Market Definition

The market refers to the industry that deals with the manufacturing of DC contactors. A DC contactor is an electrical device used to control high-voltage DC circuits. The main purpose of a DC contactor is to connect or disconnect a DC power supply to a load, such as motors, lighting systems, or other equipment that uses DC power.

It consists of an electromagnetic coil, which, when energized, pulls a set of contacts together to close the circuit and allow current to flow. When the coil is de-energized, the contacts open, cutting off the current.

The report highlights the key drivers influencing market growth, along with an in-depth analysis of emerging trends and the evolving regulatory frameworks shaping the industry's trajectory.

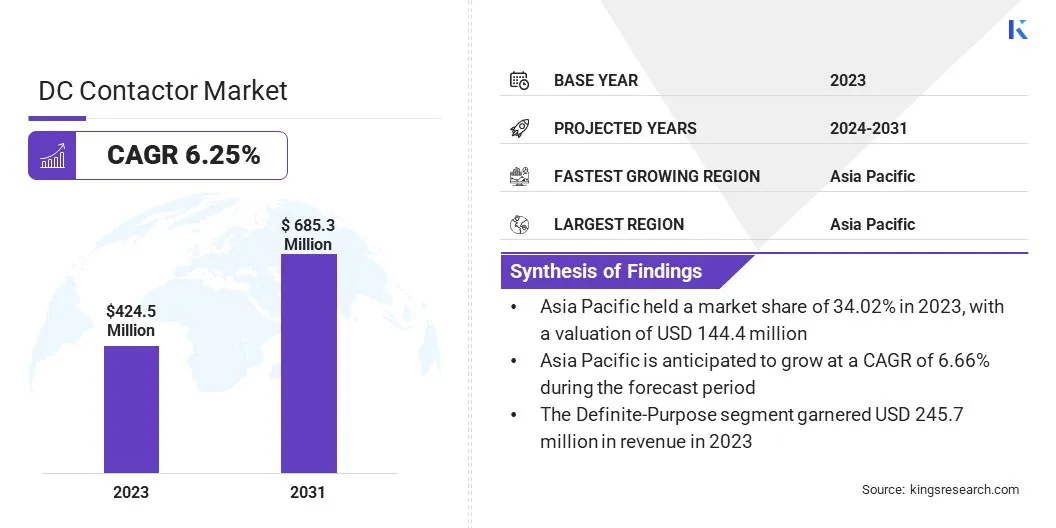

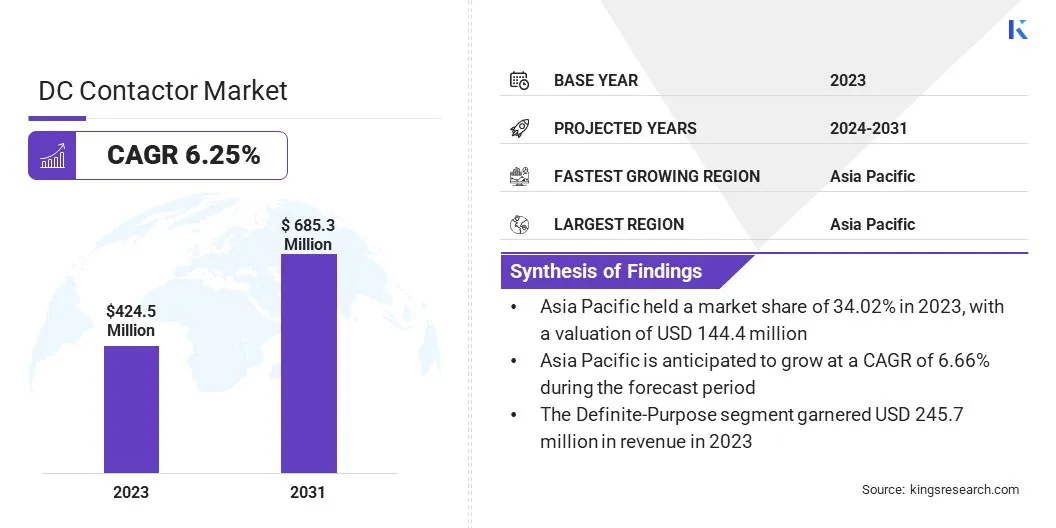

The global DC contactor market size was valued at USD 424.5 million in 2023, which is estimated to be USD 448.3 million in 2024 and reach USD 685.3 million by 2031, growing at a CAGR of 6.25% from 2024 to 2031.

