Market Definition

The market involves the production, distribution, and integration of selective compliance articulated robot arm systems across various sectors. It includes manufacturers, suppliers, and service providers catering to industries such as electronics, automotive, pharmaceuticals, food and beverage, and logistics, where high-speed, precision assembly and material handling automation are critical for operational efficiency and productivity.

The report identifies the principal factors contributing to market expansion, along with an analysis of the competitive landscape influencing its growth trajectory.

SCARA robot Market Overview

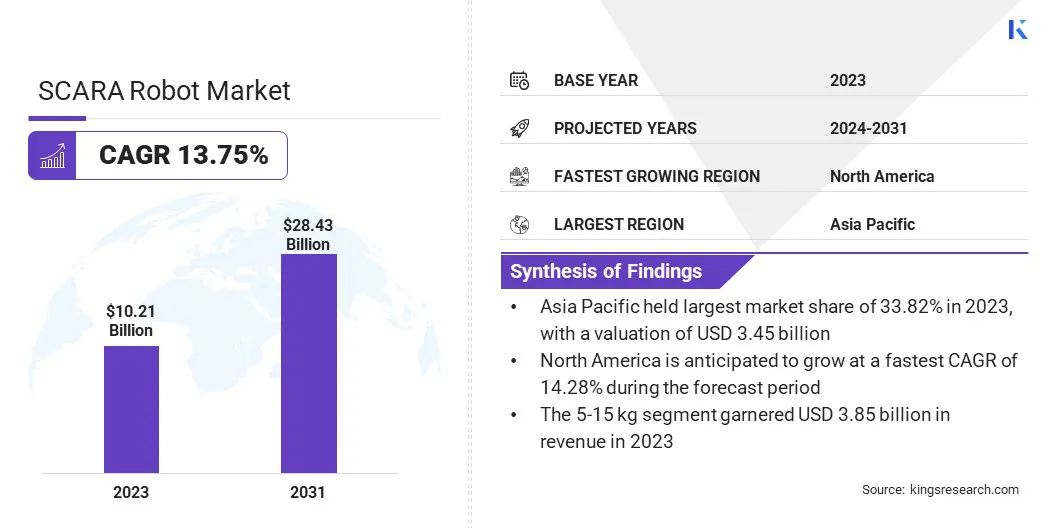

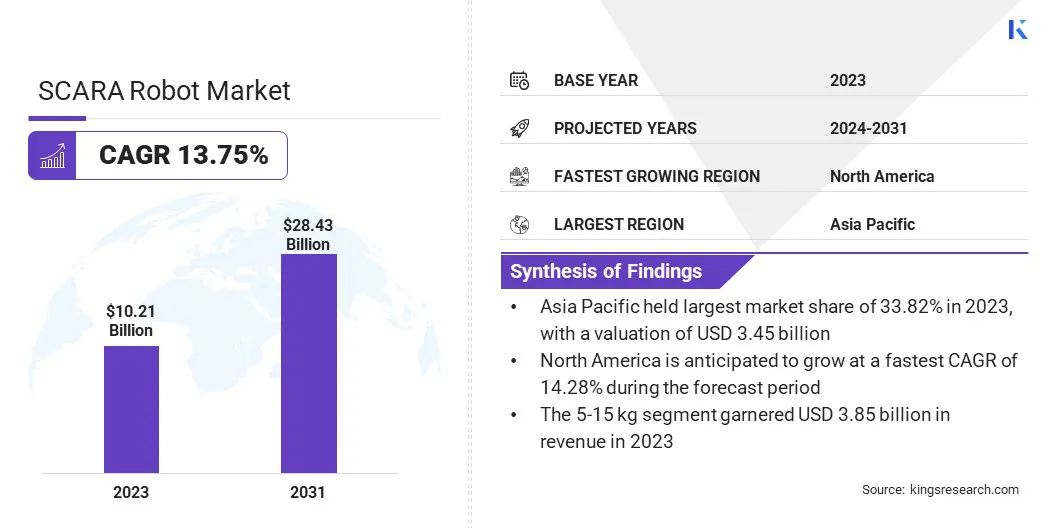

The global SCARA robot market size was valued at USD 10.21 billion in 2023 and is projected to grow from USD 11.54 billion in 2024 to USD 28.43 billion by 2031, exhibiting a CAGR of 13.75% during the forecast period.

