Market Definition

Wire and cable management is the process of organizing, securing, and supporting electrical wires and cables in various settings such as homes, offices, and industrial facilities. It involves using components like conduits, cable trays, raceways, and fasteners to ensure safe installation, reduce clutter, enhance system reliability, and simplify maintenance.

The report offers a thorough assessment of the main factors driving the market, along with detailed regional analysis and the competitive landscape influencing market dynamics.

Wire and Cable Management Market Overview

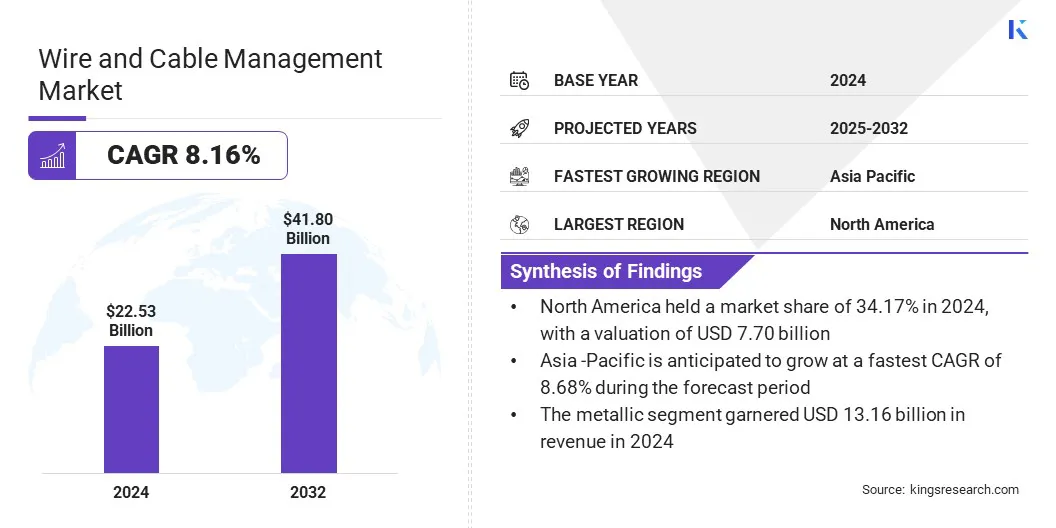

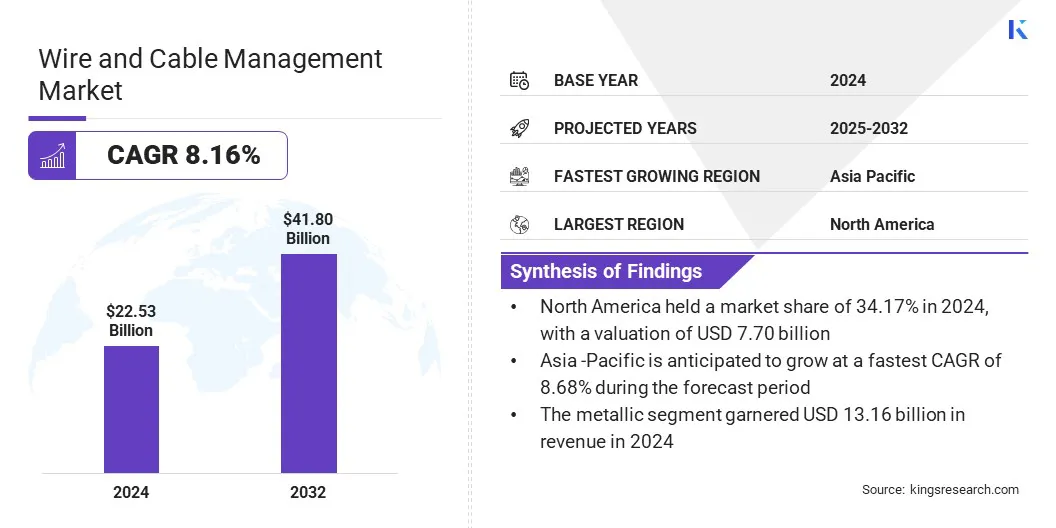

According to Kings Research, the global wire and cable management market size was valued at USD 22.53 billion in 2024 and is projected to grow from USD 24.14 billion in 2025 to USD 41.80 billion by 2032, exhibiting a CAGR of 8.16% during the forecast period. This growth is attributed to the expansion of data centers and telecom networks that boosts the need for advanced cable management solutions.

The market is further driven by increasing industrial automation, electrification in manufacturing & energy sectors, and requirement of sophisticated cable management for machinery and power systems.

