Market Definition

Workforce management (WFM) is a set of processes and tools used by organizations to optimize employee productivity and operational efficiency. It includes forecasting staffing needs, creating work schedules, tracking time & attendance, managing leave, and ensuring compliance with labor regulations.

Workforce management ensures that the right people with the right skills are available at the right time to meet business objectives. The market encompasses a variety of software solutions and services delivered through on-premise, cloud-based, and hybrid deployment models.

Workforce Management Market Overview

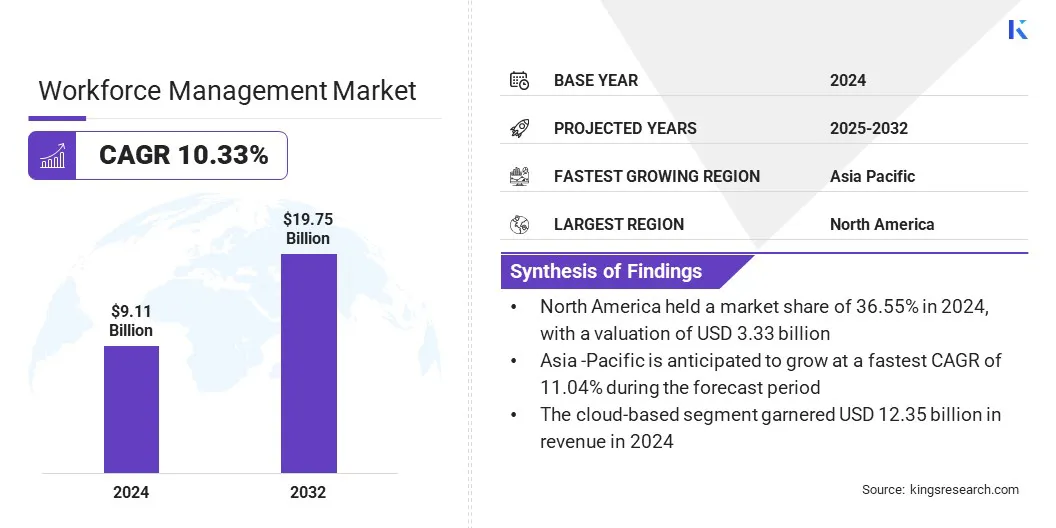

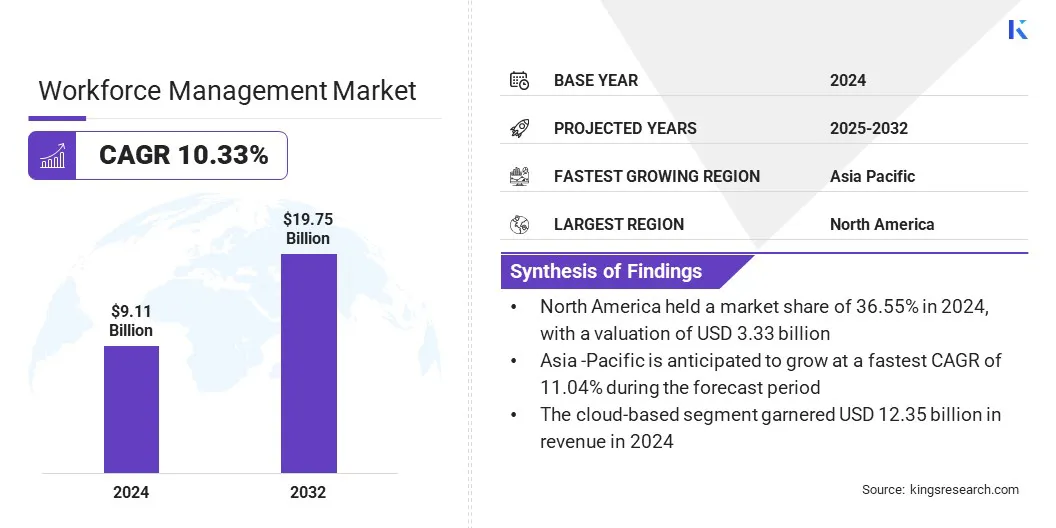

The global workforce management market size was valued at USD 9.11 billion in 2024 and is projected to grow from USD 9.92 billion in 2025 to USD 19.75 billion by 2032, exhibiting a CAGR of 10.33% during the forecast period.

The market growth is attributed to the rise of remote and hybrid work models, which is increasing the demand for workforce management solutions that support real-time tracking, remote scheduling, and seamless coordination across distributed teams.

The market is further progressing as organizations are integrating AI and predictive analytics into workforce management platforms to forecast staffing needs, optimize resource allocation, and enhance decision-making to enable more responsive and data-driven workforce operations.

Major companies operating in the workforce management industry are ADP, Inc, Oracle, SAP SE, Deel Inc., UKG Inc, Workday, Inc, Zoho Corporation Pvt. Ltd, Deltek, Inc, IBM Corporation, Infor, NiCE, Papaya Global, Paylocity, PeopleStrong, and Verint Systems Inc.

