Wave Energy Converter Market Size

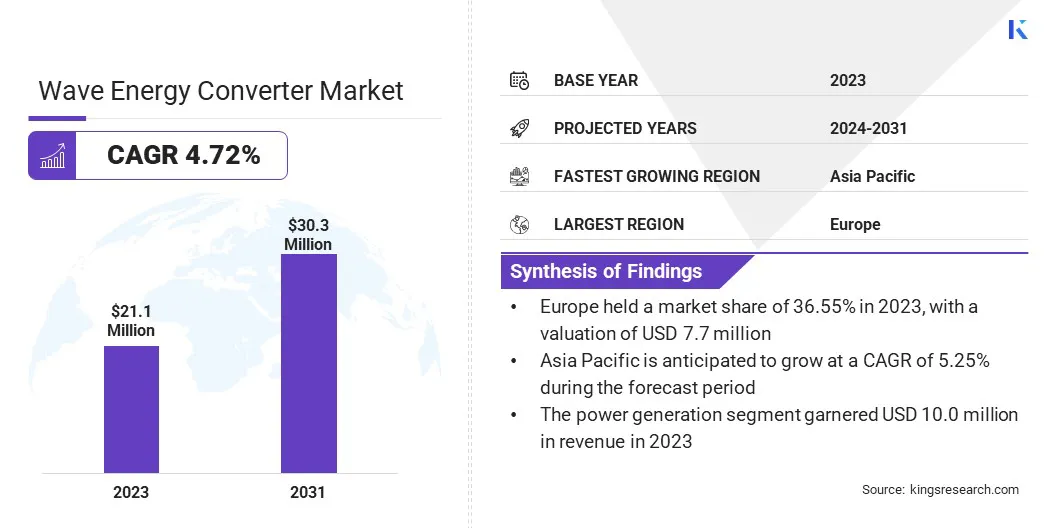

The global Wave Energy Converter Market size was valued at USD 21.1 million in 2023 and is projected to grow from USD 21.9 million in 2024 to USD 30.3 million by 2031, exhibiting a CAGR of 4.72% during the forecast period. Growing interest in renewable energy sources and substantial investments in marine energy projects are propelling the growth of the market.

In the scope of work, the report includes products offered by companies such as Ocean Power Technologies, Inc., CorPower Ocean, CalWave, Hann-Ocean Co.,Ltd., G.U.N.T. Gerätebau GmbH, Carnegie Clean Energy Limited, Bombora Wave Power, Eco Wave Power Global AB, AMOG Holdings Pty. Ltd, AW Energy, and others.

The expansion of wave energy converters into remote and island regions presents a significant opportunity for the wave energy converter market growth. Many of these areas rely heavily on imported fossil fuels, resulting in high and unpredictable energy costs. Wave energy converters offer a sustainable, locally generated energy source, thereby reducing dependence on external energy imports and stabilizing energy prices. These regions, often located near large oceanic expanses, possess vast untapped potential for wave energy, which can be utilized for electricity generation.

Furthermore, islands and remote communities typically face logistical challenges when importing fuel, making renewable solutions environmentally beneficial cost-effective in the long term. The deployment of wave energy in these areas has the potential to generate local empoyment opportunities, stimulate economic development, and enhance energy independence. Additionally, governments and international organizations are increasingly focusing on supporting such projects by offering financial incentives and technical assistance to make wave energy adoption more feasible.

- For instance, in February 2024, Ocean Power Technologies received funding from the Naval Postgraduate School for a year-long deployment of its PowerBuoy in Monterey Bay. The PowerBuoy, featuring advanced surveillance systems, satellite communication, and AT&T 5G technology, is anticipated to demonstrate its capabilities in enhancing maritime monitoring and communications, thereby reinforcing OPT's leading position in cutting-edge marine technology.

The environmental benefits, coupled with economic and logistical advantages, position wave energy as a key opportunity for powering remote and island regions sustainably.

Wave energy converters (WECs) are devices specifically designed to capture and convert the kinetic energy of ocean waves into electrical power for practical use. These converters utilize the motion and force of waves, generated by wind blowing across the surface of the ocean and transform this energy into mechanical energy that drives turbines or hydraulic pumps. Several technologies are utilized in WECs, including point absorbers, oscillating water columns, and attenuators.

Point absorbers are compact floating devices that move vertically with the waves, while oscillating water columns utilize the rise and fall of water levels in a chamber to drive air through a turbine. Attenuators are long and segmented devices that float on the water surface and extract energy from wave-induced flexing motions.

