advancing meter data management, analytics solutions, and customer engagement features.

- In October 2024, Fort Worth Water announced a 90% reduction in field investigations after implementing Xylem’s Advanced Metering Infrastructure (AMI). The new system, comprizing nearly 300,000 meters connected to Xylem’s Sensus FlexNet communication network, has significantly streamlined operations by enabling real-time data collection and secure transmission.

List of Key Companies in Advanced Metering Infrastructure Market:

- Honeywell International Inc

- Siemens

- Itron Inc

- Trilliant Holdings Inc

- Mueller Systems, LLC.

- IBM

- Dynosonic

- Cisco Systems, Inc.

- Schneider Electric

- Hubbell

- Eaton

- General Electric Company

- Renesas Electronics Corporation.

- Genus Power Infrastructures Limited

- Landis+Gyr

Recent Developments (M&A/Partnerships/Agreements/New Product Launch)

- In April 2025, the Brownsville Public Utilities Board (BPUB) unveiled its Advanced Metering Infrastructure (AMI) Smart Meter Program to improve utility services through real-time data, improved efficiency, and enhanced customer convenience.

- In February 2025, EDF India and Actis Group formed a strategic partnership to develop advanced metering infrastructure in India. The joint venture aims to establish a platform company dedicated to Advanced Metering Infrastructure Service Provider (AMISP) concessions, further demonstrating both companies' commitment to investing in India's energy sector.

- In October 2024, Trilliant Holdings Inc. partnered with Econis Labs Manufacturing to expand its advanced metering infrastructure (AMI) solutions in the water and gas industries. Econis Labs will assist in developing a new cellular network interface card, enhancing Trilliant's flexible AMI offerings for utilities.

- In September 2024, Trilliant Holdings Inc teamed up with Milton Hydro Services Inc. (MHSI) to introduce an AMI sub-metering program across Ontario, Canada. This initiative leverages Trilliant’s Smart Building platform to improve customer experiences and promote energy efficiency by individually metering units in multi-tenant buildings, enabling residents to pay based on actual energy consumption and promoting conservation.

- In May 2023, Honeywell International Inc. introduced its Next Generation Cellular Module (NXCM), enabling utilities to upgrade legacy water and gas meters into smart meters without the need for extra infrastructure. This innovation enhances wireless advanced metering infrastructure (AMI) , improving monitoring, safety, and data collection capabilities for utility providers.