Market Definition

Vendor risk management involves the processes, technologies, and services used to identify, evaluate, and mitigate the risks associated with third-party vendors. Organizations use these systems to manage risks related to cybersecurity, regulatory compliance, financial stability, and operational performance.

The market includes key components such as software solutions and support services. Deployment models include cloud-based platforms that offer scalability and remote access and on-premises systems provide greater control over data.

The market serves large enterprises with complex vendor ecosystems and small and medium enterprises seeking efficient oversight of outsourced operations.

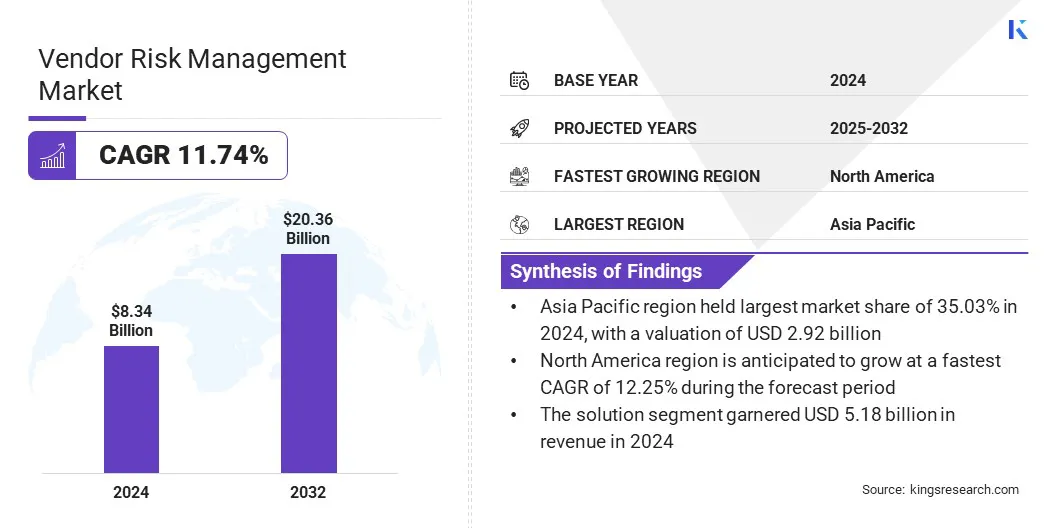

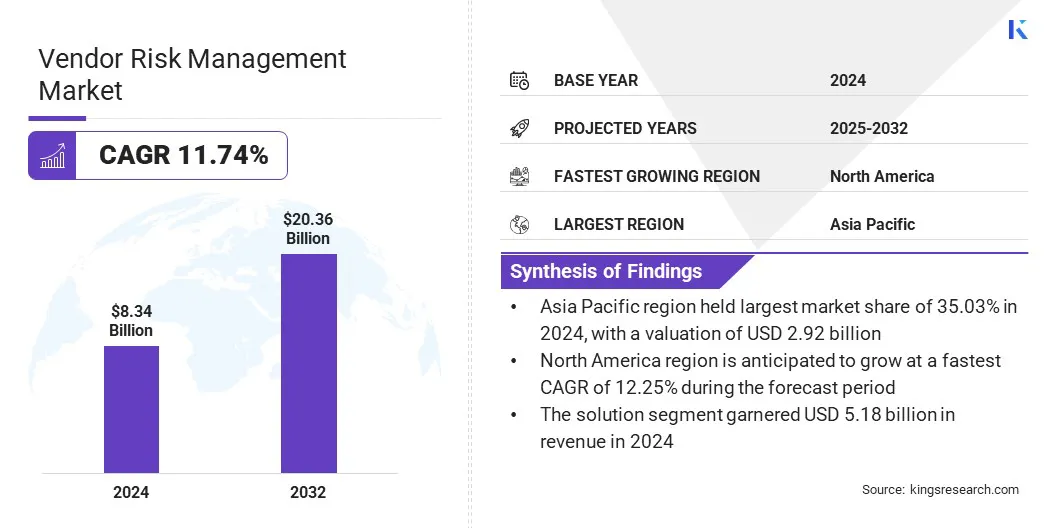

The global vendor risk management market size was valued at USD 8.34 billion in 2024 and is projected to grow from USD 9.29 billion in 2025 to USD 20.36 billion by 2032, exhibiting a CAGR of 11.74% during the forecast period.

This growth is attributed to the rising demand for an integrated view of supplier risk across domains like cybersecurity, ESG, financial stability, and operational resilience. Organizations are increasingly shifting toward AI-powered tools to enable rapid turnaround in risk assessments and replacing manual processes with automated, real-time evaluations.

Key Market Highlights:

- The global market size was valued at USD 8.34 billion in 2024.

- The market is projected to grow at a CAGR of 11.74% from 2025 to 2032.

