Market Definition

The market includes vinyl sheets, vinyl tiles, and luxury vinyl tiles (lvt), used in residential and non-residential applications. Its durability, moisture resistance, and design versatility, make it a common choice for homes, offices, healthcare facilities, and commercial spaces. Vinyl flooring provides a cost-effective and low-maintenance flooring solution suitable for various environments.

Vinyl Flooring Market Overview

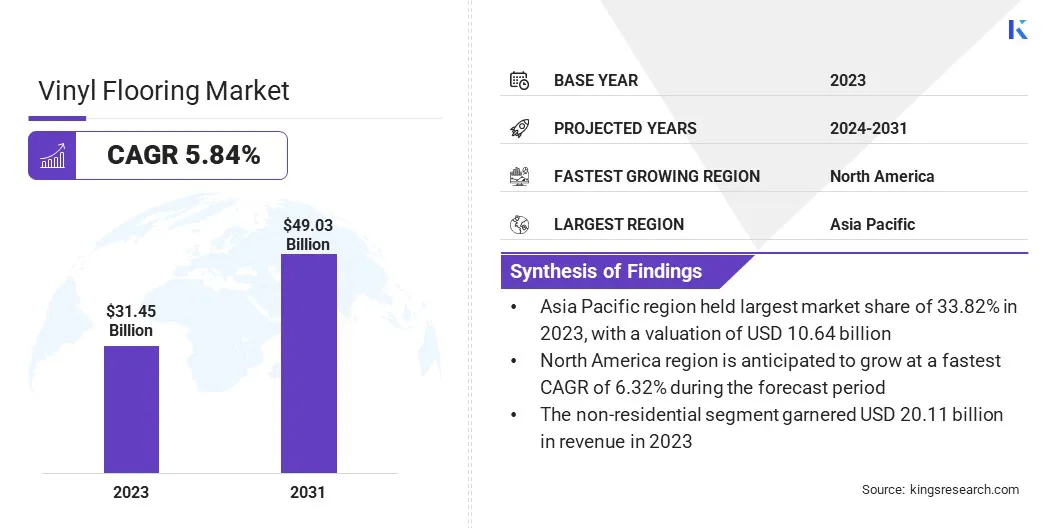

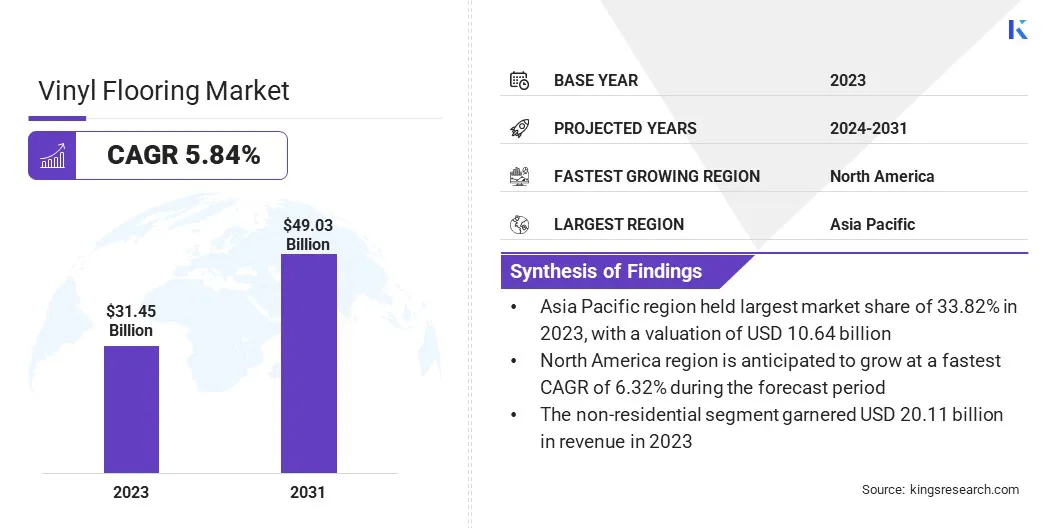

The global vinyl flooring market size was valued at USD 31.45 billion in 2023 and is projected to grow from USD 32.97 billion in 2024 to USD 49.03 billion by 2031, exhibiting a CAGR of 5.84% during the forecast period.

This growth is primarily driven by increasing demand for cost-effective, durable, and aesthetically appealing flooring solutions across residential, commercial, and industrial sectors. Additionally, rapid urbanization, infrastructure development, and growing renovation activities are fueling demand for vinyl flooring, particularly in emerging economies.

