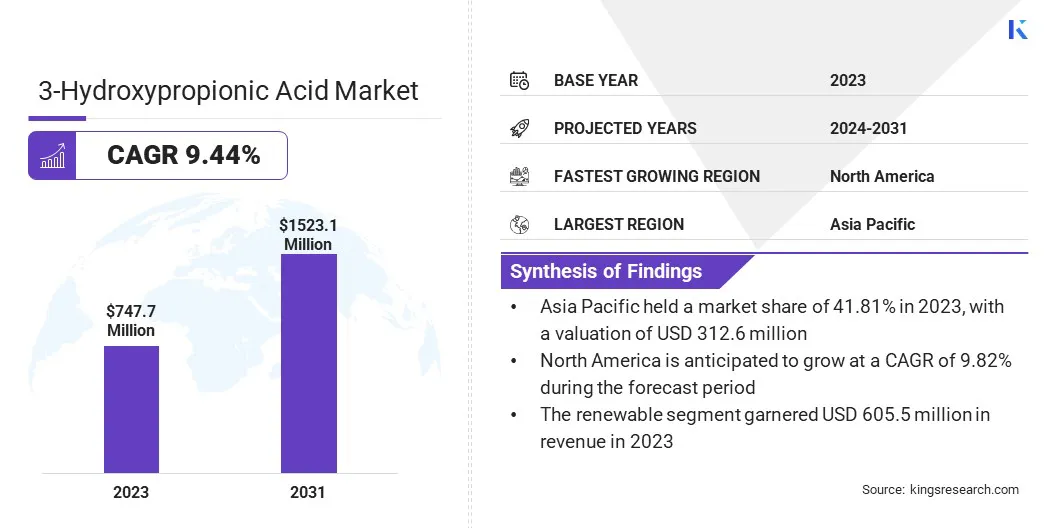

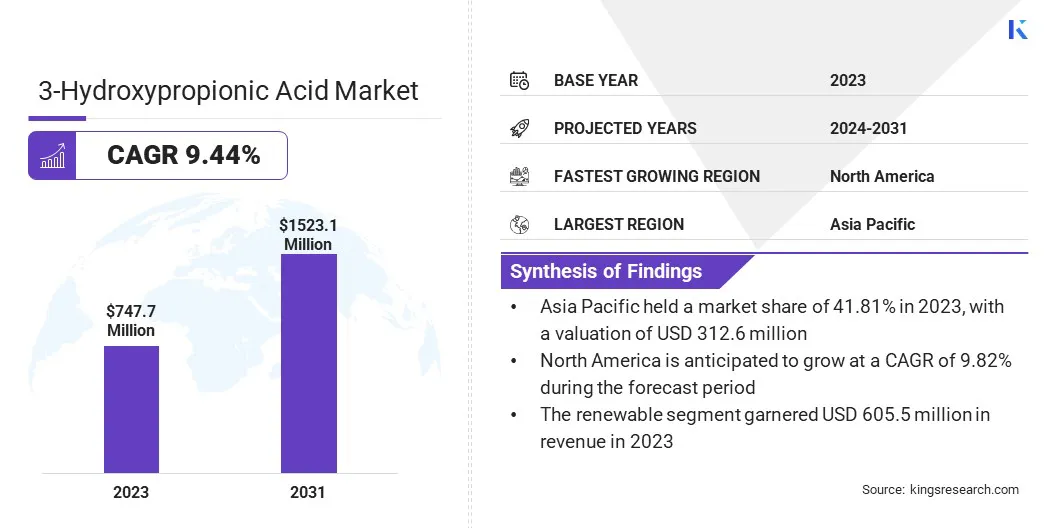

3-Hydroxypropionic Acid Market Size

The global 3-Hydroxypropionic Acid Market size was valued at USD 747.7 million in 2023 and is projected to grow from USD 809.8 million in 2024 to USD 1,523.1 million by 2031, exhibiting a CAGR of 9.44% during the forecast period. The market is expanding due to its increasing applications in the automotive and packaging industries.

Biotechnology innovations enhance production efficiencies, leading to more cost-effective and sustainable solutions. Additionally, the rising emphasis on eco-friendly materials is driving the demand for more 3-hydroxypropionic acid-based products.

In the scope of work, the report includes solutions offered by companies such as Merck KGaA, Thermo Fisher Scientific Inc., Zhengzhou Alfa Chemical Co., Ltd, Fluoropharm Co., Ltd., Olympus Corporation, LG Chem, Beijing PhaBuilder Biotechnology Co., Ltd., Tokyo Chemical Industry Co., Ltd. (TCI), Oakwood Products Inc., Spectrum Chemical, and others.

