Market Definition

The market encompasses the development and production of therapies and treatments for managing and treating acromegaly. Acromegaly is a rare hormonal disorder caused by the overproduction of growth hormone (GH) by the pituitary gland, typically due to a benign tumor.

This excessive growth hormone leads to abnormal growth of bones and tissues, particularly in the hands, feet, and face. The report examines critical market drivers, industry trends, and regional analysis, along with the regulatory frameworks influencing market growth over the forecast period.

Acromegaly Treatment Market Overview

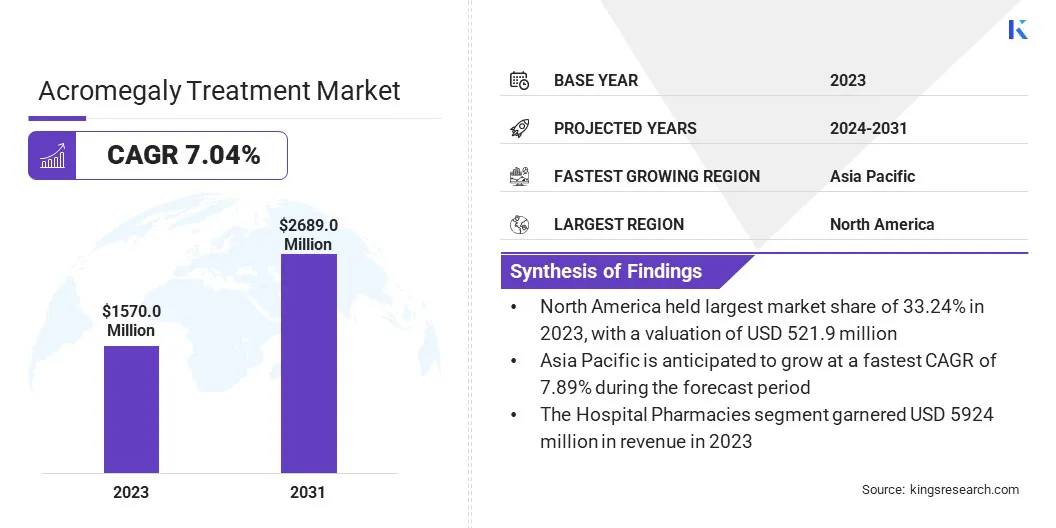

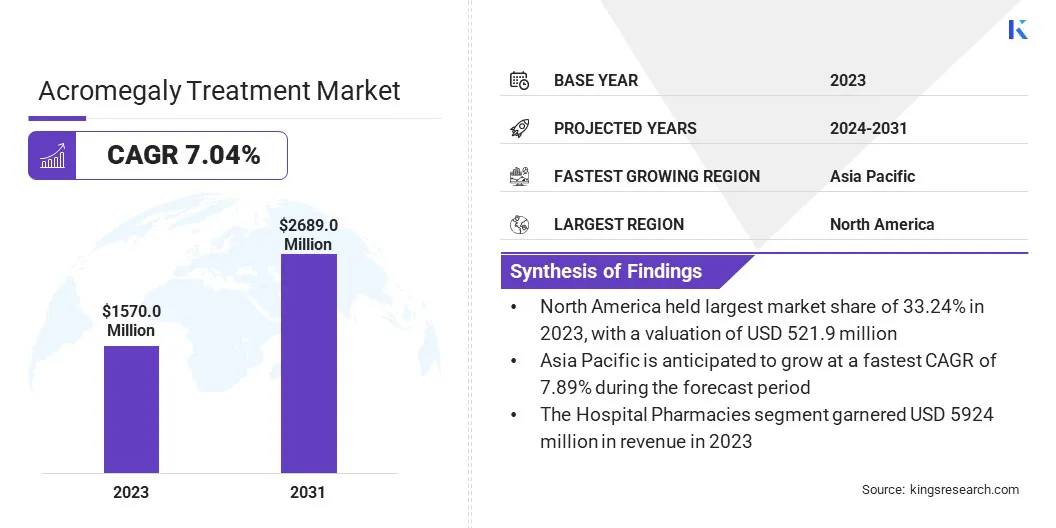

Global acromegaly treatment market size was valued at USD 1570.0 million in 2023, which is estimated to be valued at USD 1670.0 million in 2024 and reach USD 2689.0 million by 2031, growing at a CAGR of 7.04% from 2024 to 2031. Growing awareness and improved symtom recognition of acromegaly are leading to a rise in diagnosed cases, driving demand for effective treatments and therapies.

