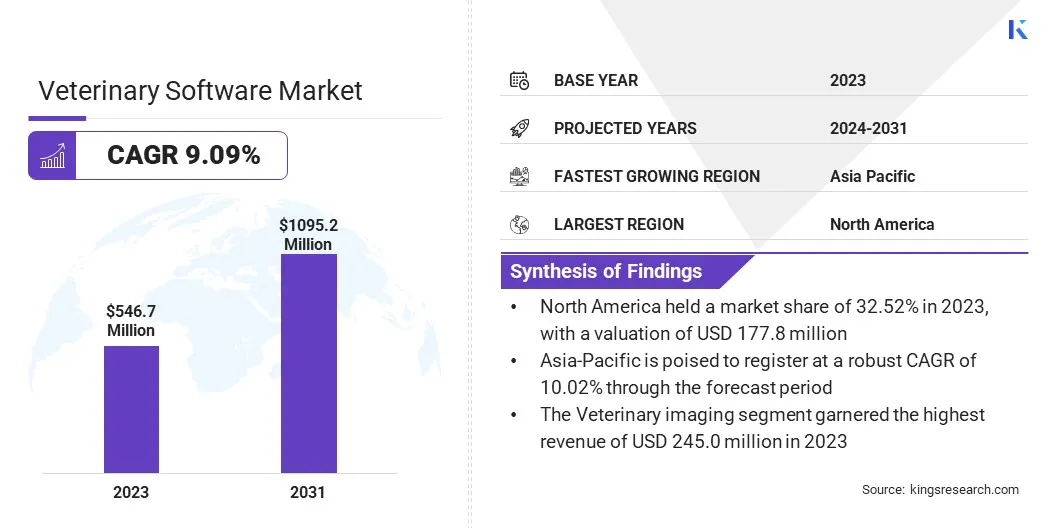

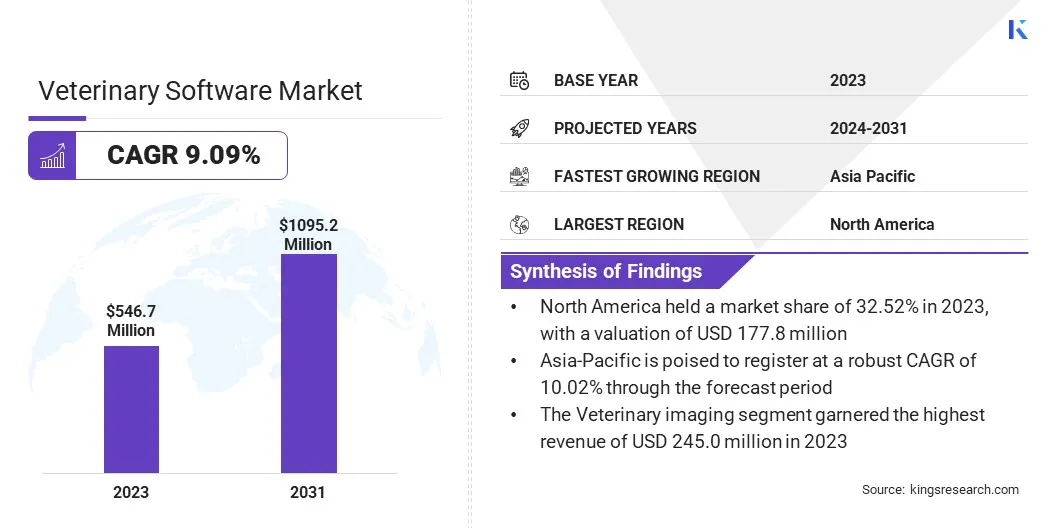

Veterinary Software Market Size

The global Veterinary Software Market size was valued at USD 546.7 Million in 2023 and is projected to reach USD 1,095.2 million by 2031, growing at a CAGR of 9.09% from 2024 to 2031. The rising trend of pet ownership, coupled with increasing awareness regarding animal health and well-being, is fueling the demand for advanced veterinary solutions.

In the scope of work, the report includes solutions offered by companies such as IDEXX Laboratories, Inc., Hippo Manager, Nordhealth Finland Oy, Henry Schein, Inc., Covetrus, Engel Engineering Services GmbH, Vitusvet, Oehm und Rehbein GmbH, Instinct Science, LLC, Asteris and Others.

