Market Definition

The market involves the production and sale of storage systems used in warehouses and distribution centers. These racking systems are designed to store goods efficiently, optimizing space utilization and improving overall warehouse operations.

They help businesses maximize storage capacity, streamline inventory management, and enhance productivity in industries such as retail, logistics, and manufacturing.

Warehouse Racking Market Overview

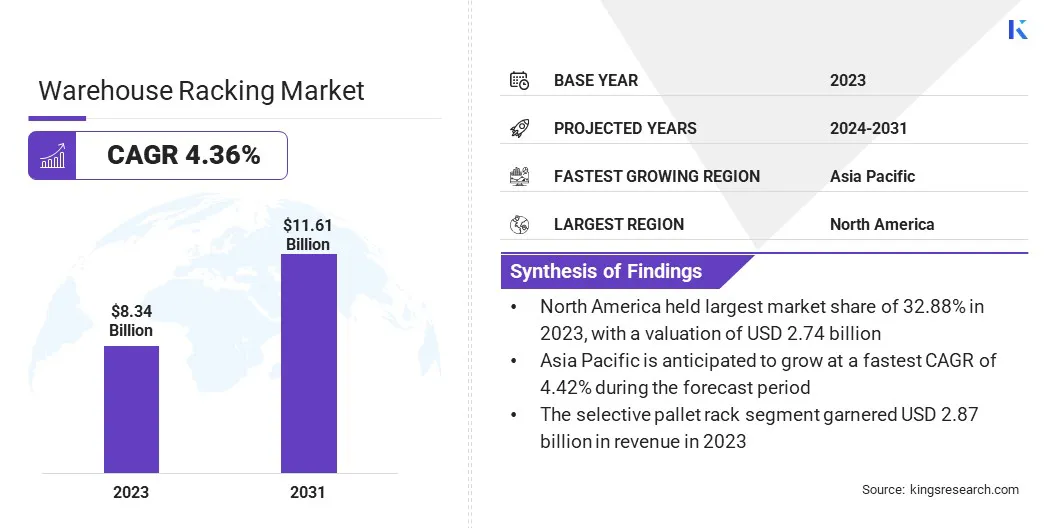

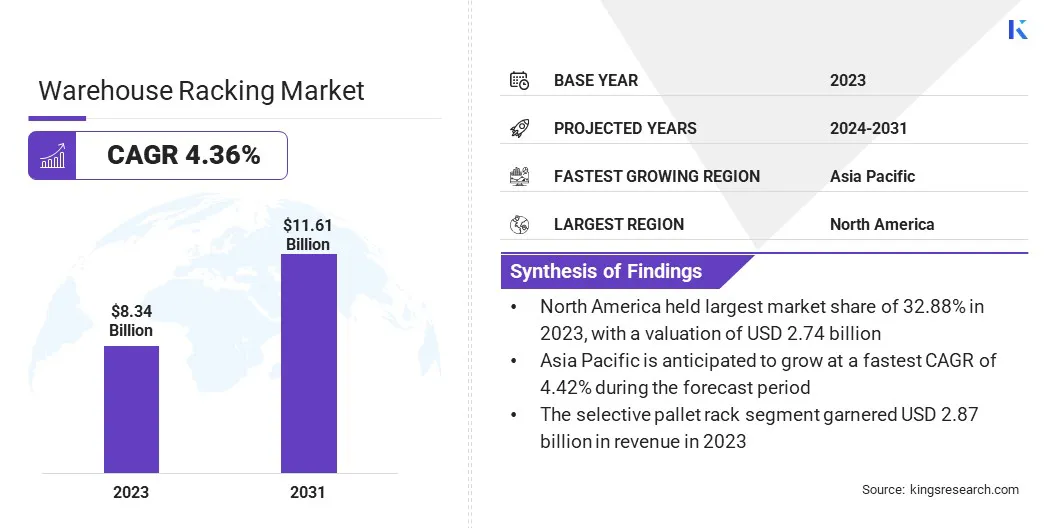

The global warehouse racking market size was USD 8.34 billion in 2023, which is estimated to be valued at USD 8.62 billion in 2024 and reach USD 11.61 billion by 2031, growing at a CAGR of 4.36% from 2024 to 2031.

