Market Definition

The market encompasses the production, distribution, and commercialization of vitamin K2, a fat-soluble nutrient essential for calcium metabolism and overall health.

It is utilized across pharmaceuticals, dietary supplements, functional foods, and personal care formulations. Market participants include raw material suppliers, contract manufacturers, and brand owners catering to consumer and industrial needs.

Vitamin K2 Market Overview

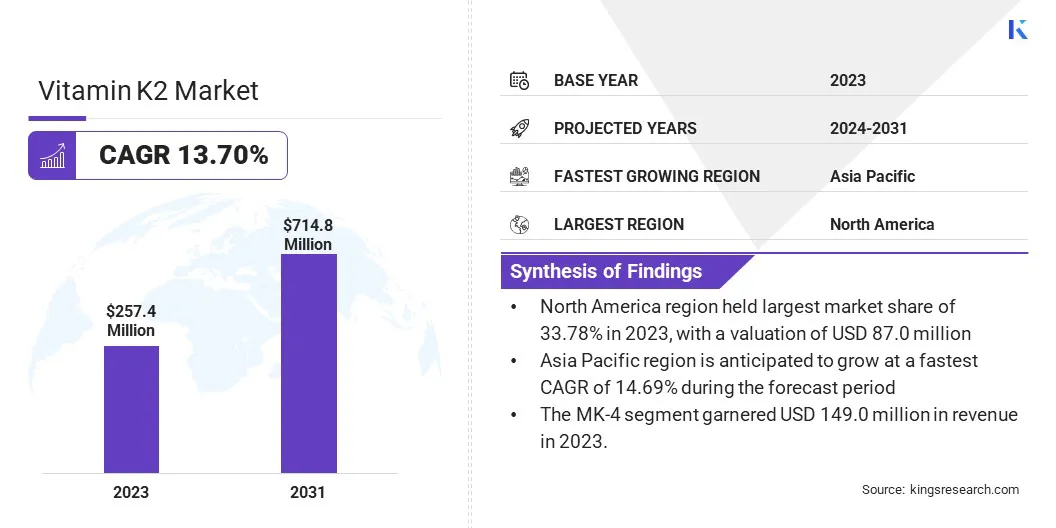

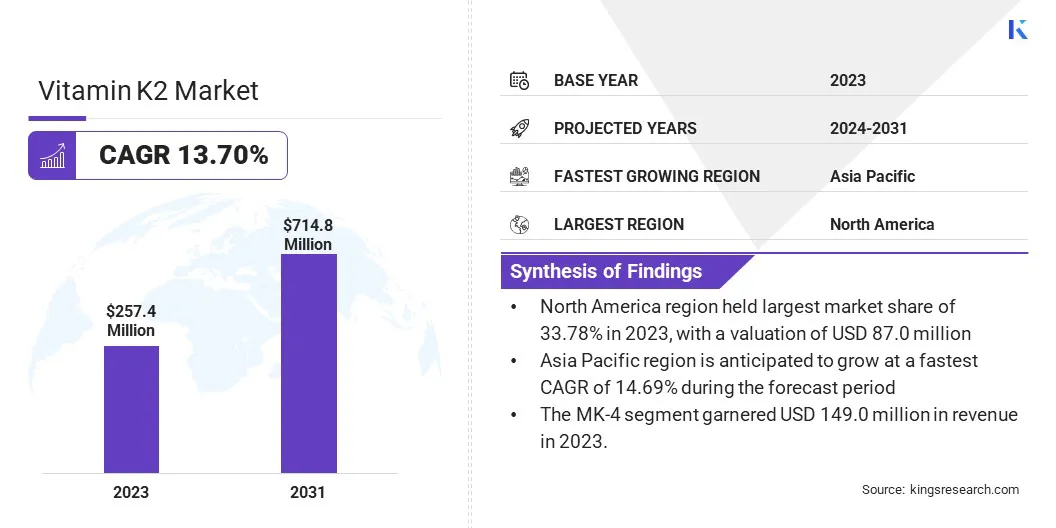

The global vitamin k2 market size was valued at USD 257.4 million in 2023 and is projected to grow from USD 290.9 million in 2024 to USD 714.8 million by 2031, exhibiting a CAGR of 13.70% during the forecast period.

The growth is driven by rising consumer awareness of bone and cardiovascular health, increasing demand for functional foods and dietary supplements, and advancements in fermentation-based production technologies. The shift toward clean-label and plant-based supplements and growing adoption in pharmaceutical and nutraceutical formulations are further fueling market growth.

Major companies operating in the vitamin k2 industry are Jarrow Formulas, Inc., Thorne, GNC Holdings, LLC, GF FERMENTECH, NOW, Balchem Corp., Vesta Nutra, KYOWA HAKKO U.S.A., INC., dsm-firmenich, Gnosis by Lesaffre, Solgar Inc., Viridis BioPharma, Ortho Molecular Products, GeneFerm Biotechnology Co., Ltd., and SEEBIO BIOTECH (SHANGHAI) CO., LTD.

