Market Definition

The market encompasses the design, production, and deployment of drones manufactured using additive manufacturing technologies, primarily utilized in aerospace, defense, agriculture, logistics, and consumer applications.

It focuses on leveraging 3D printing to create lightweight, customizable, and cost-efficient drone components, enabling rapid prototyping, reduced time-to-market, and enhanced design flexibility across various industries. The report identifies the principal factors contributing to market expansion, along with an analysis of the competitive landscape influencing its growth trajectory.

3D Printed Drone Market Overview

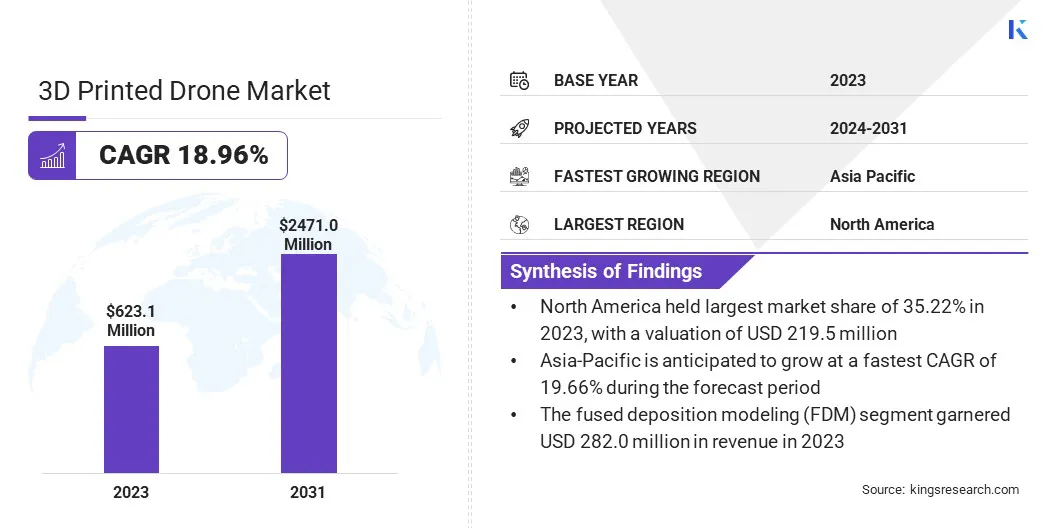

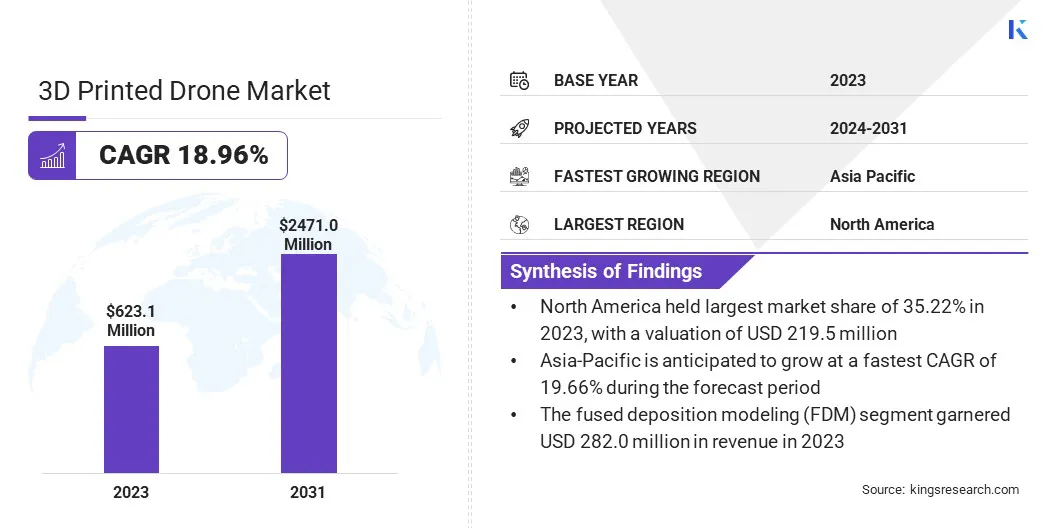

The global 3D printed drone market size was valued at USD 623.1 million in 2023 and is projected to grow from USD 732.8 million in 2024 to USD 2471.0 million by 2031, exhibiting a CAGR of 18.96% during the forecast period.

Rising demand for lightweight, durable, and customizable aerial systems across industries such as defense, agriculture, and logistics is boosting market growth. The ability of additive manufacturing to streamline production, reduce material waste, and enable rapid prototyping fosters its adoption among drone manufacturers seeking design flexibility and cost efficiency.

