Market Definition

Waterproofing membranes are continuous thin barrier layers made from bituminous, polymeric or composite materials. They are applied over structural surfaces to prevent water or moisture from penetrating. These membranes are used extensively in roofs, basements, tunnels, bridges, water tanks and other civil structures to enhance durability.

They are available as sheet-based rolls or as liquid-applied coatings that cure to form a seamless protective layer. Their primary purpose is to prevent water ingress, protect structural materials, enhance durability, and ensure compliance with building codes and sustainability standards.

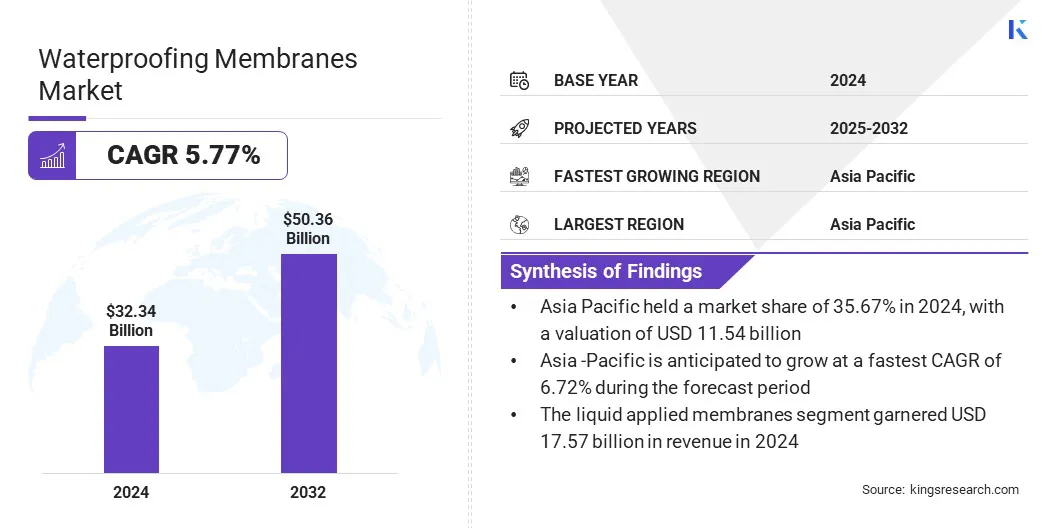

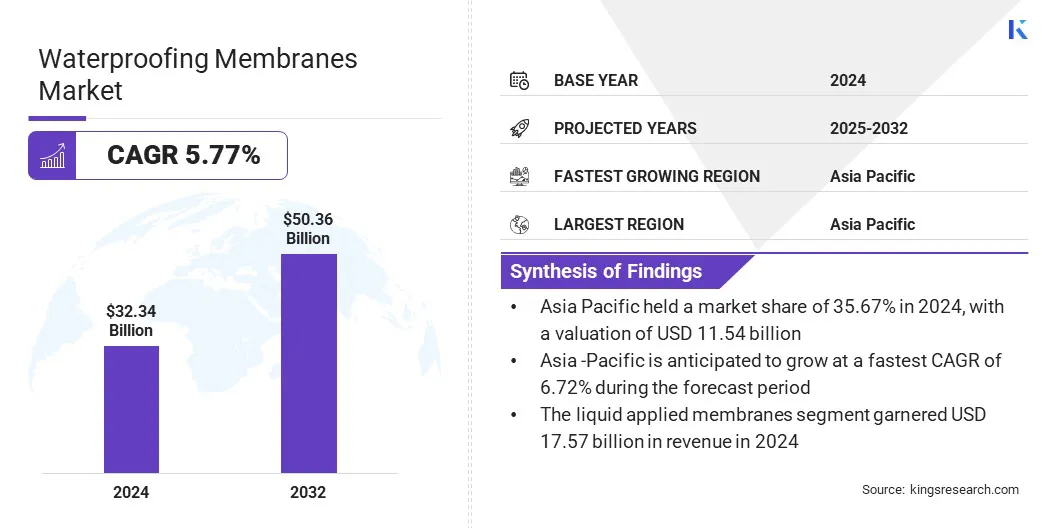

According to Kings Research, the global waterproofing membranes market size was valued at USD 32.34 billion in 2024 and is projected to grow from USD 34.01 billion in 2025 to USD 50.36 billion by 2032, exhibiting a CAGR of 5.77% during the forecast period.

The market is growing due to the rapid infrastructure development of transport networks, large commercial complexes, industrial facilities, and urban housing projects across major regions. The market is further expanding due to the shift toward hybrid polymer‑modified membranes that offer improved material performance and long-term protection for diverse construction requirements.

Key Market Highlights:

- The waterproofing membranes industry size was recorded at USD 32.34 billion in 2024.