Additionally, key industry players are investing in research and development (R&D) to enhance bioavailability, stability, and efficacy of Vitamin K2 formulations. Increasing penetration of e-commerce and direct-to-consumer (DTC) channels is also improving accessibility and market reach.

As global regulatory bodies recognize Vitamin K2’s health benefits, its applications in fortified foods, medical nutrition, and functional beverages are expected to expand, driving the market growth.

- In February 2024, Balchem Corp published a research in which the evolving cardiovascular health sector highlights the potential of vitamin K2 MK-7 as a key heart health supplement. A peer-reviewed study in the Journal of the American College of Cardiology (JACC) reveals promising findings on the impact of vitamin K2 MK-7 and vitamin D intake in mitigating the progression of coronary artery calcification (CAC) .

Key Highlights:

- The vitamin k2 industry size was recorded at USD 257.4 million in 2023.

- The market is projected to grow at a CAGR of 13.70% from 2024 to 2031.

- North America held a market share of 33.78% in 2023, with a valuation of USD 87.0 million.

- The mk-4 segment garnered USD 149.0 million in revenue in 2023.

- The blood health & clotting segment is expected to reach USD 228.2 million by 2031.

- The natural segment is expected to reach USD 413.1 million by 2031.

- The capsules & tablets segment is expected to reach USD 275.0 million by 2031.

- The health supplements segment is expected to reach USD 408.2 million by 2031.

- Asia Pacific is anticipated to grow at a CAGR of 14.69% during the forecast period.

Market Driver

"Growing Demand for Preventive Healthcare"

The vitamin k2 market is driven by the increasing consumer focus on preventive healthcare, particularly for bone and cardiovascular health. As awareness grows about the role of vitamin K2 in calcium metabolism, osteoporosis prevention, and arterial flexibility, demand for supplements and functional foods enriched with this nutrient continues to rise.

Healthcare professionals and clinical research further reinforce its benefits, encouraging proactive health management in aging populations and younger demographics seeking long-term wellness solutions. With preventive healthcare gaining traction worldwide, companies in the market are capitalizing on this trend by offering innovative product solutions tailored to consumer preferences and regional dietary needs.

- For instance, in February 2025, Balchem forged a multi-year partnership between its patented vitamin K2 brand, K2VITAL, and FC Bayern Women. As the team’s exclusive bioscience partner, K2VITAL will leverage dynamic branding and educational initiatives to enhance awareness of vitamin K2’s health benefits, supporting Balchem’s B2B-to-B2C market expansion strategy.

Market Challenge

"Supply Chain Limitations"

One of the significant challenges in the vitamin K2 market is the fluctuating supply of high-purity raw materials, particularly menaquinones such as MK-7, which are derived through bacterial fermentation.

The complex production process, high costs, and dependence on specific bacterial strains create bottlenecks in supply, leading to potential price volatility and availability concerns for manufacturers.

To mitigate supply chain risks, industry players can invest in diversified sourcing strategies by partnering with multiple raw material suppliers and developing region-specific production facilities to reduce dependency on a single region. Advancements in synthetic and bioengineered production methods can also help stabilize supply and reduce production costs.

Market Trend

"Expansion of Functional Food & Beverage Applications"

A key trend in the vitamin K2 market is the growing adoption of this nutrient in functional foods and beverages beyond traditional supplement formats. As consumers seek convenient ways to integrate essential nutrients into their daily diets, food manufacturers are increasingly fortifying dairy products, plant-based alternatives, and beverages with vitamin K2.

This trend aligns with the broader shift toward "food as medicine," where consumers prefer obtaining health benefits from everyday dietary choices rather than relying on supplements. Food and beverage brands are leveraging this trend by developing fortified products that cater to diverse consumer preferences, including dairy-free, organic, and clean-label formulations.

The combination of vitamin K2 with complementary nutrients, such as vitamin D3 and calcium, in fortified yogurts, plant-based milks, and energy drinks is gaining traction.

Vitamin K2 Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

MK-4, MK-7

|

|

By Function

|

Bone & Cardiovascular Health, Blood Health & Clotting, Anti Inflammatory & Immune Support, Others

|

|

By Source

|

Natural, Synthetic

|

|

By Form

|

Capsules & Tablets, Powder & Crystalline, Liquid

|

|

By Application

|

Functional Food & Beverages, Health Supplements

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Type (MK-4, MK-7): The MK-4 segment was valued at USD 149.0 million in 2023 due to its widespread use in pharmaceuticals and rapid absorption, making it a preferred choice for short-term therapeutic applications, particularly in bone health and cardiovascular treatments.

- By Function (Bone & Cardiovascular Health, Blood Health & Clotting, Anti Inflammatory & Immune Support, and Others): The blood health & clotting held 31.90% of the market in 2023, due to vitamin K2’s critical role in blood coagulation processes, increasing its use in medical treatments for hemophilia and anticoagulant therapy management.