Major companies operating in the 3D printed drone industry are Parrot Drone SAS, Proto Labs, Firestorm Labs, Formlabs, Sintratec AG, Weerg, Flyability SA, Vexma Technologies, BAE Systems, Locanam, Quantum-Systems GmbH, Firestorm Labs, Inc, Greenjets Limited, AeroVironment, Inc., and Skydio.

The market is witnessing a significant shift toward innovation-driven manufacturing, supported by advancements in 3D printing technologies and high-performance materials.

Companies are leveraging additive manufacturing to accelerate product development cycles, enhance operational agility, and meet evolving application-specific requirements. Additionally, the growing integration of autonomous systems and AI-powered flight capabilities in 3D printed drones is expanding their functional scope.

- In January 2023, the American Society of Mechanical Engineers (ASME) reported that researchers at Imperial College London developed 3D printing system using multiple drones to construct vertical structures mid-flight. This Aerial Additive Manufacturing approach involves coordinated fleets of autonomous drones, where one group prints while another monitors quality, enabling new possibilities for building in remote or hazardous environments.

Key Highlights

- The 3D printed drone industry size was valued at USD 623.1 million in 2023.

- The market is projected to grow at a CAGR of 18.96% from 2024 to 2031.

- North America held a share of 35.22% in 2023, valued at USD 219.5 million.

- The airframe segment garnered USD 226.1 million in revenue in 2023.

- The fused deposition modeling (FDM) segment is expected to reach USD 1131.2 million by 2031.

- The multi-rotor segment is anticipated to witness the fastest CAGR of 19.37% over the forecast period.

- The consumer segment garnered USD 200.7 million in revenue in 2023.

- Asia Pacific is anticipated to grow at a CAGR of 19.66% through the forecast period.

Market Driver

"Demand for Lightweight and Customizable Drones"

The growing demand for lightweight and customizable aerial systems, particularly in the defense, logistics, and agriculture sectors, is fueling the expansion of the 3D printed drone market.

Lightweight designs are critical for enhancing flight efficiency, extending battery life, and increasing payload capacity, making them essential for a wide range of drone applications.

As industries seek drones tailored to specific operational needs, the ability of 3D printing to produce customized, structurally optimized components is boosting adoption.

This flexibility supports innovation, reduces production costs, and accelerates time-to-market, bolstering market growth and enabling broader use of drones in both commercial and industrial settings.

Market Challenge

"Limited Material Availability"

Limited material availability poses a significant challenge to the progress of the 3D printed drone market. The production of high-performance drones depends on access to specialized additive manufacturing materials such as high-strength polymers, carbon fiber composites, and aerospace-grade resins, which are essential for producing lightweight, durable drone components.

However, these materials are are often in short supply or inconsistent in quality, particularly in emerging markets or regions with underdeveloped additive manufacturing infrastructure. This scarcity can lead to production delays, increased costs, and constrained innovation, particularly for small and medium-sized manufacturers.

To mitigate this challenge, industry players are investing in the development of new printable materials, strengthening supply chain networks, and forming partnerships with material suppliers. Advancements in material science and the expansion of global distribution channels are further improving availability and supporting sustained market growth.

Market Trend

"Expansion of Drone Applications Across Industries"

The 3D printed drone market is witnessing a growing expansion of drone applications across a wide range of industries, supported by the need for efficiency, precision, and real-time data collection.

Industries such as agriculture, logistics, construction, energy, and public safety are increasingly adopting drones for tasks, including crop monitoring, infrastructure inspection, environmental assessment, and last-mile delivery. These applications enhance operational efficiency, reduce human risk, and support data-driven decision-making.

The flexibility of 3D printing enables the development of industry-specific drone designs, allowing for faster prototyping, customization, and deployment. This trend is broadening the functional scope of drones and positioning 3D printed UAVs as essential tools across modern industrial operations.

- In April 2024, Firestorm Labs raised USD 12.5 million to scale its production of high-performance drones using 3D printing technologies. The funding, led by Lockheed Martin’s venture capital arm, will support the company’s efforts to reduce production time and costs while meeting the evolving needs of military applications.

3D Printed Drone Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Airframe, Wings, Landing Gears, Propellers, Mounts & Holders, Others

|

|

By Technology

|

Fused Deposition Modeling (FDM), Stereolithography (SLA), Selective Laser Sintering (SLS), Others

|

|

By Type

|

Fixed-wing, Multi-rotor, Single-rotor, Hybrid

|

|

By Application

|

Consumer, Military, Commercial, Government & Law Enforcement

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Component (Airframe, Wings, Landing Gears, Propellers, Mounts & Holders, and Others): The airframe segment earned USD 226.1 million in 2023 due to its critical role in providing structural integrity, lightweight design, and aerodynamic efficiency for 3D printed drones.