- Asia Pacific held a market share of 35.03% in 2024, with a valuation of USD 2.92 billion.

- The solution segment garnered USD 5.18 billion in revenue in 2024.

- The on-premises segment is expected to reach USD 12.00 billion by 2032.

- The large enterprises segment is expected to reach USD 11.59 billion by 2032.

- The BFSI segment is expected to reach USD 4.68 billion by 2032.

- North America is anticipated to grow at a CAGR of 12.25% during the forecast period.

Major companies operating in the vendor risk management industry are Mastercard, OneTrust, LLC., Vanta, ServiceNow, UpGuard, Inc., ProcessUnity, Inc., Black Kite, BitSight Technologies, Inc., Sprinto, Scytale, SecurityScorecard, Archer Technologies LLC., Aravo Solutions, Inc., Venminder, and Mitratech, Inc.

Vendor Risk Management Market Report Scope

|

Segmentation

|

Details

|

|

By Component

|

Solution (Vendor Information Management, Contract Management, Financial Control, Compliance Management, Audit Management, Quality Assurance Management), Services (Professional, Managed)

|

|

By Deployment

|

Cloud-based, On-premises

|

|

By Organization

|

Large Enterprises, Small & Medium Enterprises

|

|

By Vertical

|

BFSI, IT & Telecommunications, Retail, Manufacturing, Energy & Utilities, Healthcare, Government, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Vendor Risk Management Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The Asia Pacific vendor risk management market share stood at 35.03% in 2024, with a valuation of USD 2.92 billion. This dominance is due to rapid technological advancements in the region, such as the launch of autonomous third-party risk management platforms that automate risk assessments, onboarding, and monitoring.

Countries including India, China, and Singapore are supporting enterprise digitization and AI adoption, enabling organizations to manage vendor risks more efficiently across distributed supply chains.

The focus on technological innovation and digital infrastructure has positioned Asia Pacific as the leading contributor to the global market.

- In April 2025, SAFE launched a fully autonomous third-party risk management (TPRM) platform, built on specialized AI agents that automate the entire vendor risk lifecycle, including assessments, onboarding, and continuous monitoring. The platform introduces an agentic workflow to enable zero-effort, intelligent risk management and supports organizations in making faster, data-driven decisions at scale.

North America is poised to grow at a significant CAGR of 12.25% over the forecast period. This growth is driven by the region’s strong regulatory environment, such as the Interagency Guidance on Third-Party Relationships, which enforces comprehensive oversight of vendor operations.

This has led organizations, particularly in the financial and healthcare sectors, to adopt advanced risk management platforms to meet compliance obligations and ensure operational resilience.

This regulatory-driven adoption continues to accelerate the region’s shift toward integrated and automated vendor risk management solutions, supporting its position as the fastest growing region.

Vendor Risk Management Market Overview

Market expansion is propelled by the launch of advanced dashboard modules that improve vendor performance tracking and risk oversight. These tools offer real-time access to risk indicators, contract compliance, and service-level metrics across third-party vendors.

Custom reporting and visualizations support quicker decision-making, enable collaboration across departments, and help meet regulatory requirements. The adoption of these modules signals a clear shift toward structured, analytics-driven vendor risk management practices.

- In August 2024, Venminder launched its new Dashboards module to enhance vendor performance tracking and third-party risk management. The module enables organizations to track key performance indicators, assess program effectiveness, and improve oversight through custom visualizations and advanced reporting tools.

Market Driver

Growing Demand for an Integrated View of Supplier Risk Across Domains

The market is driven by the increasing demand for an integrated view of supplier risk across key domains such as financial, cybersecurity, compliance, and ESG. As vendor networks expand, organizations face greater exposure to diverse and interconnected risks.

Managing these risks through separate systems leads to inefficiencies and delayed decision-making. Businesses are investing in platforms that consolidate supplier risk data into a single and actionable view. This integrated approach improves risk identification, supports faster response, and ensures alignment with regulatory requirements.

It enables risk and procurement teams to make informed decisions, streamline oversight, and strengthen operational continuity across the supply chain.

- In October 2023, S&P Global Market Intelligence launched Supplier Risk Indicator, a solution designed to provide an integrated view of supplier risk across core dimensions such as resilience, conduct, and information security. The platform combines credit and location risk data, ESG scores from S&P Global Sustainable1, and cybersecurity ratings from Security Scorecard to deliver a comprehensive risk assessment for 12 million organizations.

Market Challenge

Data Quality and Inconsistency Undermining Risk Assessments

A significant challenge in the vendor risk management market is the reliance on incomplete, outdated, or inconsistent vendor data.

Poor data quality limits the accuracy of risk assessments and weakens decision-making, especially in high-risk sectors like finance and healthcare. Inconsistent inputs from vendors, manual data entry errors, and a lack of centralized systems contribute to fragmented risk profiles.