Expanding e-commerce and increasing consumer digitization are driving the market. Furthermore, the growing complexity of logistics, customer service, warehousing, and fulfillment operations is increasing the demand for advanced workforce management solutions that support real-time scheduling, time tracking and compliance management.

- According to Invest India, consumer digital shopping is projected to account for around 45% of the gross merchandise value in the e-commerce sector by 2030, with the industry aiming to reach a valuation of USD 2 trillion by 2033.This growth is driving the need for advanced workforce management solutions to efficiently handle large-scale, dynamic staffing demands across the e-commerce value chain.

Key Highlights:

- The workforce management industry size was valued at USD 9.11 billion in 2024.

- The market is projected to grow at a CAGR of 10.33% from 2025 to 2032.

- North America held a market share of 36.55% in 2024, with a valuation of USD 3.33 billion.

- The solutions segment garnered USD 5.14 billion in revenue in 2024.

- The cloud-based segment is expected to reach USD 12.35 billion by 2032.

- The large enterprises segment is anticipated to grow at a CAGR of 9.91% over the forecast period.

- The retail & e-commerce segment held a market share of 35.43% in 2024.

- The market in Asia Pacific is anticipated to grow at a CAGR of 11.04% through the forecast period.

Market Driver

Growth of Remote and Hybrid Work Models

The increasing adoption of remote and hybrid work models is propelling workforce management practices across industries. Organizations are embracing flexible work arrangements to enhance employee satisfaction, reduce overhead costs, and attract talent irrespective of geographic limitations. This shift necessitates the deployment of sophisticated WFM solutions capable of supporting real-time employee tracking, remote scheduling, and attendance monitoring.

The integration of cloud-based and AI-driven features within WFM platforms is enabling businesses to adapt quickly to dynamic workforce needs, optimize resource allocation, and uphold productivity standards in increasingly flexible and decentralized work environments.

- In June 2024, the Government Accountability Office reported that approximately 207,710 employees across 24 Chief Financial Officers Act agencies, which are key executive departments and agencies of the U.S. federal government, were working remotely, representing 9% of the total civilian federal workforce.

Market Challenge

Integration with Legacy Systems

A major challenge hindering the adoption of workforce management is the difficulty of integrating it with legacy systems. Many organizations still operate on outdated infrastructure that lacks compatibility with modern WFM platforms. This leads to data silos, manual data transfers, and reduced system efficiency. Integrating new tools with legacy payroll, HR, and ERP systems often requires custom development, which is time-consuming and costly.

Additionally, mismatched data formats and inconsistent workflows can result in errors, disrupting operations and undermining the benefits of automation & real-time workforce insights.

Market players are developing flexible and API-driven workforce management solutions that enable seamless connectivity with existing HR, payroll, and ERP platforms. They are also offering cloud-based models with modular architecture that allow phased adoption without disrupting the core operations of the organization.

Additionally, vendors are investing in pre-built connectors, integration toolkits, and professional services to simplify deployment. These efforts are helping organizations modernize workforce processes while preserving their existing IT investments and minimizing transition-related disruptions.

Market Trend

AI and Predictive Analytics Integration

Integarion of AI and predictive analytics is transforming workforce management by enabling data-driven decision-making and operational automation. Modern WFM platforms are using AI to forecast staffing needs, predict employee absenteeism, and optimize scheduling based on real-time demand patterns.

Predictive analytics also helps in identifying performance trends, turnover risks, and productivity bottlenecks. This capability allows organizations to proactively manage workforce resources, reduce costs, and improve overall efficiency.

- In August 2024, Helios launched a comprehensive workforce management platform designed to streamline how companies manage and pay global teams. The AI-driven, all-in-one solution integrates global payroll, HR, time tracking, and compliance tools into a single platform, enabling multinational organizations to simplify onboarding, ensure timely payments, and improve operational efficiency while reducing reliance on multiple disconnected systems.

Workforce Management Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Solutions (Workforce Scheduling, Time & Attendance Management, Embedded Analytics, Absence Management, Others), Services (Consulting, Integration & Deployment, Support & Maintenance)

|

|

By Deployment Mode

|

On-premise, Cloud-based

|

|

By Enterprise Size

|

Large Enterprises, Small & Medium Enterprises (SMEs)

|

|

By End-Use Industry

|

Retail & e-Commerce, Healthcare, BFSI, Manufacturing, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Component (Solutions (Workforce Scheduling, Time & Attendance Management, Embedded Analytics, Absence Management, Others) and Services (Consulting, Integration & Deployment, Support & Maintenance)): The solutions segment earned USD 5.14 billion in 2024, due to the rising adoption of integrated platforms for scheduling, attendance, and analytics across large-scale operations.

- By Deployment Mode (On-Premise and Cloud-Based): The cloud-based segment held 58.78% share of the market in 2024, due to the increased demand for scalable, accessible, and cost-efficient workforce management systems.

