Market Definition

UV curable resins are materials that undergo rapid hardening when exposed to ultraviolet (UV) light. The photoinitiators absorb UV radiation, triggering a reaction that transforms the liquid resin into a solid or cross-linked state within seconds.

UV curable resins Market Overview

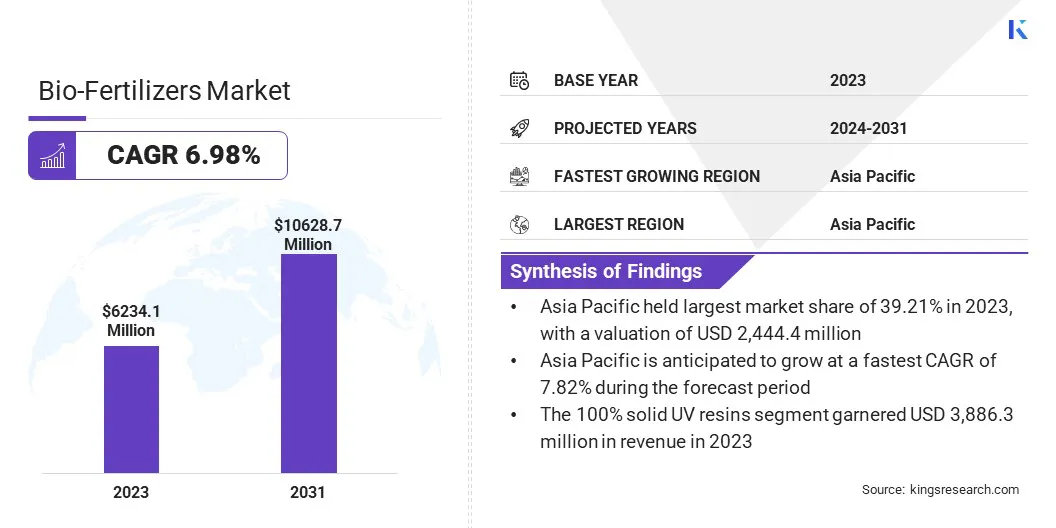

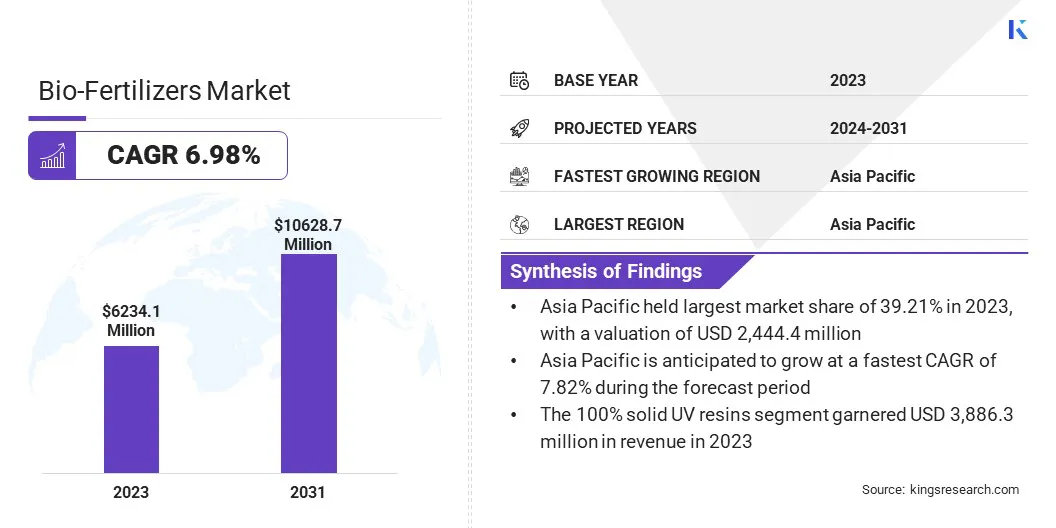

The global UV curable resins market size was valued at USD 6,234.1 million in 2023 and is projected to grow from USD 6,626.5 million in 2024 to USD 10,628.7 million by 2031, exhibiting a CAGR of 6.98% during the forecast period.