- The market is projected to grow at a CAGR of 5.77% from 2025 to 2032.

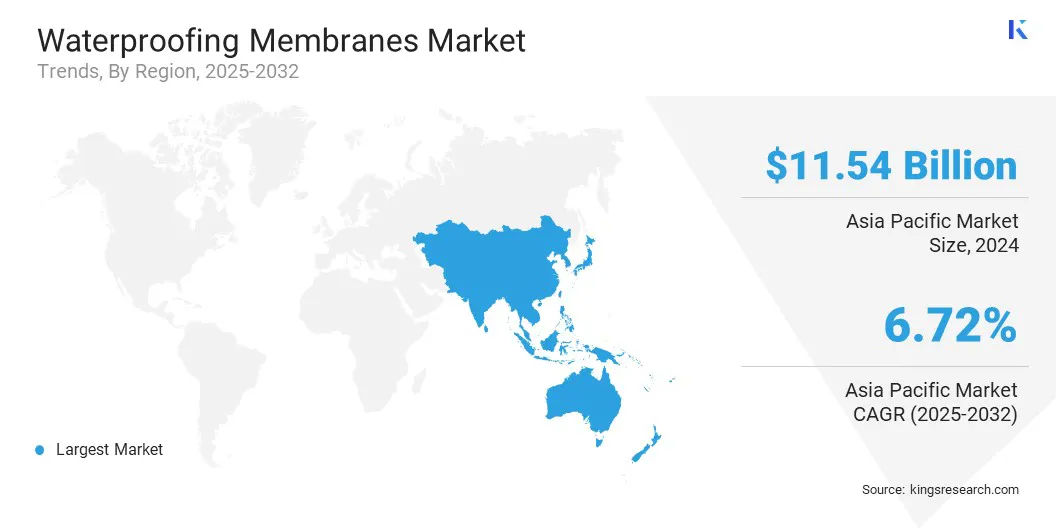

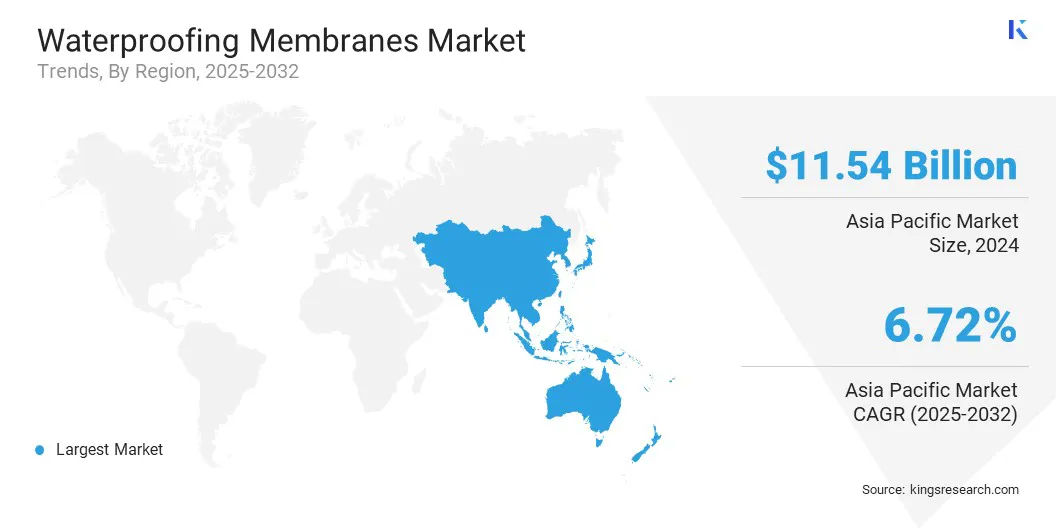

- Asia Pacific held a market share of 35.67% in 2024, with a valuation of USD 11.54 billion.

- The bituminous membranes segment garnered USD 12.18 billion in revenue in 2024.

- The liquid applied membranes segment is expected to reach USD 28.54 billion by 2032.

- The water-retaining structures segment is anticipated to witness the fastest CAGR of 7.85% over the forecast period.

- The residential segment is expected to reach USD 19.43 billion by 2032.

- North America is anticipated to grow at a CAGR of 5.89% during the forecast period.

Major companies operating in the waterproofing membranes market are Sika AG, Tremco, BASF, SOPREMA, GCP Applied Technologies Inc, Fosroc Inc, MAPEI S.p.A, Henry A Carlisle Company, Johns Manville, RENOLIT SE, Dow, RPM International Inc, Pidilite Industries Ltd, Asian Paints, and Saint-Gobain.

