Enquire Now

Zero Waste Packaging Market Size, Share, Growth & Industry Analysis, By Type (Reusable/Recyclable Packaging, Compostable Packaging, Edible Packaging), By Material (Biopolymer, Paper & Cardboard, Glass, Metal, Others), By Application (Food & Beverages, Healthcare, Cosmetics & Personal Care, Others), and Regional Analysis, 2025-2032

Pages: 190 | Base Year: 2025 | Release: October 2025 | Author: Antriksh P.

Key strategic points

Zero waste packaging is primarily designed to minimize environmental impact by eliminating waste generated within the product’s lifecycle. It emphasizes the use of recyclable, compostable, or reusable materials that align with circular economy principles. The approach reduces reliance on single-use plastics, encourages sustainable material innovation, and supports regulatory and corporate sustainability goals while addressing rising consumer demand for eco-friendly alternatives.

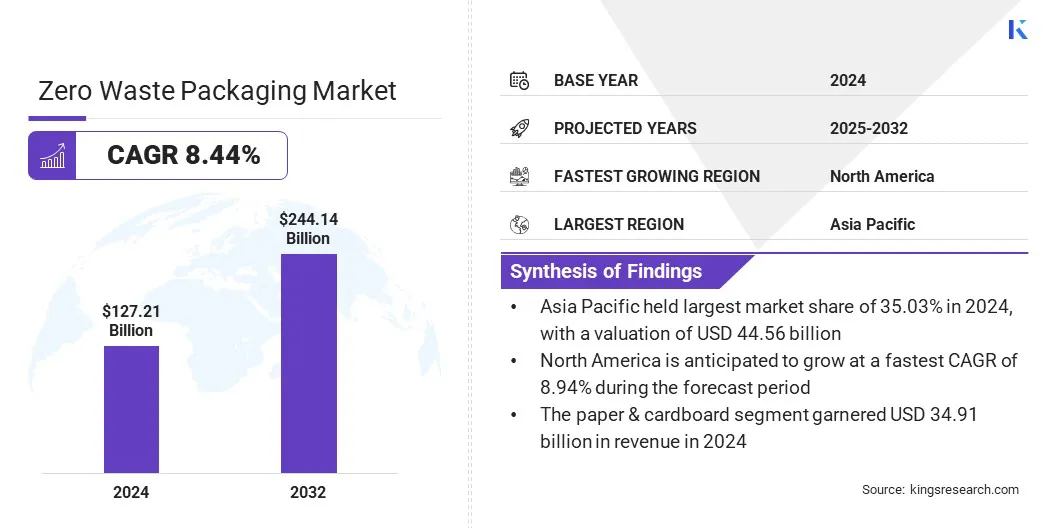

The global zero waste packaging market size was valued at USD 127.21 billion in 2024 and is projected to grow from USD 137.65 billion in 2025 to USD 244.14 billion by 2032, exhibiting a CAGR of 8.44% over the forecast period. This growth is driven by the rising preference for sustainable designs and reduced packaging waste. Market growth is further supported by retailers adopting minimalist packaging to lower costs and enhance eco-friendly branding.

Major companies operating in the zero waste packaging market are TIPA LTD, Hero Packaging, EcoEnclose, Sealed Air, UPM, Better Packaging Co., Tetra Pak International S.A., Avani, Amcor plc, DS Smith, Notpla Limited, LOLIWARE INC., Regeno, Loop Industries, and Unilever.

The market is experiencing growth driven by consumer packaged goods (CPG) brands adopting bio-based materials. CPG companies are adopting bio-based solutions to strengthen environmental commitments, meet regulatory requirements, and address rising consumer preference for eco-friendly products.

Innovations such as plant-based polymers and bioplastics support scalability, enabling broader implementation of zero waste strategies across diverse packaging applications within the consumer goods sector.

Increasing Use of Compostable Packaging Materials

A key factor propelling the progress of the zero waste packaging market is the growing use of compostable materials. These packaging solutions break down naturally without leaving harmful residues, addressing the environmental issues associated with single-use plastics. Therefore, manufacturers are integrating compostable packaging solutions into foodservice, e-commerce, and retail.

Regulatory policies restricting single-use plastics further accelerate adoption, while advancements in material science enhance performance and durability. This supports waste reduction initiatives, promoting circularity and strengthening the market of compostable packaging.

Functional Constraints Restrict Growth of Biodegradable Packaging

A major challenge hindering the expansion of the zero waste packaging market is the functional constraints of biodegradable products. These materials face issues related to durability, barrier properties, and suitability for long-term storage compared with conventional plastics.

To address this challenge, manufacturers are investing in advanced material formulations, coating technologies, and hybrid packaging systems to extend shelf stability and enhance performance. These innovations are making biodegradable packaging commercially viable.

Expansion of Circular Economy Business Models

A notable trend influencing the zero waste packaging market is the increased adoption of circular economy business models. Companies are shifting toward closed-loop systems that prioritize reuse, refill, and recycling to minimize waste. Retailers and consumer brands are also revamping their packaging formats to facilitate multiple life cycles and reduce material waste.

Further, packaging producers and recycling firms are partnering to support efficient resource recovery, while digital platforms are making traceability and consumer engagement easier. This transition is improving cost-efficiency and reducing environmental footprint, positioning circularity as a strategic framework for achieving long-term sustainability in the packaging industry.

|

Segmentation |

Details |

|

By Type |

Reusable/Recyclable Packaging, Compostable Packaging, Edible Packaging |

|

By Material |

Biopolymer, Paper & Cardboard, Glass, Metal, Others |

|

By Application |

Food & Beverages, Healthcare, Cosmetics & Personal Care, E-Commerce, Industrial, Electrical & Electronics, Others |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific |

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Based on region, the market has been classified into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

The Asia Pacific zero waste packaging market stood at 35.03% in 2024, valued at USD 44.56 billion. This dominance can be attributed to the expanding consumer awareness, rapid urbanization, and rising investments in sustainable packaging infrastructure.

Companies across retail, e-commerce, and foodservice industries are transitioning to compostable, recyclable, and reusable packaging to comply with stricter waste reduction mandates. Technological advancements in biodegradable polymers and increased deployment of refill models have further strengthened the region’s growth. Market players are also engaging in partnerships with local suppliers to enhance availability of bio-based materials across packaging applications.

North America zero waste packaging industry is set to grow at a CAGR of 8.94% over the forecast period. This growth is attributed to the adoption of sustainable packaging driven by strict regulatory policies to achieve zero waste targets. Consumer packaged companies are incorporating bio-based, recyclable, and reusable materials into their portfolios to align with circular economy practices.

Continuous innovation in material science and digital traceability solutions are strengthening market expansion. Furthermore, retailers are shifting to minimal packaging designs, while manufacturers are focusing on scaling compostable and biodegradable solutions.

Key players operating in the zero waste packaging industry are pursuing strategies centered on innovation, expansion, and collaboration. They are increasing investments in advanced material technologies, particularly bio-based polymers and compostable alternatives, to strengthen their portfolios. Strategic alliances with recycling firms and raw material suppliers are enabling secure sourcing and improved supply chain efficiency.

Companies are expanding manufacturing facilities to achieve scalability and reduce production costs. Furthermore, they are adopting acquisitions and partnerships to broaden geographic presence, while maintaining a strong focus on R&D to sustain competitiveness in the evolving market.

Frequently Asked Questions