WECs are typically deployed offshore, either nearshore areas or further out in the open ocean, where wave energy is most potent. Applications of WECs include electricity generation for grid supply, powering offshore installations such as oil rigs, and supplying energy to coastal communities. These applications contribute significantly to the global effort to advance renewable energy sources.

Analyst’s Review

The wave energy converter market is witnessing steady growth, mainly due to ongoing technological advancements and rising inclination toward renewable energy sources. Key companies operating in the sector are adopting various strategies to strengthen their market presence and capitalize on emerging opportunities. These strategies include forging partnerships with government agencies and research institutions to foster innovation, as well as forming alliances with energy utilities to integrate wave energy into existing power grids.

Additionally, certain companies are focusing on large-scale demonstration projects to showcase the commercial viability of their technologies, while others are exploring niche markets, including the provision of power to offshore installations and island communities.

- For instance, in March 2024, Ocean Power Technologies received its largest order to date, exceeding USD 1.5 million, from an offshore energy service provider in Latin America. This significant purchase of multiple Wave Adaptive Modular Vessel Uncrewed Surface Vessels (WAM-V) USVs highlights OPT’s growing prominence and expansion in the region’s energy sector.

The market is further witnessing increased investment in research and development aimed at reducing the capital costs associated with wave energy deployment. Companies in the sector are prioritizing cost-effective and durable designs that are capable of withstanding harsh marine environments. The emphasis on reducing costs, improving efficiency, and securing regulatory support is likely to be critical imperatives for players aiming to achieve long-term success in the global market.

Wave Energy Converter Market Growth Factors

Growing interest in renewable energy sources is propelling the growth of the wave energy converter market. Rising environmental concerns and climate change have led to a global shift toward cleaner energy solutions aimed at reducing carbon emissions and dependency on fossil fuels.

Wave energy converters offer a consistent and reliable source of renewable power by capturing the natural energy of ocean waves. This growing interest wave energy technology is evidenced by increased investments in research and development. Both governmental and private entities are funding projects designed to improve the efficiency and feasibility of this technology.

- For instance, in May 2023, AW-Energy, a leader in near-shore wave energy technology, signed an MOU with Kaoko Green Energy Solutions in Namibia. This partnership is dedicated to advancing renewable energy development and aims to produce green hydrogen through the utilization of wave energy. The initiative leverages AW-Energy's advancements in its WaveRoller technology, thereby establishing the company as a key player in green hydrogen solutions.

The rising demand for sustainable energy solutions is fostering innovation and stimulating the deployment of wave energy converters, thereby positioning them as a viable alternative to traditional energy sources. The growing shift toward renewables aligns with global energy policies that prioritize sustainability, thus boosting the adoption of wave energy converters as part of a broader strategy to transition to a greener energy future.

The high upfront capital required for the development, installation, and maintenance of wave energy converters presents a significant challenge to market growth. Initial investments required for research, technology development, and infrastructure can be substantial, which may potentially deter smaller players and new entrants from participating in the market.

Additionally, the costs associated with maintaining and operating wave energy systems in harsh marine environments add to the financial burden. To mitigate this challenge, industry stakeholders are focusing on reducing costs through technological innovation and economies of scale. Leveraging advancements in materials and design lead to more cost-effective solutions, while strategic partnerships and government incentives provide additional financial support.

Furthermore, collaborative efforts in research and shared resources contribute to costs and risk distribution, making wave energy projects more economically viable.

Wave Energy Converter Market Trends

Integration with offshore wind farms is emerging as a significant trend in the wave energy converter market. By combining wave energy converters with existing offshore wind infrastructure, companies are enhancing overall energy production efficiency and reducing operational costs. These hybrid systems leverage the existing offshore locations and infrastructure, including grid connections and maintenance facilities, thus optimizing resource use and minimizing logistical challenges.

- In March 2024, AW-Energy completed the 3-year WaveFarm project, which was financed by the European Maritime and Fisheries Fund. This initiative represents a significant advancement in the WaveRoller wave energy converter, marking a critical milestone in the development of commercially viable wave energy solutions and underscoring the importance of sustainable ocean energy technologies.

Moreover, the integration of wave and wind energy technologies leads to a more consistent energy output, as wave energy serves to complement wind energy during periods of low wind speeds. This integration presents opportunities for improved energy storage solutions and improved grid stability, making the combined approach a compelling option for expanding renewable energy capacity. The growing trend toward hybrid systems reflects a broader strategy to maximize the potential of renewable resources and advance the transition to a more sustainable energy landscape.