Major companies operating in the wire and cable management industry are Atkore, Belden Inc., Alpha Wire, Leviton Manufacturing Co., Inc., Schneider Electric, ABB, Eaton, Chatsworth Products, HellermannTyton, OBO Bettermann Holding GmbH & Co. KG, Panduit Corp, TE Connectivity, Legrand North America, LLC, Niedax Group, and Creative Composites Group.

Key Market Highlights:

- The wire and cable management industry size was valued at USD 22.53 billion in 2024.

- The market is projected to grow at a CAGR of 8.16% from 2025 to 2032.

- North America held a market share of 34.17% in 2024, with a valuation of USD 7.70 billion.

- The cable trays & ladders segment garnered USD 6.16 billion in revenue in 2024.

- The metallic segment is expected to reach USD 24.05 billion by 2032.

- The IT & telecommunications segment is anticipated to register the fastest CAGR of 9.21% over the forecast period.

- The market in Asia Pacific is anticipated to grow at a CAGR of 8.68% through the forecast period.

The rapid growth of cloud computing has increased the demand for wire and cable management solutions. Moreover, data centers require extensive cabling to connect servers, storage devices, and network equipment, necessitating organized and efficient cable management to prevent downtime and ensure optimal performance.

- In November 2023, the U.S. government allocated funding under the Bipartisan Infrastructure Law, a USD 1.2 trillion initiative to expand digital infrastructure, including broadband and data centers. This is driving demand for wire and cable management systems to ensure organized, reliable, and scalable network installations.

Rising Infrastructure Development

The wire and cable management market is registering growth, due to rising infrastructure development across residential, commercial, and industrial sectors. Large-scale construction projects are fueled by rapid urbanization and smart city initiatives, creating a pressing need for scalable cabling solutions.

Investments in transportation, energy, and utility infrastructure are further amplifying this demand for wire and cable management. This system is effective in ensuring safety, regulatory compliance, and operational reliability, making them indispensable in modern, performance-focused infrastructure environments.

- According to the International Energy Agency (IEA), global annual renewable capacity additions surged by nearly 50% to 510 GW in 2023 and are forecasted to reach 7300 GW by 2028.

High Installation and Maintenance Costs

High installation and maintenance costs present a significant challenge in the wire and cable management market. The deployment of advanced systems necessitates specialized materials, skilled labor, and strict adherence to safety regulations, all of which contribute to elevated initial expenditures.

Additionally, ongoing maintenance involving inspections, repairs, and system upgrades adds to the total cost of ownership. These financial implications can deter adoption in small-scale facilities and retrofit projects across cost-sensitive or developing regions, thereby impacting overall market expansion.

Companies are developing cost-efficient, modular cable management systems that simplify installation and reduce labor requirements. They are increasingly using lightweight, durable materials that lower transportation and handling expenses.

Additionally, manufacturers are offering pre-assembled or snap-fit components to minimize on-site assembly time. Digital tools such as BIM and Augmented Reality (AR) are adopted to optimize design and layout planning, reducing errors and rework. These strategies collectively aim to enhance affordability and accelerate market adoption.

Modular and Flexible Designs

Modular and flexible designs are reshaping the wire and cable management market, due to the growing end-user demand for solutions that enable streamlined installation, scalability, and seamless adaptability across varied infrastructure environments. This shift reflects a broader emphasis on operational efficiency and future-ready infrastructure systems.

These systems enable faster deployment, easier maintenance, and seamless integration with evolving layouts in data centers, industrial facilities, and commercial buildings.

By supporting future expansion or reconfiguration with minimal disruption, modular cable management solutions help reduce long-term operational costs and improve efficiency, which makes them a preferred choice for dynamic and high-growth environments.

- In February 2024, Affordable Wire Management (AWM) introduced two new cable management hardware solutions, the Photon Kit and the Helios Beam Rod. The Photon Kit utilizes winch technology and guided installation to streamline messenger cable deployment and reduce labor costs. The Helios Beam Rod is designed for compatibility with multiple pile types and features a simple screw attachment for ease of use. These innovations aim to simplify solar cable management and improve installation efficiency in utility-scale solar projects.

Wire and Cable Management Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product Type

|

Cable Trays & Ladders, Cable Raceways, Conduits & Trunking, Glands & Connectors, Others

|

|

By Material

|

Metallic, Non-metallic

|

|

By End-Use Industry

|

IT & Telecommunications, Residential, Utilities (Energy & Power), Healthcare, Aerospace & Defense

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Product Type (Cable Trays & Ladders, Cable Raceways, Conduits & Trunking, Glands & Connectors, and Others): The cable trays & ladders segment earned USD 6.16 billion in 2024, due to their suitability for large cable volumes and enhanced ventilation in industrial applications.

- By Material (Metallic, Non-Metallic): The metallic segment held 58.43% share of the market in 2024, due to durability, versatility, and resistance to environmental factors in critical infrastructure.