This market is registering significant growth, driven by increasing demand across industries such as coatings, adhesives, 3D printing, and electronics. The market is fueled by the rising preference for eco-friendly, solvent-free solutions with fast curing times and superior performance characteristics.

Major companies operating in the UV curable resins industry are The Sherwin-Williams Company, BASF, Dow, Allnex GMBH, Covestro AG, Arkema, PPG Industries, Inc., Akzo Nobel N.V., DIC CORPORATION, Eternal Materials Co.,Ltd., Wacker Chemie AG, Synthomer plc, TOAGOSEI CO.,LTD., IGM Resins B.V., and Wanhua Chemical Group Co., Ltd.

Key factors influencing market expansion include advancements in photoinitiator technology, increasing regulatory restrictions on volatile organic compounds (VOCs), and growing adoption in industries like automotive, healthcare, and packaging.

Additionally, the rapid expansion of UV LED curing technology, which offers energy efficiency, lower heat generation, and longer operational life, is further accelerating market growth. Furthermore, the rise of customized UV resin formulations tailored to specific end-use industries, such as medical devices, 3D printing, and aerospace, is contributing to market diversification.

- In November 2024, Arkema introduced bio-based UV resins, low-carbon polyamides, and recycling initiatives to enhance material performance and sustainability. Arkema also announced key partnerships with HP, Stratasys, Rapid Shape, Axtra3D, and Figure Engineering to develop advanced 3D printing materials for industries like automotive, aerospace, and industrial manufacturing.

Key Highlights:

- The UV curable resins industry size was valued at USD 6,234.1 million in 2023.

- The market is projected to grow at a CAGR of 6.98% from 2024 to 2031.

- Asia Pacific held a market share of 39.21% in 2023, with a valuation of USD 2,444.4 million.

- The 100% solid UV resins segment garnered USD 3,886.3 million in revenue in 2023.

- The epoxy acrylates segment is expected to reach USD 2,769.0 million by 2031.

- The oligomers segment is expected to reach USD 4,505.6 million by 2031.

- The coatings segment is expected to reach USD 4,702.2 million by 2031.

- The market in North America is anticipated to grow at a CAGR of 6.98% during the forecast period.

Market Driver

"Rising Demand and Technological Advancements Driving Growth in the Market"

The UV curable resins market is registering significant growth, primarily driven by the increasing demand for high-performance coatings and adhesives. Industries such as automotive, electronics, and packaging require materials that offer superior durability, chemical resistance, and fast curing times.

UV-curable resins provide these benefits while also enhancing production efficiency, making them an attractive choice for manufacturers looking to improve product performance and streamline operations. Another major driver is the expanding application of UV-curable resins in 3D printing and additive manufacturing.

These resins enable high-precision prototyping and end-use part production with superior mechanical properties and rapid curing times. Industries such as healthcare, aerospace, and consumer electronics are leveraging UV-curable resins for producing complex, high-resolution components, improving efficiency and design flexibility.

This is significantly contributing to market expansion, reinforcing the demand for UV curable materials across various industrial applications.

- In February 2024, Panacol launched its Black&Light series of UV curable black epoxy adhesives which cure in thick layers using only UV light, eliminating the need for secondary curing. These adhesives offer room temperature storage, high optical density, and superior mechanical properties, making them ideal for electronics encapsulation, optical bonding, and automotive sensors.

Market Challenge

"Cost and Adhesion Challenges in the UV Curable Resins Market"

The UV curable resins industry faces several challenges that could hinder its growth and widespread adoption. One major challenge is the high initial investment and equipment costs associated with UV curing technology.

Implementing UV curing systems requires specialized equipment such as UV lamps, curing chambers, and controlled production environments, which can be costly for small and mid-sized manufacturers.

Industry players are developing cost-effective and energy-efficient UV curing systems, including LED-based UV curing, which reduces power consumption and extends equipment lifespan, making adoption more feasible for smaller businesses.

Another significant challenge is the limited adhesion to certain substrates, particularly in industries like automotive and construction, where UV-cured coatings and adhesives must adhere to various surfaces, including metals and low-surface-energy plastics. Poor adhesion can lead to performance issues, reducing the effectiveness of UV-curable products.