The rising adoption of Electric Vehicles (EVs) is driving the demand for DC contactors, as efficient battery power management is crucial for their operation. DC contactors ensure safe connection and disconnection of battery circuits, vital for EV performance.

Major companies operating in the DC contactor industry are Siemens AG, Rockwell Automation, ABB, TE Connectivity, Mitsubishi Electric Corporation, Zhejiang Hecheng Smart Electric Co.,Ltd, Sensata Technologies, Inc, METEK Switch, Hotson International Ltd, Schaltbau GmbH, Cotronics BV, Littelfuse, Inc., Eaton, Albright, and BCH Electric Limited.

The increasing adoption of renewable energy systems, particularly solar power, is driving growth in the market. Efficient management of this power flow is crucial as solar panels, batteries, and grid connections rely on DC power.

DC contactors play a vital role in ensuring the safe and reliable operation of these systems by controlling the connection and disconnection of DC circuits. The demand for renewable energy solutions, coupled with advancements in DC contactor technology, is accelerating market expansion.

- In January 2024, ABB launched over 20 new products at the Electrification Innovation Week, including the revolutionary SACE Infinitus solid-state circuit breaker. These innovations support the transition to cleaner, more efficient energy solutions in industries such as energy storage, photovoltaic, UPS batteries, electric propulsion ships, rail transport, and buildings.

Key Highlights:

- The DC contactor industry size was valued at USD 424.5 million in 2023.

- The market is projected to grow at a CAGR of 6.25% from 2024 to 2031.

- Asia Pacific held a market share of 34.02% in 2023, with a valuation of USD 144.4 million.

- The definite-purpose segment garnered USD 245.7 million in revenue in 2023.

- The electric vehicle segment is expected to reach USD 195.4 million by 2031.

- The market in Europe is anticipated to grow at a CAGR of 6.27% during the forecast period.

Market Driver

"Rising Adoption of EVs"

The rising adoption of EVs and hybrid electric vehicles (HEVs) is leading to a surge in the demand for efficient power management systems. DC contactors are crucial for safely and reliably controlling battery power in these vehicles, ensuring optimal performance.

The need for advanced DC contactor solutions grows as EV production scales, driven by the demand for enhanced safety, energy efficiency, and reliability. This trend is accelerating the expansion of the DC contactor market, positioning it as a key growth driver in the automotive industry.

- In April 2023, Littelfuse expanded its lineup of DC contactors, targeting eMobility and industrial applications. These new products, designed for high-powered commercial EVs and industrial systems, offer reliable high-current switching capabilities, supporting a wide range of electric and hybrid vehicles.

Market Challenge

"Arcing and Durability Issues"

Arcing occurs when an electrical current jumps across a gap between contacts in a DC circuit, creating a visible spark. DC circuits are more prone to arcing compared to AC circuits, due to their continuous flow of current.

This arcing causes wear and tear on contactors, reducing their lifespan. Advanced materials and design solutions are necessary to address these issues. Manufacturers can use high-quality, corrosion-resistant materials and implement innovative contactor designs to minimize arcing, improving durability and extending the service life of DC contactors in demanding applications.

Market Trend

"Miniaturization and Compact Designs"

The DC contactor market has registered a significant trend toward miniaturization and compact designs. Manufacturers are developing contactors that can fit into tighter spaces as the demand for smaller, more efficient components grows, catering to applications in modern devices like EVs and renewable energy systems.

These compact designs help optimize space, reduce weight, and enhance overall system efficiency, while maintaining the performance and reliability required for safe & effective power management in low-voltage DC circuits.

- In January 2023, Albright International introduced the MC50 Miniature Contactor Series. The MC50, a 65A contactor, bridges the gap between 30A relays and 80A contactors, ideal for light DC switching applications such as starting engines in golf cars and garden mowers.

|

Segmentation

|

Details

|

|

By Type

|

Definite-Purpose, General-Purpose

|

|

By End User

|

Electric Vehicle, Renewable Energy and Storage, Aerospace and Defence, Industrial Machineries, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Type (Definite-Purpose, General-Purpose): The definite-purpose segment earned USD 245.7 million in 2023, due to the increasing demand for reliable power management in specialized applications.

