Market Definition

N-butanol is a primary alcohol, charaterized as a colorless, flammable liquid with a distinct odor. It is moderately soluble in water and widely used as an industrial solvent, a chemical intermediate in coatings, plastics, and pharmaceuticals production, and a biofuel additive due to its high energy content.

N-butanol Market Overview

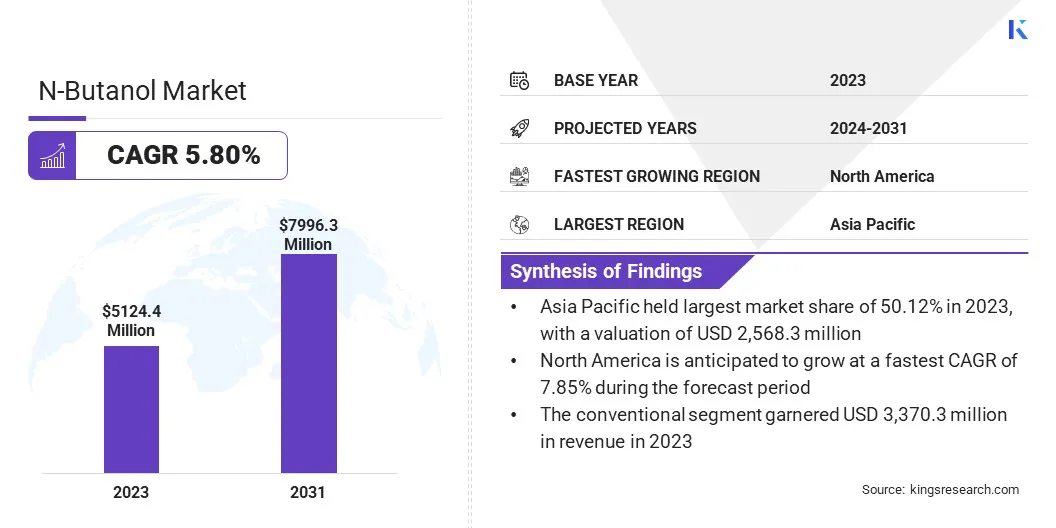

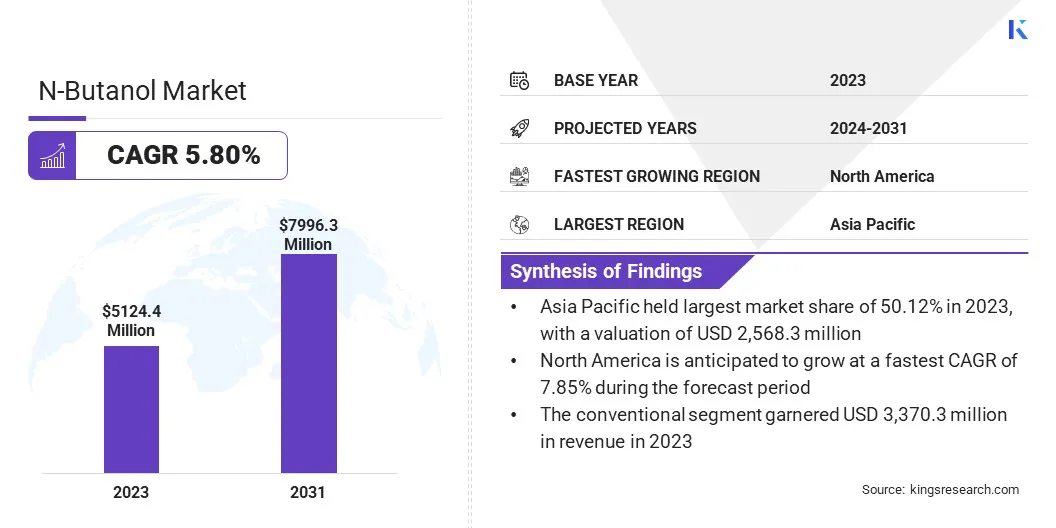

The global N-butanol market size was valued at USD 5,124.4 million in 2023 and is projected to grow from USD 5,387.4 million in 2024 to USD 7,996.3 million by 2031, exhibiting a CAGR of 5.80% during the forecast period. This growth is driven by its extensive use in industries such as paints and coatings, chemicals, textiles, plastics, and biofuels.

As a key industrial solvent and chemical intermediate, n-butanol is in high demand for the production of coatings, adhesives, and synthetic resins. Market growth is influenced by factors such as industrial expansion, urbanization, and increasing demand from the construction and automotive sectors, which drive the need for paints, coatings, and adhesives.

Major companies operating in the global N-butanol Industry are BASF, The Dow Chemical Company, Eastman Chemical Company, Saudi Basic Industries Corporation, Merck KGaA, Mitsubishi Corporation, Sasol Limited, OQ Chemicals GmbH, PetroChina Company Ltd., KH Neochem Co., Ltd., INEOS Capital Limited, Formosa Plastics Corporation, Petroliam Nasional Berhad, Solventis, and LG Chem, Ltd.

