Wind Turbine Tower Market Size

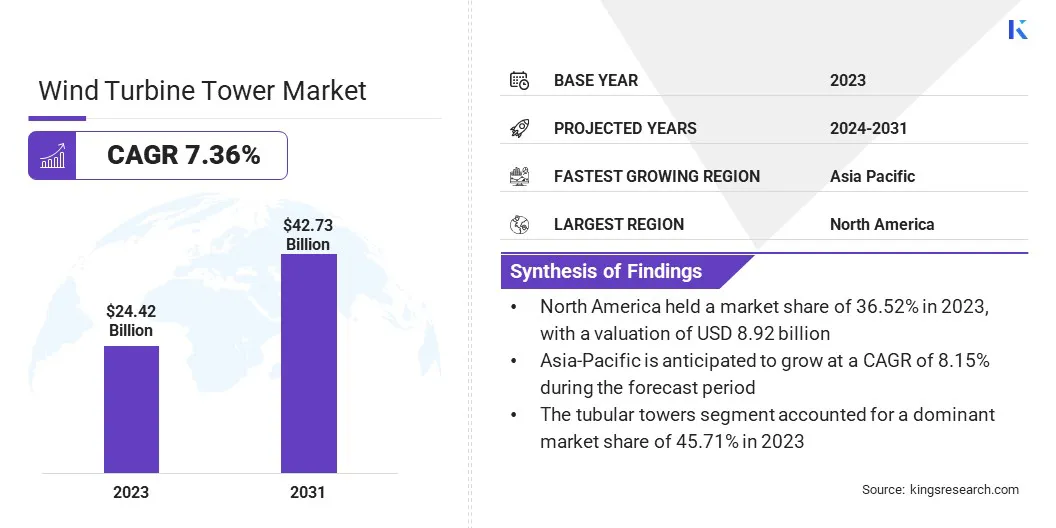

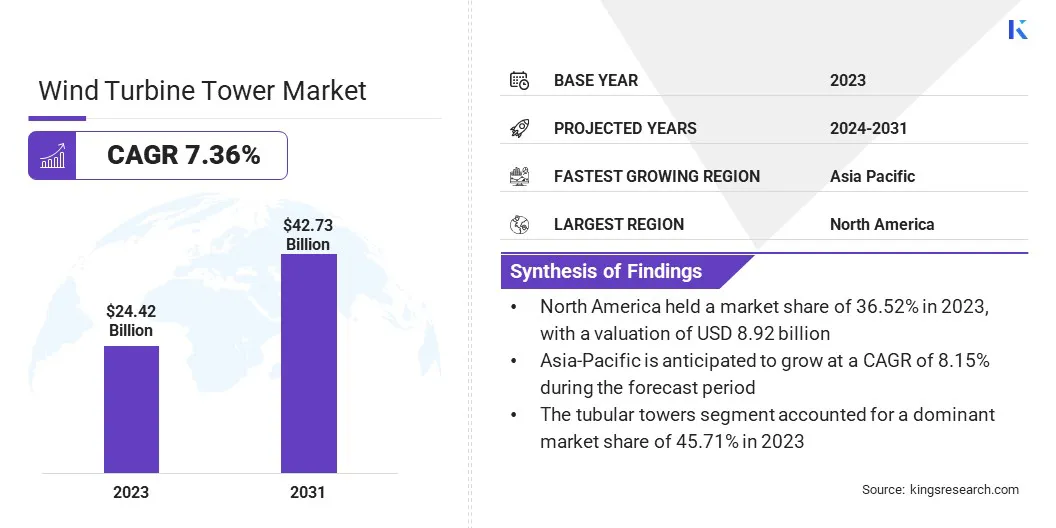

The global Wind Turbine Tower Market size was valued at USD 24.42 billion in 2023 and is projected to grow from USD 25.99 billion in 2024 to USD 42.73 billion by 2031, exhibiting a CAGR of 7.36% during the forecast period. Growing demand for renewable energy, government incentives, and favorable policies are driving the market.

