Market Definition

The zinc-nickel plating market involves the application of a zinc-nickel alloy coating to metal surfaces, primarily for corrosion protection. It is widely used in industries such as automotive, aerospace, and manufacturing, where components are exposed to harsh conditions. This plating enhances durability, resistance to corrosion, and overall performance, contributing to the longevity and reliability of critical metal parts.

Zinc-Nickel Plating Market Overview

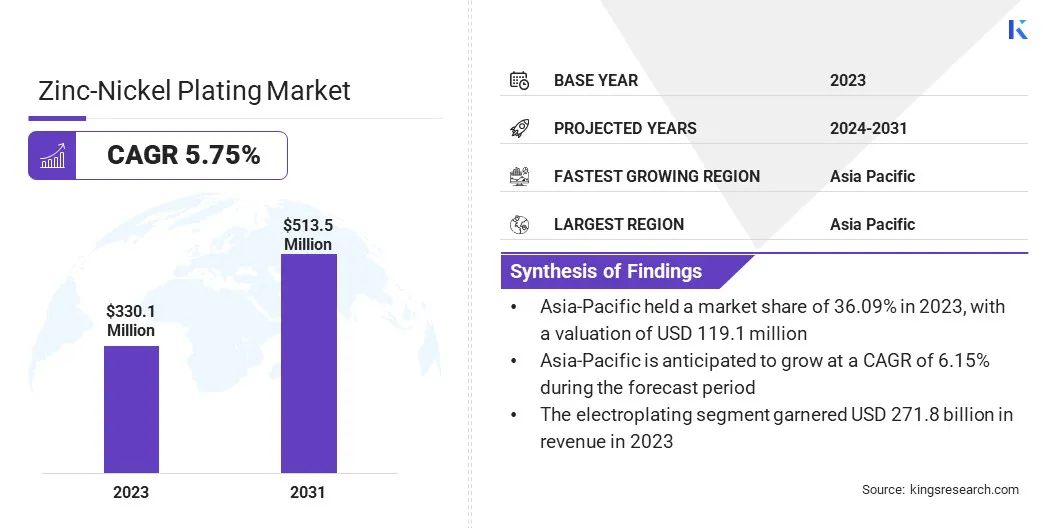

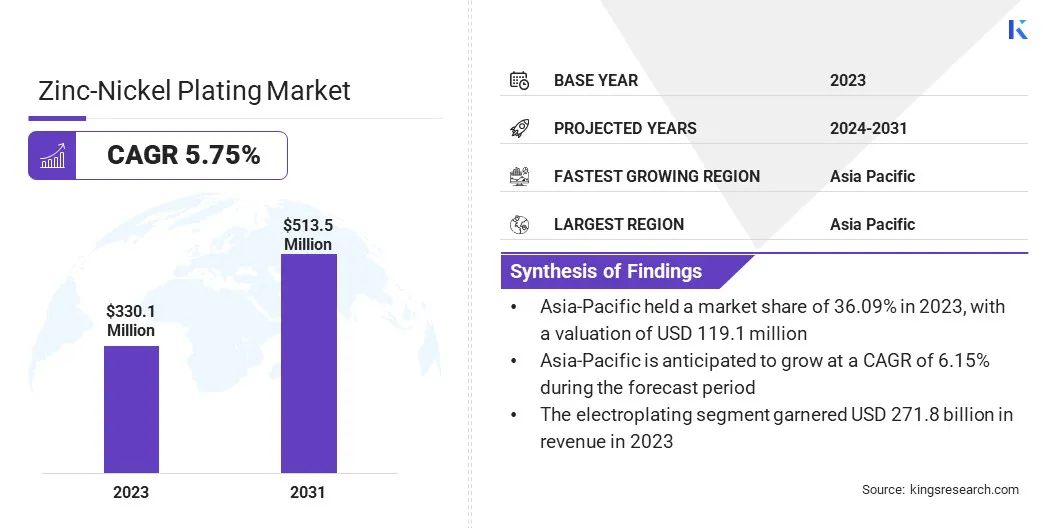

Global zinc-nickel plating market size was USD 330.1 million in 2023, which is estimated to be valued at USD 347.1 million in 2024 and reach USD 513.5 million by 2031, growing at a CAGR of 5.75% from 2024 to 2031.