Major companies operating in the vinyl flooring industry are Shaw Industries Group, Inc., Fatra, a.s., Beaulieu International Group, Tarkett, Interface, Inc., Responsive Industries Ltd., Forbo Flooring Systems, Gerflor, Polyflor Ltd, RMG Polyvinyl India Limited, NATROYAL INDUSTRIES PVT. LTD., AHF, LLC., LX Hausys, Mohawk Industries, Inc., and Mannington Mills, Inc.

As consumer preferences evolve, the market continues to expand, driven by the need for durable, aesthetic, and hygienic solutions. Innovations in antimicrobial coatings, moisture resistance, and design versatility are reshaping the industry, positioning vinyl flooring as a preferred choice across residential and commercial applications for both functionality and style.

- In August 2024, Multipanel launched a new chevron wood-effect Luxury Vinyl Tile (LVT) collection with a 30-year guarantee. Featuring a 0.5mm wear layer and ceramic bead coating, the durable flooring meets the growing demand for stylish, long-lasting, and slip-resistant solutions in high-traffic residential spaces.

Key Highlights:

- The vinyl flooring industry size was recorded at USD 31.45 billion in 2023.

- The market is projected to grow at a CAGR of 5.84% from 2024 to 2031.

- Asia Pacific held a market share of 33.82% in 2023, with a valuation of USD 10.64 billion.

- The luxury vinyl tiles segment garnered USD 13.59 billion in revenue in 2023.

- The non-residential segment is expected to reach USD 31.05 billion by 2031.

- North America is anticipated to grow at a CAGR of 6.32% during the forecast period.

Market Driver

Rising Demand for Durable and Aesthetic Flooring Solutions

The vinyl flooring market is experiencing growth due to increasing consumer preference for durable, cost-effective, and visually appealing flooring solutions. Vinyl flooring offers superior resistance to moisture, scratches, and wear, making it ideal for both residential and commercial applications.

Its ability to replicate the look of natural materials such as hardwood and stone at a fraction of the cost further enhance its appeal among consumers seeking budget-friendly options.

Additionally, the rising construction and renovation activities across residential, commercial, and industrial sectors are driving demand for vinyl flooring. Homeowners and businesses are looking for flooring solutions that not only enhance aesthetics but also require minimal maintenance.

- For instance, in September 2023, Interface introduced new flooring collections, including the Woven Gradience and Open Air carpet tile ranges, along with expansions in its carbon-negative product offerings. These additions enhance the company's portfolio while supporting sustainability initiatives in the flooring industry.

Market Challenge

Environmental Concerns and Disposal Issues

A major challenge in the vinyl flooring market is its environmental impact, particularly concerning production processes and disposal. Vinyl flooring is primarily made from polyvinyl chloride (PVC), a material associated with emissions of hazardous substances during manufacturing.

Additionally, improper disposal of vinyl flooring can contribute to environmental pollution, as PVC is not biodegradable and releases toxic compounds if incinerated. Expansion of recycling initiatives and the adoption of sustainable manufacturing practices can help address these concerns.

Governments are enforcing strict regulations on PVC disposal and promoting extended producer responsibility (EPR) programs to reduce environmental impact.

For instance, in November 2024, the Australian Competition and Consumer Commission (ACCC) authorized a flooring recycling scheme aimed at improving waste management in the industry. This initiative supports sustainable disposal practices and encourages circular economy efforts within the sector.

Market Trend

Increasing Focus on Infection Control and Moisture-Resistant Vinyl Flooring

The market is witnessing a shift to flooring solutions that offer both infection control and moisture resistance, particularly in healthcare, hospitality, and high-traffic commercial spaces. With heightened awareness of hygiene and evolving sanitation standards, businesses and homeowners are prioritizing flooring materials that help maintain cleaner indoor environments.

Vinyl flooring with antimicrobial properties is gaining traction in hospitals, clinics, and laboratories, where preventing bacterial and fungal growth is critical. These floors are designed to withstand frequent cleaning with disinfectants without deteriorating, making them an ideal choice for hygiene-sensitive environments.

Additionally, moisture resistance has become a critical factor in flooring selection, preventing warping, mold growth, and material degradation in areas prone to spills, humidity, or water exposure, such as bathrooms, kitchens, and basements.

- In November 2023, Mohawk Group introduced its Healthy Environments sheet vinyl flooring lineup designed for infection control and moisture resistance. These products, including Medella Hues and Medella Well, feature antimicrobial protection making them ideal for healthcare and high-traffic commercial spaces.

Vinyl Flooring Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product

|

Vinyl Sheets, Vinyl Tiles, Luxury Vinyl Tiles

|

|

By Application

|

Residential, Non-Residential

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Product (Vinyl Sheets, Vinyl Tiles, Luxury Vinyl Tiles): The luxury vinyl tiles segment earned USD 13.59 billion in 2023 due to its superior durability, realistic design aesthetics, and ease of installation.