Space optimization is a major factor boosting the growth of the market, as companies aim to maximize limited warehouse space. By utilizing advanced racking systems, businesses can increase storage capacity, improve operational efficiency, and reduce overall storage costs.

Major companies operating in the warehouse racking industry are Daifuku Co., Ltd., Mecalux, S.A., Emrack International, Jungheinrich AG, SSI SCHÄFER GmbH & Co KG, Dematic, Gonvarri Material Handling, BEUMER Group, Interroll Group, Toyota Industries Corporation, Godrej Enterprises, Storage Technologies & Automation Pvt. Ltd., Kardex, Nilkamal Material Handling., Delta Storage Systems Pvt. Ltd., and others.

The market is a dynamic and essential component of modern logistics and storage infrastructure. It serves various industries by providing customized storage solutions that enhance operational efficiency and optimize space.

With advancements in design and technology, these racking systems have become increasingly sophisticated, offering businesses greater flexibility and functionality.

Companies within this market focus on delivering high-quality, durable, and reliable systems that cater to a wide range of storage needs, ensuring streamlined processes with the help of technology and enhanced productivity for warehouse operations.

- In September 2024, Scalpers announced its plans to automate order picking with SSI SCHAEFER's 26 RackBots in their distribution center. This system integrates high-density racking and autonomous mobile robots to improve order picking, scalability, and storage capacity, enhancing operational efficiency.

Key Highlights:

- The warehouse racking industry size was recorded at USD 8.34 billion in 2023.

- The market is projected to grow at a CAGR of 4.36% from 2024 to 2031.

- North America held a share of 32.88% in 2023, valued at USD 2.74 billion.

- The selective pallet rack segment garnered USD 2.87 billion in revenue in 2023.

- The retail segment is expected to reach USD 3.71 billion by 2031.

- Asia Pacific is anticipated to grow at a CAGR of 4.42% over the forecast period.

Market Driver

"Rapid Growth of E-commerce Industry"

The rapid growth of e-commerce has significantly increased the demand for fast order fulfillment and efficient distribution, boosting the growth of the warehouse racking market.

As online retailers strive to meet customer expectations for quicker deliveries, warehouses need to optimize storage capacity and streamline operations.

Advanced racking systems allow for higher-density storage and faster picking processes, enabling businesses to handle large volumes of inventory efficiently. This growing need for speed, accuracy, and space utilization boosts the adoption of innovative racking solutions across the e-commerce sector.

- In October 2023, Amazon introduced its Sequoia robotic system in fulfillment centers to optimize inventory storage and order processing. This innovation enhances speed, accuracy, and safety, bolstering the demand for more efficient warehouse racking solutions to support e-commerce growth.

Market Challenge

"Rising Safety Concerns"

Safety concerns present a significant challenge to the development of the warehouse racking market, as improperly installed or overloaded racking systems can pose serious hazards, leading to accidents and injuries. These safety risks include the collapse of racks, falling items, and forklift-related accidents.

To mitigate these risks, it is essential to conduct regular inspections, ensure compliance with safety standards, and provide proper training to warehouse staff. Additionally, utilizing advanced racking systems with safety features such as load sensors and automated monitoring can enhance warehouse safety.

Market Trend

"Automation and Integration of Robotics"

Automation and robotics integration is a prominent trend in the warehouse racking market, as businesses increasingly adopt automated racking systems and robotic solutions to enhance operational efficiency. These technologies reduce manual labor, improve order picking speed, and optimize storage capacity.

Robotic systems, such as autonomous mobile robots (AMRs) and robotic arms, enhance racking solutions to streamline inventory management, minimize human error, and increase throughput. This trend is reshaping warehouse operations, allowing companies to meet growing e-commerce demands with greater precision and efficiency.

- In January 2025, AR Racking implemented an innovative storage system at IceStar’s temperature-controlled plant in Chile, featuring 4,400 pallet shuttle positions and adjustable racking. This solution optimized storage density, improved operational efficiency, and supported automated logistics.

Warehouse Racking Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Cantilever Rack, Selective Pallet Rack, Pallet Flow Rack, Drive-In/Drive-Thru Rack, Others

|

|

By End User

|

Automotive, Food and Beverages, Retail, Manufacturing, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, U.K., Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Type (Cantilever Rack, Selective Pallet Rack, Pallet Flow Rack, Drive-In/Drive-Thru Rack, and Others): The selective pallet rack segment earned USD 2.87 billion in 2023 due to its ability to maximize storage capacity and improve inventory accessibility.

