Market Definition

Waste heat recovery (WHR) refers to the systematic process of capturing and reutilizing thermal energy, which is released as a byproduct of industrial operations, power generation, or other energy-intensive activities.

It encompasses technologies such as heat exchangers, recuperators, regenerators, economizers, organic rankine cycles (ORC), and thermoelectric generators, which transfer or convert residual heat into usable energy. Its applications include improving energy efficiency in manufacturing and enhancing power generation in cement, steel, glass, and chemical industries.

Waste Heat Recovery Market Overview

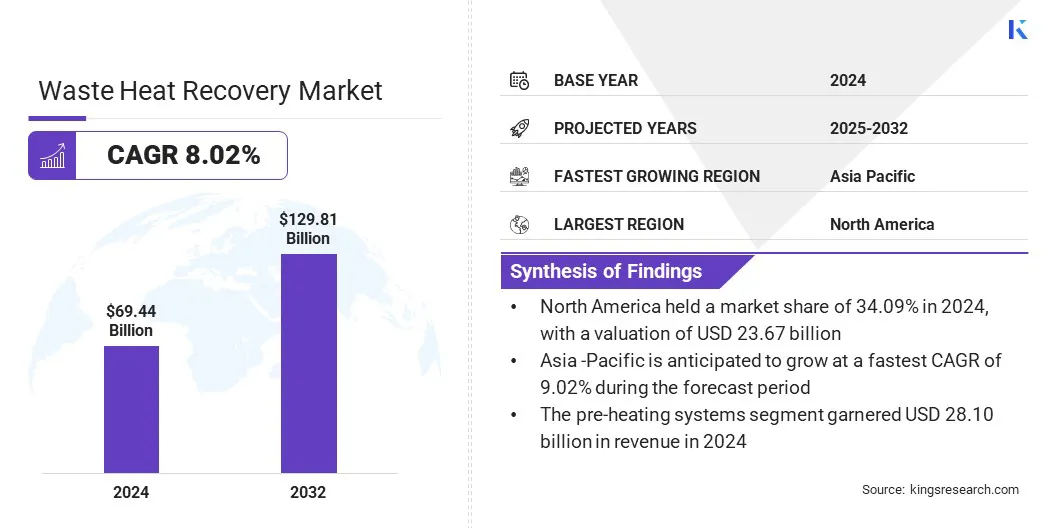

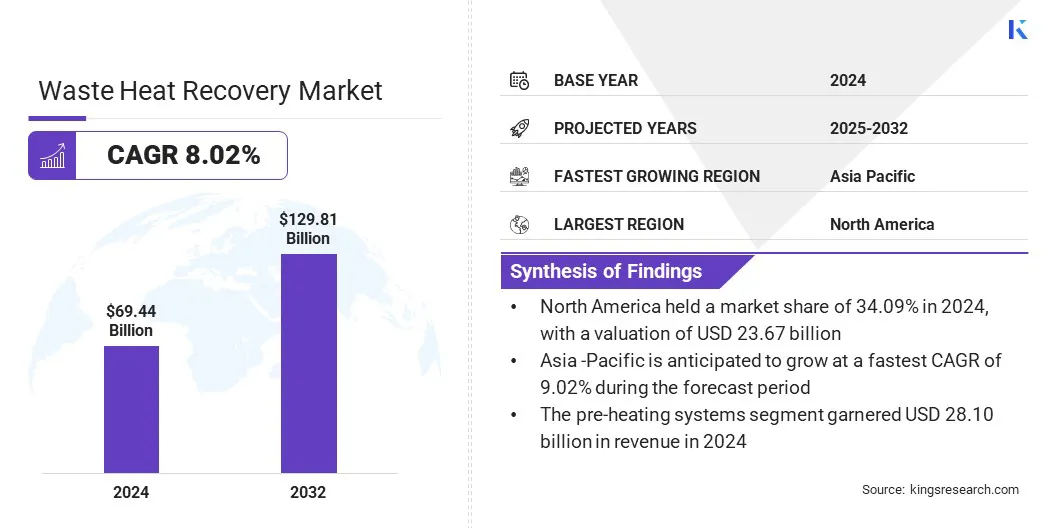

The global waste heat recovery market was valued at USD 69.44 billion in 2024 and is projected to grow from USD 74.63 billion in 2025 to USD 129.81 billion by 2032, exhibiting a CAGR of 8.02% over the forecast period.

The market growth is driven by the increasing focus on decarbonization and reducing greenhouse gas emissions, prompting industries to adopt waste heat recovery technologies to lower fossil fuel consumption and cut carbon footprints.

Key Market Highlights:

- The waste heat recovery industry size was recorded at USD 69.44 billion in 2024.

- The market is projected to grow at a CAGR of 8.02% from 2025 to 2032.

- North America held a market share of 34.09% in 2024, with a valuation of USD 23.67 billion.

- The pre-heating systems segment garnered USD 28.10 billion in revenue in 2024.