Rising industrial applications, particularly in aerospace, defense, and electronics, are contributing significantly to market growth. These industries require durable, corrosion-resistant components, where zinc-nickel plating enhances performance and extends the lifespan of critical parts.

Major companies operating in the global zinc-nickel plating industry are KC Jones Plating, Element Solutions Inc, Chem Processing, Inc., Paramount Metal Finishing, MICRO METAL FINISHING, Plating Technology, Inc., DeKalb Metal Finishing, Northeast Metal Works, LLC., Cal-Aurum, Del's Plating Works, JAI GURUDEV ENTERPRISES, Gatto Industrial Platers, Inc., BFG Manufacturing Services, MKS Instruments, Inc., WHW Walter Hillebrand GmbH & Co. KG, and others.

The market experiences steady demand, driven by industries requiring high-performance corrosion resistance. It is highly valued for its durability, offering superior protection against harsh environmental conditions.

The market is marked by technological advancements in plating techniques, which improve efficiency and coating quality. Key market players continue to innovate, offering enhanced plating solutions to meet evolving industry needs. As a result, zinc-nickel plating remians a preferred choice in automotive, aerospace, and industrial applications.

- In December 2024, Vedanta’s Hindustan Zinc announced plans to establish the world’s first industrial Zinc Park in Rajasthan, focusing on zinc-related industries, including zinc-nickel plating applications. This initiative aims to meet the growing demand for sustainable and efficient zinc-nickel coatings while strengthening the regional supply chain.

Key Highlights:

- The global zinc-nickel plating market size was recorded at USD 330.1 million in 2023.

- The market is projected to grow at a CAGR of 5.75% from 2024 to 2031.

- Asia-Pacific held a share of 36.09% in 2023, valued at USD 119.1 million.

- The high-temperature zinc-nickel plating segment garnered USD 201.0 million in revenue in 2023.

- The electroplating segment is expected to reach USD 415.7 million by 2031.

- The aftermarket segment is anticipated to grow at a CAGR of 7.26% through the forecast period.

- The automotive segment is expected to hold a share of 49.57% by 2031.

- North America is anticipated to grow at a CAGR of 5.99% through the forecast period.

Market Driver

"Increasing Demand in Automotive Industry"

The increasing demand in the automotive industry is boosting the growth of the zinc-nickel plating market, as these coatings are crucial for protecting automotive components from corrosion. Zinc-nickel plating enhances the durability of parts exposed to harsh environments such as undercarriages, engines, and chassis.

As the automotive sector prioritizes vehicle longevity and performance, the superior corrosion resistance of zinc-nickel plating is driving its widespread adoption for both internal and external components, ensuring long-term reliability.

- According to SIAM, India's automotive industry produced 2.84 crore vehicles in FY 2023-24. This growth is fueling the demand for zinc-nickel plating, which enhances corrosion resistance, ensuring longevity and reliability across vehicles segments.

Market Challenge

"High Production Costs"

High production costs present a significant challenge to the expansion of the zinc-nickel plating market due to expensive materials, chemicals, and complex processes. These costs can make it difficult for manufacturers to remain competitive, particularly in price-sensitive industries.

To address this challenge, companies can adopt more efficient plating technologies, such as closed-loop systems, which reduce chemical and material waste, lower energy consumption, and improve efficiency. Additionally, investing in research to develop cost-effective, high-quality alternatives can help mitigate costs and improve profitability.

Market Trend

"Shift Toward Sustainability"

Sustainability is a growing trend in the zinc-nickel plating market as industries increasingly prioritize eco-friendly practices. With stricter environmental regulations and a shift toward greener technologies, manufacturers are adopting more sustainable plating solutions.

Closed-loop systems, which reduce wastewater and chemical waste, and advancements in energy-efficient processes are minimizing the environmental impact of zinc-nickel plating. This trend is driven by regulatory requirements and the demand for sustainable, durable products, aligning with the broader goal of reducing industrial carbon footprints.