To address this, companies are integrating automated data collection tools, enforcing standardized reporting formats, and using real-time data validation engines within their vendor risk management platforms. These steps help improve data accuracy, streamline assessments, and strengthen overall risk oversight.

Market Trend

Shift Toward AI-Powered Tools to Enable Rapid Turnaround

The market is witnessing a significant shift toward AI-powered tools to accelerate third-party risk assessments. Organizations are increasingly adopting artificial intelligence to automate manual processes such as risk identification, control validation, and report generation.

These tools improve operational efficiency by moving from prolonged assessments to rapid turnaround and enable quicker onboarding and more informed decision-making.

AI-driven platforms also enhance risk scoring by analyzing large volumes of vendor data in real time, helping enterprises detect vulnerabilities that traditional methods may miss. This trend reflects the market’s movement toward intelligent, scalable, and proactive risk management solutions.

- In February 2025, UpGuard launched new AI-integrated tools, including Instant Risk Assessments and AI-Powered Security Profiles, to transform third-party cyber risk management. The solution enables users to uncover vendor control gaps in minutes and generate risk assessment reports in under 60 seconds.

Market Segmentation:

- By Component (Solution (Vendor Information Management, Contract Management, Financial Control, Compliance Management, Audit Management, Quality Assurance Management), and Services (Professional, Managed)): The solution segment earned USD 5.18 billion in 2024, due to the rising demand for automated vendor compliance tracking, contract oversight, and financial risk control across industries.

- By Deployment (Cloud-based, and On-premises): The on-premises segment held 59.94% of the market in 2024, attributed to the increased demand from organizations seeking full control over sensitive vendor and compliance data.

- By Organization (Large Enterprises, and Small & Medium Enterprises): The large enterprises segment is projected to reach USD 11.59 billion by 2032, owing to the complexity of multi-vendor ecosystems and the need for scalable risk management platforms.

- By Vertical (BFSI, IT & Telecommunications, Retail, Manufacturing, Energy & Utilities, Healthcare, Government, and Others): The BFSI segment is projected to reach USD 4.68 billion by 2032, due to strict regulatory frameworks and the need for continuous vendor due diligence.

Regulatory Frameworks

- In the U.S., the Interagency Guidance on Third-Party Relationships issued by the Office of the Comptroller of the Currency (OCC), Federal Reserve, and Federal Deposit Insurance Corporation (FDIC) provides the regulatory framework for vendor risk management. It requires financial institutions to conduct due diligence, monitor third-party activities, manage associated risks, and maintain oversight throughout the vendor lifecycle.

- In Europe, the Digital Operational Resilience Act (DORA) regulates vendor risk management for financial entities. It mandates the oversight of ICT third-party providers, including risk classification, contractual control, and incident response.

Competitive Landscape

Key players in the global vendor risk management market are focusing on strategic collaborations and continuous innovations to transform the third-party risk process.

Many are partnering with cybersecurity firms, compliance platforms, and cloud providers to enhance their solution capabilities and expand risk coverage across multiple domains, including IT, ESG, financial, and operational risks.

Several vendors are integrating AI and machine learning into their platforms to automate risk assessments, accelerate due diligence, and enable real-time risk monitoring.

Others are developing modular, cloud-native solutions to support scalability and customization across different enterprise sizes and sectors. These strategies collectively aim to deliver more proactive, efficient, and comprehensive approaches to managing vendor risk.

- In June 2025, EY introduced risk management solutions through its EY.ai Agentic Platform, developed in partnership with NVIDIA. These EY.ai for Risk solutions combine NVIDIA’s AI capabilities with EY’s extensive experience in risk management to improve operational efficiency and modernize third-party risk processes.

Key Companies in Vendor Risk Management Market:

- Mastercard

- OneTrust, LLC.

- Vanta

- ServiceNow

- UpGuard, Inc.

- ProcessUnity, Inc.

- Black Kite

- BitSight Technologies, Inc.

- Sprinto

- Scytale

- SecurityScorecard

- Archer Technologies LLC.

- Aravo Solutions, Inc.

- Venminder

- Mitratech, Inc.

Recent Developments (Product Launch)

- In May 2025, ImmuniWeb launched ImmuniWeb Discovery Third-Party Risk Management (TPRM), an advanced solution designed to offer in-depth monitoring of vendors and suppliers. The platform addresses increasing cyber risks associated with third parties and supports compliance with regulations such as the European Union Digital Operational Resilience Act (EU DORA) and the New York Department of Financial Services (NY DFS) Cybersecurity Regulation.

- In March 2025, Ncontracts launched enhanced Third-Party Risk Management (TPRM) Control Assessments to improve the due diligence process for vendor risk evaluation. The solution offers expert-validated, risk-based reviews of vendor controls, replacing manual document collection with streamlined assessments.

The v