In the scope of work, the report includes services offered by companies such as Arcosa Wind Towers, Inc., Nordex SE, Vestas, Global Energy (Group) Limited, Broadwind Company, Titan Wind Energy, KGW Schweriner Maschinen- und Anlagenbau GmbH, CS WIND CORPORATION, Marmen Inc., DONGKUK S&C, and others.

The proliferation of offshore wind energy projects presents a substantial opportunity for the global wind turbine tower market. Offshore wind farms are increasingly being recognized for their ability to harness stronger and more consistent wind resources found at sea, which can significantly enhance energy production. These projects typically require specialized wind turbine towers that are taller, more robust, and capable of withstanding harsh marine conditions, including strong winds, waves, and corrosive saltwater environments.

The demand for such advanced towers is expected to rise sharply as countries worldwide accelerate their offshore wind energy initiatives to meet renewable energy targets and reduce carbon emissions.

- In June 2024, Vattenfall and BASF signed contracts with Vestas to supply 112 V236-15.0 MW turbines for the Nordlicht 1 and 2 offshore wind projects in the German North Sea. These projects, operational by 2028, will serve 1.6 million households, with parts of the towers using low-emission steel to minimize the carbon footprint.

Additionally, governments worldwide are offering incentives and subsidies to support the development of offshore wind farms, further driving the need for high-performance wind turbine towers. The opportunity lies in manufacturing these towers and innovating materials and designs that improve durability and efficiency. Companies that effectively address the unique challenges of offshore deployment are likely to gain a competitive edge in this rapidly growing market.

A wind turbine tower is a crucial component of a wind turbine system, serving as the structural support that elevates the nacelle and rotor blades to the optimal height to capture wind energy. These towers are typically made from steel, concrete, or a combination of both, depending on the specific requirements of wind turbines and environmental conditions of the installation site. Wind turbine towers come in various types, including tubular steel towers, lattice towers, and hybrid towers.

Tubular steel towers are very common due to their strength, ease of fabrication, and streamlined design. Lattice towers, although less common, are lighter and more economical for certain installations. Hybrid towers, which combine steel and concrete, offer enhanced stability and are increasingly used for taller wind turbines, particularly in offshore applications. The deployment of wind turbine towers varies based on the location, with onshore towers typically being easier and less costly to install, while offshore towers require more advanced engineering and construction techniques to handle the challenging marine environment.

Analyst’s Review

The wind turbine tower market is currently experiencing robust growth, driven by the global shift toward renewable energy and the increasing adoption of wind power. Companies in this market are strategically focusing on expanding their production capabilities, investing in research and development to introduce new tower designs, and forming strategic partnerships to enhance their market presence. A significant trend observed among key players is the emphasis on developing towers that cater to the specific demands of offshore wind farms, which are expected to be a major growth area in the coming years.

- In September 2023, Nordex Group secured a contract with Ibereólica Renovables to supply N155/5.X turbines for two wind farms in Spain. The agreement includes 11 turbines for the "Aciberos" and "Padornelo 3" projects, with a total capacity of 60 MW.

Furthermore, companies are also exploring the use of sustainable and recyclable materials in tower manufacturing to align with global sustainability goals and reduce the carbon footprint of wind energy projects. In terms of current growth, many market leaders are expanding their geographic footprint, particularly in emerging markets where wind energy projects are rapidly gaining traction. To maintain their competitive edge, companies must continue to innovate and adapt to the evolving needs of the wind energy segment, particularly in the face of challenges related to logistics and the high costs of offshore deployment.

Wind Turbine Tower Market Growth Factors

The growing demand for renewable energy is a powerful driver for the wind turbine tower market, as countries around the world are intensifying efforts to transition from fossil fuels to cleaner energy sources. This shift is driven by the urgent need to address climate change, reduce greenhouse gas emissions, and achieve energy security. Wind energy, being one of the most mature and cost-effective forms of renewable energy, is at the forefront of this global transition.