- In July 2023, MKS Instruments introduced the Atotech CMA Closed-Loop System for alkaline zinc-nickel plating, certified by TÜV Rheinland. This system reduces wastewater, minimizes waste, improves plating efficiency, and lowers environmental impact, setting a new sustainability standard in the industry.

Zinc-Nickel Plating Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Low-Temperature Zinc-Nickel Plating, High-Temperature Zinc-Nickel Plating

|

|

By Process

|

Electroplating, Electroless Plating

|

|

By End User

|

OEM (Original Equipment Manufacturer), Aftermarket

|

|

By Application

|

Automotive, Aerospace, Electronics, Industrial Machinery

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Low-Temperature Zinc-Nickel Plating and High-Temperature Zinc-Nickel Plating): The high-temperature zinc-nickel Plating segment earned USD 201.0 million in 2023, due to its superior corrosion resistance in extreme conditions.

- By Process (Electroplating and Electroless Plating): The electroplating segment held a share of 82.34% in 2023, attributed to its cost-effectiveness and efficiency in large-scale applications.

- By End User [OEM (Original Equipment Manufacturer) and Aftermarket]: The OEM segment is projected to reach USD 354.1 million by 2031, owing to rising demand for durable and high-performance components in manufacturing.

- By Application (Automotive, Aerospace, Electronics, and Industrial Machinery): The aerospace segment is anticipated to grow at a CAGR of 7.72% over the forecast period, supported by increasing demand for lightweight, corrosion-resistant materials.

Zinc-Nickel Plating Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific zinc-nickel plating market captured a share of around 36.09% in 2023, valued at USD 119.1 million. This dominance is reinforced by its large-scale manufacturing base and industrial growth. The region’s rapid urbanization, coupled with expanding automotive, electronics, and aerospace industries, fuels the demand for zinc-nickel coatings.

Countries such as China, Japan, and India are at the forefront, with cost-effective production capabilities and increasing industrial output. The presence of key market players and their focus on expanding operations further solidifies Asia Pacific's dominance in the global market.

North America zinc-nickel plating industry is likely to grow at a CAGR of 5.99% over the forecast period. This growth is propelled by technological advancements and a focus on high-performance coatings. The demand for corrosion-resistant materials in industries such as automotive, aerospace, and electronics is increasing.

Additionally, stringent environmental regulations and the growing emphasis on sustainable practices are prompting industries to adopt zinc-nickel plating. With key players investing in research and development, North America is expected to see substantial market growth and innovation in the coming years.

Regulatory Frameworks

- In the U.S., the Environmental Protection Agency (EPA) safeguards public health and the environment by regulating and enforcing environmental laws, as well as conducting research.

- In the EU, the Regulation on the registration, evaluation, authorisation and restriction of chemicals (REACH) regulation governs chemical safety to mitigate risks to human health and the environment.

Competitive Landscape

The global zinc-nickel plating market is experiencing strategic acquisitions as companies aim to expand their product offerings, improve technological capabilities, and strengthen their market position.

These acquisitions allow companies to access innovative plating technologies, enhance production efficiencies, and meet growing demand in industries such as automotive and aerospace, while also addressing environmental concerns and sustainability goals.

- In May 2024, Lamons, a global leader in safety sealing solutions, acquired ModuHouston from Modumetal. Renamed ModuCoatings, the acquisition enhances the application of NanoGalv, a zinc-nickel plating system, for corrosion-resistant bolting and fastener applications across industries.

List of Key Companies in Zinc-Nickel Plating Market:

- KC Jones Plating

- Element Solutions Inc

- Chem Processing, Inc.

- Paramount Metal Finishing

- MICRO METAL FINISHING

- Plating Technology, Inc.

- DeKalb Metal Finishing

- Northeast Metal Works, LLC.

- Cal-Aurum

- Del's Plating Works

- JAI GURUDEV ENTERPRISES

- Gatto Industrial Platers, Inc.

- BFG Manufacturing Services

- MKS Instruments, Inc.

- WHW Walter Hillebrand GmbH & Co. KG