- By Technology (Fused Deposition Modeling (FDM), Stereolithography (SLA), Selective Laser Sintering (SLS), and Others): The fused deposition modeling (FDM) held a share of 45.25% in 2023, fueled by its cost-effectiveness, ease of use, and suitability for producing durable and lightweight drone components.

- By Type (Fixed-wing, Multi-rotor, Single-rotor, and Hybrid): The multi-rotor segment is projected to reach USD 1026.8 million by 2031, propelled by its versatility, stability, and widespread use in applications such as aerial photography, surveillance, and precision agriculture.

- By Application (Consumer, Military, Commercial, and Government & Law Enforcement): The military segment is anticipated to grow at a CAGR of 19.66% over the forecast period, fueled by increasing demand for lightweight, mission-specific drones for surveillance, reconnaissance, and tactical operations.

3D Printed Drone Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America 3D printed drone market share stood at around 35.22% in 2023, valued at USD 219.5 million. This dominance is attributed to the presence of established drone manufacturers, advanced additive manufacturing infrastructure, and significant investments in defense and commercial UAV applications.

The regional market benefits from strong research and development initiatives, supportive regulatory frameworks, and early adoption of emerging technologies. Additionally, growing demand for drones in sectors such as agriculture, logistics, and public safety further contributes to regional market expansion.

- In January 2025, Defence Industry Europe reported that the U.S. Army’s 101st Airborne Division is implementing 3D-printed drones for training and innovation. This initiative, conducted at Fort Campbell, Kentucky, is part of preparations for Operation Lethal Eagle, a training exercise designed to refine tactical capabilities.

The Asia-Pacific 3D printed drone industry is projected to grow at a robust CAGR of 19.66% over the forecast period. This growth is fueled by rapid technological advancements, increasing investments in drone manufacturing, and expanding applications across industries such as agriculture, construction, and defense.

Governments in countries such as China, Japan, and South Korea are actively promoting the use of drones through supportive policies, funding programs, and strategic initiatives aimed at boosting domestic production capabilities.

Moreover, the growing presence of start-ups and tech companies specializing in additive manufacturing and unmanned systems is fostering innovation and competition in the region.

Regulatory Frameworks

- In the United States, 14 CFR Part 107, regulated by the Federal Aviation Administration (FAA), governs the commercial operation of small unmanned aircraft systems (sUAS). It sets requirements for registration, remote identification, pilot certification, and airspace safety to ensure legal and safe drone integration into national airspace.

- The ISO 21384-3:2019, established by the International Organization for Standardization (ISO), outlines general requirements for the safe operation of unmanned aircraft systems (UAS). It provides standardized guidelines for operational safety, maintenance, and risk management to ensure consistency and reliability across international drone deployments.

- In the European Union, Regulation (EU) 2019/947, implemented by the European Union Aviation Safety Agency (EASA), governs the operation of unmanned aircraft systems (UAS). It establishes a risk-based framework for drone use across open, specific, and certified categories, ensuring uniform safety, registration, and operator requirements throughout EU member states.

Competitive Landscape

The 3D printed drone industry is characterized by a mix of established manufacturers and innovative start-ups specializing in additive manufacturing. Companies are increasingly investing in research and development to enhance drone performance, improve material quality, and expand application areas.

Strategic partnerships, mergers, and acquisitions are also prevalent as businesses seek to strengthen market presence and diversify product offerings. Additionally, regional players are emerging, capitaliziang on local manufacturing capabilities and industry expertise to cater to the growing demand for customized and cost-effective drone solutions.

List of Key Companies in 3D Printed Drone Market:

- Parrot Drone SAS

- Proto Labs

- Firestorm Labs

- Formlabs

- Sintratec AG

- Weerg

- Flyability SA

- Vexma Technologies

- BAE Systems

- Locanam

- Quantum-Systems GmbH

- Firestorm Labs, Inc

- Greenjets Limited

- AeroVironment, Inc.

- Skydio

Recent Developments (Partnerships)

- In June 2023, Greenjets partnered with Firestorm Labs to develop next-generation additively manufactured UAV systems. This collaboration focuses on creating fully 3D-printed airframes and propulsion modules for modular unmanned aerial systems (MUAS), aimed at enhancing mission adaptability and production speed.