Segmentation Analysis

The global market has been segmented on the basis of technology, deployment, application, and geography.

By Technology

Based on technology, the market has been classified into oscillating water column, oscillating body converters, overtopping devices, and others. The oscillating water column segment captured the largest wave energy converter market share of 45.62% in 2023, primarily attributed to its established technology and effectiveness in wave energy conversion. OWCs are renowned for their ability to efficiently utilize the energy from the rise and fall of ocean waves. They use the movement of water to create a flow of air that drives turbines. This method is highly versatile and can be deployed in various settings, including both offshore and nearshore locations.

The proven reliability and operational efficiency of OWCs, combined with ongoing advancements in their design and materials, have contributed to their significant market share. Additionally, the growing number of successful commercial projects utilizing OWC technology has demonstrated its potential for large-scale energy production. This proven track record of performance and reliability, along with advancements that reduce costs and increase efficiency, has reinforced the position of OWCs as a leading choice.

By Deployment

Based on deployment, the market has been bifurcated into coastal and offshore. The coastal segment is poised to record a robust CAGR of 5.08% through the forecast period. Coastal areas are particularly suitable for wave energy conversion due to their proximity to shorelines where wave energy is more accessible and often more consistent. This segment benefit from lower installation and maintenance costs compared to deep-sea installations, making coastal projects more economically viable.

Additionally, the rising demand for renewable energy sources and the transition to localized energy solutions are driving interest in coastal wave energy projects. Coastal areas may offer easier access to infrastructure and grid connections, thereby supporting the growth of the segment. Government policies and incentives aimed at promoting renewable energy in coastal regions further contribute to potential growth prospects. The favorable environmental conditions, economic feasibility, and supportive regulations are expected to aid the expansion of the coastal segment through the forecast period.

By Application

Based on application, the wave energy converter market has been divided into power generation, desalination, and environmental protection. The power generation segment garnered the highest revenue of USD 10.0 million in 2023, mainly propelled by the increasing adoption of wave energy converters for large-scale electricity production.

The sector's ability to provide a reliable and renewable source of power has led to significant investments and interest from both public and private entities. This revenue surge is attributed to the growing demand for clean energy solutions that complement traditional power sources and contribute to reducing carbon emissions.

Technological advancements in wave energy converters, which enhance their efficiency and reliability, have made power generation from wave energy more commercially viable. Additionally, supportive government policies and incentives for renewable energy projects have prompted increased investments and accelerated project development. The success of major commercial projects and the expanding deployment of wave energy converters for grid-connected power generation have stimulated the growth of the power generation segment.

Wave Energy Converter Market Regional Analysis

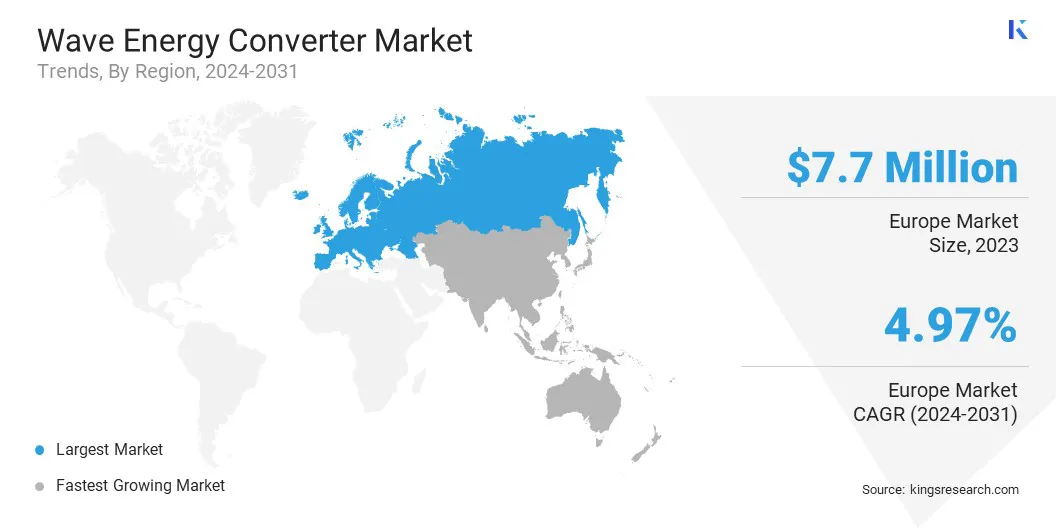

Based on region, the global market has been segmented into North America, Europe, Asia-Pacific, MEA, and Latin America.