Market growth is driven by increasing automation across manufacturing industries, particularly in electronics, automotive, and consumer goods. The demand for precision, speed, and consistency in assembly and material handling processes has positioned SCARA robots as a preferred solution due to their compact design and high repeatability.

Rapid industrialization in emerging economies, coupled with the growing need to improve production efficiency and reduce operational costs, is further accelerating adoption.

Major companies operating in the SCARA robot industry are FANUC America Corporation, DENSO WAVE INCORPORATED, Yaskawa America, Inc., Seiko Epson Corporation, Stäubli International AG, ABB, KUKA AG, OMRON Corporation, Kawasaki Heavy Industries, Ltd., Comau S.p.A., Universal Robots A/S, Hiwin Corporation, Delta Electronics, Inc., NACHI-FUJIKOSHI CORP., and Quant Storage Inc.

Additionally, the expansion of smart factories and the integration of Industry 4.0 technologies are promoting the deployment of advanced SCARA robots with enhanced control systems and connectivity. The rise in small- and medium-sized enterprises investing in automation, particularly in Asia-Pacific, boosts market growth.

Moreover, technological advancements enabling higher payload capacities and flexible applications are broadening the scope of SCARA robots across various sectors, making them a key component of modern industrial automation strategies.

- In September 2024, KUKA expanded its KR SCARA robot portfolio by introducing new models with payload capacities of 20 kg and announcing an upcoming 60 kg variant. These additions are designed to enhance automation in sectors such as battery production, automotive, electronics, and pharmaceuticals. With high precision, speed, and flexible reach up to 1.2 meters, the new SCARA robots support demanding applications such as palletizing, cleanroom operations, and medical device assembly.

f

f

Key Highlights:

- The SCARA robot industry size was valued at USD 10.21 billion in 2023.

- The market is projected to grow at a CAGR of 13.75% from 2024 to 2031.

- Asia Pacific held a share of 33.82% in 2023, valued at USD 3.45 billion.

- The 5-15 kg segment garnered USD 3.85 billion in revenue in 2023.

- The material handling segment is expected to reach USD 7.77 billion by 2031.

- The manufacturing segment is projected to generate a value of USD 7.09 billion by 2031.

- North America is anticipated to grow at a CAGR of 14.28% over the forecast period.

Market Driver

Rising Demand for Automation and Cost-Efficient, Compact Robots

The market is witnessing strong growth, propelled by the accelerating demand for automation in the electronics and automotive industries, along with a rising need for compact and cost-efficient robotic solutions. In the electronics and automotive sectors, manufacturers are under constant pressure to increase throughput, enhance precision, and reduce operational errors.

These industries rely heavily on repetitive, high-speed tasks such as assembly, inspection, and parts handling, where minor inefficiencies can lead to significant productivity losses. SCARA robots, with their exceptional speed, precision, and reliability, offer an ideal solution for streamlining such tasks, helping companies meet stringent production and quality benchmarks.

Additionally, manufacturers across all scales are increasingly adopting compact, cost-effective, and easily integrated automation solutions. SCARA robots meet these needs with their space-saving designs and relatively low acquisition and operating costs.

Their lightweight structure allows for flexible installation in limited floor space, while their high reliability and minimal maintenance requirements contribute to long-term cost savings. This makes SCARA robots particularly attractive in fast-paced, cost-sensitive manufacturing environments.

- In June 2024, FANUC America introduced the SR-12iA/C Food Grade SCARA robot, a high-speed solution designed for food processing, packaging, and cleanroom applications. Featuring a 12kg payload, compact footprint, corrosion resistance, and food safety compliance, the robot aims to enhance efficiency and safety in food automation.

Market Challenge

High Initial Investment

A significant challenge impeding the expansion of the SCARA robot market is the high initial investment required for automation implementation. It includes additional expenses related to installation, programming, integration with existing manufacturing infrastructure, staff training, and ongoing maintenance.

For small and medium-sized enterprises (SMEs), these upfront costs can be particularly burdensome, particularly when operating within tight margins or when the return on investment is uncertain. Additionally, integrating robots into legacy systems or customizing them for specific tasks can increase project costs, making automation seem risky or inaccessible.