Continuous R&D efforts are leading to the development of advanced formulations with improved adhesion promoters and surface treatment technologies, enabling UV-curable resins to bond effectively with a wider range of materials.

Market Trend

"Emerging Innovations and Sustainability Trends in the Market"

The UV curable resins market is evolving rapidly, driven by key industry trends that are shaping its future. A significant trend is the growing adoption of bio-based and sustainable UV-curable resins. Amid increasing environmental concerns and stringent regulations on VOC emissions, manufacturers are focusing on developing eco-friendly alternatives derived from renewable sources.

These bio-based resins not only reduce environmental impact but also cater to the rising consumer demand for sustainable products, especially in industries like packaging, coatings, and adhesives. Another notable trend is the integration of UV-curable resins in advanced electronics and flexible displays.

UV-curable resins are being widely used in display coatings, circuit protection, and optical adhesives as the demand for high-performance, lightweight, and durable electronic components increases.

Their ability to provide superior mechanical properties, fast curing times, and high transparency makes them ideal for next-generation electronic devices, including foldable smartphones, OLED screens, and wearable technologies.

- In January 2025, Sanyo Chemical Industries, Ltd. introduced HILUCIS, a UV-curable nanoimprint resin designed for next-generation AR/VR optical devices. This advanced material features exceptional transparency, high refractive index, and superior light resistance, enabling high-precision replication of complex microstructures. HILUCIS enhances optical design flexibility, viewing angles, light control, and device reliability.

UV curable resins Market Report Snapshot

|

Segmentation

|

Details

|

|

By Technology

|

Solventborne UV Resins, 100% Solid UV Resins, Waterborne UV Resins

|

|

By Type

|

Epoxy Acrylates, Polyester Acrylates, Urethane Acrylates, Silicone Acrylates, Others (Hybrid Resins, Specialty Resins, etc.)

|

|

By Composition

|

Monomers, Oligomers, Photoinitiators, Additives & Stabilizers

|

|

By Application

|

Coatings, Adhesives & Sealants, Inks, 3D Printing Materials, Electronics & Semiconductors, Medical Devices & Healthcare, Others (Optical Fibers, Aerospace, Specialty Applications)

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Technology (Solventborne UV Resins, 100% Solid UV Resins, Waterborne UV Resins): The 100% solid UV resins segment earned USD 3,886.3 million in 2023, due to its superior environmental benefits, absence of VOC emissions, and high-performance characteristics across various industries.

- By Type (Epoxy Acrylates, Polyester Acrylates, Urethane Acrylates, and Silicone Acrylates): The epoxy acrylates segment held 34.09% share of the market in 2023, due to its excellent adhesion, chemical resistance, and wide applicability in coatings and adhesives.

- By Composition (Monomers, Oligomers, Photoinitiators, and Additives & Stabilizers): The oligomers segment is projected to reach USD 4,505.6 million by 2031, owing to its crucial role in determining the final mechanical and chemical properties of cured resins.

- By Application (Coatings, Adhesives & Sealants, Inks, 3D Printing Materials, Electronics & Semiconductors, Medical Devices & Healthcare, Others (Optical Fibers, Aerospace, Specialty Applications)): The coatings segment is projected to reach USD 4,702.2 million by 2031, owing to the growing demand for high-performance, fast-curing, and environmentally friendly coatings in industries like automotive and packaging.

UV Curable Resins Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific accounted for a substantial UV curable resins market share of 39.21% in 2023, with a valuation of USD 2,444.4 million. The strong position of the market in the region is attributed to rapid industrialization, expanding manufacturing sectors, and increasing demand for eco-friendly coatings, adhesives, and 3D printing materials.

Countries such as China, Japan, South Korea, and India are contributing to the market growth, due to their thriving automotive, electronics, and packaging industries, along with rising investments in advanced UV-curing technologies. Additionally, the presence of major resin manufacturers and lower production costs further support the market expansion in the region.

Asia Pacific is also projected to be the fastest-growing region, fueled by stringent environmental regulations, growing R&D activities, and increasing adoption of UV LED curing technologies, which enhance energy efficiency and sustainability.