Major companies operating in the acromegaly treatment industry are Novartis Pharmaceuticals Corporation, Sun Pharmaceutical Industries Ltd., Chiesi Group, Peptron, Wockhardt, Pfizer Inc., ADVANZ PHARMA, Amryt Pharma plc, Cipla, Ipsen Pharma, Viatris Inc., Zydus Pharmaceuticals, Inc., Teva Pharmaceutical Industries Ltd., Recordati Rare Diseases, Xeris Pharmaceuticals, Inc., and others.

The market is evolving, fueled by rising awareness and improved diagnosis, particularly in regions with limited medical knowledge. The expanding patient pool is creating new opportunities for treatment providers, increasing demand for effective therapies and innovative therapies.

The market is set to winess substantial growth, propelled by improved healthcare access and greater recognition of acromegaly are expected to boost market expansion.

- In March 2024, Chiesi Global Rare Diseases launched the "Rethink Acromegaly" campaign to raise awareness and provide resources for patients, caregivers, and healthcare professionals. This initiative aims to support early diagnosis and improve disease management, thereby expanding the patient population.

Key Highlights:

- The acromegaly treatment industry size was recorded at USD 1570.0 million in 2023.

- The market is projected to grow at a CAGR of 7.04% from 2024 to 2031.

- North America held a market share of 33.24% in 2023, with a valuation of USD 521.9 million.

- The somatostatin snalogues (SSAs) segment garnered USD 559.6 million in revenue in 2023.

- The hospital pharmacies segment is expected to reach USD 1004.1 million by 2031.

- Asia Pacific is anticipated to grow at a CAGR of 7.89% over the forecast period.

Market Driver

"Rising Awareness"

Acromegaly, though rare, is being diagnosed more frequently due to increased awareness and improved diagnostic methods. As per the National Institute of Diabetes and Digestive and Kidney Diseases (NIDDK), the condition affects 3 to 14 out of every 100,000 individuals.

Greater awareness among healthcare professionals and the public is enabling earlier detection, leading to increased demand for specialized therapies. Improvements in diagnostic methods, such as advanced imaging and blood tests, is further contributing to this growth, offering a more accurate and timely diagnosis.

- In September 2024, Crinetics Pharmaceuticals submitted a New Drug Application (NDA) to the FDA for paltusotine, an oral somatostatin receptor type 2 agonist intended to improve treatment options for acromegaly patients.

Market Challenge

"Complexity in Managing Long-Term Treatment"

A major challenge hampering the expansion of the acromegaly treatment market is the complexity of long-term therapy management, which require continuous monitoring and regular treatment adjustments. This places a burden on patients and healthcare providers.

However, innovations such as a once-daily oral treatments offer a promising solution by eliminating frequent injections, improving patient compliance, and reducing logistical challenges in chronic care.

Market Trend

"Shift Toward Innovative and Less Invasive Therapies"

The acromegaly treatment market is witnessing a notable shift toward more innovative and less invasive therapies. This trend reflects the growing demand for treatments that reduce the complexity of managing the condition.

Patients increasingly seek options that offer convenience, such as oral medications, to avoid the challenges of regular injections and hospital visits. This focus on less invasive therapies aims to improve patient adherence, reduce treatment burdens, and enhance the long-term management of acromegaly, driving a more patient-centric approach in the market.

- In March 2025, ProBioGen successfully completed CMC development milestones for Marea's promising acromegaly therapeutic, MAR002. The therapy is supported by a robust, scalable manufacturing process designed to improve treatment experience and accelerated timelines.