Europe wave energy converter market accounted for a major share of 36.55% and was valued at USD 7.7 million in 2023. This substantial market presence is facilitated by Europe’s early adoption of renewable energy technologies and its ongoing commitment to reducing carbon emissions. The region has been at the forefront of research and development in wave energy, benefiting from supportive government policies and substantial funding dedicated to innovation in renewable energy.

- In September 2023, CorPower Ocean successfully installed its first commercial-scale wave energy converter in northern Portugal. The CorPower C4 device, launched from the port of Viana do Castelo and positioned 4km offshore, represents a major advancement in making wave energy both bankable and scalable for widespread adoption in the renewable energy sector.

- In August 2024, Eco Wave Power Global AB launched its first MW-scale wave energy project in Porto, Portugal. This project aligns with a 20MW Concession Agreement with APDL and is anticipated to gradually expand to a full 20MW of installed capacity, positioning Eco Wave Power as a key player in Portugal’s renewable energy landscape.

Europe’s extensive coastline, particularly in countries such as the United Kingdom and Portugal, offers favorable conditions for wave energy projects, thereby fostering regional market growth. The presence of advanced infrastructure and established energy frameworks facilitates the integration of wave energy converters into the existing energy grid.

Additionally, Europe’s strategic focus on transitioning to a low-carbon economy and achieving ambitious renewable energy targets has contributed to its leading position in the wave energy market. The combination of strong policy support, technological advancements, and favorable geographic conditions has solidified the dominance of the Europe wave energy converter sector.

Asia-Pacific region is estimated to grow at a robust CAGR of 5.25% in the forthcoming years. The region's rapid economic development and increasing energy demands necessitates a significant shift toward the adoption of renewable energy sources, including wave energy. Countries in the Asia-Pacific region with extensive coastlines, such as Australia, Japan, and South Korea, have extensive oceanic areas that offer substantial wave energy potential, generating lucrative opportunities for the development of wave energy projects.

- For instance, in July 2024, Hann-Ocean Energy completed its wave energy conversion project on Shengsi Island in Zhejiang Province after a 2.5-year sea trial. The project tested the performance of the Drakoo 15kW wave energy converter and evaluated various coatings to enhance durability, providing valuable insights for the advancement of robust wave energy technologies.

Moreover, the growing focus on reducing carbon emissions and enhancing energy security fuels investments in renewable technologies, with backing from both government policies and private sector interests. Additionally, the advancements in wave energy technology and decreasing costs of deployment are making these projects more feasible and attractive in the region. The increasing awareness of environmental issues and the need for sustainable energy solutions are presenting lucrative growth prospects in the Asia-Pacific wave energy market.

Competitive Landscape

The global wave energy converter market report provides valuable insights, highlighting the fragmented nature of the industry. Prominent players are focusing on several key business strategies, such as partnerships, mergers and acquisitions, product innovations, and joint ventures, to expand their product portfolio and increase their market shares across different regions. Companies are implementing impactful strategic initiatives, such as expansion of services, investments in research and development (R&D), establishment of new service delivery centers, and optimization of their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Wave Energy Converter Market

- Ocean Power Technologies, Inc.

- CorPower Ocean

- CalWave

- Hann-Ocean Co.,Ltd.

- U.N.T. Gerätebau GmbH

- Carnegie Clean Energy Limited

- Bombora Wave Power

- Eco Wave Power Global AB

- AMOG Holdings Pty. Ltd

- AW Energy

Key Industry Developments

- May 2024 (Expansion): Ocean Power Technologies approached 15MWh of renewable energy production from its PowerBuoy systems. The recent deployment of its Next Generation PB system off the coast of New Jersey has significantly boosted average energy output by integrating solar, wind, and wave energy sources, thereby enhancing its renewable energy capabilities.

- April 2024 (Partnership): Hann-Ocean Technology and Walden International Commerce formed a key partnership for the design and construction of a 1,200-ton modular floating jetty. This project is integral to the development of an ecological resort on Australia’s Lindeman Island, demonstrating innovative infrastructure capabilities for sustainable resort projects.

The global wave energy converter market has been segmented:

By Technology

- Oscillating Water Column

- Oscillating Body Converters

- Overtopping Devices

- Others

By Deployment

By Application

- Power Generation

- Desalination

- Environmental Protection

By Region

- North America

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America