Additionally, the rising focus on bio-based fuels has boosted demand for n-butanol as a fuel additive. The growing pharmaceutical industry contributes to market expansion, as n-butanol is used in drug formulation and chemical synthesis.

With its growing applications in multiple industries and advancements in bio-based production, the market is expected to see steady growth in the coming years.

Key Highlights:

- The global N-butanol market size was valued at USD 5,124.4 million in 2023.

- The market is projected to grow at a CAGR of 5.80% from 2024 to 2031.

- Asia Pacific held a share of 50.12% in 2023, valued at USD 2,568.3 million.

- The conventional segment garnered USD 3,370.3 million in revenue in 2023.

- The butyl acetate segment is projected to generate a revenue of USD 2,574.7 million by 2031.

- The chemical manufacturing segment is expected to reach USD 2,802.7 million by 2031.

- The market in North America is anticipated to grow at a CAGR of 7.85% over the forecast period.

Market Driver

"Growing Demand from Key Industries and Technological Advancements"

The N-butanol market is experiencing significant growth, fueled bu by increasing demand from the construction and automotive industries, as well as advancements in chemical manufacturing processes.

Rapid urbanization and infrastructure development have led to a surge in construction activities, boosting the demand for paints, coatings, and adhesives, where n-butanol is a key solvent.

Moreover, the expanding automotive sector, supported by rising vehicle production and evolving consumer preferences, has increased the need for high-performance coatings and fuel additives, further propelling market growth. Additionally, continuous technological advancements in chemical manufacturing have enhanced the efficiency of n-butanol production.

Innovations in process optimization, catalyst development, and bio-based production methods have reduced operational costs, improved yield, and minimized environmental impact. These combined factors are driving the widespread adoption of n-butanol across multiple industries, supporting market expansion.

Market Challenge

"Market Volatility and Supply Chain Constraints"

The N-butanol market faces several challenges, including fluctuating raw material prices and logistical and supply chain constraints, both of which significantly impact profitability and market stability. The volatility in crude oil and natural gas prices directly affects the cost of petrochemical-based n-butanol, creating uncertainty for both manufacturers and consumers.

Since traditional n-butanol is derived from propylene, a byproduct of crude oil refining, any disruptions in the global oil supply chain or price spikes lead to increased production costs and reduced profit margins.

To address this challenge, companies are increasingly investing in bio-based n-butanol production, which reduces dependence on fossil fuels and provides a more stable and sustainable supply chain, mitigating the impact of raw material fluctuations.

Another major challenge impeding market expansion is logistical and supply chain constraints, which impact the seamless availability of n-butanol across various industries. Transportation and storage of n-butanol require strict handling measures due to its flammable nature, which increases shipping costs and regulatory requirements.

Additionally, limited regional production facilities in certain regions lead to supply shortages and delays, further affecting market dynamics. To overcome these challenges, companies are investing in strategic geographic expansions, partnerships with logistics providers, and improved storage technologies to enhance supply chain efficiency.

By strengthening infrastructure and optimizing distribution networks, industry players are working to ensure a more resilient and uninterrupted supply of n-butanol to meet global demand.

Market Trend

"Growing Emphasis on Sustainability and Expanding Applications"

The N-butanol market is witnessing notable shifts, supported by the rising demand for bio-based n-butanol and the expansion of end-use applications across various industries.

Growing environmental concerns and stringent regulations on carbon emissions and petrochemical-based solvents have accelerated the shift toward sustainable and renewable alternatives, making bio-based n-butanol a preferred option. Its lower environmental impact, reduced reliance on fossil fuels, and compatibility with green chemistry initiatives have further increased its market appeal.

Additionally, the applications of n-butanol are expanding beyond traditional chemical manufacturing, with increasing use in pharmaceuticals, personal care, and coatings.

The pharmaceutical industry leverages n-butanol as a solvent and intermediate in drug formulation, while the cosmetics sector utilizes it in fragrances and skincare products. In coatings, its role as a key component in high-performance paints and finishes continues to grow due to rising demand from the construction and automotive industries.

N-butanol Market Report Snapshot

|

Segmentation

|

Details

|

|

By Feedstock

|

Conventional, Bio-based

|

|

By Application

|

Butyl Acrylate, Butyl Acetate, Solvents, Chemical Synthesis, Others

|

|

By End Use Industry

|

Chemical Manufacturing, Automotive, Construction, Agriculture, Textile, Pharmaceuticals & Cosmetics

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, U.K., Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Feedstock (Conventional and Bio-based): The conventional segment earned USD 3,370.3 million in 2023 due to its widespread availability, cost-effectiveness, and strong demand in industrial applications.

- By Application (Butyl Acrylate, Butyl Acetate, Solvents, Chemical Synthesis, and Others): The butyl acetate segment held a share of 32.09% in 2023, attributed to its extensive use in coatings, adhesives, and personal care products.