- By End User (Automotive, Food and Beverages, Retail, Manufacturing, and Others): The retail segment held a share of 31.92% in 2023, attributed to increasing demand for efficient storage solutions in e-commerce and fast inventory turnover.

Warehouse Racking Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America warehouse racking market captured a share of around 32.88% in 2023, valued at USD 2.74 billion. This dominance is reinforced by the region's advanced infrastructure, high demand for efficient logistics, and widespread adoption of automation technologies.

The U.S. and Canada lead in warehouse automation and robotics integration, as businesses strive to meet the growing e-commerce demand. Additionally, the robust industrial and manufacturing sectors in North America support the growth of warehouse racking solutions, positioning the region as the key market in this sector.

- In January 2025, AR Racking strengthened its presence in North America by establishing a U.S. subsidiary and opening an office in Charlotte, North Carolina. This strategic move aims to support U.S. companies with optimized logistics solutions, offering advanced racking systems for various industrial sectors.

Asia Pacific warehouse racking industry is set to grow at a CAGR of 4.42% over the forecast period. This growth is stimulated by rapid industrialization, urbanization, and the booming e-commerce industry. Countries such as China, India, and Japan are expanding their warehouse capacities to support growing demand for goods storage and efficient distribution.

The adoption of automated racking systems and robotics is rising, as businesses focus on improving operational efficiency and space utilization. Asia Pacific's large population and increasing trade further boost the demand for advanced racking solutions.

Regulatory Frameworks:

- OSHA, part of the United States Department of Labor. OSHA's mission, ensures safe and healthful working conditions free from unlawful retaliation.

- In the U.S., the American National Standards Institute (ANSI) does not develop standards but provides a framework for fair standards development and quality conformity assessment systems and continually works to safeguard their integrity.

- In the EU, machinery legislation governs the harmonization of essential health and safety requirements for machinery.

Competitive Landscape

The warehouse racking industry is characterized by a large number of participants, including both established corporations and emerging players. Investments in the market are directed toward expanding production capabilities, adopting advanced technologies, and enhancing system customization.

Companies are channeling funds into automation, robotics, and smart racking systems to meet growing demand. These investments aim to improve operational efficiency, optimize storage capacity, and strengthen market presence, ensuring businesses maintain competitiveness in the evolving logistics and warehousing landscape.

- In November 2024, AR Racking announced a USD 20.27 million investment plan, supported by USD 8.29 million from INI, to expand its Tudela plant. This expansion aims to enhance production capacity, create 35 new jobs, and strengthen AR Racking’s market presence, particularly in key global regions.

List of Key Companies in Warehouse Racking Market:

- Daifuku Co., Ltd.

- Mecalux, S.A.

- Emrack International

- Jungheinrich AG

- SSI SCHÄFER GmbH & Co KG

- Dematic

- Gonvarri Material Handling

- BEUMER Group

- Interroll Group

- Toyota Industries Corporation

- Godrej Enterprises

- Storage Technologies & Automation Pvt. Ltd.

- Kardex

- Nilkamal Material Handling.

- Delta Storage Systems Pvt. Ltd.

Recent Developments (Launch/Partnership/Acquisition)

- In August 2024, SSI SCHAEFER implemented the largest mobile racking system for cold rooms in the UAE, increasing storage capacity by 90%. This advanced system, installed at AD Ports Group’s KLP21 hub, enhances cooling efficiency, safety, and capacity for pharmaceutical and logistics needS.

- In November 2024, AR Racking enhanced Brenntag Colombia's logistics efficiency by installing an adjustable pallet racking system at their Yumbo facility. The system, covering 710 m², offers 888 pallet positions, optimizing space and boosting operational efficiency for the chemical distributor.

- In January 2025, AR Racking strengthened its position in the Swedish market through a strategic partnership with Rudells Lagerinredningar. This collaboration expands AR Racking’s reach in Scandinavia, enabling the local distribution of high-quality storage solutions tailored to customer needs.

- In March 2023, Jungheinrich completed the acquisition of Storage Solutions, reinforcing its position in the U.S. racking systems and warehouse automation sectors. This strategic move provides strengthens its growth platform and market presence.