Waterproofing Membranes Market Report Scope

|

Segmentation

|

Details

|

|

By Product Type

|

Bituminous Membranes, Polyurethane, PVC (Polyvinyl Chloride), TPO (Thermoplastic Olefin), Others

|

|

By Membrane

|

Liquid Applied Membranes, Sheet Membranes

|

|

By Application

|

Roofing, Foundations & Below Grade, Walls & Facades, Water-Retaining Structures, Others

|

|

By End-Use

|

Residential, Commercial, Industrial, Infrastructure

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Waterproofing Membranes Market Regional Analysis

Based on region, the global waterproofing membranes market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific accounted for a market share of 35.67% in 2024, with a valuation of USD 11.54 billion. This dominance is attributed to the rapid urbanization and the continuous growth of large infrastructure projects in the region. The expanding construction of transport networks, residential buildings, and industrial complexes is driving demand for durable membranes used in structural protection applications.

Moreover, the market is expanding as regional players broaden their roofing system portfolios to include solutions for green roofs and sustainable building envelopes. Manufacturers are focusing on integrating waterproofing technologies with energy-efficient and environmentally sustainable features. These efforts are strengthening the adoption of advanced membranes and contributing to the market’s growth across the region.

- In February 2025, Sika acquired Elmich Pte Ltd, a Singapore-based provider of urban greening systems. The acquisition expands Sika’s portfolio in the Asia Pacific region by adding green roof and facade solutions and supports its activities in roofing and waterproofing applications for commercial and residential projects.

North America is set to grow at a robust CAGR of 5.89% over the forecast period. This growth is attributed to the rapid pace of construction activities and the rising renovation demand across commercial and residential sectors in the region. The market in the region is growing due to the increase in infrastructure projects in transportation, housing, and industrial facilities.

Governments and private developers continue to allocate significant investments for new construction and the upgrading of existing structures. Increasing large-scale projects across urban and semi-urban areas is creating a higher demand for waterproofing membranes to ensure durability and protection against water-related damage.

Additionally, the market is expanding due to the steady growth of water and wastewater management projects and the enforcement of strict building regulations mandating effective moisture protection in structures. These factors are supporting increased use of membranes in residential and commercial construction, thereby driving market growth in the region.

- In September 2024, Kingspan acquired IB Roof Systems, a Texas-based manufacturer of PVC single-ply roofing membranes. This acquisition strengthens the company’s product portfolio for low-slope roof applications and expands its presence in the commercial and industrial roofing and waterproofing market.

Waterproofing Membranes Market Overview

Additionally, government funding for water and wastewater improvement projects is driving the waterproofing membranes market by creating higher demand for protective solutions in tanks, pipelines, reservoirs, and treatment facilities. These projects require durable membranes to prevent leakage and corrosion, which encourages the adoption of advanced materials across construction and infrastructure applications.

- In November 2024, the U.S. Environmental Protection Agency approved a USD 196 million SWIFIA loan to support drinking water and wastewater improvement projects in Indiana, U.S.

Rapid Infrastructure Development

Rapid infrastructure development is driving growth for the waterproofing membranes market. The expansion of transportation corridors, commercial complexes, industrial facilities, and housing projects is creating strong demand for advanced moisture protection solutions.

Waterproofing membranes are being adopted to safeguard foundations, tunnels, bridges, and building structures from water damage and to improve their durability. In addition, rising demand for long-lasting and low-maintenance infrastructure is encouraging the use of sheet membranes and liquid-applied systems across a range of construction projects.

- In February 2025, the U.S. Department of Transportation granted USD 5 billion for more than 560 infrastructure projects across all 50 states, D.C., and U.S. territories under the Bipartisan Infrastructure Law. This large-scale investment is driving the demand for waterproofing membranes to ensure long-term moisture protection and structural durability.

High Upfront Costs

A key challenge in the waterproofing membranes market is the high initial cost involved in implementing advanced membrane systems in construction projects. Modern sheet-based and liquid-applied waterproofing membranes require superior raw materials, extensive surface preparation, and skilled installation, which drive up project costs compared to traditional moisture protection methods.

These expenses are significant for large-scale infrastructure and commercial projects where extensive application is needed. The higher upfront investment discourages cost-sensitive builders and contractors and hinders the adoption of waterproofing membranes.

To address this challenge, market players are focusing on cost optimization through technological innovation and improved manufacturing efficiency. Manufacturers are developing membranes that require less material and faster application, reducing labor expenses. They are also investing in localized production facilities and strategic sourcing of raw materials to cut logistics costs and stabilize pricing.

Shift Toward Hybrid Polymer‑Modified Membranes

A key trend in the waterproofing membranes market is the shift toward hybrid polymer‑modified membranes that combine APP (Atactic Polypropylene) and SBS (Styrene‑Butadiene‑Styrene) technologies in a single sheet. These membranes are designed to deliver high heat resistance and flexibility, making them suitable for regions with variable climates and diverse building requirements.