- The chemical & petrochemical segment is expected to reach USD 31.53 billion by 2032.

- Asia Pacific is anticipated to grow at a CAGR of 9.02% over the forecast period.

The market is further growing due to the rising deployment of organic rankine cycle (ORC) and other advanced WHR systems in industrial and commercial applications, which enhance energy efficiency and reduce operational costs. These technologies are being increasingly adopted across chemical, cement, steel, power generation, biomass, oil and gas, and data center sectors.

Major companies operating in the waste heat recovery market are Siemens, General Electric Company, MITSUBISHI HEAVY INDUSTRIES, LTD., Thermax Limited, Ormat, Echogen, Econotherm Limited, Mutares SE & Co. KGaA, Viessmann, Boustead International Heaters Ltd, HRS Heat Exchangers, MTPV Power Corporation, Sigma Thermal, Exodraft, and Cochran.

Industrial adoption of waste heat recovery is driving growth in the market by converting byproducts into cleaner energy and optimizing overall process efficiency.

Advanced heat exchangers capture and transfer residual heat, reducing fossil fuel consumption, lowering emissions, and cutting operational costs. This approach supports sustainability goals, enhances energy management, and encourages industries to integrate WHR technologies across chemical, power generation, and other energy-intensive sectors.

- In March 2024, Sterling TT partnered with OEMs to deliver a Waste Heat Recovery (WHR) system for industrial applications such as oil hydrogenation, and hydrogen generation for fuel cells. The system integrates with an NH₃ cracker to convert ammonia into a cleaner energy source. The project leverages bespoke heat exchangers to enhance energy efficiency and support the energy transition towards low-carbon energy solutions.

Market Driver

Increasing Focus on Decarbonization and Reducing GHG Emissions

A major factor driving the market is the increasing focus on decarbonization and the reduction of greenhouse gas emissions across industries.

Companies are adopting WHR technologies that capture and reuse excess heat from industrial processes, including cement, steel, glass, and chemicals, to lower fossil fuel consumption, reduce carbon footprint, and comply with stringent emission regulations. This rising focus on sustainability and energy efficiency is accelerating the large-scale adoption of WHR solutions worldwide.

-

In November 2024, the United Kingdom announced the country’s ambitious Nationally Determined Contribution (NDC) target to reduce all greenhouse gas emissions by at least 81% by 2035 at COP29, encouraging industries and power plants to adopt energy-efficient solutions such as waste heat recovery systems to curb emissions and improve sustainability.

Market Challenge

High Upfront Capital Investment

A key challenge in the waste heat recovery market is the high upfront capital investment required for system installation and integration. WHR projects involve complex equipment such as heat exchangers, organic rankine cycle units, and specialized piping, which can result in high implementation costs.

This initial financial burden prevents small and medium-sized enterprises from adopting these solutions, despite long-term energy savings. Additionally, project planning, customization, and installation timelines further contribute to investment barriers and slow widespread adoption across energy-intensive sectors.

To address this challenge, market players are increasingly adopting innovative financing models, such as Energy-as-a-Service (EaaS) agreements and leasing options. These approaches enable clients to implement WHR systems without significant upfront expenditure.

Companies are also standardizing modular WHR solutions to reduce installation complexity and costs of implementing waste heat recovery systems. Collaborations with governments and financial institutions are facilitating subsidies, grants, and incentives that support the wider deployment of WHR technologies.

Market Trend

Rising Deployment of Waste Heat Recovery in Data Centers

A key trend influencing the market is the rising deployment of WHR systems in data centers to repurpose excess thermal energy for district heating and commercial applications. Market players are developing solutions that capture low- to medium-temperature heat from server operations and distribute it through local heating networks.

This approach prompts the broader adoption of WHR technologies in data centers, and these innovations are helping transform data centers into decentralized energy contributors, while advancing urban sustainability and low-carbon objectives.

- In April 2025, NTT Data launched a waste heat recovery project in Berlin, redirecting 8 MW of data center heat to a new residential and commercial development. The system is highly supported by a power-to-heat boiler and hot water storage.

Waste Heat Recovery Market Report Snapshot

|

Segmentation

|

Details

|

|

By Application

|

Pre-Heating Systems, Electricity Generation, Others

|

|

By End Use

|

Chemical & Petrochemical, Oil & Gas, Energy & Power, Food & Beverages, Cement, Paper & Pulp Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Application (Pre-Heating Systems, Electricity Generation, and Others): The pre-heating systems segment earned USD 28.10 billion in revenue in 2024, due to the increasing adoption in energy-intensive industries to improve fuel efficiency and reduce operational costs.

- By End Use (Chemical & Petrochemical, Oil & Gas, Energy & Power, Food & Beverages, Cement, Paper & Pulp, and Others): The chemical & petrochemical segment held 24.20% of the market in 2024, due to the high demand for process heat recovery and stringent energy efficiency regulations in the sector.