- By Source (Natural, Synthetic): The natural segment is projected to reach USD 413.1 million by 2031, owing to the growing consumer preference for bioavailable and fermentation-derived vitamin K2, along with increased demand for clean-label and plant-based supplement formulations.

- By Form (Capsules & Tablets, Powder & Crystalline, Liquid): The capsules & tablets segment is projected to reach USD 275.0 million by 2031, owing to higher consumer trust in traditional oral dosage forms, ease of consumption, and extended shelf life compared to liquid and powder formats.

- By Application (Functional Food & Beverages, Health Supplements): The health supplements held 57.74% of the market in 2023, due to rising adoption of vitamin K2 in dietary supplements for bone and heart health, increasing clinical research supporting its efficacy, and growing consumer awareness about preventive healthcare.

Vitamin K2 Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America vitamin K2 market share stood at around 33.78% in 2023 in the global market, with a valuation of USD 87.0 million. The region’s strong market position is driven by high consumer awareness, increasing adoption of dietary supplements, and a well-established nutraceutical industry.

The rising prevalence of osteoporosis, cardiovascular diseases, and vitamin deficiencies in aging populations has fueled the demand for vitamin K2-enriched supplements and functional foods. Additionally, approvals from the U.S. Food and Drug Administration (FDA) and Health Canada, have supported market growth by ensuring product safety and quality standards.

Asia Pacific is also poised to grow at a significant CAGR of 14.69% over the forecast period, driven by rapid urbanization, increasing disposable income, and rising health-consciousness among consumers. Expanding pharmaceutical and nutraceutical sectors, particularly in China, India, and Japan, are creating significant growth opportunities.

The increasing prevalence of osteoporosis and cardiovascular disorders, along with a shift toward preventive healthcare, is boosting the demand for vitamin K2-based products. Additionally, government initiatives promoting dietary supplements and increasing penetration of e-commerce platforms are accelerating market expansion across the region.

Regulatory Frameworks

- In the U.S, the Food and Drug Administration (FDA) regulates vitamin K2 in dietary supplements, fortified foods, and pharmaceuticals, ensuring compliance with labeling, safety, and manufacturing standards. Prescription formulations require FDA approval, while supplements must adhere to Good Manufacturing Practices (GMP).

- In Europe, the European Food Safety Authority (EFSA) regulates Vitamin K2 in food and dietary supplements, ensuring safety, labeling, and health claims compliance. The European Medicines Agency (EMA) oversees its pharmaceutical applications, evaluating efficacy, quality, and therapeutic use. Manufacturers must meet stringent EU safety and regulatory standards for market approval.

- In India, the Food Safety and Standards Authority of India (FSSAI) regulates vitamin K2 in food, dietary supplements, and nutraceuticals by setting safety, labeling, permissible limits, and quality standards to ensure consumer protection and compliance.

Competitive Landscape

The global vitamin k2 industry is characterized by a number of participants. Leading players focus on product innovation and are investing in research and development (R&D) to enhance bioavailability, improve production efficiency, and develop new formulations catering to diverse consumer needs.

Companies are also engaging in mergers, acquisitions, and collaborations to expand their product portfolios and gain a competitive edge. Additionally, increasing competition has led to price differentiation strategies and aggressive marketing campaigns to capture market share.

Companies are focusing on regulatory compliance and quality assurance to meet stringent international standards, ensuring consumer trust and brand credibility. With the growing demand for natural and plant-based sources, players are also investing in fermentation-derived MK-7 production to cater to the evolving market trends.

- In November 2023, Abbott, a global healthcare leader, launched PediaSure with the Nutri-Pull system, featuring Vitamin K2, Vitamin D, Vitamin C, and casein phosphopeptides (CPPs). This innovation enhances nutrient absorption, supporting catch-up growth in children and aligning with the growing demand for Vitamin K2-enriched functional nutrition.

List of Key Companies in Vitamin K2 Market:

- Jarrow Formulas, Inc.

- Thorne

- GNC Holdings, LLC

- GF FERMENTECH

- NOW

- Balchem Corp.

- Vesta Nutra

- KYOWA HAKKO U.S.A., INC.

- dsm-firmenich

- Gnosis by Lesaffre

- Solgar Inc.

- Ortho Molecular Products

- GeneFerm Biotechnology Co., Ltd.

- SEEBIO BIOTECH (SHANGHAI) CO., LTD.

Recent Developments (New Product Launch)

- In February 2024, ILSI Europe launched the Vitamin K2 Task Force to advance research, regulatory alignment, and scientific understanding. This initiative aims to enhance market credibility, drive innovation, and support industry growth by fostering collaboration among key stakeholders in the market.

- In April 2023, Petrovax launched Sundevit, a new vitamin K2-enriched product in the Russian market, reflecting the rising demand for bone and cardiovascular health supplements. This expansion highlights the growing global competition in the vitamin K2 industry, with companies introducing innovative formulations to capture market share.