- By End Use Industry (Chemical Manufacturing, Automotive, Construction, Agriculture, Textile, and Pharmaceuticals & Cosmetics): The chemical manufacturing segment is projected to reach USD 2,802.7 million by 2031, owing to increasing demand for n-butanol in producing intermediates and specialty chemicals.

N-butanol Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific N-butanol market accounted for a substantial share of 50.12% in 2023, valued at USD 2,568.3 million. This expansion is supported by rapid industrialization, increasing construction activities, and the growing demand for paints, coatings, and adhesives.

Countries such as China, India, and Japan are contributing significantly to this growth, benefiting from strong manufacturing bases, expanding automotive sectors, and rising investments in infrastructure.

Additionally, the presence of key chemical manufacturers and favorable government policies supporting industrial growth fuels this growth. The regional market further benefits from low production costs and abundant availability of raw materials, enhancing the competitiveness of local manufacturers.

- In August 2024, BASF and UPC Technology Corporation signed a Memorandum of Understanding to strengthen cooperation on plasticizer alcohols and catalysts. BASF will supply N-Butanol and 2-Ethylhexanol to support UPC’s growing demand in South China.

North America N-butanol Industry is expected to register the fastest growth, with a CAGR of 7.85% over the forecast period. This growth is fueled by increasing demand for bio-based n-butanol, advancements in chemical manufacturing, and rising applications in the pharmaceutical and cosmetic industries.

The United States and Canada are at the forefront of this growth, mainly due to strong research and development activities, growing emphasis on sustainable and green chemicals, and expansion in sectors such as automotive and construction.

Additionally, rising investments in infrastructure development and industrial automation, along with a surge in demand for high-performance coatings and adhesives, are contributing to regional market expansion.

This growth is further charaterized by a well-established chemical supply chain, technological advancements in bio-refining and increasing adoption of alternative fuels, creating new growth opportunities for n-butanol manufacturers.

Regulatory Framework

- In the U.S., the Environmental Protection Agency (EPA) regulates N-butanol under the Toxic Substances Control Act (TSCA) to ensure safe handling and environmental compliance. Additionally, the Occupational Safety and Health Administration (OSHA) sets workplace exposure limits.

- In Europe, the European Chemicals Agency (ECHA) monitors N-butanol under the Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH) regulation to ensure chemical safety. The European Commission (EC) enforces sustainability and industrial safety regulations.

- In Japan, the Ministry of Economy, Trade and Industry (METI) enforces chemical regulations under the Chemical Substances Control Law (CSCL) to manage the safe use of N-butanol. The Japan Industrial Standards Committee (JISC) sets industry-specific safety and quality standards.

Competitive Landscape

The global N-butanol market is characterized by a large number of participants, including both established corporations and emerging players. Market participants are focusing on strategic expansions, mergers and acquisitions, product innovations, and sustainability initiatives to strengthen their market position.

Leading companies are investing in R&D activities to develop bio-based and environmentally friendly alternatives, catering to the growing demand for sustainable chemicals.

Additionally, collaborations and partnerships with end-use industries, research institutions, and government bodies are becoming increasingly common to enhance production capabilities and market reach.

They are further adopting capacity expansion strategies to meet the rising demand from industries such as paints and coatings, automotive, construction, and pharmaceuticals.

Companies are establishing manufacturing plants in high-growth regions where industrialization and infrastructure development are creating demand. Furthermore, the price volatility of raw materials and stringent environmental regulations are influencing manufacturers to explore innovative and cost-effective production techniques, including the advancement of bio-based n-butanol production.

List of Key Companies in N-Butanol Market:

- BASF

- The Dow Chemical Company

- Eastman Chemical Company

- Saudi Basic Industries Corporation

- Merck KGaA

- Mitsubishi Corporation

- Sasol Limited

- OQ Chemicals GmbH

- PetroChina Company Ltd.

- KH Neochem Co., Ltd.

- INEOS Capital Limited

- Formosa Plastics Corporation

- Petroliam Nasional Berhad

- Solventis

- LG Chem, Ltd.

Recent Developments (M&A/Partnerships/Agreements/New Product Launch)

- In November 2024, Catalyxx Inc. secured funding from Aether Chemical Investments and the European Commission’s EIC Accelerator Program to support the scale-up and commercialization of its bio-based high-alcohol technology, which converts bioethanol into sustainable chemicals, including n-butanol.

- In June 2024, Technip Energies and Mitsubishi Chemical Corporation announced the licensing of their improved OXO M-Process technology for OXO alcohol production. The enhanced process aims to reduce capital and operating costs and improve n-butanol and 2-ethylhexanol production efficiency.

- In May 2024, OQ Chemicals announced the lifting of force majeure on all products from its German plants in Oberhausen and Marl after successfully resuming operations. The company implemented strategic enhancements to optimize production processes, restoring all plants to full capacity. Products, including n-butanol, are no longer under force majeure.