Market Definition

Zeolite is a crystalline aluminosilicate mineral with a porous, three-dimensional structure composed of silicon, aluminum, and oxygen. Found in volcanic rocks and alkaline lake deposits, it is also synthetically produced for industrial applications.

Known for its exceptional adsorption, ion exchange, and catalytic properties, zeolite is widely used in water purification, petrochemical refining, gas separation, and detergents. Its ability to selectively trap ions makes it valuable for removing heavy metals and radioactive contaminants from wastewater.

Zeolite Market Overview

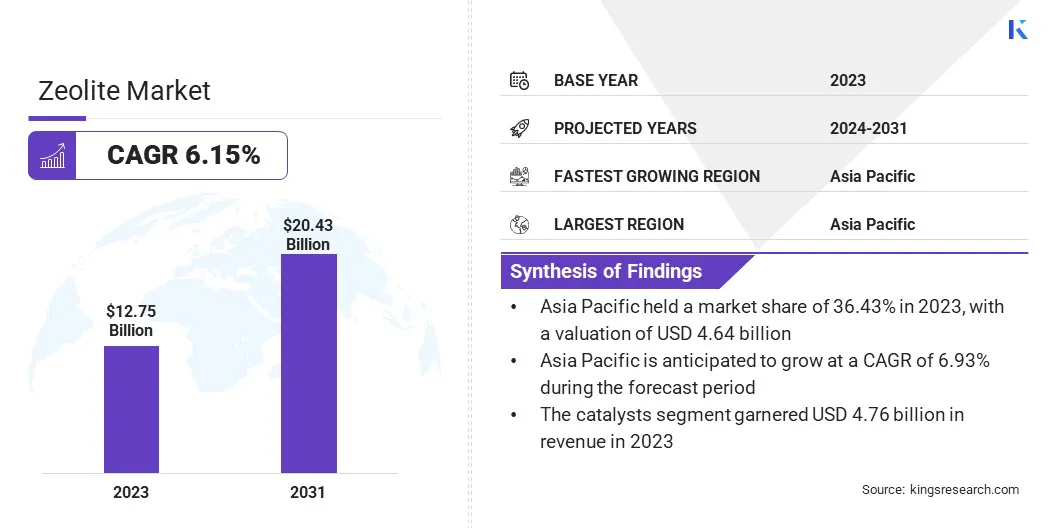

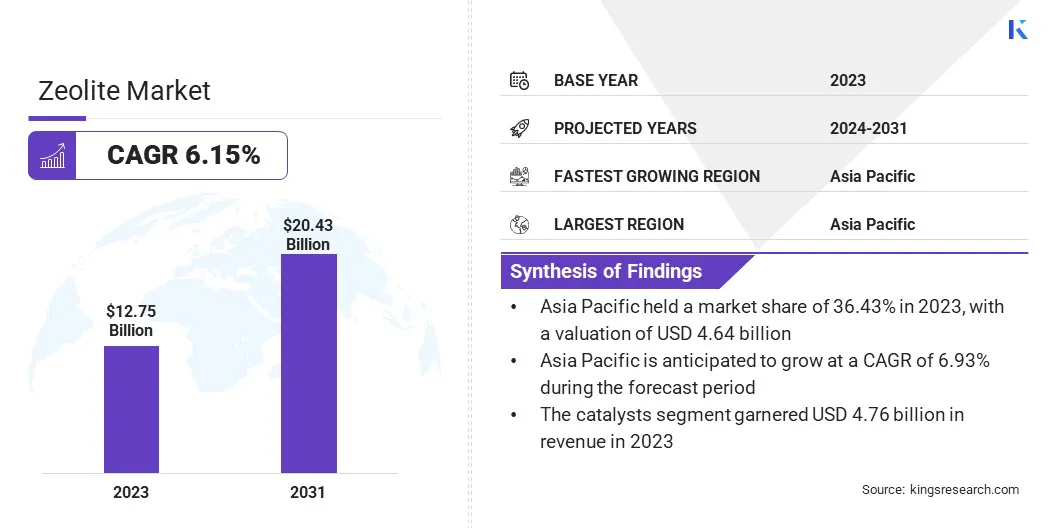

Global zeolite market size was USD 12.75 billion in 2023, which is estimated to be valued at USD 13.45 billion in 2024 and reach USD 20.43 billion by 2031, growing at a CAGR of 6.15% from 2024 to 2031.