- By End User (Electric Vehicle, Renewable Energy and Storage, Aerospace and Defence, Industrial Machineries, Others): The electric vehicle segment held 28.47% share of the market in 2023, due to the rising adoption of EVs requiring efficient DC power control solutions.

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific DC contactor market share stood at around 34.02% in 2023, with a valuation of USD 144.4 million. Asia Pacific is the dominant region in the market, driven by rapid industrialization, significant growth in EV adoption, and expanding renewable energy projects.

The region's robust manufacturing sector, particularly in countries like China, Japan, and India, is boosting the demand for efficient power management solutions. Additionally, the growing focus on sustainability and carbon reduction, along with increasing infrastructure development, is fueling the need for advanced DC contactors, establishing Asia Pacific as the market leader.

The DC contactor industry in Europe is poised for significant growth at a robust CAGR of 6.27% over the forecast period. Europe is emerging as a rapidly growing region for the market, driven by the increased adoption of renewable energy sources, EVs, and industrial automation.

The region's strong push for carbon neutrality and the expansion of offshore wind power projects are major factors fueling this growth. Additionally, stringent regulations and government incentives are accelerating the need for efficient and reliable DC power management solutions, further boosting the demand for advanced DC contactors across various applications.

- In February 2023, Mitsubishi Electric acquired Scibreak AB, a Swedish company specializing in DC circuit breaker (DCCB) technology. This acquisition aims to strengthen Mitsubishi's HVDC systems, supporting global renewable energy deployment, particularly in offshore wind power generation across Europe.

Regulatory Frameworks

- In the U.S., the National Electrical Code (NEC), governs electrical installations, including DC circuits and contactors, ensuring safety for people and property through comprehensive electrical system standards.

- In India, the Bureau of Indian Standards (BIS) provides standards for electrical equipment, including DC contactors, ensuring safety, performance, and reliability in electrical installations and systems.

- In the EU, CE marking is a mandatory conformity marking for electrical equipment, including DC contactors, indicating compliance with safety, health, and environmental standards required for market access.

Competitive Landscape:

Companies in the DC contactor industry are focusing on enhancing product performance by developing innovative technologies such as smart contactors with real-time monitoring, faster switching capabilities, and better integration into modern automation systems.

They are also prioritizing compact designs, energy efficiency, and improved durability to meet the growing demands of industries like energy, automotive, and manufacturing, while ensuring enhanced safety, reliability, and ease of use in critical applications like EVs and renewable energy systems.

- In March 2025, Schaltbau will showcase its smart contactor SC503 at Hannover Messe, demonstrating its advanced technology for high-speed switching in DC and AC applications. The SC503 enhances system safety, efficiency, and adaptability, featuring real-time monitoring and seamless automation integration.

List of Key Companies in DC Contactor Market:

- Siemens AG

- Rockwell Automation

- ABB

- TE Connectivity

- Mitsubishi Electric Corporation

- Zhejiang Hecheng Smart Electric Co.,Ltd

- Sensata Technologies, Inc

- METEK Switch

- Hotson International Ltd

- Schaltbau GmbH

- Cotronics BV

- Littelfuse, Inc.

- Eaton

- Albright

- BCH Electric Limited

Recent Developments (Partnerships/Product Launches)

- In March 2025, Schaltbau announced a strategic partnership with fortop UK to distribute and integrate Eddicy’s DC contactor portfolio in the UK. This collaboration aims to enhance energy efficiency, system reliability, and sustainability in key sectors such as renewable energy and e-mobility.

- In June 2024, Sensata Technologies introduced the SGX Series contactors, including SGX150, SGX250, and SGX400 models. These contactors, designed for applications like energy storage and DC fast charging, feature a hermetically sealed square form factor and advanced ceramic brazing technology.

- In September 2023, LOVATO Electric updated its contactor range, introducing a more compact design for higher current ratings (up to 600A). These contactors feature energy-efficient coils, wide voltage ranges, and enhanced adaptability for motor control applications, meeting industry needs.