The use of hybrid membranes eliminates the need to apply different membrane types for varying climate conditions, improves durability, and ensures better performance in demanding construction environments, leading to wider adoption in roofing and waterproofing projects.

- In February 2025, Sika Corporation launched the SikaShield brand and introduced a hybrid modified bitumen waterproofing membrane in the U.S. market. This membrane combines APP (Atactic Polypropylene) and SBS (Styrene‑Butadiene‑Styrene) technologies in a single sheet to provide improved heat resistance, flexibility, and durability for roofing and waterproofing applications, particularly in areas with variable climates and heavy foot traffic.

Market Segmentation:

- By Product Type (Bituminous Membranes, Polyurethane, PVC (Polyvinyl Chloride), TPO (Thermoplastic Olefin), and Others): The bituminous membranes segment earned USD 12.18 billion in 2024 due to their cost-effectiveness, durability, and widespread use in roofing and below‑grade waterproofing applications.

- By Membrane (Liquid Applied Membranes, Sheet Membranes): The liquid applied membranes held 54.34% of the market in 2024, due to their seamless application, ability to cover complex structures, and suitability for retrofit projects.

- By Application (Roofing, Foundations & Below Grade, Walls & Facades, and Water-Retaining Structures): The roofing segment is projected to reach USD 17.56 billion by 2032, owing to the rising demand for weatherproof building envelopes and energy‑efficient roofing systems.

- By End-Use (Residential, Commercial, Industrial, and Infrastructure): The Infrastructure segment is anticipated to witness the fastest CAGR of 6.79% over the forecast period, owing to large-scale investments in transport networks, public utilities, and urban development projects.

Regulatory Frameworks

- In the U.S., the International Code Council (ICC) develops and maintains the International Building Code (IBC), which governs material standards, installation methods, and moisture protection requirements. ICC ensures waterproofing membranes in foundations, roofs, and basements meet fire safety, durability, and performance standards.

- In the UK, the British Standards Institution (BSI) develops BS and EN standards, including BS 8102 and BS EN 13967, governing waterproofing membranes. BSI oversees specifications, testing, and certification of materials used for damp proofing, below-ground structures, and roofing, ensuring durability, environmental performance, and compliance with the UK Building Regulations.

- In China, the Ministry of Housing and Urban-Rural Development (MOHURD) issues and enforces the GB national construction codes, which regulate waterproofing membranes in housing, commercial projects, and infrastructure. It oversees product quality, application techniques, safety standards, and compliance for waterproofing in tunnels, subways, and green buildings, ensuring these materials meet national durability and water-resistance performance benchmarks.

- In India, the Bureau of Indian Standards (BIS) formulates and enforces IS codes such as IS 16471:2017 for waterproofing membranes. BIS regulates product specifications, testing protocols, material safety, and durability criteria for waterproofing membranes in buildings, water tanks, and infrastructure, ensuring these materials comply with national quality and performance standards.

Competitive Landscape

Market players in the waterproofing membranes market are focusing on strengthening their portfolios by adding complementary products such as sealants, admixtures, concrete repair materials, and flooring systems to offer integrated construction solutions.

They are expanding their presence in fast-growing regions, including Asia Pacific, the Middle East, and India, to capture rising demand from large-scale infrastructure and building projects. They are also focusing on expanding manufacturing capabilities and technical expertise to support the supply of waterproofing solutions.

- In February 2025, Saint-Gobain acquired Fosroc, a global construction chemicals company with a strong presence in India, the Middle East, and Asia Pacific. This acquisition aims to add a wide range of products, including admixtures, sealants, waterproofing solutions, concrete repair systems, and flooring materials to Saint-Gobain’s portfolio and to strengthen its position in construction chemicals within rapidly expanding regions.

Key Companies in Waterproofing Membranes Market:

- Sika AG

- Tremco

- BASF

- SOPREMA

- GCP Applied Technologies Inc

- Fosroc, Inc

- MAPEI S.p.A

- Henry, A Carlisle Company

- Johns Manville

- RENOLIT SE

- Dow

- RPM International Inc

- Pidilite Industries Ltd

- Asian Paints

- Saint-Gobain.

Recent Developments (Product Launch/Expansion)

- In January 2025, Polyglass U.S.A., Inc. launched TECNOCOAT, a monolithic waterproofing and traffic coating system in the U.S. This system forms a seamless liquid-applied membrane that offers durability, chemical resistance, and versatility for applications such as below-grade foundations, plazas, parking decks, and secondary containment areas.

- In March 2024, Mapei opened a new manufacturing plant in Cantanhede, Portugal, as part of its international expansion strategy. The facility enhances production capacity and diversifies the product portfolio, supporting the supply of construction chemicals to meet growing demand in Portugal and across Europe.