To address this barrier, the industry is shifting toward scalable, modular automation solutions that enable incremental adoption—starting with core functionalities and expanding as needs and budgets evolve. Furthermore, flexible financing models, such as leasing and robotics-as-a-service (RaaS), are easing financial burden by converting capital expenditures into manageable operational costs.

Market Trend

Cleanroom Applications and Smart Integration

The market is witnessing substantial growth, propelled by increasing adoption in cleanroom and medical applications, and advancements in intelligent controllers and collaborative capabilities.

These robots are increasingly customized to meet stringent cleanroom standards required in pharmaceutical manufacturing, medical device assembly, and semiconductor production. Their compact design, high-speed precision, and ability to maintain sterility make them highly suitable for sensitive applications in healthcare and high-tech manufacturing sectors.

- In November 2023, Yamaha Motor Co., Ltd. launched the YK-XEC series, a cleanroom-compatible addition to its cost-efficient YK-XE SCARA robot lineup. Designed to meet ISO Class 4 cleanliness standards, the YK-XEC is ideal for automated operations in semiconductors, hard disk drives, food, and medical equipment. Maintaining the core specifications of the YK-XE series, the new model delivers enhanced productivity and labor savings through high-speed performance.

Moreover, there is a growing trend toward integrating SCARA robots with advanced controllers and collaborative features. Modern control systems offer enhanced data processing, real-time feedback, and seamless communication with other factory automation components.

These capabilities enable predictive maintenance, improved synchronization, and more efficient programming. Additionally, safety-focused features and support for human-robot collaboration are expanding the usability of SCARA robots in mixed work environments, further promoting their adoption in digitally transforming factories.

SCARA Robot Market Report Snapshot

|

Segmentation

|

Details

|

|

By Payload Capacity

|

Up to 5 kg, 5-15 kg, Above 15 kg

|

|

By Application

|

Material Handling, Assembling & Disassembling, Welding & Soldering, Dispensing & Processing, Others

|

|

By Vertical

|

Manufacturing, Automotive, Food & Beverages, Pharmaceuticals, Metal & Machinery, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Payload Capacity (Up to 5 kg, 5-15 kg, and Above 15 kg): The 5-15 kg segment earned USD 3.85 billion in 2023 due to its optimal balance of speed and load capacity, making it suitable for a wide range of industrial tasks.

- By Application (Material Handling, Assembling & Disassembling, Welding & Soldering, Dispensing & Processing, and Others): The material handling segment held a share of 27.30% in 2023, due to rising automation in logistics and warehouse operations for improved throughput.

- By Vertical (Manufacturing, Automotive, Food & Beverages, Pharmaceuticals, Metal & Machinery, and Others): The manufacturing segment is projected to reach USD 7.09 billion by 2031, propelled by the increasing adoption of SCARA robots for high-precision assembly and streamlined production processes.

SCARA Robot Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific SCARA robot market accounted for a substantial share of 33.82% in 2023, valued at USD 3.45 billion. This dominance is largely attributed to the strong presence of consumer electronics and automotive manufacturing hubs in countries such as China, Japan, and South Korea.

High-volume production lines in these nations increasingly rely on SCARA robots for tasks requiring speed and precision, particularly in PCB assembly and component handling. Additionally, the expansion of small and mid-sized enterprises in Southeast Asia embracing industrial automation has further fueled regional market growth.

Japan, a pioneer in robotics, continues to innovate and export SCARA systems, while China’s growing investments in smart manufacturing have led to widespread SCARA adoption across private and state-owned enterprises.

North America SCARA robot industry is expected to register the fastest CAGR of 14.28% over the forecast period. This surge is fueled by the rapid integration of advanced robotics in the U.S. and Canada’s high-tech manufacturing sectors, particularly in electronics and medical device production.

The reshoring of manufacturing and increased investment in factory automation to boost labor productivity and global competitiveness are contributing to regional market growth. Furthermore, the presence of leading robotics solution providers and growing collaboration between automation companies and end-user industries are accelerating SCARA robots deployment, particularly in high-precision, hygiene-sensitive sectors like pharmaceuticals and biotechnology.