The UV curable resins industry in North America is expected to register the fastest growth in the market, with a projected CAGR of 6.98% over the forecast period. The market growth in the region is primarily driven by strict environmental policies regulating VOC emissions, advancements in 3D printing applications, and rising demand for high-performance coatings in industries such as aerospace, healthcare, and electronics.

The U.S. leads the market, due to its technological advancements, increasing investment in UV-curable materials, and expanding use in medical and semiconductor applications. Additionally, the adoption of bio-based UV resins and the growing trend of sustainable manufacturing processes further contribute to the market expansion in the region.

- In July 2024, Arkema announced the establishment of a UV/LED/EB technologies innovation lab at its Kyoto Technical Center (KTC) in Japan. This strategic expansion aims to enhance innovation in UV/LED/EB curable resins and additives for specialty coatings and adhesives.

Regulatory Frameworks Also Play a Significant Role in Shaping the Market

- In the U.S., the Food and Drug Administration (FDA) regulates UV curable resins, particularly in coatings, adhesives, and food packaging applications. The Clean Air Technology Center (CATC) provides information on the use, effectiveness, and cost of air pollution prevention and control technologies.

- In Europe, the European Chemicals Agency (ECHA) enforces regulations under Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH) to ensure the safe use of UV curable resins. Additionally, the European Food Safety Authority (EFSA) oversees their application in food contact materials, while the European Commission (EC) ensures compliance with sustainability and environmental directives.

- In China, the Ministry of Ecology and Environment (MEE) regulates the production and environmental impact of UV curable resins under China's chemical safety laws. The National Medical Products Administration (NMPA) monitors their use in medical and cosmetic applications.

Competitive Landscape:

The global UV curable resins market is characterized by a large number of participants, including established corporations and rising organizations. Market players are actively engaged in product innovations, strategic collaborations, mergers & acquisitions, and capacity expansions to strengthen their market position and cater to the increasing demand for high-performance, sustainable UV-curable materials.

Leading manufacturers are focusing on Research and Development (R&D) initiatives to enhance resin formulations, improve curing efficiency, and develop bio-based and low-VOC UV resins to align with stringent environmental regulations. Additionally, advancements in UV LED curing technology have driven companies to invest in energy-efficient and cost-effective solutions to gain a competitive edge.

- In May 2024, H.B. Fuller Company announced the acquisition of ND Industries Inc. The addition of ND Industries' Vibra-Tite brand enhances H.B. Fuller’s existing portfolio of epoxy, cyanoacrylate, UV-curable, and anaerobic products. This acquisition strengthens H.B. Fuller's adhesive application expertise by integrating pre-applied processing centers and custom-engineered coating services, improving the safety and reliability of fastener assemblies.

List of Key Companies in UV Curable Resins Market:

- The Sherwin-Williams Company

- BASF

- Dow

- Allnex GMBH

- Covestro AG

- Arkema

- PPG Industries, Inc.

- Akzo Nobel N.V.

- DIC CORPORATION

- Eternal Materials Co.,Ltd.

- Wacker Chemie AG

- Synthomer plc

- TOAGOSEI CO.,LTD.

- IGM Resins B.V.

- Wanhua Chemical Group Co., Ltd.

Recent Developments (Partnerships/New Product Launch)

- In February 2025, allnex announced its participation in JEC World 2025. The company will showcase its latest innovations in gelcoats, UV-curable composites, and phenolic resins. Additionally, allnex will host a live demonstration of its UV-curable composite technology and present on disruptive resin technology at the Composite Exchange in March 2025.

- In June 2024, TOYO INK CO., LTD. announced a collaboration with J-Film Co., Ltd. to develop a deinking technology for clear packaging used in cosmetics and other products. The collaboration leverages TOYO INK’s UV-curable ink deinking technology and J-Film’s expertise in clear sheet production.

- In March 2024, FUJIFILM Corporation introduced AQUAFUZE inkjet ink technology, combining water-based and UV-curable inks for wide-format printing. It enhances durability, stretchability, and user safety, making it ideal for indoor signage and wallpaper. The ink ensures stable ejection, strong adhesion, reduced odor, and improved gloss without primers or topcoats.