The growth of the market is primarily driven by increasing demand for water treatment solutions, rising use in detergents due to environmental regulations, and expanding applications in petrochemical refining . Additionally, the shift toward sustainable agriculture and eco-friendly construction materials further boosts market expansion.

Major companies operating in the zeolite industry are Honeywell International Inc., Arkema, BASF, W. R. Grace & Co., CLARIANT, Ecovyst Inc., Zeotech Limited, International Zeolite Corp, Tosoh, Zeochem, KNT Group, Bear River Zeolite Co., Hengye Inc., Shijiazhuang Jianda High-tech Chemical Co., Ltd., Albemarle Corporation, and others.

The growing construction sector is creating a robust demand for zeolite-based materials. Zeolites enhance the durability, strength, and thermal insulation properties of cement and concrete, making them essential for infrastructure development.

Governments and private developers are investing in sustainable construction materials to meet environmental regulations and enhance energy efficiency. With increasing urbanization and infrastructure projects worldwide, the demand for zeolite is surging in the construction sector.

- As outlined in the National Action Plans (NAPs) on Business and Human Rights, the global construction market is projected to grow by USD 4.5 trillion, reaching USD 15.2 trillion within the next decade. China, India, the United States, and Indonesia are expected to account for 58.3% of this expansion.

Key Highlights:

- The zeolite industry size was recorded at USD 12.75 billion in 2023.

- The market is projected to grow at a CAGR of 6.15% from 2024 to 2031.

- Asia Pacific held a share of 36.43% in 2023, valued at USD 4.64 billion, and is anticipated to grow at a CAGR of 6.93% through the forecast period.

- The catalysts segment garnered USD 4.76 billion in revenue in 2023.

- The synthetic segment is expected to reach USD 12.35 billion by 2031.

Market Driver

"Rising Demand for Water Treatment Solutions"

The increasing need for effective water purification methods is fueling the growth of the zeolite market. Zeolites play a crucial role in removing heavy metals, ammonia, and organic pollutants from water, making them vital for municipal and industrial wastewater treatment. Rising concerns over freshwater scarcity are further fostering the demand for zeolite-based purification technologies.

- The UN World Water Development Report 2023 highlights Sustainable Development Goal 6 (SDG 6), which aims for universal access to sustainable water and sanitation by 2030. The report offers recommendations for policymakers to accelerate progress through capacity building, advanced data systems, innovation, increased financing, and strengthened governance.

Market Challenge

"Stringent Environmental Regulations"

Stringent environmental regulations on mining and processing pose a significant challenge to the growth of the zeolite market. Emissions and wastewater from extraction and production processes lead to compliance difficulties for manufacturers.

Regulatory restrictions on land use and waste disposal further increase operational complexities, hindering the widespread adoption of this chemical compound.

To address these challenges, companies are investing in sustainable mining practices and adopting eco-friendly production technologies. Advanced filtration and recycling systems are being integrated to minimize waste and reduce environmental impact.

Strategic collaborations with regulatory bodies and research institutions are helping companies develop innovative, compliant solutions that align with global sustainability goals.

Market Trend

"Notable Shift Toward Phosphate-free Detergents"

The transition to phosphate-free detergents is fueling the expansion of the zeolite market. Zeolites are effective builders that replace phosphates, which contribute to water pollution. Stringent environmental regulations restricting phosphate usage have prompted detergent manufacturers to adopt zeolite-based formulations.

The increasing consumer preference for eco-friendly cleaning products further supports market expansion. With major detergent producers shifting toward sustainable alternatives, the market for zeolite-based cleaning solutions is experiencing steady growth.

- In January 2023, the Delhi government prohibited the sale, storage, transportation, and marketing of soaps and detergents to align with the latest BIS standards and reduce Yamuna River pollution.

Zeolite Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Natural, Synthetic

|

|

By Application

|

Detergents, Catalysts, Adsorbents, Construction & Building Materials, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, U.K., Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Type (Natural and Synthetic): The synthetic segment earned USD 7.48 billion in 2023, mainly due to its tailored properties, higher purity, and consistent performance, making it a preferred choice for a wide range of industrial applications such as catalysis, water treatment, and gas separation.