Acromegaly Treatment Market Report Snapshot

|

Segmentation

|

Details

|

|

By Drug Class

|

Somatostatin Analogues, Growth Hormone Receptor Antagonists (GHRAs), Dopamine Agonists, Others

|

|

By Distribution Channel

|

Hospital Pharmacies, Retail Pharmacies, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Drug Class [Somatostatin Analogues (SSAs), Growth Hormone Receptor Antagonists (GHRAs), Dopamine Agonists, and Others]: The Somatostatin Analogues (SSAs) segment earned USD 559.6 million in 2023 due to their widespread use in managing acromegaly.

- By Distribution Channel [Hospital Pharmacies, Retail Pharmacies, and Others]: The hospital pharmacies segment held 37.74% of the market in 2023, attributed to their major role in administering specialized treatments for complex conditions such as acromegaly.

Acromegaly Treatment Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America acromegaly treatment market share stood at around 33.24% in 2023, valued at USD 521.9 million. This dominance is reinforved by advanced healthcare infrastructure, increased awareness, and strong adoption of innovative therapies.

The presence of leading healthcare providers, along with significant investments in research and development, further supports regional market growth. Additionally, a well-established reimbursement system and access to specialized care lead to higher diagnosis rates and treatment uptake, positioning North America as a key region for the acromegaly treatment landscape.

- In August 2024, Crinetics Pharmaceuticals, a US-based company, launched the ACRO/TRUTH initiative, an educational platform highlighting the challenges of current acromegaly treatments. The initiative emphasizes patient perspectives to improve healthcare provider-patient communication and treatment outcomes.

Asia Pacific acromegaly treatment industry is set to grow at a robust CAGR of 7.89% over the forecast period. This growth is fueled by robust healthcare infrastructure, increasing awareness of rare diseases, and a rising number of diagnosed cases.

Rapid medical advancements, improved access to treatments, and favorable healthcare policies. Additionally, rising disposable incomes and greater healthcare investments are fostering regional market growth, making Asia Pacific a key region for acromegaly treatment advancements.

Regulatory Frameworks

- In the U.S., the Food and Drug Administration (FDA) ensures the safety, efficacy, and security of acromegaly treatments through clinical trials, pre-market approvals, and post-market surveillance, while disseminating science-based health information.

- In the EU, the European Medicines Agency (EMA) ensures acromegaly treatments meet high standards of safety, effectiveness, and quality, evaluating and approving them based on stringent regulations, clinical trial data, and manufacturing guidelines to protect patient health.

Competitive Landscape

In the acromegaly treatment industry, companies are focusing on innovative therapies that offer more convenient administration and improved efficacy. Key developments include oral medications, longer-acting injectable formulations, and targeted therapies. These advancements aim to enhance patient compliance, reduce side effects, and improve disease management.

- In October 2024, U.S.-based Teva launched the first and only generic version of Sandostatin LAR Depot (octreotide acetate for injectable suspension) in the U.S., offering an key treatment option for acromegaly and carcinoid syndrome.

List of Key Companies in Acromegaly Treatment Market:

- Novartis Pharmaceuticals Corporation

- Sun Pharmaceutical Industries Ltd.

- Chiesi Group

- Peptron

- Wockhardt

- Pfizer Inc.

- ADVANZ PHARMA

- Amryt Pharma plc

- Cipla

- Ipsen Pharma

- Viatris Inc.

- Zydus Pharmaceuticals, Inc.

- Teva Pharmaceutical Industries Ltd.

- Recordati Rare Diseases

- Xeris Pharmaceuticals, Inc.

Recent Developments (Clinical Trial/Launch)

- In January 2025, Marea Therapeutics announced the second lead program, MAR002, a growth hormone receptor antagonist for acromegaly treatment. The Phase 1 clinical trial is expected to begin in the second half of 2025, marking significant progress in addressing unmet needs in acromegaly therapy.

- In July 2024, Camurus reported positive Phase 3 results from the ACROINNOVA 2 study of octreotide SC depot (CAM2029) for acromegaly. The treatment demonstrated improved biochemical response, symptom relief, and quality of life, with regulatory reviews ongoing in the US and EU.

- In May 2024, Cipla launched Lanreotide Injection in select markets, including the U.S. and several European countries. This long-acting somatostatin analog is indicated for acromegaly and gastroenteropancreatic neuroendocrine tumors, supporting better disease management and patient outcomes.