- In December 2023, Nordex Group began installing N163/5.X turbines at the Karahka wind farm in Finland, featuring the first in-house developed hybrid concrete and steel tower. This innovative design, with a 168-meter hub height, builds on Nordex’s extensive experience with concrete towers in several global markets.

Governments implement stringent policies and provide incentives to promote renewable energy, which is fueling the deployment of wind turbines, directly boosting the demand for wind turbine towers. These towers are essential for capturing wind energy efficiently, as they elevate the turbine blades to heights where wind speeds are optimal. Additionally, growing investments in wind energy infrastructure, both onshore and offshore, is expected to fuel the demand for advanced wind turbine towers.

A significant hurdle in the market is the logistical challenge in transportation and installation, particularly as turbines become larger and are installed in more remote or offshore locations. Wind turbine towers are massive, often exceeding 100 meters in height, making their transportation from manufacturing facilities to installation sites a complex and costly process. The challenges include navigating narrow roads, bridges, and other infrastructure constraints, as well as securing specialized transport vehicles capable of carrying such oversized and heavy loads.

Offshore installations present even greater logistical difficulties, requiring the use of heavy-lift vessels, cranes, and other specialized equipment to install the towers at sea. These logistical complexities lead to delays, increased costs, and potential risks during the transportation and installation phases.

To mitigate these challenges, companies are increasingly investing in modular tower designs that include transporting the structure in smaller sections to be assembled on-site. In addition, advanced logistics planning and coordination with local authorities are done to ensure smooth and efficient operations. Therefore, the use of innovative transportation solutions and planning effectively can reduce risks and ensure timely project delivery.

Wind Turbine Tower Market Trends

The increasing adoption of offshore wind turbines is a notable trend that is reshaping the wind turbine tower market. Offshore wind energy offers several advantages over onshore wind, including stronger and more consistent wind speeds, which lead to higher energy yields. This potential is driving the adoption of offshore wind projects, particularly in regions with vast coastlines and high energy demands. Offshore wind turbines require taller and more robust towers capable of withstanding the harsh marine environment, including strong winds, waves, and corrosive saltwater.

The demand for these specialized towers is growing with countries and energy companies investing heavily in offshore wind farms to meet renewable energy targets and reduce reliance on fossil fuels. The trend of adopting offshore wind energy is also supported by advanced technologies, such as floating wind turbines, which enable the deployment of turbines in deeper waters where wind resources are even more abundant.

Segmentation Analysis

The global market has been segmented on the basis of type, deployment, and geography.

By Type

Based on type, the wind turbine tower market has been segmented into lattice towers, tubular towers, and hybrid towers. The tubular towers segment accounted for a dominant market share of 45.71% in 2023, largely attributed to their widespread adoption in both onshore and offshore wind energy projects.

Tubular towers are favored for their structural efficiency, durability, and cost-effectiveness, which makes them ideal for use in a majority of wind turbine installations. These towers, typically constructed from steel, provide the necessary strength and stability to support the increasing size and capacity of modern wind turbines. Their streamlined design, characterized by a gradually tapering cylindrical shape, reduces material usage while maintaining high load-bearing capabilities, which is crucial as turbines get bigger.

Additionally, the ease of fabrication and transport of tubular sections, combined with the simplicity of assembly at the installation site, further enhances their appeal. The growing focus on renewable energy and expansion of wind power projects globally have driven demand for reliable and efficient tower solutions, solidifying the position of tubular towers as the leading segment in the wind turbine tower market.