- By Application (Detergents, Catalysts, Adsorbents, Construction & Building Materials, and Others): The catalysts segment held a share of 37.31% in 2023, largely attributed to its effectiveness in refining processes, particularly fluid catalytic cracking, which enhances fuel efficiency and supports the growing demand for cleaner petroleum products.

Zeolite Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

The Asia Pacific zeolite market accounted for a substantial share of around 36.43% in 2023, valued at USD 4.64 billion. The Asia-Pacific region, particularly China and India, is home to some of the world’s largest petrochemical and refining industries.

Zeolites play a major role as catalysts in processes such as fluid catalytic cracking (FCC), enhancing fuel efficiency and optimizing production. The growing demand for cleaner fuels, coupled with rapid industrial growth, is highlighting the need for zeolite-based catalysts in regional refining operations.

- The IEA forecasts that Asia will account for over 60% of global petrochemical oil demand growth by 2050. China's petrochemical sector is expanding at an unprecedented pace, nearly twice as fast as the Middle East and the United States.

Additionally, the growing focus on enhancing crop yields and improving soil health is fueling the adoption of zeolite-based products. The increasing demand for organic farming and sustainable agriculture practices in the region further boosts the demand for zeolite-based soil conditioners and fertilizers.

Europe zeolite industry is set to grow at a CAGR of 6.61% over the forecast period. European governments are increasingly investing in advanced water purification systems to meet the growing demand for clean, sustainable water sources, further boosting the adoption of zeolite-based solutions for water treatment.

Zeolites are highly effective in removing contaminants and improving water quality, making them indispensable for wastewater treatment and industrial and urban water recycling.

- In October 2024, Water Europe introduced a research initiative valued at USD 272.85 billion, focused on water investments over the next six years to protect Europe's economy and enhance environmental sustainability. The "Value of EU Investing in Water" study underscores the urgent need for better water management to address the growing threat of water scarcity, impacting 38% of the EU population.

Regulatory Framework Also Plays a Significant Role in Shaping the Market

- In the U.S., the Environmental Protection Agency (EPA) oversees the regulation of zeolite products, particularly in water treatment and soil amendments. Zeolites must comply with the Safe Drinking Water Act (SDWA) and the Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA) for pesticide applications.

- In the UK, the Environment Agency regulates zeolite products used in water treatment and environmental applications. Zeolites used as pesticides are governed by the Health and Safety Executive (HSE) under the Control of Pesticides Regulations.

- In China, the Ministry of Ecology and Environment (MEE) overns the use of zeolites in environmental applications, while the Ministry of Agriculture and Rural Affairs (MARA) monitors agricultural applications.

- In India, the Central Pollution Control Board (CPCB) oversees zeolite use in environmental applications, with the Department of Agriculture and Cooperation regulating agricultural applications.

- In Japan, the Ministry of the Environment (MOE) regulates zeolite products for environmental applications, while the Ministry of Agriculture, Forestry and Fisheries (MAFF) oversees their use in agriculture.

Competitive Landscape

The zeolite industry is characterized by a number of participants, including both established corporations and emerging players. Major market participants are expanding production facilities to enhance their market presence and meet the growing demand.

By increasing production capacity, these companies aim to better serve key industries, including water treatment, agriculture, and petrochemical applications. Additionally, enhanced production capabilities enable companies to innovate and provide customized zeolite solutions, fostering market growth and strengthening competitive positioning.

- In March 2023, International Zeolite launched a new production plant in Jordan, Ontario, acquired in December 2022. The facility will manufacture nutrient delivery and NEREA products, expanding the company's production capacity to 25 tons per day.

List of Key Companies in Zeolite Market:

- Honeywell International Inc.

- Arkema

- BASF

- R. Grace & Co.

- CLARIANT

- Ecovyst Inc.

- Zeotech Limited

- International Zeolite Corp

- Tosoh

- Zeochem

- KNT Group

- Bear River Zeolite Co.

- Hengye Inc.

- Shijiazhuang Jianda High-tech Chemical Co., Ltd.

- Albemarle Corporation

Recent Developments (Expansion)

- In May 2024, Zeolyst International, a joint venture of Ecovyst Inc., comiisioned a laboratory-scale thermal pyrolysis reactor equipped with state-of-the-art analytical tools. This new reactor replicates the plastic recycling process, enabling the development of zeolite-based advanced materials aimed at enhancing recycling efficiency.