Enquire Now

Active Electronic Components Market Size, Share, Growth & Industry Analysis, By Product Type (Semiconductor Devices, Display Devices, Vacuum Tubes, Others), By End User (Consumer Electronics, Networking & Telecommunication, Automotive, Manufacturing), and Regional Analysis, 2025-2032

Pages: 170 | Base Year: 2024 | Release: October 2025 | Author: Versha V.

Key strategic points

The market includes devices that control, amplify, or convert electrical signals for specific electronic functions. It includes semiconductor devices such as diodes, transistors, integrated circuits, and optoelectronic components, along with display devices and vacuum tubes.

These components are essential for enabling functionality in consumer electronics, networking and telecommunication systems, automotive electronics, manufacturing equipment, aerospace and defense systems, and healthcare devices.

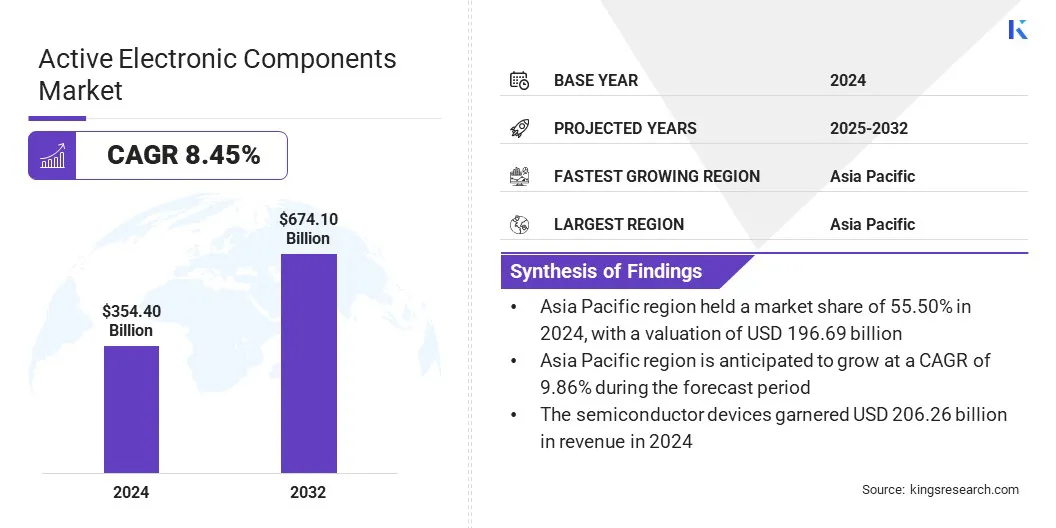

The global active electronic components market size was valued at USD 354.40 billion in 2024 and is projected to grow from USD 382.09 billion in 2025 to USD 674.10 billion by 2032, exhibiting a CAGR of 8.45% over the forecast period.

The market is growing due to the rising demand for higher performance processors that depend on advanced semiconductors, transistors, and integrated circuits to deliver improved speed and efficiency. Technological advancements in 3D-printed active electronics are allowing for greater design flexibility for developing next-generation components.

Major companies operating in the active electronic components market are Infineon Technologies AG, Texas Instruments Incorporated, Analog Devices, Inc., STMicroelectronics, Renesas Electronics Corporation, Vishay Intertechnology, Inc., Semiconductor Components Industries, LLC, Microchip Technology Inc., TOSHIBA ELECTRONIC DEVICES & STORAGE CORPORATION, Broadcom, Qualcomm Technologies, Inc., MediaTek, Samsung, SK HYNIX INC., and Micron Technology, Inc.

Companies are introducing advanced transistors that enhance signal integrity, support higher frequency ranges, and improve power efficiency in satellite communication systems. The market is driven by the growing demand for reliable wave satellite communications that require components that are capable of handling complex data transmission and long-distance connectivity.

These high-performance transistors improve bandwidth utilization and offer stable communication links. This approach strengthens the deployment of next-generation satellite networks and expands the application scope of active electronic components in aerospace and defense sectors.

Growing Demand for Higher Performance Processors

The active electronic components market is driven by the growing demand for higher performance processors across computing, telecommunications, and automotive applications. The expansion of cloud computing, artificial intelligence, and 5G infrastructure is fueling the need for processors that deliver faster speeds, greater efficiency, and stable performance.

Meeting these requirements depends on advanced semiconductors, transistors, and integrated circuits, which are integral parts of active electronic components. The rising adoption of powerful processors in critical systems directly boosts the demand for active electronic components.

Supply Chain Disruptions Impacting Active Electronic Components Production

A major challenge for the active electronic components market is the disruption in global supply chains affecting the availability of critical semiconductors and raw materials.

Shortages and transportation delays create production bottlenecks, leading to extended lead times and higher costs for manufacturers. This instability restricts timely delivery to end-use industries such as consumer electronics and automotive, which depend on consistent component supply. To address this, companies are localizing supply chains, adopting multi-sourcing strategies, and using digital monitoring tools to improve visibility and resilience in procurement and logistics.

Technological Advancements Towards 3D-Printed Active Electronics

The active electronic components market is experiencing a growing adoption of 3D-printed active electronics. Additive manufacturing is used to create complex circuit structures with greater design flexibility and faster prototyping cycles. This capability supports customization of components, reduces production costs for low-volume runs, and accelerates time-to-market for innovative designs.

The integration of 3D printing technologies enhances manufacturing efficiency, drives material optimization, and opens opportunities for next-generation electronic applications.

|

Segmentation |

Details |

|

By Product Type |

Semiconductor Devices (Diodes, Transistors, Integrated Circuits (ICs), Optoelectronic Components), Display Devices, Vacuum Tubes, Others |

|

By End User |

Consumer Electronics, Networking & Telecommunication, Automotive, Manufacturing, Aerospace & Defense, Healthcare, Others |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific |

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Based on region, the market has been classified into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Asia Pacific active electronic components market share stood at 55.50% in 2024 with a valuation of USD 196.69 billion in the global market. The region is dominating due to a strong electronic manufacturing base supported by government initiatives for local production, which has accelerated large-scale adoption of advanced semiconductor devices and display components.

This has enabled cost-effective manufacturing, strengthened supply chain resilience, and ensured continuous scaling of production capacity, driving the region’s dominance in the market.

North America is poised to grow at a CAGR of 6.41% over the forecast period. The growth is driven primarily by large-scale government investments in domestic semiconductor manufacturing and research through initiatives such as the CHIPS Act.

The funding supports advanced-node fabrication facilities, strengthens research infrastructure, and reduces risk for private capital investment in new projects. This approach expands local production capacity and enhances technological capabilities across key industries in the region.

Key players in the active electronic components industry are focusing on the development of high-efficiency, high-reliability diodes to strengthen their product portfolios and maintain competitiveness. They are investing in advanced fabrication processes to enhance performance consistency and durability in power management and signal control applications.

They are expanding research and development efforts to introduce diodes capable of supporting higher voltage tolerance, faster switching speeds, and improved thermal management. Strategic collaborations with semiconductor foundries and technology providers are being pursued to accelerate product innovation and secure supply chain stability.

Frequently Asked Questions