Regulatory Frameworks

- In the United States, robots are regulated under the Occupational Safety and Health Administration (OSHA), with safety standards guided by the ANSI/RIA and harmonized with international ISO standards for industrial robots.

- In the European Union, robots must comply with the Machinery Directive, Electromagnetic Compatibility Directive, and Low Voltage Directive, with safety standards defined under EN ISO 10218 and ISO/TS 15066 for collaborative robots.

- In China, robot safety and quality are governed by the Standardization Administration of China (SAC) and the Ministry of Industry and Information Technology (MIIT), under national standards such as GB/T 15706 for machinery safety and GB/T for industrial robots.

- In Japan, robots are regulated under the Industrial Safety and Health Act, with technical standards specified in Japanese Industrial Standards (JIS) and oversight provided by the Ministry of Health, Labour and Welfare (MHLW).

- In India, the Bureau of Indian Standards (BIS) addresses robot safety in accordance with global ISO standards, enforced through the Factories Act, 1948, under the Ministry of Labour and Employment.

Competitive Landscape

The global SCARA robot market is characterized by established players striving to strengthen their market position through continuous innovation and strategic expansion. Key companies are focusing on enhancing the performance capabilities of their SCARA robots by integrating advanced features such as AI-driven motion control, real-time data analytics, and improved human-machine interfaces.

Additionally, they are investing heavily in R&D to develop faster, more compact and energy-efficient models tailored to specific industry needs such as electronics, food processing, and pharmaceuticals.

Strategic partnerships and collaborations with system integrators and end-user industries are being leveraged to expand application scope and improve customization.

In addition, market players are expanding their geographic footprint through mergers, acquisitions, and new facilities, particularly in high-growth regions such as Asia Pacific and North America. Customization and modular designs have allowed manufacturers to address diverse operational requirements and improve customer retention.

- In 2024, International Innovation Network Oy (IIN) partnered with Mecademic to integrate the MCS500, recognized as the world’s most compact and precise SCARA robot, into its upcoming white-label desktop robot cell. This solution aims to deliver cost-efficient, standardized automation for industries such as medical devices, consumer electronics, and diagnostics, supporting applications icnluding assembly, glue dispensing, and pick-and-place operations.

List of Key Companies in SCARA Robot Market:

- FANUC America Corporation

- DENSO WAVE INCORPORATED

- Yaskawa America, Inc.

- Seiko Epson Corporation

- Stäubli International AG

- ABB

- KUKA AG

- OMRON Corporation

- Kawasaki Heavy Industries, Ltd.

- Comau S.p.A.

- Universal Robots A/S

- Hiwin Corporation

- Delta Electronics, Inc.

- NACHI-FUJIKOSHI CORP.

- Quant Storage Inc.

Recent Developments (Product Launches)

- In March 2025, Mitsubishi Electric launched the MELFA RH-10CRH and RH-20CRH SCARA robots to support digital transformation in manufacturing. These compact, lightweight robots are designed for high-speed performance and feature battery less motors, integrated wiring, and compatibility with vision sensors and industrial networks, addressing productivity challenges and skilled labor shortages across industries such as food, automotive, and packaging.

- In September 2024, Schneider Electric introduced its new ultra-compact Lexium SCARA robot, aimed at enhancing productivity in manufacturing and assembly processes across industries such as battery production, electronics, warehousing, and consumer packaged goods. The robot offers high-speed, precise motion in a footprint 40% smaller than competitors and integrates with the EcoStruxure Machine Expert Twin digital twin solution for virtual design and testing.

- In September 2024, Yamaha Motor Co., Ltd. introduced the YK1200XG SCARA robot and the RCX341 dedicated controller, expanding its YK-XG series. The YK1200XG features a 1,200mm arm length and supports a maximum payload of 50kg. Designed for large-object assembly and transport, it addresses growing demand in sectors such as automotive battery manufacturing.

- In November 2023, ABB launched its new IRB 930 SCARA robot to enhance pick-and-place and assembly operations across key sectors such as electronics, automotive, and renewable energy. The IRB 930 features three variants with 12 kg and 22 kg payload capacities, offering a 10% increase in throughput and 200% stronger push-down force for force-intensive tasks.