Waste Heat Recovery Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America waste heat recovery market share stood at 34.09% in 2024, with a valuation of USD 23.67 billion. This dominance is attributed to the increasing deployment of advanced waste heat recovery solutions and the expansion of large-scale industrial and commercial applications.

Rising deployment of organic rankine cycle (ORC) and other advanced WHR systems across chemical, cement, steel, power generation, biomass, oil and gas, and data center sectors is further accelerating market expansion. Increasing focus on decarbonization and reducing greenhouse gas emissions is prompting industries to adopt technologies that lower fossil fuel consumption and carbon footprints.

Additionally, investment by key players in magnetic bearing organic rankine cycle (ORC) systems is driving market growth in region by enhancing reliability, lowering costs, and improving energy efficiency. The region is leveraging these innovations to reinforce the adoption of waste heat to power solutions and support sustainable power generation. These initiatives are driving the market expansion in the region.

- In April 2025, Clean Energy Technologies, Inc. secured USD 4,00,000 in sales of its magnetic bearing ORC heat recovery solutions and is developing a 350 kW system for industrial and commercial applications. Thisenhances manufacturing and distribution, supporting deployment across biomass, oil and gas, data centers, and power plants.

Asia Pacific is set to grow at a CAGR of 9.02% over the forecast period. This growth is attributed to increasing investments in industrial thermal systems and the expansion of energy efficiency solutions in cement, steel, chemical, and power generation industries.

Increasing adoption of advanced WHR technologies, including industrial heat recovery boilers, pre-heating systems, and waste-to-energy solutions, is significantly contributing to the growth of the market. Firms are integrating WHR solutions into existing equipment to optimize energy utilization and expand service offerings across industrial clients.

Strategic collaborations and investments by key players are enhancing manufacturing capabilities and market reach, supporting large-scale deployment and promoting sustainable energy practices. These initiatives are driving faster deployment of energy-efficient solutions and accelerating market growth across the region.

Regulatory Frameworks

- In the U.S., the Environmental Protection Agency regulates waste heat recovery within its broader energy efficiency and air quality programs. The EPA oversees compliance with emission standards, promotes clean energy integration, and supports WHR through initiatives like the combined heat and power partnership. It ensures that industries deploy WHR to reduce fuel consumption, limit greenhouse gases, and meet federal environmental policies.

- In China, the National Development and Reform Commission oversees waste heat recovery as a part of national energy efficiency and carbon reduction strategies. The NDRC regulates industrial efficiency targets, supervises clean energy adoption, and directs subsidies or mandates for WHR integration in heavy industries. It ensures that WHR adoption aligns with China’s “dual carbon” goals, reducing energy intensity and industrial emissions.

- In India, the Bureau of Energy Efficiency regulates and promotes waste heat recovery under the Energy Conservation Act. The BEE oversees energy audits, sets efficiency benchmarks, and mandates WHR adoption in energy-intensive sectors under the Perform, Achieve, and Trade (PAT) scheme.

Competitive Landscape

Major players operating in the waste heat recovery market are implementing large-scale projects to capture unused heat from industrial processes and reuse it for internal energy needs. Operators are integrating advanced organic rankine cycle systems to convert waste heat into electricity and support potential district heating applications.

Market players are optimizing kiln and exhaust operations to maximize heat recovery and improve overall energy efficiency. Additionally, they are focusing on reducing emissions and enhancing sustainability across industrial processes.

- In July 2025, Holcim partnered with E.ON Energy Infrastructure Solutions and Orcan Energy to implement a waste heat recovery project at its Dotternhausen cement plant, capturing 10 MW from kiln exhaust gases to supply internal processes, district heating, and power generation through an eP1000 Organic Rankine Cycle system.

Key Companies in Waste Heat Recovery Market:

- Siemens

- General Electric Company

- MITSUBISHI HEAVY INDUSTRIES, LTD

- Thermax Limited

- Ormat

- Echogen

- Econotherm Limited

- Mutares SE & Co. KGaA

- Viessmann

- Boustead International Heaters Ltd

- HRS Heat Exchangers

- MTPV Power Corporation

- Sigma Thermal

- Exodraft

- Cochran

Recent Developments (M&A)

- In April 2024, Mutares SE & Co. KGaA acquired a majority stake in Sofinter Group, a provider of industrial and heat recovery boilers, including Heat Recovery Steam Generation (HRSG) solutions. Sofinter operates multiple brands serving industrial, waste-to-energy, and power generation markets across 45 countries. Through this acquisition, Mutares aims to strengthen its engineering and technology capabilities in heat recovery and boiler solutions.

- In March 2024, Pemberstone Capital Partners acquired Sterling Thermal Technology, a specialist in custom heat exchange and waste heat recovery solutions for industrial, energy, and power sectors. The acquisition aims to provide growth capital and expertise to accelerate domestic and international expansion while supporting technological advancements in waste heat recovery and custom heat transfer solutions.

and expands market presence