- By End-use Industry (IT & Telecommunications, Residential, Utilities (Energy & Power), and Healthcare): The IT& telecommunications segment is projected to reach USD 15.11 billion by 2032, owing to the increasing number of data centers and 5G network deployments requiring robust cable management.

Wire and Cable Management Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America wire and cable management market share stood at around 34.17% in 2024. with a valuation of USD 7.70 billion. The market dominance is attributed to strong investment in infrastructure development, expanding industrial & commercial construction, and the rapid growth of digital & power distribution networks across the region.

Strategic collaborations among private players are further strengthening regional footprint through enhanced local manufacturing, advanced R&D capabilities, and improved service delivery.

The market in North America is benefiting from the increasing demand for reliable, scalable solutions in construction, manufacturing, and utilities sectors. These factors collectively contribute to the region’s leadership in providing advanced and integrated cable management systems.

- In May 2024, ABB and Niedax Group entered into a joint venture to meet the growing demand for cable tray systems in North America. The collaboration will combine their North American cable tray businesses to deliver advanced cable management solutions for the power distribution, construction, and manufacturing sectors. The venture aims to enhance customer value through expanded manufacturing capabilities, localized R&D, improved logistics, and a comprehensive product & service portfolio across the U.S., Canada, and Mexico.

The wire and cable management industry in Asia Pacific is set to grow at a robust CAGR of 8.68% over the forecast period. This growth is supported by strategic capacity expansions and growing regional capabilities in the market.

Key market players in the region are actively investing in advanced manufacturing facilities to meet the increasing need for high-quality wire and cable solutions. These developments support local production and enable faster delivery across diverse end-use sectors.

The market is also benefiting from a greater focus on technological advancement, such as automated manufacturing systems and integration of precision engineering in cable design that enhance operational efficiency. With rising demand for advanced electrical infrastructure, the region is emerging as a leading center for manufacturing and innovation, contributing to the growth of the market in Asia Pacific.

Regulatory Frameworks

- In the U.S., the Federal Communications Commission (FCC) regulates interstate and international communications involving wires and cables.

- In India, the Bureau of Indian Standards (BIS) sets standards for various cable characteristics, including cable size, composition, sheath, insulation properties, and performance testing.

- In China, the Ministry of Industry and Information Technology (MIIT) sets national standards and policies for industrial electronics, including wire and cable management. It oversees the digital infrastructure development and promotes innovation in smart cable systems.

Competitive Landscape

Major players in the wire and cable management industry are focusing on strategic acquisitions to expand their footprint across utility and power infrastructure sectors. They are targeting well-established players with strong market presence and complementary product portfolios to strengthen their capabilities in wire and cable management.

These moves reflect a broader strategy to support long-term growth, diversify offerings, and capture greater market share in critical infrastructure and industrial applications such as telecommunication.

- In May 2024, Mueller Industries acquired the Nehring Electrical Works Company to expand its presence in the wire and cable market. Nehring, a long-established provider of electrical and telecommunication cable solutions, enhances Mueller’s footprint in the utility and power infrastructure sectors. The acquisition supports Mueller’s strategy of investing in high-quality businesses with strong market positions and growth potential, while retaining Nehring’s experienced management team to ensure continuity and long-term operational success.

Key Companies in Wire and Cable Management Market:

- Atkore

- Belden Inc.

- Alpha Wire,

- Leviton Manufacturing Co., Inc

- Schneider Electric

- ABB

- Eaton

- Chatsworth Products

- HellermannTyton

- OBO Bettermann Holding GmbH & Co. KG

- Panduit Corp

- TE Connectivity

- Legrand North America, LLC

- Niedax Group

- Creative Composites Group.

Recent Developments (M&A/Product Launch)

- In March 2025, Prysmian acquired Channell Commercial Corporation for USD 950 million, enhancing its digital solutions portfolio and expanding its wire and cable management offerings. The acquisition strengthens Prysmian’s presence in North America by integrating Channell’s connectivity solutions, including fiber-optic cable management systems, into its Digital Solutions segment, supporting growth in data centers and telecommunications.

- In January 2025, Mattr acquired AmerCable for USD 280 million, strengthening its U.S. manufacturing footprint and expanding its portfolio of engineered wire and cable solutions. The acquisition enhances Mattr’s presence in the North America market by integrating AmerCable’s low and medium-voltage power, control, and instrumentation cable offerings into its connection technologies segment.

- In January 2024, Panduit launched its wire basket cable tray routing system to enhance cable routing efficiency across data centers, connected buildings, and industrial settings. The system features an innovative grid design that supports greater cable capacity, improves safety by minimizing wire cutting, and enables quicker installation.