- By Application (Residential, Non-Residential): The non-residential segment held 63.95% of the market in 2023, due to the rising adoption of vinyl flooring in commercial spaces, including offices, healthcare facilities, retail stores, and hospitality establishments.

Vinyl Flooring Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

The Asia Pacific vinyl flooring market share stood around 33.82% in 2023 in the global market, with a valuation of USD 10.64 billion. The region’s dominance is driven by rapid urbanization, increasing construction activities, and strong demand from both residential and commercial sectors.

Countries such as China, India, and Japan are witnessing significant infrastructure development, boosting the adoption of vinyl flooring in commercial spaces such as offices, shopping malls, hotels, and healthcare facilities. Manufacturers in the region are focusing on producing cost-effective and innovative vinyl flooring solutions, including Luxury Vinyl Tiles (LVT), to cater to evolving consumer preferences.

With continuous advancements in flooring technology and increasing awareness of eco-friendly alternatives, the Asia Pacific market is expected to witness steady growth in the coming years.

North America is poised to grow at a significant growth at a CAGR of 6.32% over the forecast period, driven by rising renovation and remodeling activities in the residential sector, coupled with increasing demand for low-maintenance and high-performance flooring solutions.

The region's commercial sector, particularly in healthcare, retail, and hospitality, is also a key contributor to market expansion. The presence of leading manufacturers, ongoing innovations in waterproof and antimicrobial vinyl flooring, and the shift toward sustainable building materials are further accelerating market growth.

The U.S. and Canada remain the primary markets, with strong demand for Vinyl flooring due to their durability, aesthetic appeal, and ease of installation.

- In September 2024, Floor & Decor strengthened its market presence in the U.S. by launching four new stores in Austell-Mableton, Georgia; North Kansas City, Missouri; Davie, Florida; Turnersville, New Jersey. The expansion enhances access to a diverse range of tile, wood, natural stone, and other hard-surface flooring solutions.

Regulatory Frameworks

- In the U.S., the U.S. Environmental Protection Agency (EPA) regulates the market by overseeing emissions of Volatile Organic Compounds (VOCs) and phthalates, ensuring product safety, and monitoring indoor air quality. The agency focuses on reducing environmental and health risks associated with flooring materials and manufacturing processes.

- In Europe, the European Chemicals Agency (ECHA) regulates the market under the REACH Regulation, ensuring compliance with chemical safety standards. It restricts hazardous substances like phthalates and volatile organic compounds (VOCs), promoting environmentally responsible production while ensuring product safety and sustainability across residential and commercial flooring applications.

Competitive Landscape

The vinyl flooring industry is highly competitive, with key players prioritizing product innovation, sustainability, and strategic partnerships to strengthen their market position. Leading manufacturers are investing in advanced flooring technologies, such as antimicrobial coatings and waterproof features, to meet evolving consumer demands across residential and commercial applications.

Mergers, acquisitions, and collaborations remain key strategies, allowing companies to expand their footprint in floor renovation and maintenance solutions. Companies are also developing eco-friendly vinyl flooring by developing recyclable and low-VOC products to align with growing sustainability trends.

Market players are also expanding their distribution networks, leveraging e-commerce channels, and adopting digital marketing strategies to enhance customer reach. The rising demand for Luxury Vinyl Tiles (LVT) and Stone Plastic Composite (SPC) flooring is intensifying competition, pushing companies to focus on continuous innovation and market expansion.

- In December 2024, Blanchon Group acquired Dr. Schutz, a leading German floor renovation and maintenance solution provider. This strategic acquisition includes PU Sealer, a well-known product designed to enhance the durability, protection, and longevity of vinyl flooring, reinforcing Blanchon Group’s market presence in high-performance flooring solutions.

List of Key Companies in Vinyl Flooring Market:

- Shaw Industries Group, Inc.

- Fatra, a.s.

- Beaulieu International Group

- Tarkett

- Interface, Inc.

- Responsive Industries Ltd.

- Forbo Flooring Systems

- Gerflor

- Polyflor Ltd

- RMG Polyvinyl India Limited

- NATROYAL INDUSTRIES PVT. LTD.

- AHF, LLC.

- LX Hausys

- Mohawk Industries, Inc.

- Mannington Mills, Inc.

Recent Developments (New Product Launch)

- In March 2024, AHF Products launched unfazed luxury vinyl flooring under the Parterre brand, strengthening its position in the market. Manufactured in the USA, it features a proprietary core for superior indent resistance and optique coating for enhanced scuff, scratch, and stain resistance, ensuring durability and low maintenance.