Technological advancements such as cloud-based platforms, mobile applications, and AI-driven diagnostics, offering veterinarians enhanced diagnostic capabilities and remote monitoring options, are fostering market growth. However, challenges such as data security concerns, interoperability issues, and the complexity of regulatory compliance pose hurdles for market players.

Furthermore, the veterinary software market is experiencing significant growth globally, driven by increasing pet ownership and the rising demand for efficient practice management solutions. Key trends shaping the market include the rising adoption of cloud-based solutions, the widespread integration of AI and telemedicine platforms, and the development of other niche offerings to address specific veterinary needs.

Moreover, changing demographic trends are influencing pet ownership patterns and thereby, the demand for veterinary services. Urbanization also plays a crucial role in increasing pet ownership due to the surging availability of convenient veterinary software solutions.

The veterinary software market focuses on the ecosystem of software solutions designed specifically for veterinary practices, clinics, hospitals, research facilities, and other animal healthcare organizations. These software offerings encompass a wide range of functionalities, including practice management, electronic health records (EHR), veterinary imaging, laboratory information management systems (LIMS), telemedicine platforms, and more.

The market addresses the growing need for efficient workflow management, patient care optimization, and client communication in the veterinary industry. With advancements in technology, regulatory compliance, and evolving customer preferences, the veterinary software market presents lucrative opportunities for software providers to innovate and enhance the delivery of veterinary care.

Analyst’s Review

The veterinary software market continues to exhibit robust growth, fueled by technological advancements and increasing demand for streamlined practice management solutions.

Key factors including the rising adoption of electronic health records (EHR) systems, integration of telemedicine capabilities, and the emphasis on enhancing patient care and operational efficiency are driving the market growth. Market players are innovating to meet evolving industry needs, offering comprehensive software suites tailored to veterinary clinics, hospitals, and research facilities.

Veterinary Software Market Growth Factors

The growth of the veterinary software market is fueled by rising pet ownership trends and the expansion of the domestic animal industry. With the global population projected to exceed 9 billion by 2050, there is a growing demand for animal-derived products such as meat, milk, and eggs, which is driving investment in animal health and welfare.

Veterinary software solutions play a crucial role in managing the health and productivity of domestic animals, facilitating tasks such as herd management, reproductive monitoring, and disease surveillance. As the domestic animal industry continues to expand to meet the growing demand for animal-derived products, the demand for veterinary software solutions for livestock management and animal health is expected to increase significantly.

Moreover, regulatory bodies worldwide are imposing stricter guidelines and standards for veterinary practices to ensure safety, data security, and ethical treatment of animals. For instance, regulations such as the Veterinary Feed Directive (VFD) in the United States and the European Medicines Agency (EMA) regulations in the European Union mandate comprehensive record-keeping, reporting, and traceability of veterinary treatments and medications.

Veterinary software solutions that offer compliance features, such as electronic record-keeping, medication tracking, and audit trails, help practitioners adhere to regulatory requirements efficiently. The increasing complexity and stringency of regulatory mandates drive the adoption of advanced veterinary software solutions, creating opportunities for software providers to offer specialized compliance-focused features and services.

Despite the significant growth, data security and privacy concerns are hampering market expansion. With the digitization of patient records and the adoption of cloud-based solutions, veterinary practices have become vulnerable to data breaches, cyberattacks, and regulatory violations.

Companies are focusing on ensuring the confidentiality, integrity, and availability of sensitive patient information to maintain trust and compliance with regulations such as HIPAA and GDPR. However, the development and implementation of robust cybersecurity measures, encryption protocols, and access controls are enhancing the security of this software, which is likely to positively influence the product outlook.

Veterinary Software Market Trends

The integration of artificial intelligence (AI) for automated diagnostics and predictive analysis is a prominent trend in the veterinary software market that is revolutionizing the approach to veterinarians’ diagnosis and treatment of animal health conditions. AI-powered algorithms are deployed to analyze vast amounts of patient data, including medical records, diagnostic images, and laboratory results, to identify patterns, trends, and potential health risks with remarkable accuracy and efficiency.

- For instance, companies such as Zoetis have developed AI-driven diagnostic tools, and diagnostics accelerator, that leverages machine learning to interpret diagnostic test results and provide actionable insights to veterinarians. With the increasing adoption of Electronic Health Records (EHR) and digital imaging solutions in veterinary practices, AI integration offers immense potential to streamline diagnostic processes, reduce diagnostic errors, and enhance overall healthcare delivery.