By Deployment

Based on deployment, the market has been classified into onshore and offshore. The onshore segment's anticipated CAGR of 7.55% over the forecast period reflects the robust growth in wind energy projects across the globe, particularly in regions where land-based wind farms are rapidly expanding. Onshore wind energy remains one of the most cost-effective and mature forms of renewable energy, driving significant investments from both the public and private sectors. The relative ease of installation, lower costs compared to offshore projects, and the availability of vast expanses of land in countries like the U.S., China, and India are key factors contributing to the accelerated growth of the onshore segment.

Technological advancements also play a pivotal role in boosting this segment, with the development of more efficient and taller wind turbines that capture wind energy at greater heights, even in areas with less favorable wind conditions. Furthermore, favorable government policies, subsidies, and the increasing urgency to transition to renewable energy sources are expected to continue propelling the onshore wind energy market.

Wind Turbine Tower Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, MEA, and Latin America.

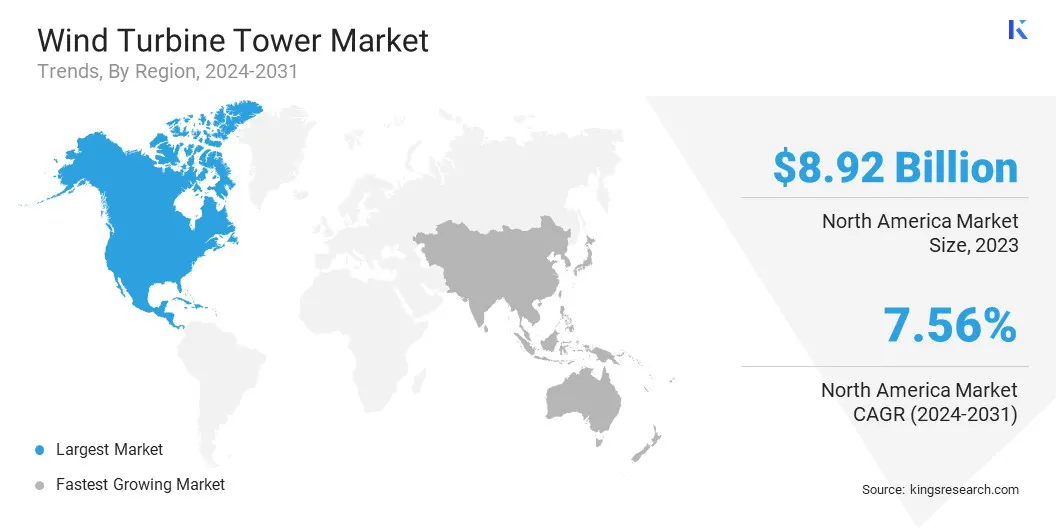

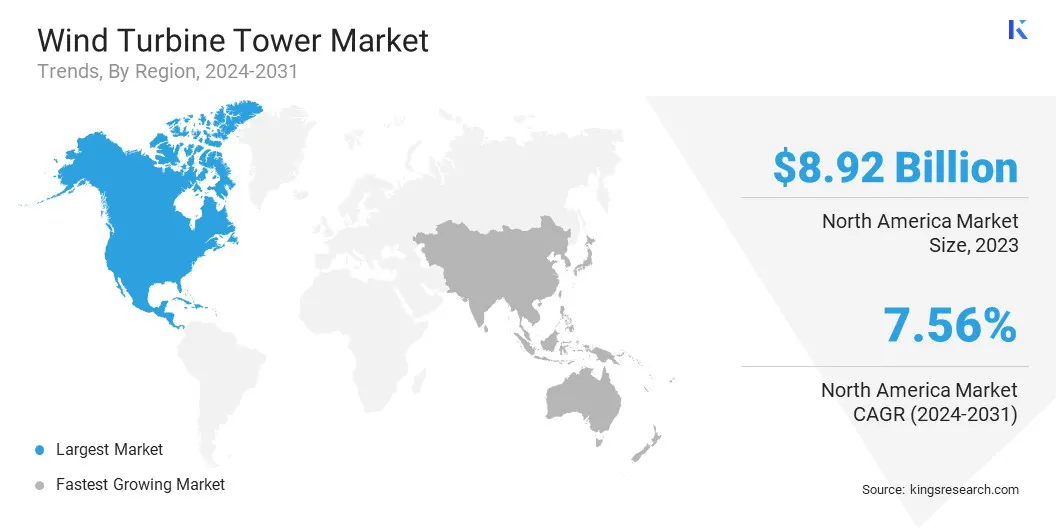

North America wind turbine tower market accounted for a 36.52% share of the global market, accounting for USD 8.92 billion in 2023. This reflects the region's strong commitment to expanding its renewable energy portfolio. The U.S, in particular, has been a driving force behind this growth, with substantial investments in wind energy infrastructure across both onshore and offshore projects. The U.S. government’s policies, including tax incentives like the Production Tax Credit (PTC), have significantly bolstered the wind energy sector, encouraging the development of new wind farms and upgrade of existing ones.

- In March 2023, Arcosa secured wind tower orders valued at approximately USD 750 million, with deliveries set from 2024 through 2028. The orders, primarily for Southwest U.S. projects, have prompted Arcosa to establish a new manufacturing facility in Belen, New Mexico, strategically located to support these major developments.

Additionally, the availability of vast, wind-rich areas in Texas, Iowa, and Oklahoma has further fueled the demand for wind turbine towers. Canada also contributes to the market’s dominance in North America, with increasing wind energy installations as part of its strategy to reduce carbon emissions and transition to cleaner energy sources.