The 3-hydroxypropionic acid market is experiencing significant growth that can be attributed to its use in producing acrylic esters, which are crucial for various applications. As industries seek durable, high-quality coatings, the demand for acrylic acids, known for their excellent color consistency, heat resistance, and low-temperature durability, is rising. The expanding construction sector and a shift toward sustainable materials are further propelling market growth.

- For instance, in October 2023, Lummus Technology announced an agreement with Air Liquide Engineering & Construction to acquire the rights to license and market technology related to ester-grade acrylic acid and light and heavy acrylate processes.

The trend favoring sustainable and high-quality coatings is also contributing to market growth, as industries seek innovative solutions to meet both performance and environmental standards.

3-Hydroxypropionic acid (3-HPA) is a versatile organic compound used primarily as a building block in the production of acrylic esters and other chemical derivatives. It is a colorless, water-soluble liquid with a broad range of applications, including its use in biodegradable plastics and pharmaceuticals, and as a precursor in the synthesis of various polymers.

3-HPA is valued for its ability to create environmentally friendly products due to its potential role in bio-based chemical processes. Its properties make it a key ingredient in creating materials with enhanced performance characteristics and sustainability features.

Analyst’s Review

The global 3-Hydroxypropionic Acid (3-HPA) market is increasingly driven by strategic partnerships and mergers & acquisitions.

- For instance, in October 2023, LG Chem and GS Caltex announced a collaboration to accelerate the commercialization of the world's first eco-friendly 3-HPA biomaterial. GS Caltex's Yeosu plant successfully completed test production to produce a prototype by early 2024. This partnership focused on achieving sustainable production through fermentation and advanced process technologies.

As key players invest in research and development to bridge product and technology gaps, these efforts are expected to significantly enhance market growth in the coming years, fostering innovation and expanding applications across various industries.

3-Hydroxypropionic Acid Market Growth Factors

The increasing focus on environmental sustainability is significantly driving the demand for biodegradable plastics, consequently boosting the market for 3-hydroxypropionic acid. As a key raw material in the production of biodegradable plastics, 3-HP offers an eco-friendly alternative to conventional petroleum-based plastics, in consensus with global efforts to reduce plastic pollution and carbon footprints.

This growing demand is propelling market growth as manufacturers seek sustainable solutions to meet regulatory requirements and consumer preferences for green products. By leveraging advancements in biotechnology, companies are enhancing the production efficiency of 3-HP, further reducing costs and improving market competitiveness, thereby accelerating market growth.

Meanwhile, the 3-Hydroxypropionic Acid (3-HPA) market also faces challenges due to high production costs and limited raw material availability. These issues lead to increased costs and supply chain disruptions, impeding market growth. Additionally, scaling up production to meet the rising demand is complex and expensive.

To address these challenges, key players invest in advanced production technologies and optimizing supply chains. For example, LG Chem and GS Caltex are collaborating to develop eco-friendly 3-HPA, aiming to enhance production efficiency and reduce costs. Such strategic initiatives are crucial in mitigating the impact of these challenges and supporting market growth.

3-Hydroxypropionic Acid Market Trends

The expanding use of 3-hydroxypropionic acid in the pharmaceutical industry is significantly propelling market growth. As 3-HP is increasingly used in drug formulation, its role as a key intermediate in synthesizing pharmaceuticals enhances their stability, efficacy, and overall performance. This growing application is attracting substantial investments in research and development, leading to the creation of novel drug formulations and treatments.

Additionally, the shift of pharmaceutical industry toward utilizing 3-HP underscores its strategic value and aligns with broader trends of incorporating sustainable and bio-based materials in drug development, thereby fostering continued growth and innovation within the market.

3-hydroxypropionic acid is emerging as a bio-based alternative to traditional petrochemical-derived compounds in paint formulations. It is extensively polymerized to produce biodegradable polymers, which are utilized as binders or additives in paints and coatings. In the correct market, biodegradable coatings are gaining traction in applications with a high environmental impact, such as architectural coatings and outdoor equipment.

The trend toward incorporating 3-HPA in formulations reflects a growing emphasis on sustainability and eco-friendliness in the coatings industry. As industries prioritize reducing environmental footprints, the adoption of 3-HPA-based biodegradable coatings is continuously expanding, driving innovation and growth in the market.

Segmentation Analysis

The global market is segmented based on source, form, application, and geography.