- By Enterprise Size (Large Enterprises and Small & Medium Enterprises (SMEs)): The large enterprises segment is projected to reach USD 10.88 billion by 2032, owing to complex workforce structures and the need for advanced compliance-driven solutions.

- By End-Use Industry (Retail & e-Commerce, Healthcare, BFSI, Manufacturing and Others): The retail & e-commerce segment is anticipated to grow at a CAGR of 11.12% over the forecast period, due to expanding distributed workforces and the need for real-time labor optimization tools.

Workforce Management Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

North America workforce management market share stood at around 36.55% in 2024, with a valuation of USD 3.33 billion. This market dominance is attributed to the continuous expansion of large-scale enterprise operations in the region and the growing integration of advanced digital tools across workforce management platforms.

Companies operating in the region are consolidating services through strategic acquisitions to enhance workforce capabilities, extend operational reach, and streamline service delivery. The market is registering consistent growth, with organizations strengthening cross-border functions to address diverse labor needs and support revenue generation.

The market is advancing, due to the increasing presence of employer of record (EOR) and human capital management (HCM) solution providers that cater to complex, multi-country operations. Additionally, a well-established client base across the U.S., Canada, and Mexico continues to drive the market in the region.

- In February 2025, Workwell Group acquired Eastridge Workforce Management to expand its presence in the market in North America and strengthen its position in the HCM and EOR sectors. The acquisition increases Workwell’s revenue and client base across the U.S., Canada, and Mexico, enhancing its capability to deliver integrated, tech-enabled workforce solutions and reinforcing its strategic focus on scaling operations in the world’s largest hiring market.

The workforce management industry in Asia Pacific is set to grow at a robust CAGR of 11.04% over the forecast period. The market growth is attributed to rising investments in digital transformation across the region and the widespread adoption of SaaS-based workforce management platforms by key players.

Companies in the region are enhancing their workforce management capabilities by integrating predictive analytics and maintenance tools that improve operational transparency and efficiency.

The market is registering steady growth as organizations across the region prioritize digital transformation and adopt scalable solutions. Additionally, growing investments in intelligent platforms and increasing demand from diverse industries are supporting the market growth in the region.

- In March 2025, VentureTECH invested in Pomen Autodata Sdn Bhd to support its regional expansion and enhance its workforce management & maintenance platforms. The investment enables Pomen to strengthen its SaaS offerings, adopt emerging technologies, and deliver deeper analytics, predictive maintenance, and API-integrated solutions.

Regulatory Frameworks

- In the U.S., the Department of Labor (DOL) oversees federal labor laws that govern wages, working hours, employee benefits, and workplace safety. It regulates key elements of workforce management such as time tracking, overtime compliance, and fair labor standards.

- In China, the Ministry of Human Resources and Social Security (MOHRSS) regulates employment standards, labor contracts, social insurance, and workplace policies. It oversees enforcement of workforce rules, labor quotas, and employee welfare programs.

- In India, the Ministry of Labour and Employment governs labor welfare, wage laws, and working condition regulations. It monitors WFM compliance with statutes like the Code on Wages and the Occupational Safety Code.

- In the UK, the Health and Safety Executive (HSE) regulates workplace health, safety, and welfare standards that directly impact workforce scheduling, shift patterns, and employee well-being.

Competitive Landscape

Major players in the workforce management industry are expanding their portfolios to address complex labor requirements across global operations. They are enhancing core capabilities in time & attendance, scheduling, forecasting, and absence management to meet the diverse needs of large enterprises. Firms are also focusing on improving employee engagement by integrating tools that support flexible scheduling and responsive workforce planning.

Additionally, businesses are pursuing strategic acquisitions to strengthen their position, accelerate innovation, and deliver more comprehensive, compliance-driven workforce management solutions at scale.

- In October 2024, ADP acquired WorkForce Software to expand its global workforce management offerings and drive innovation in compliance-focused and employee-centric solutions. The acquisition enhances ADP’s capabilities in time & attendance, scheduling, forecasting, and absence management, supporting organizations in managing complex global labor requirements while improving workforce productivity and engagement.

List of Key Companies in Workforce Management Market:

- ADP, Inc

- Oracle

- SAP SE

- Deel Inc.

- UKG Inc

- Workday, Inc

- Zoho Corporation Pvt. Ltd

- Deltek, Inc

- IBM Corporation

- Infor

- NiCE

- papaya global

- Paylocity

- PeopleStrong

- Verint Systems Inc.

Recent Developments (M&A)

- In December 2024, Prometheus Group acquired WorkTech to enhance its workforce management capabilities within asset-intensive industries. The acquisition strengthens Prometheus’s contractor management and productivity solutions by integrating real-time tracking, cost control, and workforce utilization tools into its platform.

- In May 2025, Employer.com acquired FinTech startup MainStreet.com to strengthen its workforce management platform by integrating advanced financial optimization tools. The acquisition supports its goal of combining HR, payroll, compliance, and benefits management with FinTech capabilities such as tax credit discovery and financial planning.