The adoption of telemedicine solutions in veterinary practice is rapidly gaining momentum, driven by factors such as advancements in communication technology, changing consumer preferences, and the need for remote healthcare delivery. Telemedicine platforms enable veterinarians to conduct virtual consultations, provide remote monitoring services, and offer client education and support through video conferencing, messaging apps, and telehealth portals.

Companies such as Vetster and TeleVet are pioneering telemedicine solutions tailored specifically for the veterinary industry, offering features such as appointment scheduling, secure messaging, and virtual exam rooms. As telemedicine continues to evolve and regulatory frameworks adapt to accommodate remote veterinary care, the market is anticipated to observe steady growth.

Segmentation Analysis

The global veterinary software market is segmented based on product type, practice type, delivery mode, and geography.

By Product Type

Based on product type, the market is categorized into veterinary imaging, veterinary practice management, and others. Veterinary imaging garnered the highest revenue of USD 245.0 million in 2023. The increasing importance of diagnostic imaging in veterinary medicine for accurate diagnosis and treatment planning is fostering segment growth.

Veterinary imaging software enables practitioners to capture, store, and analyze diagnostic images such as X-rays, ultrasounds, and MRIs, facilitating precise and efficient clinical decision-making. Additionally, advancements in imaging technology, such as digital radiography and 3D imaging, drive adoption among veterinary practices seeking improved diagnostic capabilities and patient care outcomes.

By Practice Type

Based on practice type, the market is classified into exclusive small animal practices, mixed animal practices, and exclusive large animal practices. The exclusive large animal practices segment held the largest market share of 58.92% in 2023. This dominance can be attributed to several factors, including the specialized needs of large animal practitioners, such as herd management, reproductive services, and production optimization.

Exclusive large animal practices often manage complex operations and require software solutions tailored to their unique requirements, such as livestock tracking, medication administration, and compliance reporting, which is aiding segment growth.

By Delivery Mode

Based on delivery mode, the market is bifurcated into on-premise and cloud-based. The on-premise segment is projected to generate the highest revenue of USD 679.0 million by 2031.

On-premise solutions entail software installation and management directly within veterinary facilities, offering localized control and data storage. By hosting software and patient data locally, veterinary facilities can maintain greater control over data security and compliance with regulatory requirements, thus mitigating risks associated with data breaches and privacy violations.

Veterinary Software Market Regional Analysis

Based on region, the global veterinary software market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The North America Veterinary Software Market share stood around 32.52% in 2023 in the global market, with a valuation of USD 177.8 million. The region boasts a large and well-established veterinary healthcare industry, supported by a high level of pet ownership, advanced veterinary care standards, and robust regulatory frameworks. The presence of leading veterinary software providers, coupled with a technologically advanced healthcare infrastructure, is driving market growth in North America.

Moreover, increasing investments in companion animal healthcare, rising demand for specialty veterinary services, and growing awareness about the benefits of digitalization in veterinary practice management are further fueling market expansion. Additionally, favorable reimbursement policies, strong government initiatives promoting animal health, and a highly competitive landscape are impelling innovation and adoption of veterinary software solutions in the region.

Asia-Pacific is poised to register at a robust CAGR of 10.02% through the forecast period. The region's increasing pet ownership, driven by increasing awareness of pet health and well-being, and growing animal husbandry activities, is bolstering market growth. As more households across Asia-Pacific adopt pets, the demand for advanced veterinary care and management solutions is rising.

Additionally, the growing emphasis on animal welfare standards and preventive healthcare measures is further propelling the adoption of veterinary software solutions in the region. Furthermore, supportive government policies, technological advancements, and collaborations with international veterinary organizations are contributing to market growth.

Competitive Landscape

The global veterinary software market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, are foreseen to create new opportunities for market growth.

List of Key Companies in Veterinary Software Market

Key Industry Developments

March 2024 (Acquisition) - Herdwatch, a prominent AgTech software firm, acquired Lilac Technology, which is recognized for its TB Master software in the UK, and ComTag in Ireland. The deal is intended to advance Herdwatch's efforts in offering software solutions within the veterinary sector.

The Global Veterinary Software Market is Segmented as:

By Product Type

- Veterinary Imaging

- Veterinary Practice Management

- Others

By Practice Type

- Exclusive Small Animal Practice

- Mixed Animal Practices

- Exclusive Large Animal Practices

By Delivery Mode

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America