Asia-Pacific is expected to grow at the highest CAGR of 8.15% in the coming years, driven by the rapid expansion of wind energy projects across the region. Countries like China, India, Japan, and South Korea are at the forefront of this growth, with ambitious renewable energy targets and substantial investments in wind energy infrastructure. China, the largest wind energy producer globally, continues to lead the charge with aggressive plans to increase its wind power capacity, both onshore and offshore.

The Chinese government’s strong support for renewable energy, coupled with the country’s manufacturing capabilities, is expected to drive significant demand for wind turbine towers. India is also making considerable strides, with a growing focus on developing its wind energy sector to meet the rising energy demand and reduce reliance on fossil fuels. Additionally, the increasing interest in offshore wind projects in Japan and South Korea could further enhance growth prospects in the region.

Competitive Landscape

The global wind turbine tower market report provides valuable insights with a specialized emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies, such as partnerships, mergers and acquisitions, product innovations, and joint ventures, to expand their product portfolio and increase their market shares across different regions. Companies are implementing impactful strategic initiatives, such as expansion of services, investments in research and development (R&D), establishment of new service delivery centers, and optimization of their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Wind Turbine Tower Market

- Arcosa Wind Towers, Inc.

- Nordex SE

- Vestas

- Global Energy (Group) Limited

- Broadwind Company

- Titan Wind Energy

- KGW Schweriner Maschinen- und Anlagenbau GmbH

- CS WIND CORPORATION

- Marmen Inc.

- DONGKUK S&C

Key Industry Developments

- August 2024 (Expansion): Vestas received an order to supply and install 46 V162-6.2 MW turbines from the EnVentus platform for CS Energy’s Lotus Creek Wind Farm in Queensland. The project, with a 285 MW capacity, includes a long-term Active Output Management 5000 (AOM 5000) service agreement.

- July 2024 (Product Launch): Nordex Group expanded its product portfolio in the 5 MW segment with the launch of the N169/5.X turbine, for the U.S. market. This expansion was done to strengthen its presence in North America by offering one of the largest and most efficient turbines.

- January 2023 (Expansion): Broadwind announced new tower orders worth approximately USD 175 million from a leading global wind turbine manufacturer, further solidifying its position as a key supplier of specialized components in the wind energy sector.

The global wind turbine tower market has been segmented as:

By Type

- Lattice Towers

- Tubular Towers

- Hybrid Towers

By Deployment

By Region

- North America

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America