By Source

Based on source, the market is categorized into renewable and non-renewable segments. The renewable segment led the 3-hydroxypropionic acid market in 2023, reaching a valuation of USD 605.5 million. As industries seek greener alternatives to traditional petrochemical-based products, 3-HPA's role as a bio-based feedstock for producing biodegradable plastics and other eco-friendly materials is expanding.

The push toward renewable energy and environmental sustainability is propelling this segment, with significant investments in research and development enhancing production technologies. The increasing focus on renewable solutions is helping to meet regulatory requirements and consumer preferences for environmentally responsible products, thereby accelerating the growth of the renewable segment in the 3-HPA market.

By Form

Based on form, the market is categorized into Powder and Liquid. The liquid segment captured the largest 3-hydroxypropionic acid market share of 58.36% in 2023. In the liquid form, 3-HPA is utilized effectively in the production of high-performance polymers, coatings, and pharmaceuticals. The increasing demand for liquid 3-HPA is fueled by its versatility and ease of integration into chemical processes.

Enhanced production technologies and a focus on developing high-quality liquid products are expected to contribute to this segment's growth. The rising need for advanced materials in automotive and construction applications is further boosting the growth of the liquid segment, making it a key area of development in the 3-HPA market.

By Application

Based on application, the market is categorized into acrylic acid production, biodegradable polymer production, and others. The acrylic acid production segment is expected to account for the highest revenue of USD 668.8 million by 2031, owing to its vital role in producing various acrylic esters.

As the demand for acrylic acids rises, driven by their use in high-performance coatings, adhesives, and super-absorbent polymers, the 3-HPA segment is expected to meet these needs over the forecast period. Advances in production technologies are enhancing the efficiency and yield of acrylic acid, contributing to market growth.

Furthermore, the emphasis on developing sustainable and cost-effective production methods is accelerating the segment's expansion, as industries increasingly seek innovative solutions for acrylic acid applications.

3-Hydroxypropionic Acid Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

Asia-Pacific 3-hydroxypropionic acid market share stood around 41.81% in 2023 in the global market, with a valuation of USD 312.6 million, mainly due to the high product demand for manufacturing key chemicals such as acrylic acid, 1,3-propanediol, and lactic acid. These chemicals are consumed in diverse end-uses across automotive, construction, food and beverages, and textile industries.

- Additionally, according to the India Brand Equity Foundation, global electric vehicle (EV) market, valued at approximately USD 250 billion in 2021, is projected to expand five-fold by 2028, reaching USD 1,318 billion. This surge in EV production further fuels the demand for 3-HPA, bolstering the market's growth in the region.

Furthermore, the rapid expansion of the automotive and construction sectors, coupled with increased investment in sustainable and eco-friendly technologies, is propelling the need for 3-HPA-based products, therby propelling market growth in the region.

North America is anticipated to witness significant growth at a CAGR of 9.82% over the forecast period. The rising demand for bio-based polymers is driving growth in the 3-Hydroxypropionic Acid (3-HPA) market. 3-HPA is essential for producing biodegradable

like poly(3-hydroxypropionic acid) and for manufacturing 1,3-propanediol and acrylic acid, which are widely used in paints and coatings. The U.S. has seen significant growth in automobile production:

- For instance, in June 2022, Ford Motor Company announced its plan to produce 2 million electric vehicles annually by 2026, reflecting significant growth in the U.S. automotive sector.

This expansion, coupled with increased plant capacities, is expected to drive higher demand for 3-HPA, thereby fostering market expansion in the region.

Competitive Landscape

The global 3-hydroxypropionic acid market report will provide valuable insights with a specialized focus on the fragmented nature of the industry. Prominent players are focusing on several key business strategies, such as partnerships, mergers and acquisitions, product innovations, and joint ventures, to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expanding services, investing in research and development (R&D), establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in 3-Hydroxypropionic Acid Market

- Merck KGaA

- Thermo Fisher Scientific Inc.

- Zhengzhou Alfa Chemical Co.,Ltd

- Fluoropharm Co., Ltd.

- Olympus Corporation

- LG Chem

- Beijing PhaBuilder Biotechnology Co., Ltd.

- Tokyo Chemical Industry Co., Ltd. (TCI)

- Oakwood Products Inc.

- Spectrum Chemical

The global 3-hydroxypropionic acid market is segmented:

By Source

By Form

By Application

- Acrylic Acid Production

- Biodegradable Polymer Production

- Others

By Region

- North America

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America